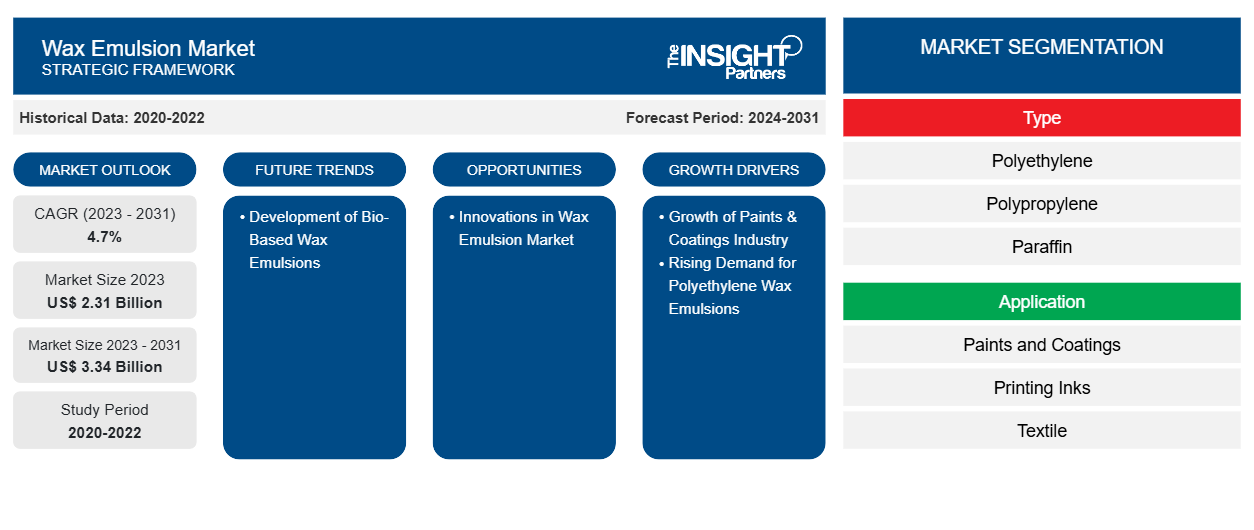

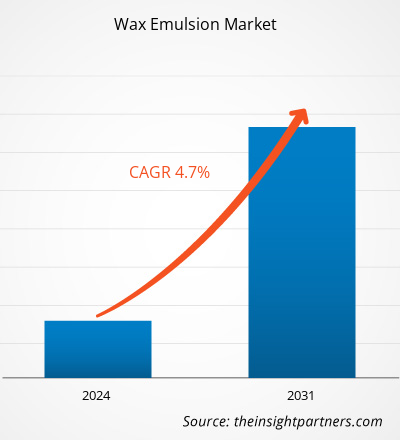

The wax emulsion market size is expected to grow from US$ 2.31 billion in 2023 to US$ 3.34 billion by 2031; it is estimated to register a CAGR of 4.7% from 2023 to 2031.

Market Insights and Analyst View:

Wax emulsions are formulated additives made of fine and stabilized wax particles homogeneously distributed in water. Wax emulsions are stabilized by non-ionic emulsifiers or ionic emulsifiers. Wax emulsions are extensively used in various aqueous formulations. They are used in various applications such as paints and coatings, packaging, printing inks, textiles, and rubber and plastic processing. Wax emulsions are used as additives in coatings, paints, and varnishes to improve surface properties such as scratch resistance, water repellency, and gloss. It acts as a matting agent or anti-blocking agent in coatings. In the textile industry, wax emulsions are applied to fabrics to impart properties such as water repellency, wrinkle resistance, and fabric softening. Wax emulsions are used in paper coatings and packaging materials to provide moisture resistance, gloss, and barrier properties. They are used in printing inks to modify rheological properties and enhance printability. Wax emulsions are used in the formulation of personal care products, including creams, lotions, and hair care products, to provide thickening and conditioning properties.

Growth Drivers and Challenges:

The key factor contributing to the increasing wax emulsion market size is the growth of the paints & coatings industry. Paints and coatings are used for decorative purposes and enhancing surface properties such as corrosion resistance, scratch resistance, adhesion, appearance, and water resistance. Paints & coatings are increasingly used in end-use industries such as construction, furniture, packaging, automotive & transportation, and other industrial applications. Wax emulsions are an integral component of paints and coatings. Polyethylene wax emulsions are used in aqueous coatings due to their characteristics such as physical stability, fine particle size, anti-scuff properties, waterproofing, gloss, and ease of handling. Wax emulsions are also used in wood polishes and finishes and outdoor timber treatment. Wax emulsions render wood with abrasion resistance, waterproofing, and anti-blocking properties. It also finds application in metal components and automotive coatings. The growing global sales of electric vehicles drive the demand for high-performance coatings and electrical insulating coatings. According to the International Organization of Motor Vehicle Manufacturers, motor vehicle production in Germany stood at 3.68 million units in 2022, reporting a rise of 11% compared to 2021. According to the International Energy Agency, the electric car market has witnessed exponential growth in the past few years, with reported global sales of more than 10 million electric cars in 2022. Thus, growth in the paints & coatings industry fuels the wax emulsion market. The wax emulsion market trends include the development of bio-based wax emulsions.

The fluctuation in raw material prices restrains the global wax emulsion market growth. Raw materials used in wax emulsion manufacturing are often traded as commodities in the global markets, subjecting them to commodity market dynamics. Raw materials such as paraffin, polyethylene, and other polyolefin waxes are derived from crude oil. Crude oil-derived products are subject to price volatility due to various factors, such as supply chain disruptions, geopolitical tensions, and fluctuations in demand. Energy costs, particularly for energy-intensive manufacturing processes, can significantly influence raw material prices. Disruption in transportation and supply chain, rise in demand for crude oil, and inflation in raw material prices raise petroleum product prices. Fluctuations in prices of oil and other energy sources can adversely affect production costs for wax emulsion and contribute to price volatility.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wax Emulsion Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wax Emulsion Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

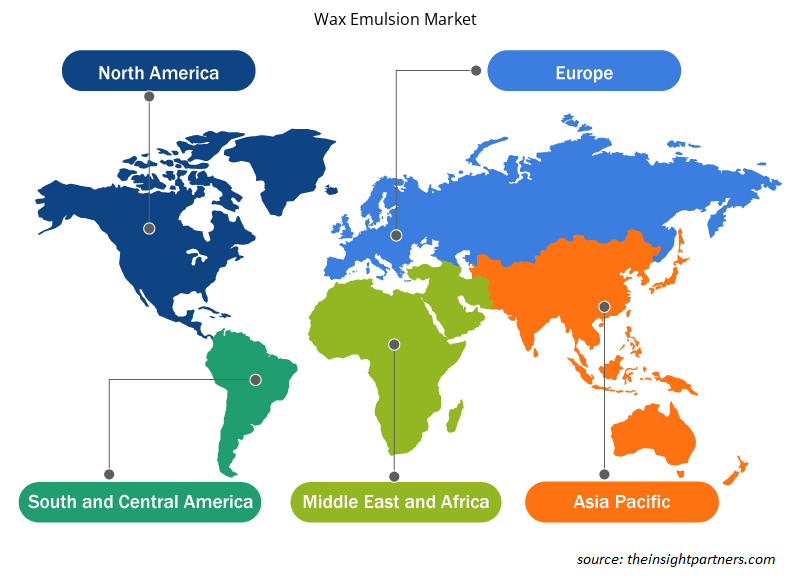

The "Global Wax Emulsion Market Analysis" has been performed by considering the following segments: type, application, and geography. Based on type, the market is segmented into polyethylene, polypropylene, paraffin, vegetable-based, and others. By application, the market is segmented into paints and coatings, printing inks, textiles, personal care, packaging, and others. The geographic scope of the wax emulsion market report focuses on North America (the US, Canada, and Mexico), Europe (Germany, France, Italy, the UK, Russia, and the Rest of Europe), Asia Pacific (Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific), the Middle East & Africa (South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa), and South & Central America (Brazil, Argentina, and the Rest of South & Central America).

Segmental Analysis:

Based on type, the market is segmented into polyethylene, polypropylene, paraffin, vegetable-based, and others. The polyethylene segment is anticipated to hold a significant wax emulsion market share by 2030. Polyethylene is obtained by polymerization of ethylene monomers. To produce polyethylene wax, high molecular weight polyethylene is subjected to a degradation process. The long chains of polyethylene are broken down into shorter chains using specific catalysts or thermal processes, resulting in polyethylene wax. The advantages of polyethylene wax are lubricity, stability, compatibility, versatility, and non-toxicity. Polyethylene wax provides outstanding thermal stability due to its chemical structure. This makes it a preferred choice in applications that involve high-temperature processes. Polypropylene is also one of the major types in the wax emulsion market. Polypropylene waxes are relatively low molecular weight polymers of propylene, and they are produced via the polymerization of propene. Polypropylene wax emulsions provide a strong anti-slip effect and good dirt repulsion. They also help improve abrasion resistance and wet scrub resistance. The emulsions based on a modified polypropylene wax are highly used for improving the surface properties of different products. Polypropylene-based wax emulsions are used in the paint, printing ink, and floor polish industries.

Regional Analysis:

Based on geography, the wax emulsion market is segmented into five key regions—North America, Europe, Asia Pacific, South & Central America, and the Middle East & Africa. In terms of revenue, Asia Pacific dominated the global market share in 2023. The market in Asia Pacific accounted for over US$ 1 billion in 2023. The Asia Pacific wax emulsion market is witnessing considerable growth owing to the strong growth of the paints & coatings, packaging, textile, and personal care industries. China is one of the high-skilled manufacturing hubs. In contrast, India, South Korea, and Taiwan are considered attractive business destinations for companies looking for medium-skilled manufacturing infrastructure and low labor costs. As per the International Trade Administration, total investment in China's infrastructure during the 14th Five-Year Plan period (2021–2025) is estimated to reach ~US$ 4.2 trillion. According to the International Organization of Motor Vehicle Manufacturers report motor vehicle production in Asia Pacific was estimated to be ~48.96 million units in 2022. China has emerged as one of the largest electric vehicle markets globally, supported by government policies promoting electric vehicles. The growing demand for paints and coatings from the automotive and construction industries drives the wax emulsion market growth in Asia Pacific.

Europe is another major contributor, holding more than 20% of the global wax emulsion market share. Wax emulsions offer wear and corrosion resistance and are therefore used in lubricants and protective coatings in the automotive industry. Several European countries have set targets to phase out internal combustion engine vehicles and support the transition toward electric vehicles. According to the International Trade Administration report published in 2022, increased investments in the automotive industry would create lucrative opportunities for automotive component and material producers in Europe. Further, according to the European Commission, the construction industry is one of the major industries in Europe, contributing ~9% to the region's GDP. As per the European Commission, in June 2023, the EU invested ~US$ 6 billion in the construction of sustainable, safe, and efficient transport infrastructure, including 107 transport infrastructure projects. Thus, growth in the construction and automotive industries in Europe fuels the demand for wax emulsions.

Wax Emulsion Market Regional Insights

Wax Emulsion Market Regional Insights

The regional trends and factors influencing the Wax Emulsion Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wax Emulsion Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wax Emulsion Market

Wax Emulsion Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.31 Billion |

| Market Size by 2031 | US$ 3.34 Billion |

| Global CAGR (2023 - 2031) | 4.7% |

| Historical Data | 2020-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

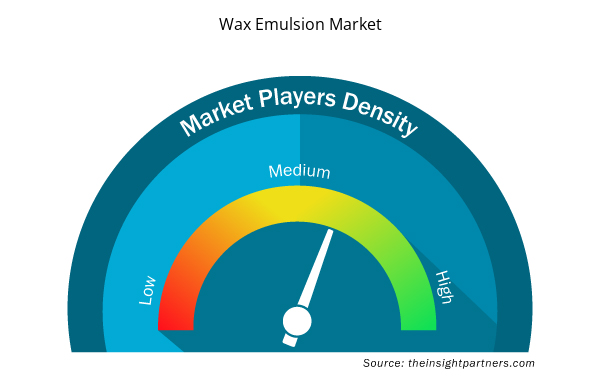

Wax Emulsion Market Players Density: Understanding Its Impact on Business Dynamics

The Wax Emulsion Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wax Emulsion Market are:

- BASF SE

- Hexion Inc

- Repsol SA

- Sasol Ltd

- The Lubrizol Corp

- Clariant AG

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wax Emulsion Market top key players overview

Industry Developments and Future Opportunities:

The wax emulsion market forecast can help stakeholders plan their growth strategies. As per company press releases, the following are a few recent developments by major companies in the market:

- In June 2021, Omya signed an agreement with Michelman to distribute Michelman's surface modifiers and wax emulsion product line to the paints and coating markets in Canada.

- In January 2023, Ter Chemicals announced an agreement with Allinova to be an exclusive distributor of Allinova wax emulsions in Poland. The wide product portfolio ranges from wax emulsions, flame retardants, crosslinking agents, repellents, and solvents to plastic dispersions.

- In October 2021, H&R Group, a global sustainable refiner and marketer of specialty plasticizers, extender oils, softeners, and waxes headquartered in Hamburg, Germany, invested US$ 48.3 million in a specialty manufacturing plant in Lumut, Perak, Malaysia.

- In June 2023, Concentrol updated its catalog of wax emulsions, introducing a wide range of EMULTROL products that cater to various application sectors. These wax or oil emulsions are formulated using diverse materials, offering unique and versatile properties that make them ideal for a wide range of industries and applications.

- In October 2023, Emulco NV launched AquaVeg bio-emulsion into the panel board industry. The emulsion manufacturer is combining its AquaVeg water-based bio-emulsion with formaldehyde-free bio-based binders to produce zero-emission panel boards.

Competitive Landscape and Key Companies:

BASF SE, Hexion Inc, Repsol SA, Sasol Ltd, The Lubrizol Corp, Clariant AG, Michelman Inc, Allinova BV, H&R Group, and Productos Concentrol SA are among the prominent players profiled in the wax emulsion market report. The global market players focus on providing high-quality products to fulfill customer demand. Also, they focus on adopting various strategies such as new product launches, capacity expansions, partnerships, and collaborations to stay competitive in the wax emulsion market.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Extracellular Matrix Market

- Greens Powder Market

- Enzymatic DNA Synthesis Market

- Single-Use Negative Pressure Wound Therapy Devices Market

- Fixed-Base Operator Market

- Terahertz Technology Market

- Webbing Market

- Redistribution Layer Material Market

- Aircraft Wire and Cable Market

- Authentication and Brand Protection Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

BASF SE, Hexion Inc, Repsol SA, Sasol Ltd, The Lubrizol Corp, Clariant AG, Michelman Inc, Allinova BV, H&R Group, and Productos Concentrol SA are among the prominent players profiled in the wax emulsion market report.

In 2023, Asia Pacific held the largest share of the global wax emulsion market. China is one of the major markets in Asia Pacific for wax emulsion. The growth in construction, packaging, and the textile industry in the region is positively impacting the demand for wax emulsions.

The polyethylene segment held the largest share in the global wax emulsion market in 2023. Polyethylene wax emulsion is highly used in architectural coatings. Also, polyethylene wax emulsion is widely used in food packaging containers, textiles, printing inks, water-borne paints, water-borne polishes, and other applications.

The paints and coatings segment held the largest share of the global wax emulsion market in 2023. Paints and coatings are one of the major applications of wax emulsions. This application includes the use of wax emulsion in wood coatings, architectural coatings, car polishes, and floor polishes.

The wax emulsion market growth is attributed to the growth of the paints & coatings industry and the rising demand for polyethylene wax emulsions.

Asia Pacific is estimated to register the fastest CAGR in the global wax emulsion market over the forecast period. The growth in construction, electric vehicles, and the textile industry in the region is expected to drive the demand for wax emulsions.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Wax Emulsion Market

- BASF SE

- Hexion Inc

- Repsol SA

- Sasol Ltd

- The Lubrizol Corp

- Clariant AG

- Michelman Inc

- Allinova BV

- H&R Group

- Productos Concentrol SA

Get Free Sample For

Get Free Sample For