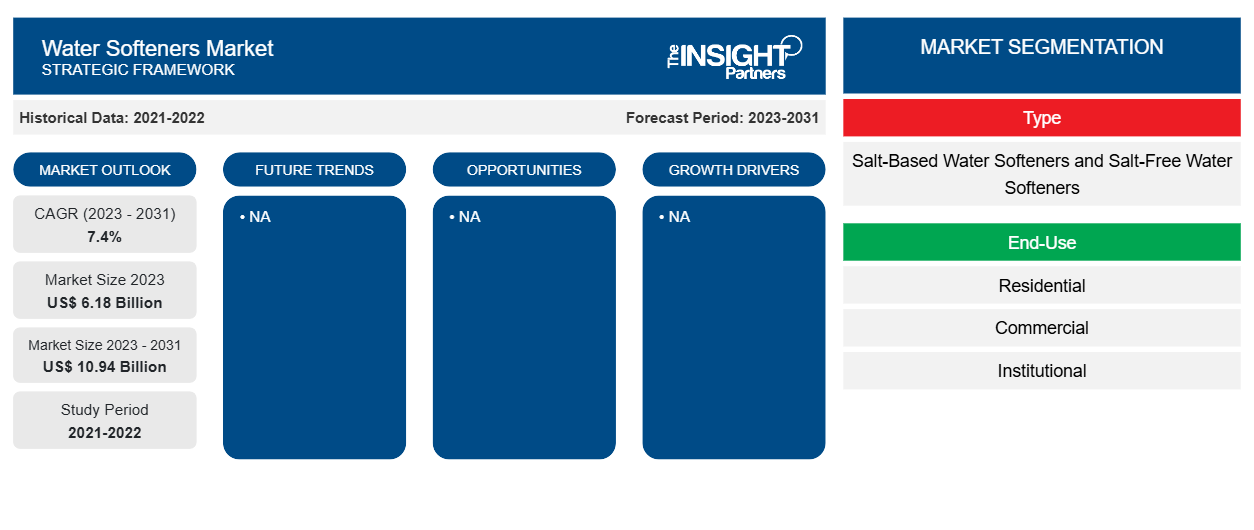

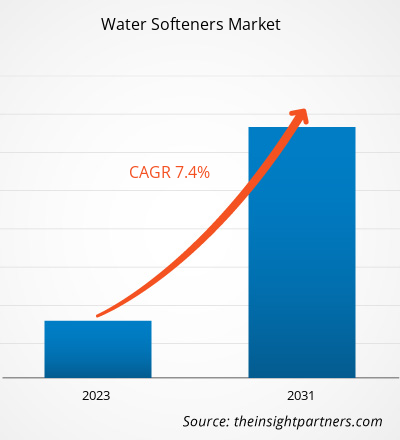

The water softeners market size is projected to reach US$ 10.94 billion by 2031 from US$ 6.18 billion in 2023. The market is expected to register a CAGR of 7.4% in 2023–2031. The Increasing awareness regarding the harmful effects of hard water is likely to remain a key water softeners market trend.

Water Softeners Market Analysis

The water softeners market has witnessed significant growth in recent years, driven by increasing awareness about the detrimental effects of hard water on plumbing systems, appliances, and overall water quality. Hard water with high levels of calcium, magnesium, and other minerals poses challenges such as scale buildup and soap scum formation, lowering the efficiency of water heaters and washing machines. As a result, residential, commercial, and institutional consumers are increasingly adopting water-softening systems to overcome these issues.

Water Softeners Market Overview

Water softeners are gaining significant popularity due to their ability to remove minerals such as calcium and magnesium from water, preventing scale buildup and improving water quality. Urbanization, industrialization, the need for clean water, rising disposable income, and changing consumer preferences are among the major factors contributing to the water softeners market growth. Government regulations promoting water softeners to reduce water wastage also contribute to market expansion. Salt-based water softeners are the most widely used type. Among all major regions, North America and Europe lead the market due to high hard water prevalence.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Water Softeners Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Water Softeners Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Water Softeners Market Drivers and Opportunities

Increasing Awareness Regarding Harmful Effects of Hardwater Bolsters Market

Hard water can lead to the buildup of limescale deposits in plumbing and appliances, reducing their efficiency and lifespan. Water-softening solutions are adopted to protect various equipment, plumbing systems, and human health from the detrimental effects of hard water. Water-softening systems allow residential users to prolong the longevity of their household infrastructure. Hard water can leave skin feeling dry and hair brittle due to the residual mineral deposits left on skin and hair surfaces. As individuals seek to address these personal care concerns, the demand for water softeners has increased in the last few years. Additionally, the potential health benefits of reducing the consumption of hard water, particularly in relation to cardiovascular health, further underline the importance of water-softening systems in households.

Rising Adoption of Water Softeners in Emerging Economies Creates Significant Growth Opportunities

Urbanization and industrialization are prominent trends in countries such as India and China. As urban populations grow and industrial activities expand, the demand for water softeners has risen to address the challenges posed by hard water in residential and commercial settings. A survey conducted by KentRO in Bengaluru, India, stated that 24% of areas in the city receive hard water, which resulted in increased water-softening system installation in households and commercial sectors.

Water Softeners Market Report Segmentation Analysis

Key segments that contributed to the derivation of the water softeners market analysis are type, end use, and distribution channel.

- Based on type, the water softeners market is bifurcated into salt-based water softeners and salt-free water softeners. The salt-based water softeners segment held a larger market share in 2023.

- Based on end use, the water softeners market is segmented into residential, commercial (hotels and lodges, restaurants, offices, hospitals, and others), and institutional. The residential segment held the largest market share in 2023.

- Based on distribution channel, the water softeners market is bifurcated into direct and indirect. The direct segment held a larger market share in 2023.

Water Softeners Market Share Analysis by Geography

The geographic scope of the water softeners market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific held a significant share of the water softeners market in 2023. With the rising population, water consumption is rapidly increasing across the region. The burden on municipal water treatment plants across the region has significantly increased due to the need to fulfill the rising demand for drinking water and sanitary facilities. Due to infrastructure limitations, municipal corporations in countries such as China and India are unable to handle hard water efficiently. According to the Asian Development Bank, nearly 3,400 million people in Asia are estimated to live in water-stressed areas by 2050. Such stats emphasize the need to implement water recycling and reuse approaches, which would drive the demand for water softeners over the coming years.

Water Softeners Market News and Recent Developments

The water softeners market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the water softeners market as mentioned below:

- Organica Water is raising institutional funds to expand its operations. (Source: Organica Water, News, 2023)

- SpringWell Water extended its sales to Canada to expand the reach of its product offerings to new geographies that present growth opportunities and reinforce its mission to provide every family with clean, refreshing, and contaminate-free drinking water. (Source: SpringWell Water, News, 2021)

Water Softeners Market Regional Insights

The regional trends and factors influencing the Water Softeners Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Water Softeners Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Water Softeners Market

Water Softeners Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6.18 Billion |

| Market Size by 2031 | US$ 10.94 Billion |

| Global CAGR (2023 - 2031) | 7.4% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Water Softeners Market Players Density: Understanding Its Impact on Business Dynamics

The Water Softeners Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Water Softeners Market are:

- Rheem Manufacturing Co

- Marlo Inc

- Robert B Hill Co

- Silverline UK Ltd

- Hobart Corp

- Water-Right Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Water Softeners Market top key players overview

Water Softeners Market Report Coverage and Deliverables

The “Water Softeners Market Size and Forecast (2021–2031)” report provides a detailed analysis of the market covering below areas:

- Water softeners market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Water softeners market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Water softeners market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the water softeners market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Enzymatic DNA Synthesis Market

- Volumetric Video Market

- Transdermal Drug Delivery System Market

- 3D Mapping and Modelling Market

- Rare Neurological Disease Treatment Market

- Integrated Platform Management System Market

- MEMS Foundry Market

- Intraoperative Neuromonitoring Market

- Passport Reader Market

- Sleep Apnea Diagnostics Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Asia Pacific is the largest region of global water softeners market. With the rising population, water consumption is rapidly increasing across Asia Pacific. The burden on municipal water treatment plants across the region has significantly increased due to the need to fulfill the rising demand for drinking water and sanitary facilities.

Hard water can lead to the buildup of limescale deposits in plumbing and appliances, reducing their efficiency and lifespan. Water-softening solutions are adopted to protect various equipment, plumbing systems, and human health from the detrimental effects of hard water.

Based on type, the market is bifurcated into salt-based water softeners and salt-free water softeners. The salt-based water softeners segment accounted for a larger water softeners market share in 2023. Salt-based water softeners are a widely utilized solution for addressing the challenges posed by hard water.

Based on end use, the water softeners market is segmented into residential, commercial (hotels and lodges, restaurants, offices, hospitals, and others), and institutional. The residential segment accounted for the largest and fastest water softeners market share in 2023. Water softeners play a vital role in residential applications, providing numerous benefits to households dealing with hard water.

The major players operating in the global water softeners market are Rheem Manufacturing Co, Marlo Inc, Robert B Hill Co, Silverline UK Ltd, Hobart Corp, Water-Right Inc, US Water Systems Inc, Kinetico Inc, Ecowater Systems LLC, and Culligan International Co.

Water softener manufacturers engage in mergers and acquisitions, collaborations, and other strategic developments to expand their clientele and enhance their market position. In November 2022, Culligan International and Waterlogic Group Holdings joined forces to offer clean and sustainable drinking water solutions. Culligan is a provider of consumer-focused, sustainable water solutions and services, and Waterlogic is a globally operating designer, manufacturer, and distributor of purified drinking water dispensers.

Trends and growth analysis reports related to Consumer Goods : READ MORE..

The List of Companies - Water Softeners Market

- Rheem Manufacturing Co

- Marlo Inc

- Robert B Hill Co

- Silverline UK Ltd

- Hobart Corp

- Water-Right Inc

- US Water Systems Inc

- Kinetico Inc

- Ecowater Systems LLC

- Culligan International Co

Get Free Sample For

Get Free Sample For