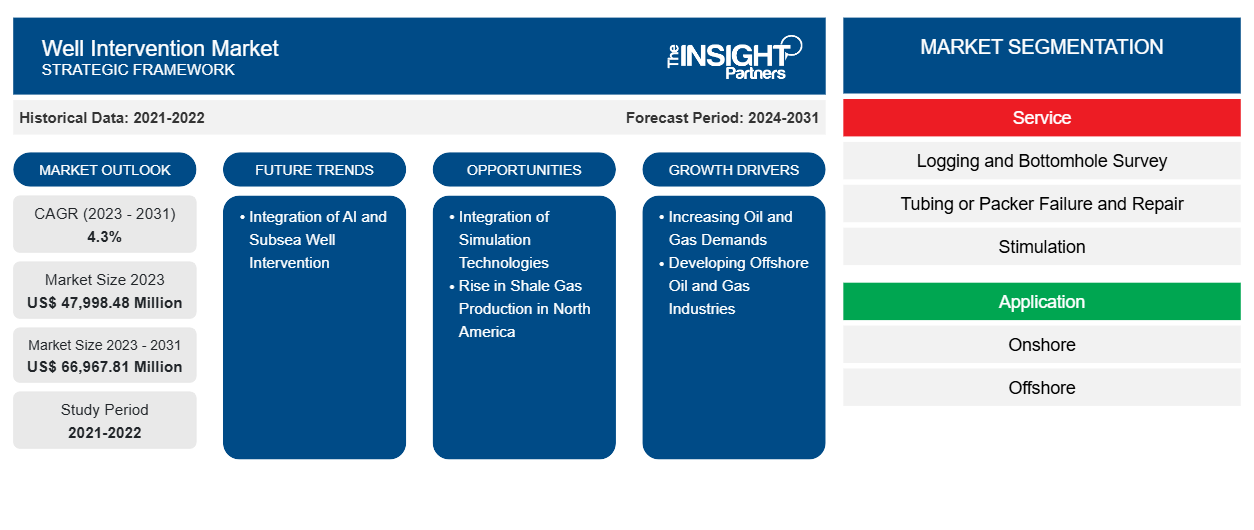

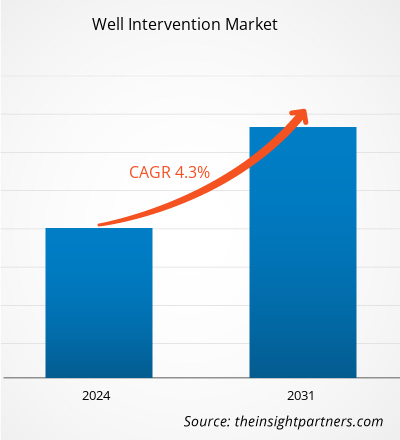

The well intervention market size is projected to reach US$ 66,967.81 million by 2031 from US$ 47,998.48 million in 2023. The market is expected to register a CAGR of 4.3% during 2023–2031. Artificial intelligence (AI) technology integration and subsea well interventions are likely to emerge as new trends in the market in the coming years.

Well Intervention Market Analysis

The key factors fueling the growth of the well intervention market include increasing oil & gas demands and developing offshore oil & gas industries. However, a rising shift from conventional fuels to renewable energy hinders the growth of the well intervention market. Irrespective of the hindrances, the integration of simulation technologies is projected to create opportunities for the key players operating in the market during the forecast period.

Well Intervention Market Overview

Well intervention, or well work, operations are carried out during the active life of any oil or gas well. These operations are initiated for the repair and maintenance of infrastructure during its active or final production life, with a probable aim to extend its life. These operations aim to oversee the well's production processes, provide diagnostic evaluations, or modify the well's construction or condition. The types of intervention procedures depend on the equipment installed and the completion design inside the wellbore. Maintenance operations such as wellbore logging, cleaning, repairing, broken equipment replacement, well alteration to enhance production, and injecting fluids are the common areas of focus of the well intervention job.

Based on intervention type, the well intervention market is segmented into light, medium, and heavy. Technicians move instruments or sensors into a live well during light interventions while maintaining pressure at the surface. On the other hand, during heavy interventions, the rig crew may halt production at the site before initiating any significant equipment adjustments. In terms of application, the well intervention market analysis is based on offshore and onshore applications. Thus, the growing number of both onshore and offshore drilling projects fuels the overall market.

Halliburton Co, Baker Hughes Co, Weatherford International Plc, Expro Group Holdings NV, Oceaneering International Inc, Archer Ltd, Schlumberger NV, Forum Energy Technologies Inc, Helix Energy Solutions Group Inc, and Trican Well Service Ltd are a few of the prominent players offering well intervention solutions worldwide. Research and development, and strategic alliances with smaller firms through mergers and acquisitions are among the key business strategies adopted by companies operating in the well intervention market to strengthen their market positions.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Well Intervention Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Well Intervention Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Well Intervention Market Drivers and Opportunities

Increasing Oil and Gas Demands Boost Market Growth

According to information provided by the International Energy Agency in October 2024, global oil demand is projected to increase by 900,000 barrels per day (kb/d) in 2024 and by 1 million barrels per day in 2025. China's demand for crude oil reached a record high at 16 mb/d in March 2023. The Russian Federation's invasion of Ukraine has threatened the global energy supply with an upsurge in oil and gas prices. In May 2022, the European Council announced a partial ban on Russian oil imports. According to the IEA, European countries imported 23% of their oil from Russia in 2021. Sourcing oil from more far-flung locations is expected to keep prices high. Elevated crude oil prices compel oil and gas companies to focus on extracting oil more profitably and ramping up the production levels with advanced techniques such as well intervention.

Well intervention services are critical to the oil and gas industry because they help maintain the productivity of onshore and offshore oil and gas wells. Neglecting well conditions can result in lower production outcomes, ultimately resulting in financial losses for the company, as well as for national economies. Early well intervention is, therefore, crucial to ensure that wells are productive and profitable. Its benefits include higher production rates, improved safety, and reduced expenses associated with deferred maintenance. On the other hand, overlooking the upkeep of the matured wells can increase the risk of equipment damage or failure, which can lead to safety hazards and expensive repairs. Hence, the demand for well intervention services increases with the growing need for oil and gas across the world, as these services aid in the optimal production of oil and gas wells.

Integration of Simulation Technologies to Generate Growth Opportunities in Future

The integration of well intervention simulators brings a variety of benefits to the oil and gas industry. These simulators play an essential role in reducing the risk of accidents by allowing oil and gas operators to hone their skills in a risk-free environment. They also contribute to greater operational efficiency by providing operators with a platform to refine their techniques and strategies. Moreover, digital twin technology, creating virtual representations of physical assets and processes, is becoming increasingly crucial in subsea well interventions. Digital twins provide real-time insights into well performance, and further enable engineers to simulate and optimize intervention operations. By using digital twins, engineers can test different intervention scenarios, identify potential risks, and optimize workflow. These virtual tests minimize the need for physical testing, and save time and resources while enhancing the safety and efficiency of subsea well operations. Additionally, these software simulators facilitate the improvement of the overall quality of well intervention jobs throughout the well lifecycle. They allow operators to identify potential problems and evaluate various intervention strategies before implementing them in real-field scenarios. They not only contribute to time and cost savings but also increase the safety and efficiency of assets. Moreover, the oil and gas industries can proactively address challenges associated with well intervention operations and ensure optimal performance through refined processes, ultimately improving the sustainability and success of oil and gas operations. Thus, the integration of simulation technologies is expected to bring significant growth opportunities in the well intervention market in the coming years.

Well Intervention Market Report Segmentation Analysis

Key segments that contributed to the derivation of the well intervention market analysis are service, application, intervention, and well type.

- Based on service, the global well intervention market is segmented into logging and bottomhole survey, tubing/packer failure and repair, and stimulation. The logging and bottomhole survey segment held the largest market share in 2023.

- By application, the market is divided into onshore and offshore. The onshore segment held a larger share of the market in 2023.

- Based on intervention, the market is divided into light, medium, and heavy. The light segment held the largest share of the market in 2023.

- Based on well type, the market is divided into horizontal and vertical. The vertical held a larger share of the market in 2023.

Well Intervention Market Share Analysis by Geography

The geographic scope of the well intervention market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America. North America dominated the well intervention market in 2023 with a share of 36.7%; it is likely to continue its dominance during the forecast period and account for 36.0% share by 2031. The US, Canada, and Mexico are the major economies in North America. The region is one of the major oil and gas exporters across the world. The US accounted for more than 18% of global oil production in 2023, with the presence of a large number of onshore and offshore oil fields across the country. The US and Canada, together, produce more oil and gas than any other region in the world. Moreover, their production volumes are much higher than their consumption levels. The high volumes underscore the dynamic production capability driven by unconventional oil and gas sources, including shale oil, shale gas, and the Canadian oil sands. Thus, North American countries generate a vast demand for well intervention equipment and services.

Well Intervention Market Regional Insights

The regional trends and factors influencing the Well Intervention Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Well Intervention Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Well Intervention Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 47,998.48 Million |

| Market Size by 2031 | US$ 66,967.81 Million |

| Global CAGR (2023 - 2031) | 4.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Service

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Well Intervention Market Players Density: Understanding Its Impact on Business Dynamics

The Well Intervention Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Well Intervention Market top key players overview

Well Intervention Market News and Recent Developments

The well intervention market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the well intervention market are listed below:

- Expro acquired Coretrax, a technology leader in performance drilling tools and wellbore cleanup, from Buckthorn Partners. (Expro, Press Release, 2024)

- Baker Hughes completed the acquisition of Norway-based well-intervention specialist Altus Intervention, which operates in 11 countries. (Baker Hughes, Press Release, 2023)

- CeraPhi Energy, UK, signed an exclusive agreement with Halliburton for drilling and well intervention services in exchange for in-kind engineering and project management support. (CeraPhi Energy, Press Release, 2022)

Well Intervention Market Report Coverage and Deliverables

The "Well Intervention Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Well intervention market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Well intervention market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Well intervention market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the well intervention market

- Detailed company profiles

Frequently Asked Questions

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Yes! We provide a free sample of the report, which includes Report Scope (Table of Contents), report structure, and selected insights to help you assess the value of the full report. Please click on the "Download Sample" button or contact us to receive your copy.

Absolutely — analyst assistance is part of the package. You can connect with our analyst post-purchase to clarify report insights, methodology or discuss how the findings apply to your business needs.

Once your order is successfully placed, you will receive a confirmation email along with your invoice.

• For published reports: You’ll receive access to the report within 4–6 working hours via a secured email sent to your email.

• For upcoming reports: Your order will be recorded as a pre-booking. Our team will share the estimated release date and keep you informed of any updates. As soon as the report is published, it will be delivered to your registered email.

We offer customization options to align the report with your specific objectives. Whether you need deeper insights into a particular region, industry segment, competitor analysis, or data cut, our research team can tailor the report accordingly. Please share your requirements with us, and we’ll be happy to provide a customized proposal or scope.

The report is available in either PDF format or as an Excel dataset, depending on the license you choose.

The PDF version provides the full analysis and visuals in a ready-to-read format. The Excel dataset includes all underlying data tables for easy manipulation and further analysis.

Please review the license options at checkout or contact us to confirm which formats are included with your purchase.

Our payment process is fully secure and PCI-DSS compliant.

We use trusted and encrypted payment gateways to ensure that all transactions are protected with industry-standard SSL encryption. Your payment details are never stored on our servers and are handled securely by certified third-party processors.

You can make your purchase with confidence, knowing your personal and financial information is safe with us.

Yes, we do offer special pricing for bulk purchases.

If you're interested in purchasing multiple reports, we’re happy to provide a customized bundle offer or volume-based discount tailored to your needs. Please contact our sales team with the list of reports you’re considering, and we’ll share a personalized quote.

Yes, absolutely.

Our team is available to help you make an informed decision. Whether you have questions about the report’s scope, methodology, customization options, or which license suits you best, we’re here to assist. Please reach out to us at sales@theinsightpartners.com, and one of our representatives will get in touch promptly.

Yes, a billing invoice will be automatically generated and sent to your registered email upon successful completion of your purchase.

If you need the invoice in a specific format or require additional details (such as company name, GST, or VAT information), feel free to contact us, and we’ll be happy to assist.

Yes, certainly.

If you encounter any difficulties accessing or receiving your report, our support team is ready to assist you. Simply reach out to us via email or live chat with your order information, and we’ll ensure the issue is resolved quickly so you can access your report without interruption.

The List of Companies - Well Intervention Market

- Halliburton Co

- Baker Hughes Co

- Weatherford International Plc

- Expro Group Holdings NV

- Oceaneering International Inc

- Archer Ltd

- Schlumberger NV

- Forum Energy Technologies Inc

- Helix Energy Solutions Group Inc.

- Trican Well Service Ltd

Get Free Sample For

Get Free Sample For