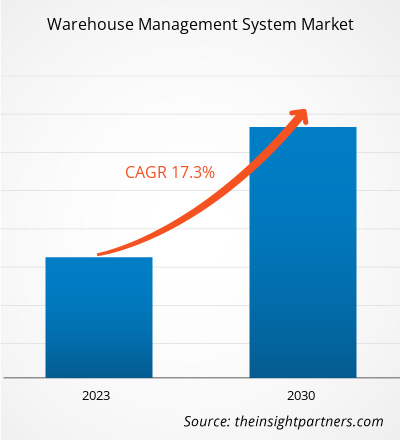

The warehouse management system market is expected to grow from US$ 14,517.07 million in 2022 to US$ 51,360.23 million by 2030; it is estimated to register a CAGR of 17.3% from 2023 to 2030.

Many enterprises are introducing robotics technology to improve the management of inventory, especially after the onset of the COVID-19 pandemic. The implementation of robotics technology reduces labor costs, provides more efficient and accurate process flow, and robots can work 24x7 at the same cost. In addition, robotics technology integrated with artificial intelligence (AI) and the Internet of Things (IoT) helped enterprises improve warehouse automation. With the integration of robotics technology and warehouse management system, robots are fed the inventory data, which helps them perform accurate and efficient warehouse operations. Such benefits are fueling the warehouse management system market growth.

Warehouses are incorporating robots to perform simple and repetitive tasks, especially in industries such as manufacturing and retail & e-commerce. Due to shifting consumer preferences during the COVID-19 pandemic, warehouses across all sizes increasingly adopted automation to maintain social distancing and reduce the number of staff that works from the facility. In addition, robots are widely used to perform tasks for workers such as measuring temperatures and administering hand sanitizer. Many logistics experts have also shifted their manual operations to automation. Warehouse robotics technology is rapidly advancing; for instance, robots can navigate the warehouse autonomously. In addition to bulk transport of goods, robots can pick, pack, and palletize items, which simplifies warehouse-related processes. Moreover, the rising popularity of e-commerce has accelerated the demand for robots across WMS. With the growing number of online orders and rising demand for faster shipping, warehouses and fulfillment centers are leveraging robotic systems to improve order completion and better manage inventory. The demand for robot hardware systems is growing, which helps reduce the time and resources spent on retrieving and transporting items around the warehouse floor. The system allows workers to concentrate on more complicated processes such as packing and shipping orders.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Warehouse Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Warehouse Management System Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Warehouse Management System Market -

Impact of COVID-19 Pandemic on Europe Warehouse Management System Market Growth

In Europe, the timing and the degree of response by different countries to the COVID-19 pandemic, followed by gradually restarting economies, resulted in an adverse impact on the warehouse management system market in the region. Prominent European warehouse management system market players suffered a significant downturn in revenue forecasts as the supply chain was disrupted due to import and export restrictions. In addition, the shutdown of manufacturing and production in commercial spaces, especially during the initial phase of the pandemic, negatively impacted the market in the region. Several verticals, such as manufacturing, retail, e-commerce, and automotive, are adopting WMS offerings as consumers quickly migrate to internet platforms. In addition, there is a rise in demand for online food and beverages, essentials, and prescriptions—increasing the requirement for warehousing.

Several major firms are opening warehouses in several countries to accommodate the rising demand for WMS solutions. As a result, WMS is becoming more popular in e-commerce and third-party logistics companies. E-commerce behemoths such as Amazon, Asos, and eBay are projected to continue driving the demand for WMS as they establish new facilities throughout the region. Additionally, the situation is improving owing to the decline in COVID-19 cases in the area, and the market is picking up speed and will expand throughout the projection period. Therefore, the warehouse management system market growth is estimated to rise substantially post-COVID-19.

Market Insights – Warehouse Management System Market

Evolving Global Supply Chain Networks

The cause-and-effect situation in a supply chain network is relatively straightforward. Organizations have more geographic distribution within their warehouse network, adding a layer of complexity regarding management. Managing a supply chain across borders also introduces regulatory and localization complexity that must be dealt with, as users in different countries use the same underlying systems to get the job done. Moreover, WMS plays a critical role in helping organizations deal with the added logistical burden of globalization. Leading WMS solutions can take this to another level through specialized data collection and integration tools. In January 2023, Crave InfoTech launched a new product for extended warehouse management (EWM) called cEWM, which is built using SAP BTP. It is a cross-platform that streamlines warehouse processes, whether online or offline. The traditional Internet-ported apps used in warehouses often lose connectivity and with it, all the process data, thereby becoming a bottleneck for the overall supply chain. Crave InfoTech's cEWM app addresses these challenges and works efficiently offline or online, irrespective of mid-process disconnection. Furthermore, supply chain management aims to maintain an uninterrupted flow of goods, from collecting raw materials to manufacturing to distributing the final product.

Component-Based Insights – Warehouse Management System Market

Based on component, the warehouse management system market size is segmented into hardware, software, and services. The hardware segment accounted for the largest share of the market in 2022.

The hardware components in the WMS optimize warehouse workflow by analyzing the best use of floor space based on the task and material characteristics. A warehouse can lower operating expenses by considering the best locations to store products and materials or equipment. Implementation of hardware systems enables core capabilities and features such as stock locating, task interleaving, wave planning, order allocation, inventory management, cycle counting, picking, replenishment, packing, shipping, labor management, and automated materials handling equipment (MHE) interfaces. The emergence of the COVID-19 pandemic has accelerated progress toward automation, and even with a spike in unemployment rates, warehouse operations were automated to meet the growing demand from customers.

The warehouse management system market is segmented based on component, tier type, industry, and geography. Based on component, the market is segmented into hardware, software, and services. Based on tier type, the market is segmented into advance (tier 1), intermediate (tier 2), and basic (tier 3). Based on industry, the warehouse management system market is segmented into manufacturing, automotive, food & beverages, electrical & electronics, healthcare, retail and e-commerce, and others.

Based on geography, the warehouse management system market size is primarily segmented into North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America. In 2022, APAC held the largest warehouse management system market share and is expected to retain its dominance during the forecast period. The region is also expected to register the highest CAGR in the global warehouse management system market during the forecast period.

International Business Machines Corp, SAP SE, Epicor Software Corp, Softeon Inc, Oracle Corp, Panasonic Holdings Corp, Infor Inc, Manhattan Associates Inc, PTC Inc, and Tecsys Inc are among the key warehouse management system market players.

Warehouse Management System Market Regional Insights

The regional trends and factors influencing the Warehouse Management System Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Warehouse Management System Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Warehouse Management System Market

Warehouse Management System Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 14.52 Billion |

| Market Size by 2030 | US$ 51.36 Billion |

| Global CAGR (2022 - 2030) | 17.3% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

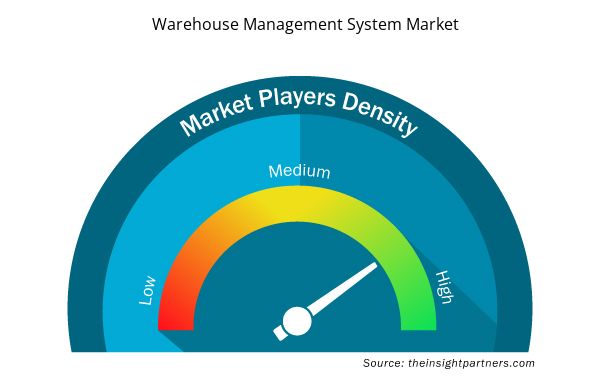

Warehouse Management System Market Players Density: Understanding Its Impact on Business Dynamics

The Warehouse Management System Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Warehouse Management System Market are:

- Panasonic Corporation

- IBM Corporation

- SAP SE

- Epicor Software Corporation

- Softeon

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Warehouse Management System Market top key players overview

The warehouse management system market players focus on developing advanced and efficient systems. For instance:

- In 2023, Tecsys announced how its warehouse-in-a-warehouse e-commerce fulfillment solution enables retailers and brands to execute e-commerce fulfillment flawlessly while leaving existing wholesale and distribution models and legacy systems intact.

- In 2022, Infor, the industry cloud company, announced that Mooneh, a third-party logistics storage and distribution provider operating for leading international pharmaceutical corporations, deployed Infor WMS (warehouse management system). In addition to establishing an efficient and effective warehouse operation, the solution delivers full inventory traceability. SNS, a leading supply chain consultancy and software implementation provider, successfully delivered the project.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Personality Assessment Solution Market

- Quantitative Structure-Activity Relationship (QSAR) Market

- Fish Protein Hydrolysate Market

- Public Key Infrastructure Market

- Non-Emergency Medical Transportation Market

- Analog-to-Digital Converter Market

- Third Party Logistics Market

- Lymphedema Treatment Market

- 3D Audio Market

- Electronic Data Interchange Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Tier Type, Industry, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The hardware segment led the global warehouse management system market in 2022.

The US, UK, Rest of APAC, Saudi Arabia, and Rest of SAM are the countries registering high growth rate during the forecast period.

The global warehouse management system market was valued at US$ 14,517.07 Mn in 2022

APAC is the fastest-growing regional market in the global warehouse management system market between 2023-2030.

The key players of warehouse management system market are encompassed with International Business Machines Corp, SAP SE, Epicor Software Corp, Softeon Inc, Oracle Corp, Panasonic Holdings Corp, Infor Inc, Manhattan Associates Inc, PTC Inc, and Tecsys Inc.

The key driving factors impacting warehouse management system market growth includes:

1. Migration to Cloud-Based WMS

2. E-Commerce Industry Growth

3. Global Supply Chain Networks

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Warehouse Management System Market

- Panasonic Corporation

- IBM Corporation

- SAP SE

- Epicor Software Corporation

- Softeon

- Infor

- Manhattan Associates

- PTC Inc.

- Tecsys, Inc.

- Oracle Corporation

Get Free Sample For

Get Free Sample For