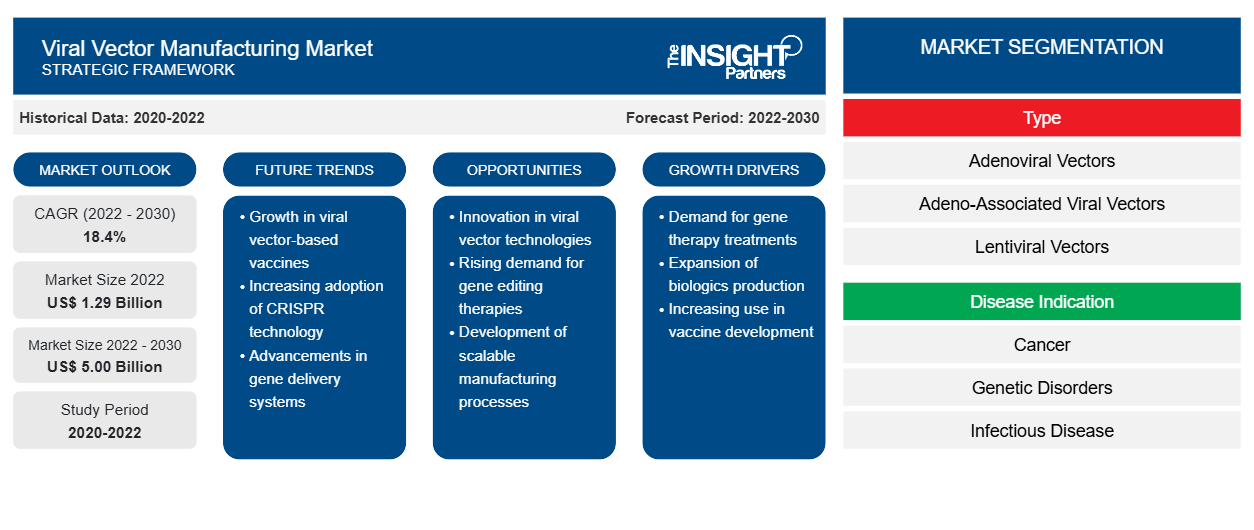

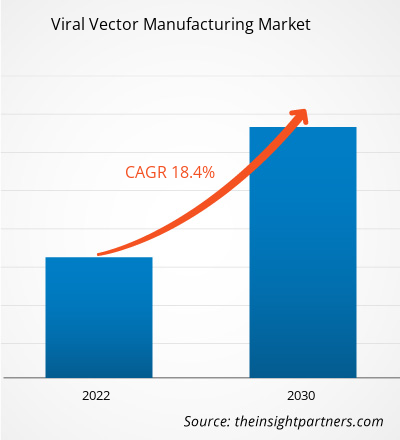

[Research Report] The viral vector manufacturing market is projected to grow from US$ 1.29 billion in 2022 to US$ 5.00 billion by 2030; the market is estimated to record a CAGR of 18.4% during 2022–2030.

Market Insights and Analyst View:

Viral vectors help deliver genetic material into cells. Various types of viral vectors can be used to carry nucleic acids into the genetic composition of cells, including lentivirus, adenovirus, retrovirus, and adeno-associated virus, each with its own set of benefits and drawbacks for certain applications. Viral vectors are used in gene and cell therapy as a basis for prophylactic and therapeutic vaccines. Key factors driving the market growth are increasing clinical studies and development of viral-vector therapeutics and increasing demand for gene therapy. However, the complex viral-vector development process hinders the viral vector manufacturing market growth. Furthermore, technological advancements and strategic activities by viral vector manufacturers are expected to bring new viral vector manufacturing market trends in the coming years.

Growth Drivers and Restraints:

Recent developments in cell and gene therapies have made it feasible to treat various illnesses, including congenital disorders and cancer, which increases the viral vector manufacturing market size. According to the study “Gene therapy clinical trials, where do we go?” published in September 2022 in Elsevier Journal, the first gene therapy product, Gendicine, was approved for head and neck cancer after ~686 clinical trials by the Chinese State Food and Drug Administration (SFDA). In 2012, the clinical trials were doubled with the approval of Glybera by the European Medicines Agency (EMA), which indicated lipoprotein lipase deficiency. Similarly, in 2017, the FDA approved two chimeric antigen receptor (CAR) products—Kymriah and Yescarta. Furthermore, in 2019, Zolgensma (the most expensive drug to date), an adeno-associated viral vector (AAV) applied while performing gene therapies to treat pediatric spinal muscular atrophy, was approved by FDA.

Similarly, the US Food and Drug Administration (FDA) has approved many viral vector-based gene therapies over recent years. According to the FDA Office of Tissues and Advanced Therapies (OTAT), as of August 2023, more than 30 viral vector therapy products have been approved by the FDA. Similarly, according to Evaluate Pharma, as of February 2023, ~120 viral-vector therapeutics are in Phase II trials. Thus, a significant increase in approved gene therapy products and viral vector-based gene therapies each year boosts the viral vector manufacturing market size.

However, developing viral vectors is a complex process involving challenges in viral vector production and quality control measures. The production of viral vectors requires specialized equipment and facilities with adherence to good manufacturing practices (GMP) practices and other regulatory standards to ensure the final product's purity, safety, and efficacy. This can pose significant challenges for manufacturers, especially smaller companies or new entrants, owing to limited resources and expertise to meet these requirements. Furthermore, large-scale viral-vector manufacturing faces various other challenges, such as the incompatibility of production systems, which may impact different stages of viral vector development.

According to Patheon (service brand of Thermo Fisher Scientific), commercialization of viral vectors requires regulatory considerations to mitigate unnecessary risks such as compressed timelines, assay challenges and variability, raw materials using tumorigenic cell lines, and limited batches available at commercial scale. Thus, the complex viral vector development process hinders the viral vector manufacturing market expansion.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Viral Vector Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Viral Vector Manufacturing Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The “viral vector manufacturing market analysis” has been carried out by considering the following segments: type, disease indication, application, and end user. Based on type, the market is differentiated into adenoviral vectors, adeno-associated viral vectors, lentiviral vectors, retroviral vectors, and others. By disease indication, the market is segmented into cancer, genetic disorders, infectious diseases, and others. In terms of application, the market is differentiated into therapeutic development, vaccine development, and research. Based on end user, the viral vector manufacturing market is segmented into pharmaceutical & biotechnology companies, research institutes, and CDMOs & CROs. Geographically, the market is primarily divided into North America (the US, Canada, and Mexico), Europe (Spain, the UK, Germany, France, Italy, and the Rest of Europe), Asia Pacific (South Korea, China, India, Japan, Australia, and the Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the market is differentiated into adenoviral vectors, adeno-associated viral vectors, lentiviral vectors, retroviral vectors, and others. The adeno-associated viral vectors segment held the largest viral vector manufacturing market share in 2022. The lentiviral vectors segment is anticipated to register the highest CAGR during 2022–2030.

Based on disease indication, the viral vector manufacturing market is segmented into cancer, genetic disorders, infectious diseases, and others. The cancer segment held the largest market share in 2022, and the genetic disorders segment is anticipated to register the highest CAGR from 2022 to 2030.

By application, the market is differentiated into therapeutics development, vaccine development, and research. In 2022, the vaccine development segment held the largest market share, and the therapeutics development segment is anticipated to register the highest CAGR during 2022–2030.

In terms of end user, the market is segmented into pharmaceutical & biotechnology companies, research institutes, and CDMOs & CROs. The pharmaceutical & biotechnology companies segment is anticipated to hold a significant viral vector manufacturing market share during 2022–2030.

Regional Analysis:

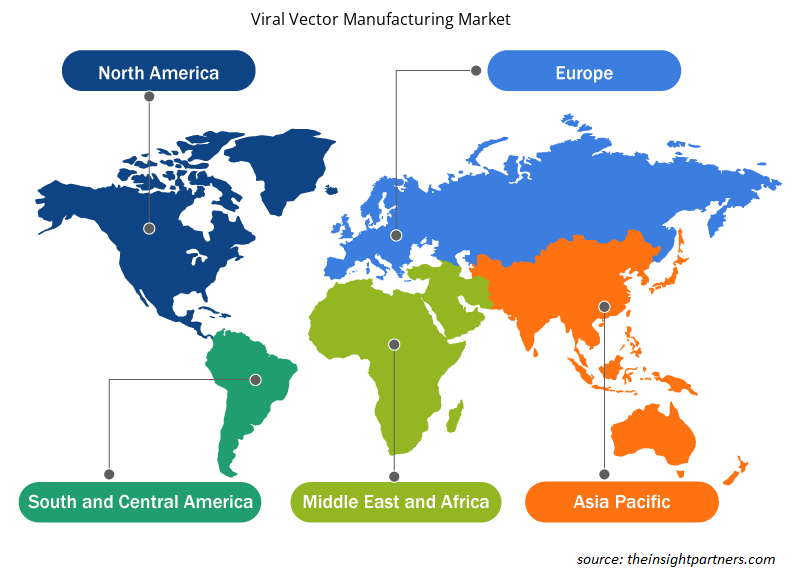

The scope of the global viral vector manufacturing market report focuses on North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa.

In terms of revenue, North America dominated the viral vector manufacturing market share. The developments in medical infrastructure, the prevalence of cancer and genetic disorders, and the increasing expenditure on healthcare services across the US are the key factors, driving the growth of the market in the country. For instance, according to the American Cancer Society estimates, in 2022, ~1.9 million new cancer cases were diagnosed and more than 609,000 cancer deaths were reported in the US. Thus, the use of viral vectors in clinical trials, vaccine development, and biomedical research for cancer treatment and other diseases will substantially impact the viral vector manufacturing market growth.

Industry Developments and Future Opportunities:

The viral vector manufacturing market forecast can help stakeholders in this marketplace plan their growth strategies. A few initiatives taken by key players operating in the market are listed below:

- In July 2023, Biovian Oy announced an expansion of its manufacturing facility in Turku, Finland. The company announced a major investment of over €50 million (~US$ 55) for a facility with an area of 69,000 sq. ft. The facility houses advanced technologies and cutting-edge equipment to support the development and manufacturing of advanced therapy medicinal products, such as adenoviral and adeno-associated viral vector (AAV) therapies. The manufacturing facility also features dedicated Class A to D cleanroom areas for bulk drug materials and final drug product manufacture.

- In May 2023, AGC Biologics, the leading biopharmaceutical contract development and manufacturing organization (CDMO) in the world, launched two viral vector platforms: BravoAAV and ProntoLVV. AGC Biologics' innovative platforms provide quick, effective, and repeatable clinical and commercial GMP production and release by utilizing their combined 30 years of experience in the development, manufacturing, and analyses of lentiviral vector (LVV) and AAVs. The CDMO can offer GMP products in nine months because of its patented methodology and capsid-specific platform approaches, which can shorten development time.

- In March 2023, Catalent announced the expansion of its UpTempo platform process for the development and CGMP manufacturing of AAVs. Catalent is a global pioneer in facilitating the discovery and provision of better patient medicines. The platform now comprises an in-house, clonal HEK293 cell line and commercial plasmids to facilitate a strong supply chain for the research and production of gene therapies and accelerate the duration of first-in-human clinical assessment.

- In March 2023, Vector Biolabs announced the completion of a facility expansion. The newly constructed facility has office space, warehouses, QC labs, and a cleanroom manufacturing suite. With the extra capacity, vector will be able to continue providing its fast response times even as field demand grows and expand its offering to include new product characterization and quality control services.

- In August 2022, Merck became one of the first CDMOs and technology developers to offer a complete viral vector manufacturing offering, including AAV, Lentiviral, CDMO, CTO, and process development, with the introduction of the VirusExpress 293 AAV Production Platform. Due to this new platform, biopharmaceutical businesses can now accelerate clinical manufacturing while minimizing costs and time associated with process development.

- In September 2020, OXGENE officially launched their scalable, plasmid-free AAV manufacturing method. OXGENE's recently developed TESSA technology resolves industry-wide issues related to reliable and consistent AAV production on a large scale.

Viral Vector Manufacturing Market Regional Insights

Viral Vector Manufacturing Market Regional Insights

The regional trends and factors influencing the Viral Vector Manufacturing Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Viral Vector Manufacturing Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Viral Vector Manufacturing Market

Viral Vector Manufacturing Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1.29 Billion |

| Market Size by 2030 | US$ 5.00 Billion |

| Global CAGR (2022 - 2030) | 18.4% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Viral Vector Manufacturing Market Players Density: Understanding Its Impact on Business Dynamics

The Viral Vector Manufacturing Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Viral Vector Manufacturing Market are:

- Charles River Laboratories

- Merck KGaA

- Biovian Oy

- Global Life Sciences Solutions USA LLC

- Lonza Group Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Viral Vector Manufacturing Market top key players overview

Competitive Landscape and Key Companies:

Charles River Laboratories, Merck KGaA, Biovian Oy, Global Life Sciences Solutions USA LLC, Lonza Group Ltd, Creative Biogene, VIVEbiotech SL, Genezen Laboratories Inc, GenScript Biotech Corporation, and AGC Biologics are among the prominent players operating in the viral vector manufacturing market. These companies focus on new technologies, advancements in existing products, and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Disease Indication, Application, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The viral vector manufacturing market majorly consists of the players, including Charles River Laboratories, Merck KGaA, Biovian Oy, Global Life Sciences Solutions USA LLC, Lonza Group Ltd, Creative Biogene, VIVEbiotech SL, Genezen Laboratories Inc, GenScript Biotech Corporation, and AGC Biologics

Key factors driving the viral vector manufacturing market growth are increasing clinical studies and development of viral-vector therapeutics and increasing demand for gene therapy.

The viral vector manufacturing market was valued at US$ 1.29 billion in 2022.

Based on type, the viral vector manufacturing market is differentiated into adenoviral vectors, adeno-associated viral vectors, lentiviral vectors, retroviral vectors, and others. The adeno-associated viral vectors segment held the largest market share in 2022. The lentiviral vectors segment is anticipated to register the highest CAGR during 2022–2030.

Viral vectors help deliver genetic material into cells. Various types of viral vectors can be used to carry nucleic acids into the genetic composition of cells, including lentivirus, adenovirus, retrovirus, and adeno-associated virus, each with its own set of benefits and drawbacks for certain applications. Viral vectors are used in gene and cell therapy as a basis for prophylactic and therapeutic vaccines.

In terms of end user, the viral vector manufacturing market is segmented into pharmaceutical & biotechnology companies, research institutes, and CDMOs & CROs. In 2022, the pharmaceutical & biotechnology companies segment held the largest market share and is anticipated to register the highest CAGR during 2022–2030.

By application, the viral vector manufacturing market is differentiated into therapeutics development, vaccine development, and research. In 2022, the vaccine development segment held the largest market share, and the therapeutics development segment is anticipated to register the highest CAGR during 2022–2030.

The viral vector manufacturing market is expected to be valued at US$ 5.00 billion in 2030.

Based on disease indication, the viral vector manufacturing market is segmented into cancer, genetic disorders, infectious disease, and others. The cancer segment held the largest market share in 2022, and the genetic disorders segment is anticipated to register the highest CAGR from 2022 to 2030.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Viral Vector Manufacturing Market

- Charles River Laboratories

- Merck KGaA

- Biovian Oy

- Global Life Sciences Solutions USA LLC

- Lonza Group Ltd

- Creative Biogene

- VIVEbiotech SL

- Genezen Laboratories Inc

- GenScript Biotech Corporation

- AGC Biologics

Get Free Sample For

Get Free Sample For