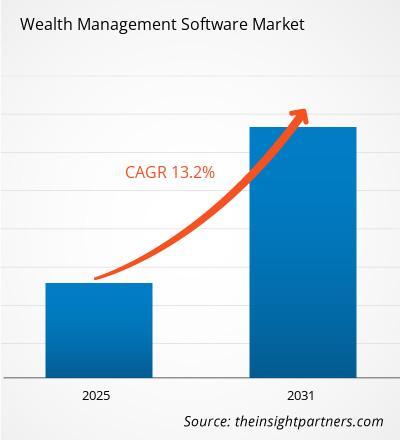

The Wealth Management Software Market is expected to register a CAGR of 13.2% from 2025 to 2031, with a market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is divided into four sections: Component (Software, Services), Deployment (Software, Services), Advisory Mode and End User (Banks, Investment Management Firms, Trading & Exchange Firms, Brokerage Firms). The global analysis is broken down at the regional level and major countries. The market evaluation is presented in US$ for the above segmental analysis.

Purpose of the Report

The report Wealth Management Software Market by The Insight Partners aims to describe the present landscape and future growth, top driving factors, challenges, and opportunities. This will provide insights to various business stakeholders, such as:

- Technology Providers/Manufacturers: To understand the evolving market dynamics and know the potential growth opportunities, enabling them to make informed strategic decisions.

- Investors: To conduct a comprehensive trend analysis regarding the market growth rate, market financial projections, and opportunities that exist across the value chain.

- Regulatory bodies: To regulate policies and police activities in the market with the aim of minimizing abuse, preserving investor trust and confidence, and upholding the integrity and stability of the market.

Wealth Management Software Market Segmentation

Component

- Software

- Services

Deployment

- Software

- Services

Advisory Mode and End User

- Banks

- Investment Management Firms

- Trading & Exchange Firms

- Brokerage Firms

Geography

- North America

- Europe

- Asia-Pacific

- South and Central America

- Middle East and Africa

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wealth Management Software Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Wealth Management Software Market Growth Drivers

- Growing Affluent Population: The global rise of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) is driving demand for sophisticated wealth management software to manage complex portfolios and provide personalized services.

- Regulatory Compliance: Increasing regulatory scrutiny and compliance requirements, such as KYC/AML regulations and data privacy laws, necessitate robust wealth management software solutions to ensure compliance and mitigate risks.

- Digital Transformation: The increasing adoption of digital channels and the growing demand for personalized and convenient services are driving the need for digital-first wealth management software solutions that can cater to the evolving needs of clients.

Wealth Management Software Market Future Trends

- Artificial Intelligence (AI) & Machine Learning: AI and ML are being increasingly integrated into wealth management software to enable personalized investment advice, portfolio optimization, and risk management.

- Open Architecture & API Integration: Open APIs and interoperability are becoming increasingly important, enabling seamless integration with third-party applications and data sources to provide a more comprehensive and personalized client experience.

- Cloud Computing: The migration of wealth management software to the cloud is gaining traction, offering enhanced scalability, flexibility, and cost-effectiveness.

Wealth Management Software Market Opportunities

- Developing AI-powered Wealth Management Solutions: Focus on developing AI-powered solutions, such as robo-advisors and AI-driven portfolio management tools, to enhance investment decision-making and improve client outcomes.

- Expanding into Emerging Markets: Explore untapped markets in developing economies where the wealth management industry is growing rapidly.

- Offering Comprehensive Wealth Management Platforms: Provide comprehensive wealth management platforms that encompass all aspects of wealth management, including investment management, financial planning, and estate planning.

Wealth Management Software Market Regional Insights

The regional trends and factors influencing the Wealth Management Software Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wealth Management Software Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wealth Management Software Market

Wealth Management Software Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ XX million |

| Market Size by 2031 | US$ XX Million |

| Global CAGR (2025 - 2031) | 13.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

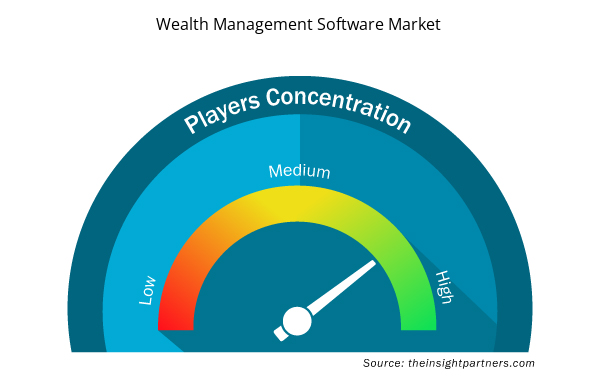

Wealth Management Software Market Players Density: Understanding Its Impact on Business Dynamics

The Wealth Management Software Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wealth Management Software Market are:

- Comarch SA

- Dorsum Ltd.

- Fidelity National Information Services, Inc.;

- Fiserv, Inc.

- Objectway S.p.A.

- Profile Software

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wealth Management Software Market top key players overview

Key Selling Points

- Comprehensive Coverage: The report comprehensively covers the analysis of products, services, types, and end users of the Wealth Management Software Market, providing a holistic landscape.

- Expert Analysis: The report is compiled based on the in-depth understanding of industry experts and analysts.

- Up-to-date Information: The report assures business relevance due to its coverage of recent information and data trends.

- Customization Options: This report can be customized to cater to specific client requirements and suit the business strategies aptly.

The research report on the Wealth Management Software Market can, therefore, help spearhead the trail of decoding and understanding the industry scenario and growth prospects. Although there can be a few valid concerns, the overall benefits of this report tend to outweigh the disadvantages.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Some of the customization options available based on request are additional 3-5 company profiles and country-specific analysis of 3-5 countries of your choice. Customizations are to be requested/discussed before making final order confirmation, as our team would review the same and check the feasibility.

The report can be delivered in PDF/PPT format; we can also share excel dataset based on the request.

The leading players of the market are: Comarch SA, Dorsum Ltd, Fidelity National Information Services Inc, Fiserv Inc, Objectway S p A, Profile Software, SEI Investments Company, SS C Technologies Holdings Inc, Temenos Headquarters SA, Fintso

The future trends of the Wealth Management Software Market are: Artificial Intelligence (AI) & Machine Learning, Open Architecture & API Integration and Cloud Computing

Wealth Managment Software Market is expected to grow at a CAGR of 13.2% between 2023-2031

The driving factors impacting the Wealth Management Software Market are: Growing Affluent Population, Regulatory Compliance and Digital Transformation

Get Free Sample For

Get Free Sample For