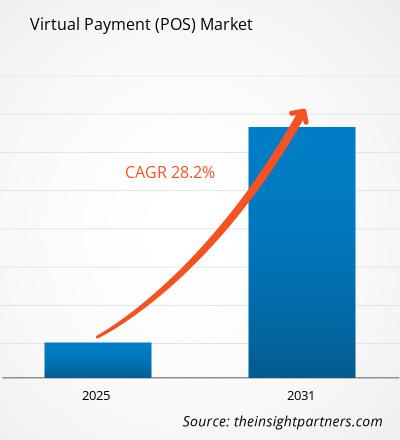

The virtual payment (POS) market size is expected to grow at a CAGR of 28.2% from 2025 to 2031. The virtual payment (POS) market includes growth prospects owing to the current virtual payment (POS) market trends and their foreseeable impact during the forecast period. The virtual payment (POS) market is growing due to factors such as the rising penetration of smartphones and the growing trend of a cashless economy. Technological integration and the rise of digital wallets provide lucrative opportunities for the virtual payment (POS) market growth.

Virtual Payment (POS) Market Analysis

A virtual point of sale (POS) is a software-based system that allows businesses to process transactions without using physical hardware such as cash registers or card readers. A virtual POS means businesses can enter payment details, such as debit or credit card information, into a web interface or application. Typically, virtual POS systems are accessible via a computer, tablet, or smartphone with an internet connection.

Virtual Payment (POS) Market Industry Overview

- The virtual payment (POS) market is a booming sector where consumers use their smartphones or other mobile devices to make payments. It's rapidly growing due to its convenience and accessibility.

- Various players, such as tech giants, banks, and startups, compete in this market to offer secure and user-friendly payment solutions.

- Consumer adoption of mobile payments has also been steadily increasing, fuelled by the proliferation of smartphones and a growing acceptance of digital transactions.

- With the rise of digital wallets and contactless payment methods, the industry continues to evolve, presenting opportunities for innovation and growth.

Virtual Payment (POS) Market Driver

Rising Penetration Of Smartphones To Drive The Virtual Payment (POS) Market

- The increasing popularity of smartphones is a major driving force behind the growth of the virtual payment (POS) market. As more people around the world own smartphones, they have access to convenient and versatile payment options right at their fingertips. Smartphones enable users to store payment information securely, making transactions quick and hassle-free.

- Moreover, the widespread availability of mobile internet connections allows consumers to make payments anytime and anywhere without the need for physical cash. This convenience appeals to and encourages the adoption of the virtual payment (POS) market.

- Businesses also benefit from the rise in smartphone usage, as they can offer mobile-friendly payment methods to attract customers and enhance their shopping experience. Additionally, the integration of mobile payments into various apps and platforms streamlines the checkout process, reducing abandoned carts and increasing sales.

Virtual Payment (POS) Market Report Segmentation Analysis

- Based on type, the virtual payment (POS) market is segmented into solution and services. The solution segment is expected to hold a substantial virtual payment (POS) market share in 2023.

Virtual Payment (POS) Market Share Analysis By Geography

The scope of the virtual payment (POS) market is primarily divided into five regions - North America, Europe, Asia Pacific, Middle East & Africa, and South America. North America is experiencing rapid growth and is anticipated to hold a significant virtual payment (POS) market share. With the widespread use of smartphones and advanced banking infrastructure, consumers are increasingly turning to virtual payment solutions for their transactions. Major players in North America, including tech companies, financial institutions, and retailers, are investing in and expanding their virtual payment offerings to meet the growing demand.

Virtual Payment (POS) Market Report Scope

The "Virtual Payment (POS) Market Analysis" was carried out based on component, vertical and geography. On the basis of component, the market is segmented into solution and services. Based on vertical, the market is segmented into retail, hospitality, consumer electronics, food & beverages, healthcare, entertainment, and others. Based on geography, the market is segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Virtual Payment (POS) Market News and Recent Developments

Companies adopt inorganic and organic strategies such as mergers and acquisitions in the virtual payment (POS) market. A few recent key market developments are listed below:

- In July 2022, Electronic Merchant Systems announced the acquisition of paysley, an omnichannel payment solution. Under this acquisition, Paysley combined the physical and virtual payment worlds to provide omnichannel capabilities to merchants of all sizes and allowed merchants to send secure, contactless, tap-to-pay requests to customers over text and email.

[Source: Electronic Merchant Systems, Press Release]

Virtual Payment (POS) Market Report Coverage & Deliverables

The virtual payment (POS) market forecast is estimated based on various secondary and primary research findings, such as key company publications, association data, and databases. The market report "Virtual Payment (POS) Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering below areas-

- Market size & forecast at global, regional, and country levels for all the key market segments covered under the scope.

- Market dynamics such as drivers, restraints, and key opportunities.

- Key future trends.

- Detailed PEST & SWOT analysis

- Global and regional market analysis covering key market trends, key players, regulations, and recent market developments.

- Industry landscape and competition analysis covering market concentration, heat map analysis, key players, and recent developments.

- Detailed company profiles.

Virtual Payment (POS) Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 28.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Pressure Vessel Composite Materials Market

- Unit Heater Market

- Webbing Market

- Frozen Potato Market

- Smart Grid Sensors Market

- Integrated Platform Management System Market

- Pipe Relining Market

- Biopharmaceutical Contract Manufacturing Market

- Redistribution Layer Material Market

- Employment Screening Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

Get Free Sample For

Get Free Sample For