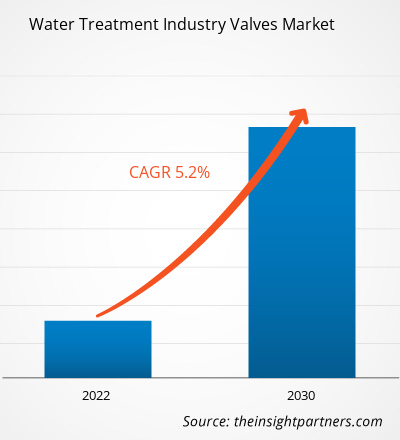

The Water Treatment Industry Valves market size is projected to reach US$ 16,282.87 million by 2030 from US$ 10,853.95 million in 2022. The market is expected to register a CAGR of 5.2% during 2022–2030. Continuous research and development activities by the valve manufacturer are likely to remain key trends in the market.

Water Treatment Industry Valves Market Analysis

The safety valves are projected to grow with the highest CAGR during the forecast period. Safety valves are majorly used across steam systems for protection against boiler overpressure situations and downstream pressure-reducing controls. These valves are also used for process operations to prevent product damage owing to high pressure. Safety valves are generally of three types: relief valves, normal safety valves, and proportional safety relief valves. Safety valves are majorly used across steam systems for protection against boiler overpressure situations and downstream pressure-reducing controls. These valves are also used for process operations to prevent product damage owing to high pressure. Safety valves are generally of three types: relief valves, normal safety valves, and proportional safety relief valves. Major industries using safety valves include oil & gas, energy & power, chemicals, food & beverages, water treatment, and pharmaceuticals. In the water treatment industry, these safety valves are used to prevent excessive pressure in pipelines and ensure the integrity of the water distribution system. Alfa Laval, Kent Valve, Hyper Valves, IMI PLC, and Emerson are a few of the key safety valve manufacturers operating in the market.

Water Treatment Industry Valves Market Overview

In Europe, the quality of valves is regulated by the specific organization. Manufacturers in the European region become members of valve associations such as VDMA, Profluid, and BVAMA, among others. These national associations may, in turn, become voluntary members of CEIR, which is multi-national within Europe in scope. In addition to national associations, there are national standards bodies such as BSI in the UK, DIN in Germany, SNV in Switzerland, and ANFOR in France. Food & beverage sanitary applications are governed by the European Hygienic and Engineering Design Guidelines (EHEDG). The CEN (European Committee for Standardization) is an organization that supports the harmonization of European standards described above.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Water Treatment Industry Valves Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Water Treatment Industry Valves Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Water Treatment Industry Valves Market Drivers and Opportunities

Increased investments in water treatment plants to Favor Market

In March 2022, the US Department of the Interior stated that the Bureau of Reclamation invested US$ 420 million in rural water-building efforts in fiscal year 2022. This investment in rural water systems involves work associated with pipeline connections, the building of water treatment facilities and intakes, pump systems, reservoir construction, and other activities to deliver potable water to rural and tribal populations. Owing to such investments in the development of water treatment and management plants, the demand for industry valves in the US has surged.

Growing smart cities initiatives

Across the globe, governments are notably focusing on the development of smart cities. With the implementation of smart cities, governments are significantly increasing water management as water is one of the main resources for carrying out daily routines in residential, commercial, and industrial setups. The adoption and integration of digital technologies across industries, including the water treatment industry, is expected to rise owing to the smart city initiatives. This will increase the development and demand for the next generation and smart valves, ultimately generating lucrative opportunities for the water treatment industry valves.

Water Treatment Industry Valves Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Water Treatment Industry Valves market analysis are valve type, and material type.

- Based on valve type, the water treatment industry valves market is divided into ball valves, butterfly valves, diaphragm valves, safety valves, check valves, gate valves, and others. The ball valves segment held a larger market share in 2022.

- By material type, the market is segmented into steel alloys, stainless steel, cast iron, and others. The stainless steel segment held the largest share of the market in 2022.

Water Treatment Industry Valves Market Share Analysis by Geography

The geographic scope of the Water Treatment Industry Valves market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific has the largest share of the water treatment industry valve owing to the presence of a huge population with increasing demand for clean water along with increasing government initiatives for water-related infrastructure. Asia Pacific's population crossed over 2.1 billion with increasing rapid urbanization and growing investment in water infrastructure drives the market growth. According to the International Trade Administration (ITA), in January 2021, there are around 10,000 water treatment plants in China for wastewater in municipalities and rural areas. In 2021, there were 40,000 new wastewater treatment plants were planned to set up. Such growth in wastewater treatment plants drives market growth.

Water Treatment Industry Valves Market Regional Insights

The regional trends and factors influencing the Water Treatment Industry Valves Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Water Treatment Industry Valves Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Water Treatment Industry Valves Market

Water Treatment Industry Valves Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 10,853.95 Million |

| Market Size by 2030 | US$ 16,282.87 Million |

| Global CAGR (2022 - 2030) | 5.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Valve Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

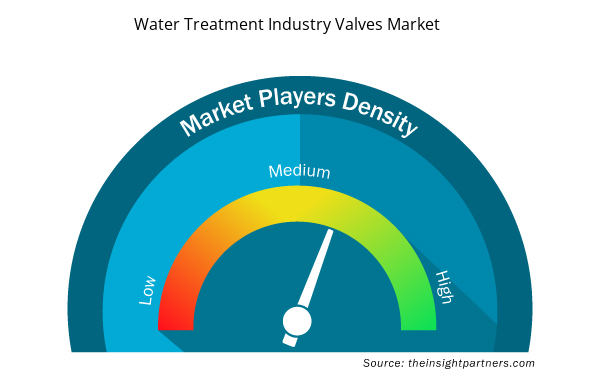

Water Treatment Industry Valves Market Players Density: Understanding Its Impact on Business Dynamics

The Water Treatment Industry Valves Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Water Treatment Industry Valves Market are:

- Velan Inc.

- Alfa Laval Solution

- Flowserve Corporation

- Emerson Electric Co

- Dutch Valve Vision

- Valco Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Water Treatment Industry Valves Market top key players overview

Water Treatment Industry Valves Market News and Recent Developments

The Water Treatment Industry Valves market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Water Treatment Industry Valves market are listed below:

- Alfa Laval is unveiling two new hygienic valves, the Alfa Laval Unique Mixproof CIP and Unique Mixproof Process, extending its hygienic double-seat valve range to meet market demands. With the introduction of these two innovative mix-proof valves, manufacturers concerned about product integrity now have a cost-effective way to enhance product safety while boosting process efficiency and sustainability. (Source: ALFA LAVAL, Press Release, September 2023)

- American AVK has developed a line of AWWA C515 Gate Valves. Upon request, they can be certified to have Holiday-Free internal coatings for excellent corrosion resistance. (Source: American AVK, Press Release, November 2023)

Water Treatment Industry Valves Market Report Coverage and Deliverables

The “Water Treatment Industry Valves Market Size and Forecast (2020–2030)” report provides a detailed analysis of the market covering below areas:

- Water Treatment Industry Valves market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Water Treatment Industry Valves market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Water Treatment Industry Valves market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Water Treatment Industry Valves market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Valve Type, and Material Type

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

5.4% is the expected CAGR of the water treatment industry valves market

The global water treatment industry valve market is estimated to reach US$ 17.4 billion by 2031

Velan Inc., Alfa Laval Solution, Flowserve Corporation, Emerson Electric Co, Dutch Valve Vision, Valco Group, American AVK Co, Kitz Corporation, Spirax Sarco Engineering Plc, and DeZURIK Inc.

Increased investments in water treatment plants are driving the water treatment industry valves market

Asia Pacific dominated the water treatment industry valves market in 2023

Get Free Sample For

Get Free Sample For