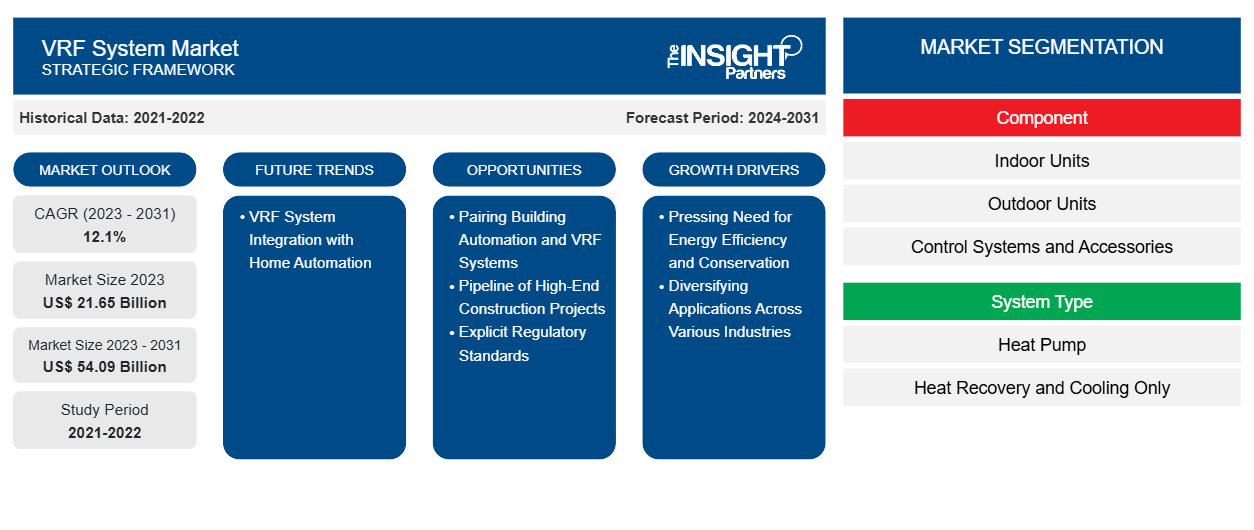

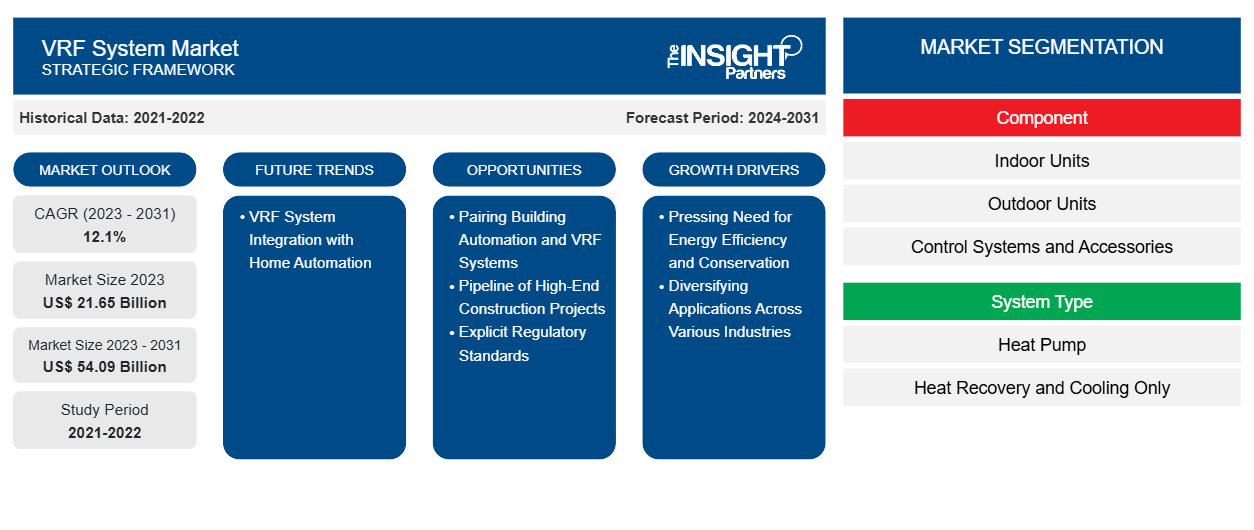

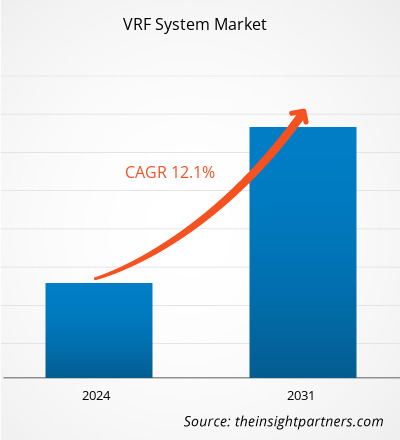

The VRF system market size is expected to reach US$ 54.09 billion by 2031 from US$ 21.65 billion in 2023. The market is estimated to record a CAGR of 12.1% from 2023 to 2031. The growing demand for customized cooling fans is likely to be a key market trend.

VRF System Market Analysis

VRF systems provide higher levels of energy efficiency. Unlike typical systems, which need turning on and off, a VRF system can run continuously at part-load, resulting in much improved overall operating efficiency. It can be equipped with heat recovery, which allows heat recovered from one space to be utilized to condition other places requiring heat in the establishment and vice versa, subsequently enhancing total system efficiency. VRF systems are often smaller and lighter in weight than their counterparts, making them easier to install and move while maintaining valuable ceiling heights and flooring areas.

The pressing need for energy efficiency and conservation and diversifying applications across various industries are the main factors driving the VRF system market growth. On the other hand, higher upfront costs limit the growth of the market. Nevertheless, pairing building automation and VRF systems and explicit regulatory standards create significant growth opportunities for the VRF system market. VRF system integration with home automation is likely to set significant future trends in the VRF system market.

VRF System Market Overview

VRF systems use refrigerants for both heating and cooling. VRF is a large-scale, high-efficiency ductless HVAC system technology. Unlike split ACs, VRF systems can support many indoor units on a single system that can be tailored to the unique requirements of users. These systems are categorized as either heat recovery or heat pump systems. Heat recovery VRF systems can deliver heating and cooling at the same time. Further, VRF systems are outfitted with multiple air handlers that can be regulated separately, and they can operate silently, even at full capacities. Thus, these systems are intended for both industrial and residential applications.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

VRF System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

VRF System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

VRF System Market Drivers and Opportunities

Diversifying Applications Across Various Industries

Operations of VRF systems involve the continuous functioning of compressors and directing refrigerant strategically in every zone as needed. A VRF system serves as an HVAC solution for a wide range of applications across various industries due to its small size, high energy efficiency, and exceptional zoning capabilities. These systems are installed in hotels, office buildings, apartment buildings, schools and universities, dormitories, data centers, hospitals, manufacturing plants, laboratory facilities, restaurants, large retail spaces, and anywhere that requires simultaneous heating and cooling over multiple zones. They provide a comfortable experience with their quieter operation and personalized zoning, regardless of room occupancy. Centralized control systems aid in the adjustment of room temperatures before guests' arrival or after checkout, resulting in significant cost savings. VRF systems with a single condenser unlock further energy savings. These devices are also available as water-source heat pumps, serving as an excellent solution for data rooms in office buildings equipped with cooling towers that supply water-cooled air handling systems. Water-source condensing units are incredibly compact and can be installed in a local equipment room with minimal floor space.

Educational facilities, ranging from large college campuses to smaller elementary schools, face particular challenges arising from a variety of rooms. Each room, from modest administrative offices to mid-sized classrooms to big gymnasiums, requires various HVAC equipment. All of these diverse needs can be fulfilled with ease using a VRF system with a single control panel. Air quality and temperature management specifications are critical in hospitals or clinical settings. The air can have an impact on patients' rehabilitation. A VRF system allows for keeping lobbies and common passages heated or at ambient temperatures while maintaining low temperatures inside recovery rooms. Thus, one can create zones without duct leaks, thereby filtering the air more effectively and minimizing cross-contamination. Therefore, diversifying applications across various industries drive the growth of the VRF system market.

Pairing Building Automation and VRF Systems

The combination of building automation systems and VRF systems may provide more holistic control over energy usage. Engineers these days capitalize on the long-term benefits of building decarbonization. For years, climate experts have warned about the dangers of permitting greenhouse gas (GHG) emissions. More than 20 states across North America have set mandated decarbonization targets, and more than 45 states in North America provide utility incentives for using electric equipment in buildings. In February 2024, the European Commission announced a new climate objective that aims to reduce greenhouse gas emissions in the European Union by 90% by 2040 compared to 1990 levels. The aim is consistent with the 90–95% emissions target proposed by the European Scientific Advisory Board on Climate Change. VRF systems are uniquely positioned to help building owners meet current carbon dioxide reduction goals while lowering utility costs. The systems do not require ducting, which makes them ideal for upgrading older buildings to modern standards. They can offer zonal, individualized comfort management and improved indoor environmental quality. The energy efficiency and cost efficiency benefits of VRF systems are enhanced with their integration with building automation systems (BAS). According to scientific experts associated with the Project Drawdown, building automation systems can increase heating and cooling efficiency by more than 20% while reducing energy consumption for lighting, appliances, and other items by 8%. BAS adoption ranges from 0% to 75% in high-income nations, including the US. Substantially increasing adoption—at a net initial cost of US US$ 287.70–393.35 billion—could save building owners US$ 2.27–3.42 trillion in operational expenditures. It may also prevent 9.55–14.01 gigatons of carbon dioxide emissions by 2050. Thus, pairing building automation and VRF systems can create ample opportunities for the growth of the VRF system market during the forecast period.

VRF System Market Report Segmentation Analysis

Key segments that contributed to the derivation of the VRF System Market analysis are component, system type, and applications.

- Based on component, the market is segmented into indoor units, outdoor units, and control systems and accessories. The outdoor units segment dominated the market in 2023.

- In terms of system type, the market is categorized into heat pump, heat recovery, and cooling only. The heat pump segment dominated the market in 2023.

- Based on application, the market is segmented into commercial, industrial, and residential. The commercial segment dominated the market in 2023.

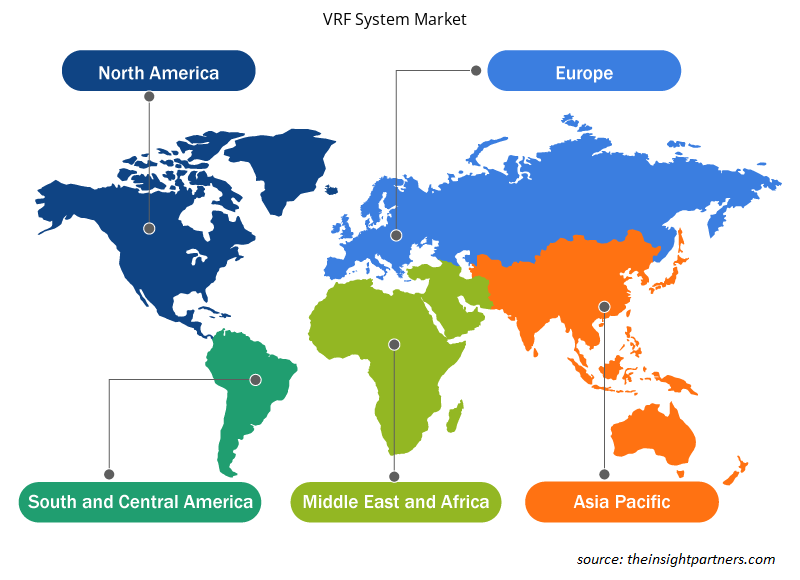

VRF System Market Share Analysis by Geography

- The VRF System Market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. APAC dominated the market in 2023, followed by Europe and North America.

- The rising temperatures and unpredictable weather have encouraged consumers to adopt VRF systems across countries in Asia Pacific. VRF systems provide nonsimultaneous cooling and heating at any time and improve the visual value of commercial and residential buildings. Various companies provide appealing VRF systems to customers, allowing them to select from various types and designs. The altering preferences of consumers and the advent of cutting-edge designs are projected to boost the demand for VRF systems.

VRF System Market Regional Insights

The regional trends and factors influencing the VRF System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses VRF System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for VRF System Market

VRF System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 21.65 Billion |

| Market Size by 2031 | US$ 54.09 Billion |

| Global CAGR (2023 - 2031) | 12.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

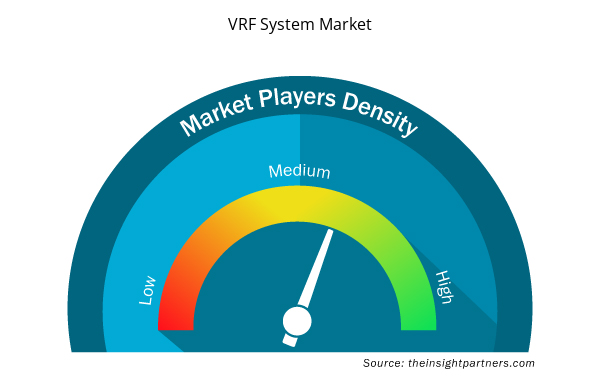

VRF System Market Players Density: Understanding Its Impact on Business Dynamics

The VRF System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the VRF System Market are:

- FUJITSU GENERAL

- Daikin Industries Ltd

- Johnson Controls International Plc

- Carrier Global Corp.

- LG Electronics Inc.

- Panasonic Holdings Corp.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the VRF System Market top key players overview

VRF System Market News and Recent Developments

The VRF system market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the VRF system market are listed below:

- Fujitsu General America released Airstage VU-V systems that offer greater flexibility, efficiency, and capacity for commercial and light commercial applications. Airstage VU-V outdoor units can serve either as heat pumps or heat recovery systems with simple setting changes and the addition of refrigerant branch units (RBUs). The new VRF platform offers single modules with broader size ranges, from 6 to 16 tons and up to 36 tons per combined system. As many as 64 indoor units can be connected to a single system.

(Source: Fujitsu General, Press Release, February 2023)

- LG Electronics announced the launch of the new Multi V i VRF solution equipped with the company's highly evolved AI engine in key global markets, starting from Europe. Suitable for mid- to high-rise buildings, such as offices, schools, shopping malls, apartment buildings, and hotels, the energy-efficient Multi V I comes with a range of differentiated, smart features that help reduce energy consumption and deliver a more comfortable indoor environment as well as a quieter outdoor environment throughout a year.

(Source: LG Electronics, Press Release, February 2023)

VRF System Market Report Coverage and Deliverables

The "VRF System Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- VRF system market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- VRF system market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- VRF system market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the VRF system market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The VRF system market was estimated to be US$ 21.65 billion in 2023 and is expected to grow at a CAGR of 12.1 % during the forecast period 2023 - 2031.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - VRF System Market

- FUJITSU GENERAL

- Daikin Industries Ltd

- Johnson Controls International Plc

- Carrier Global Corp.

- LG Electronics Inc.

- Panasonic Holdings Corp.

- Samsung Electronics Co Ltd.

- Mitsubishi Electric Corp.

- Midea Group Co Ltd.

- Lennox International Inc.

Get Free Sample For

Get Free Sample For