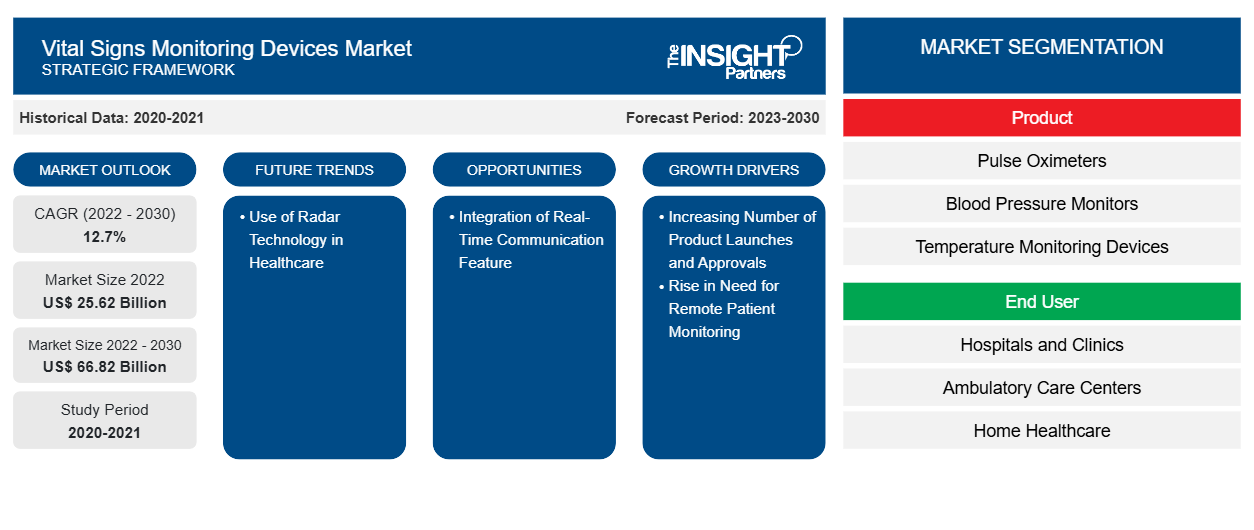

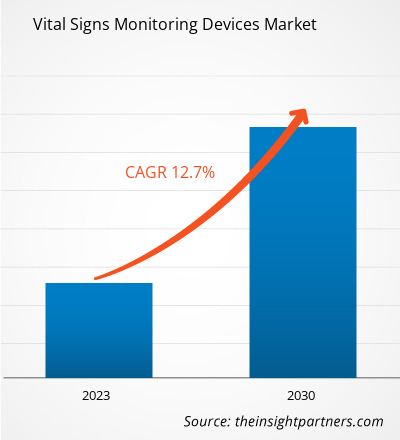

[Research Report] The vital signs monitoring devices market size was valued at US$ 25,617.24 million in 2022 and is expected to reach US$ 66,824.03 million by 2030. It is estimated to grow at a CAGR of 12.7% from 2022 to 2030

Market Insights and Analyst View:

The growing adoption of remote patient monitoring drives the growth of the vital signs monitoring devices market. During the COVID-19 pandemic, the initiation of telemedicine has leveraged the growth of home healthcare. In addition, the growing awareness about using pulse oximeters, thermometers, and blood pressure monitors to keep track of vitals as precautionary measures propelled the demand for these devices. A surge in preference for home healthcare—largely driven by the growing geriatric population and rising awareness about healthy and fit lifestyles—is another vital factor boosting the vital signs monitoring devices market

Growth Drivers and Challenges:

In the global vital signs monitoring devices market companies are designing, developing, and upgrading their existing products by harnessing ongoing advancements in medical technology. Frequent product launches significantly contribute to market growth by encouraging players to compete with each other by developing innovative products and obtaining regulatory approvals for their products. A few of the recent product launches and approvals that have significantly contributed to the market growth are mentioned below.

- In June 2023, Masimo received US Food and Drug Administration (FDA) approval for its Radius VSM, a continuous, multi-parameter vital signs monitor. The device was developed to allow physicians to measure physiological parameters such as blood pressure, temperature, respiration rate, ECG, and oxygen. The Masimo SET pulse oximeter integrated into Radius VSM allows it to keep a check on the oxygen levels of patients. In addition, Masio Radius VSM is a self-operated device, or it can also be used by connecting it wirelessly to Masimo bedside monitors that include Root and the Masimo Hospital Automation platform.

- In April 2023, Honeywell introduced a real-time health monitoring system to capture patient’s vital signs in hospitals and remote setups. The sensing technology incorporated in the system monitors vital signs through a skin patch and instantaneously notifies healthcare providers on their mobile devices and an online dashboard. Through this innovation, the company can aid improvements in patient care at home, hospitals, and ambulatory surgical centers.

- In June 2022, GE Healthcare announced the launch of Portrait Mobile, a product developed by combining wireless patient-worn sensors and a smartphone-style monitor. People wearing this monitoring device can move freely without any location restrictions. In August 2023, GE Healthcare received FDA approval for the Portrait Mobile and 510(k) approval for its Carescape Canvas patient monitoring platform.

- In April 2021, Oxehealth Service won FDA approval for its vital sign software, which can monitor heart rate and breathing with an overhead camera attached to the device. The product is suitable for end users in nursing homes and long-term care facilities.

- In January 2020, BioIntelliSense, Inc. announced the commercial launch of its Data-as-a-Service (DaaS) platform. It also announced receiving FDA 510(k) clearance for its BioSticker, an on-body sensor for remote care devices. Further, in July 2020, BioIntelliSense, Inc. collaborated with Royal Philips to integrate BioSticker into Philips’s remote patient monitoring devices.

On the other hand, the recall rate of vital signs monitoring devices has increased in recent years. A few major players in the vital signs monitoring devices market have executed product recalls in the last several years. Regulatory authorities have raised concerns about product recalls showcasing players' shortcomings and affecting their brand image. Thus, product recalls by companies and regulatory authorities are hindering the growth of the vital signs monitoring devices market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vital Signs Monitoring Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Vital Signs Monitoring Devices Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The vital signs monitoring devices market is segmented on the basis of product and end user. The market, based on product, is subsegmented into pulse oximeters, temperature monitoring devices, blood pressure monitors, and glucose monitoring devices. On the basis of end user, the market is categorized into hospitals and clinics, ambulatory care centers, home healthcare, and others. Based on geography, the market is divided into North America (US, Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia Pacific (China, Japan, India, South Korea, Australia, and Rest of Asia Pacific), Middle East & Africa (South Africa, Saudi Arabia, UAE, and Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and Rest of South & Central America).

Segmental Analysis:

Based on product, the glucose monitors segment accounted for the largest share of the vital signs monitoring devices market in 2022. The pulse oximeters segment is estimated to register the fastest CAGR of during 2022–2030. Glucose monitoring devices are used to diagnose both hyperglycemic and hypoglycemic conditions in diabetic patients. These devices allow patients and clinicians to detect high or low blood glucose levels, further allowing therapy modifications and protecting patients by promptly confirming acute hypoglycemia or hyperglycemia. The technology contributes to patients’ knowledge about diabetes and its management.

Pulse oximeters are electronic devices used to determine the saturation of oxygen carried in red blood cells. The growth of the market for pulse oximeters is majorly driven by a rising prevalence of cardiovascular diseases and respiratory diseases, an increase in demand for minimally invasive surgeries, and newer developments in these devices. Pulse oximeters are available in table-top and handheld models along with accessories.

On the basis of end user, the market is categorized into hospitals and clinics, ambulatory care centers, home healthcare, and others. The hospitals and clinics segment held the largest market share in 2022. The home healthcare segment is estimated to register the fastest CAGR during 2022–2030. The increasing number of hospitals and clinics, surging preference for home healthcare settings, and rising R&D in medical devices are the key factors contributing to the growth of the vital signs monitoring devices market.

Regional Analysis:

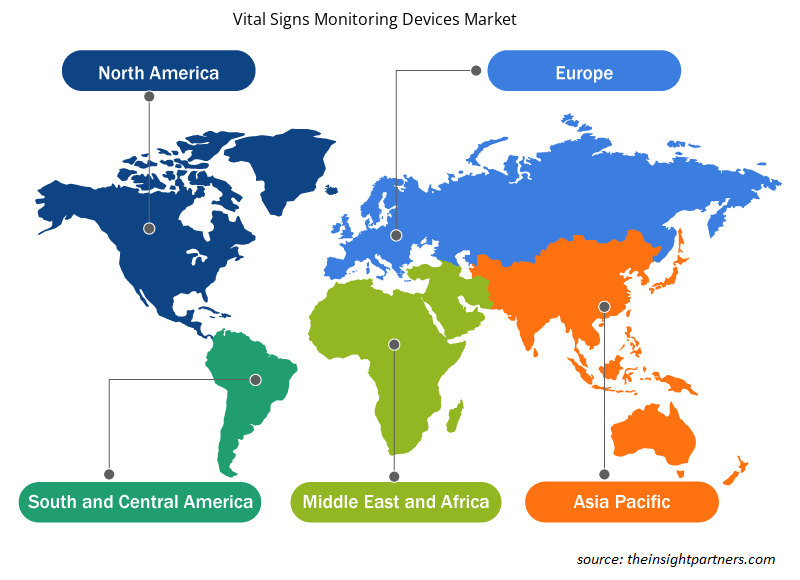

Based on geography, thevital signs monitoring devices market is segmented into North America, Europe, Asia Pacific, Middle East & Africa, and South & Central America. North America is the largest contributor to the growth of the market, and Europe is expected to register the fastest CAGR during 2022–2030. The market growth in North America is attributed to an extensive rise in respiratory diseases, a large pool of diabetic population, and an increase in awareness of respiratory diseases among the population. In Europe, the vital signs monitoring devices market is driven by factors such as the rising incidences of chronic diseases, an increasing number of product launches, growing investments for product developments, and a surge in the aging population.

Industry Developments and Future Opportunities:

Various initiatives by key players operating in the vital signs monitoring devices market are listed below:

- In August 2023, GE HealthCare unveiled its smartphone-sized Portrait Mobile to continuously monitor vital signs of patients using wearable sensors with a wireless protocol. This device does not require patients to continuously lie on hospital beds for vitals monitoring. Portrait Mobile features an innovative measurement technology to capture respiration rate, one of the most sensitive vital signs for early patient deterioration, continuously, accurately, and reliably.

- In May 2023, Omron, an electrical equipment company based in Japan, announced its plans to open its first medical device plant in India. The new manufacturing plant would be established in the state of Tamil Nadu and is scheduled to commence operations by March 2025. This announcement was made after Tamil Nadu signed the Memoranda of Understanding (MoU) with 6 Japanese companies for a total value of US$ 9.89 million. Omron would invest nearly US$ 15.7 million to set up the plant to manufacture blood pressure monitors

- In December 2022, Medtronic partnered with BioIntelliSense, a firm offering continuous health monitoring solutions and clinical health intelligence. As part of this partnership, Medtronic would exclusively distribute the BioButton multi-parameter continuous, connected wearable monitoring device in the US. BioButton is rechargeable, and has configurable acute and post-acute modes as patients transition through acuity settings. BioButton records up to 1,440 vital sign measurements daily, including skin temperature, respiratory rate at rest, and rest heart rate. Adding BioButton to Medtronic’s HealthCast connectivity gateway is likely to benefit more general care patients, both inside and outside hospitals, with near real-time measurements and alerts.

Vital Signs Monitoring Devices Market Regional Insights

Vital Signs Monitoring Devices Market Regional Insights

The regional trends and factors influencing the Vital Signs Monitoring Devices Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Vital Signs Monitoring Devices Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Vital Signs Monitoring Devices Market

Vital Signs Monitoring Devices Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 25.62 Billion |

| Market Size by 2030 | US$ 66.82 Billion |

| Global CAGR (2022 - 2030) | 12.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

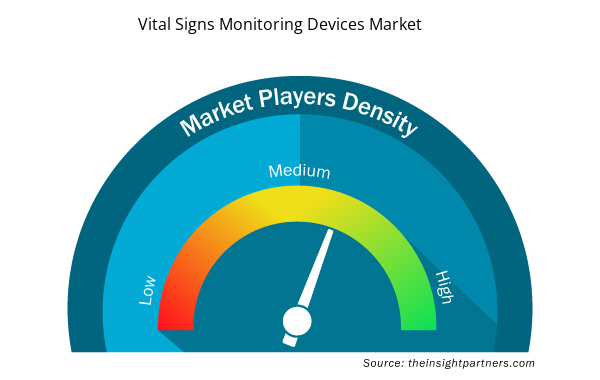

Vital Signs Monitoring Devices Market Players Density: Understanding Its Impact on Business Dynamics

The Vital Signs Monitoring Devices Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Vital Signs Monitoring Devices Market are:

- Koninklijke Philips NV

- Medtronic Plc

- Nihon Kohden Corp

- GE HealthCare Technologies Inc

- OMRON Corp

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Vital Signs Monitoring Devices Market top key players overview

Competitive Landscape and Key Companies:

A few prominent players operating in the vital signs monitoring devices market are Koninklijke Philips NV, Medtronic Plc, Nihon Kohden Corp, GE HealthCare Technologies Inc, OMRON Corp, Nonin Medical Inc, SunTech Medical Inc, Masimo Corp, Contec Medical Systems Co Ltd, and Baxter International Inc. These companies focus on new product launches and geographic expansions to meet the growing consumer demand worldwide and increase their product range in specialty portfolios. Their global presence allows them to serve a large set of customers, subsequently allowing them to expand their market share.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Mobile Phone Insurance Market

- Energy Recovery Ventilator Market

- Hair Wig Market

- Explosion-Proof Equipment Market

- Embolization Devices Market

- Vision Guided Robotics Software Market

- E-Bike Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Cell Line Development Market

- Long Read Sequencing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The growth of the market is attributed to the growing adoption of robotic pharmacies and the growing risk of medication errors. However, high capitalization cost requirements and shortcomings of systems are hindering market growth.

The vital signs monitoring devices market majorly consists of players such as Koninklijke Philips NV, Medtronic Plc, Nihon Kohden Corp, GE HealthCare Technologies Inc, OMRON Corp, Nonin Medical Inc, SunTech Medical Inc, Masimo Corp, Contec Medical Systems Co Ltd, and Baxter International Inc.

Answer: - The vital signs monitoring devices market is analyzed on the product and end user. Based on product, the market is segmented into pulse oximeter, blood pressure monitors, temperature monitoring devices, and glucose monitors. Pulse oximeter is subsegmented into table-top/beside pulse oximeters, hand-held pulse oximeters, and pulse oximeter accessories. Blood pressure monitors is subsegmented into mercury blood pressure monitors, ambulatory blood pressure monitors, digital blood pressure monitors, analog blood pressure monitors, and blood pressure instrument accessories. Temperature monitoring devices is subsegmented into mercury filled thermometers, digital thermometers, infrared thermometers liquid crystal thermometers, and temperature monitoring device accessories. And based on glucose monitors is subsegmeneted into self glucose monitors and continuous glucose monitors.

Based on end user, the market is classified into hospitals & clinics, ambulatory surgical centers, home healthcare, and others.

Vital signs monitoring devices measure basic medical conditions such as pulse, temperature, blood pressure, and breathing. The devices include thermometers, pulse oximeters, blood pressure monitors, and glucose monitors used to detect and monitor vital conditions in different medical or healthcare settings such as hospitals, ambulatory surgical centers, home care settings, and others.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Vital Signs Monitoring Devices Market

- Koninklijke Philips NV

- Medtronic Plc

- Nihon Kohden Corp

- GE HealthCare Technologies Inc

- OMRON Corp

- Nonin Medical Inc

- SunTech Medical Inc

- Masimo Corp

- Contec Medical Systems Co Ltd

- Baxter International Inc

Get Free Sample For

Get Free Sample For