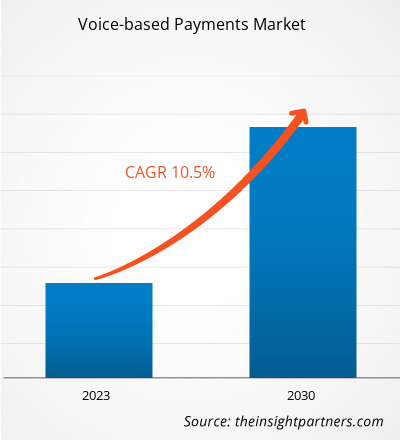

The voice-based payments market size was valued at US$ 6.47 billion in 2022 and is expected to reach US$ 14.37 billion by 2030; it is estimated to register a CAGR of 10.5% from 2022 to 2030. The advancements in automated speech recognition (ASR), machine learning (ML), and natural language understanding (NLU) are likely to remain key voice-based payments market trends.

Voice-based Payments Market Analysis

The voice-based payments market has witnessed significant growth in recent years, driven by numerous voice commerce solutions from payment service providers. As a result, the industry is expanding, and more customers are becoming interested in voice payment alternatives. With the adoption of voice-based payment solutions, businesses can cater to the growing demand for frictionless and intuitive payment experiences, improving customer satisfaction and potentially increasing conversion rates. Additionally, this technology can streamline internal payment processes, offering businesses a more efficient and automated way to handle financial transactions.

Voice-based Payments Market Overview

Voice-based payments refer to a method of conducting financial transactions using spoken commands or instructions, typically through voice-enabled devices or digital assistants. This technology allows users to make payments, initiate transfers, or perform other monetary transactions by utilizing their voice instead of traditional manual inputs, such as typing or clicking. Furthermore, voice-based payments can be integrated into various platforms, including mobile applications, virtual assistants, or smart devices, enabling businesses to offer a wide range of payment options to their customers. This technology often incorporates robust security measures, such as authentication protocols and encryption, to ensure the privacy and protection of sensitive financial information.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Voice-based Payments Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Voice-based Payments Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Voice-based Payments Market Drivers and Opportunities

Advancements in Speech Recognition Technology to Favor Market

With the increased use of smart speakers, smartphones, and other voice-enabled devices in households, more consumers have access to voice assistants. They are comfortable using them for various tasks, including making payments. This widespread adoption has paved the way for the integration of voice-based payment capabilities into these devices, further fuelling the market growth. The future of voice-based payments appears promising as advancements in AI and NLP continue to enhance the accuracy and efficiency of voice assistants, which are major drivers of voice-based payments market share.

Artificial Intelligence (AI) – An Opportunity in Voice-based Payments

Artificial intelligence (AI), with its ability to perform cognitive functions associated with human minds, offers a range of capabilities that can enhance and optimize voice-based payment systems. AI-powered voice assistants can use algorithms to understand better and interpret user commands, leading to more accurate and seamless voice-based payment experiences. This can enhance user satisfaction and increase the adoption of voice-based payment solutions. AI can also contribute to enhanced security in voice-based payments. By analyzing patterns and behaviors, AI algorithms can detect and prevent fraudulent activities, providing an additional layer of protection for users. This can help build trust in voice-based payment systems, encouraging more individuals to adopt this payment method. Therefore, the adoption of AI is expected to present significant opportunities for the voice-based payments market.

Voice-based Payments Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Voice-based Payments market analysis are component, enterprise size, and industry.

- Based on component, the market is bifurcated into hardware and software. The software segment held the largest share of the voice-based payments market in 2022.

- Based on enterprise size, the market is segmented into large enterprises and small and medium-sized enterprises. The large enterprises segment held the largest share of the voice-based payments market in 2022.

- Based on industry, the market is segmented into BFSI, automotive, healthcare, retail, government, and others. The BFSI segment held the largest share of the voice-based payments market in 2022.

Voice-based Payments Market Share Analysis by Geography

The geographic scope of the Voice-based Payments market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America.

North America holds one of the largest global voice-based payments market share in 2022. High technology adoption trends in various industries in the region fuel the growth of the voice-based payments market. The increased adoption of digital tools and high technological spending by government agencies are a few factors expected to boost the North America voice-based payments market growth. Moreover, a strong emphasis on research and development in the developed economies of the US and Canada is forcing the North American players to introduce technologically advanced solutions into the market. Furthermore, the region has a robust ecosystem of innovative tech companies, financial institutions, and payment solution providers.

Voice-based Payments Market News and Recent Developments

The voice-based payments market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market for voice-based payments and strategies:

- PCI Pal, a leading global provider of secure payment solutions, unveiled the latest advancements in Automatic Speech Recognition (ASR) technology for their suite of PCI-compliant payment solutions. This includes enhancements to their well-regarded offerings, such as PCI Pal Agent Assist and IVR Payments. The release of these next-generation ASR improvements underscores PCI Pal's commitment to providing cutting-edge solutions that ensure secure and compliant payment processing. (Source: PCI PAL, Press Release/Company Website/Newsletter, 2023)

- The National Payments Corporation of India (NPCI) introduced several new payment features to enhance digital inclusivity. These offerings include a credit line on UPI, UPI Lite X for offline payments, a Tap & Pay feature enabled by near-field communication (NFC), and conversational payments through Hello! UPI and conversational bill payments with BillPay Connect. (Source: National Payments Corporation of India (NPCI), Press Release/Company Website/Newsletter, 2023)

- ToneTag introduced VoiceSe UPI Payments in vernacular languages on feature phones. This service allows users to make voice-based digital payments in languages such as Hindi, Tamil, Telugu, Malayalam, Kannada, and Bengali. The company plans to expand the availability of this voice-based payment system to other languages like Gujarati, Marathi, and Punjabi in the near future. (Source: ToneTag, Press Release/Company Website/Newsletter, 2022)

- VibePay, a social payment initiation service, has recently unveiled its voice-activated account-to-account payment feature in Europe. This new functionality allows VibePay users on iOS to conveniently make or request payments using their voice, specifically through Siri. The payments are executed instantly and involve no fees, enabling seamless transactions from one UK bank account to another. By integrating voice activation and eliminating transaction fees, VibePay aims to enhance the user experience and streamline the payment process for its customers. (Source: VibePay, Press Release/Company Website/Newsletter, 2021)

- Google introduced voice-enabled payment for gas and announced a partnership with Honda as part of a series of upgrades. Google Assistant enables drivers to use voice commands to make purchases using Google Pay at over 32,500 gas stations in the US, including Conoco, 76, Phillips 66, Exxon, and Mobil. (Source: VibePay, Press Release/Company Website/Newsletter, 2021)

Voice-based Payments Market Regional Insights

The regional trends and factors influencing the Voice-based Payments Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Voice-based Payments Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Voice-based Payments Market

Voice-based Payments Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6.47 Billion |

| Market Size by 2030 | US$ 14.37 Billion |

| Global CAGR (2022 - 2030) | 10.5% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

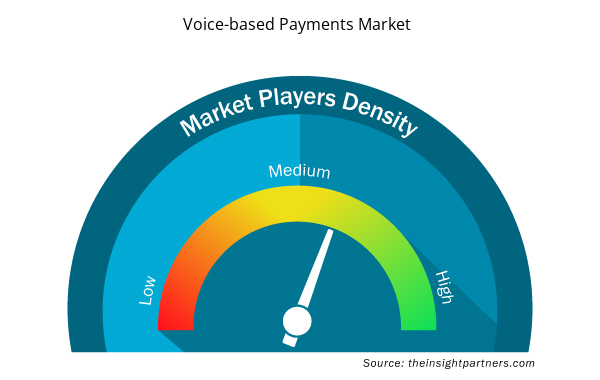

Voice-based Payments Market Players Density: Understanding Its Impact on Business Dynamics

The Voice-based Payments Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Voice-based Payments Market are:

- NCR Corporation

- Amazon.com

- Google LLC

- PayPal

- Vibepay

- NPCI Corporation

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Voice-based Payments Market top key players overview

Voice-based Payments Market Report Coverage and Deliverables

The "Voice-based Payments Market Size and Forecast (2020–2030)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Rare Neurological Disease Treatment Market

- Hydrocephalus Shunts Market

- Pipe Relining Market

- Dealer Management System Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Cut Flowers Market

- Europe Industrial Chillers Market

- Saudi Arabia Drywall Panels Market

- Electronic Signature Software Market

- Identity Verification Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Enterprise Size, and Industry

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The key players holding majority shares in the global voice-based payments market are PayPal; NCR Corporation; NPCI; Google LLC; and Amazon.com, Inc.

The global voice-based payments market was estimated to be US$ 6.47 billion in 2022 and is expected to grow at a CAGR of 10.5 % during the forecast period 2023 - 2030.

Preference for contactless payment solutions, advancements in Natural Language Processing (NLP) technology, and widespread use of smartphones and smart speakers are the major factors that propel the global voice-based payments market.

The incremental growth expected to be recorded for the global voice-based payments market during the forecast period is US$ 7.89 billion.

Increasing adoption by retail sector which is anticipated to play a significant role in the global voice-based payments market in the coming years.

The global voice-based payments market is expected to reach US$ 14.37 billion by 2030.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies - Voice-Based Payments Market

- PayPal

- NCR Corporation

- NPCI

- Google LLC

- Amazon.com, Inc.

- Paysafe

- Huawei Technologies Co., Ltd.

- Vibepay

- Cerence Inc.

- PCI Pal

Get Free Sample For

Get Free Sample For