Wheat Flour Market Growth and Analysis by 2027

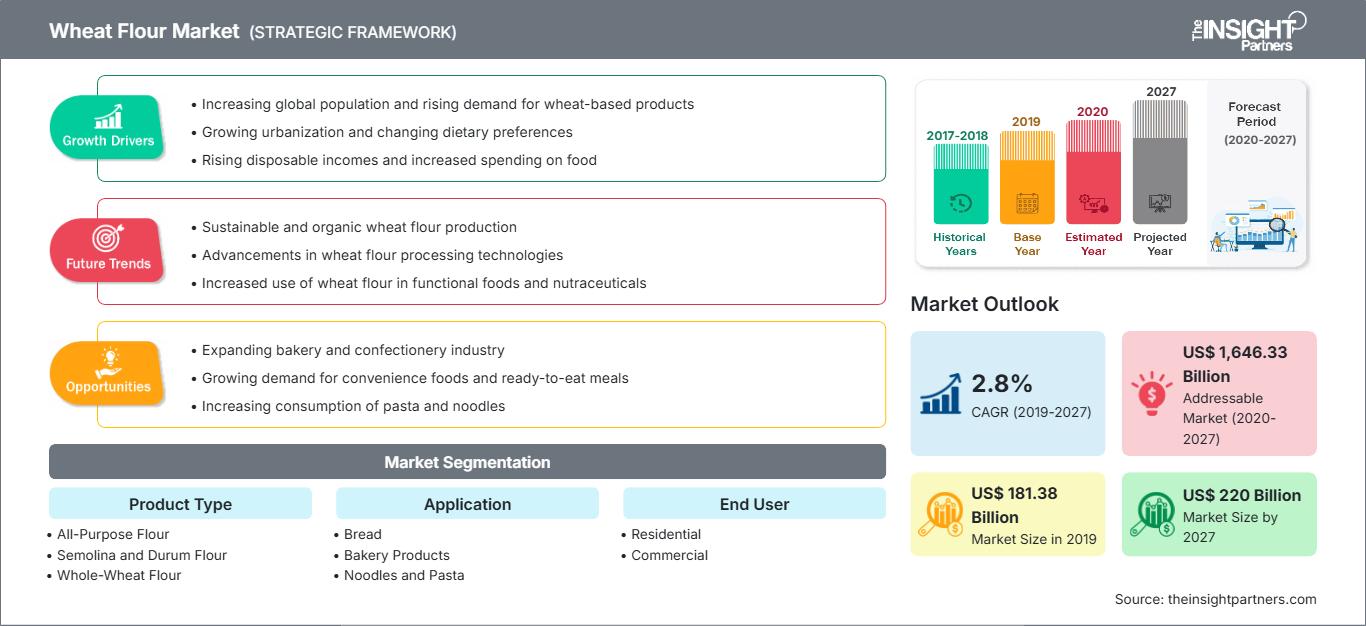

Historic Data: 2017-2018 | Base Year: 2019 | Forecast Period: 2020-2027Wheat Flour Market Forecast to 2027 - COVID-19 Impact and Global Analysis by Product Type (All-Purpose Flour, Semolina and Durum Flour, Whole-Wheat Flour, Bread Flour, Others); Application (Bread, Bakery Products, Noodles and Pasta, Others ); End User (Residential, Commercial ); Distribution Channel ( Supermarkets and Hypermarkets, Convenience Stores, Online, Others ), and Geography

- Report Date : Aug 2020

- Report Code : TIPRE00008702

- Category : Food and Beverages

- Status : Published

- Available Report Formats :

- No. of Pages : 187

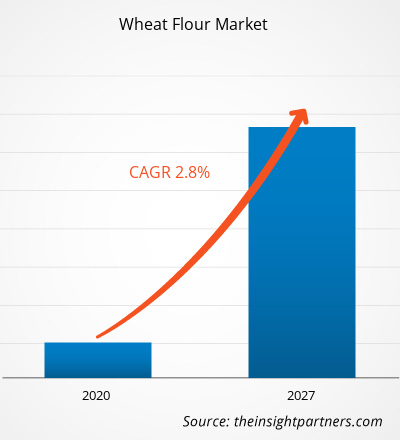

The wheat flour market was valued at US$ 181,377.66 million in 2019 and is projected to reach US$ 219,995.42 million by 2027; it is expected to grow at a CAGR of 2.8% from 2020 to 2027.

The wheat flour market has experienced tremendous growth in the past on the back of the development in food processing technologies and an increase in the demand for vegan products. The upsurge in demand for bakery products, snacks, noodles, and pasta, among others, has also bolstered the wheat flour market growth. Gluten is a naturally occurring protein in wheat, and it is responsible for the shape of the baked goods as it helps make the dough more elastic when kneaded. The amount of gluten may vary according to different varieties of wheat flour available. Low-gluten wheat variety is termed as "soft" or "weak," and the high-gluten wheat variety is referred to as "hard" or "strong." Bread is a part of a wide range of meals and cuisines, and there is a high demand for wheat bread among consumers.

The wheat flour market in Asia Pacific is expected to grow at the highest CAGR during the forecast period. Moreover, Asia Pacific holds the largest share in the global wheat flour market due to the consumption of wheat flour in everyday meals and a large wheat production capacity of the region; China and India are among the leading wheat-producing countries in the world. China dominated the Asia Pacific wheat flour market in 2019 and is projected to lead the market during 2020–2027. The growth of the market in China is mainly attributed to the existence of well-established food and beverages sector and increasing spending by companies on the development of innovative wheat flour products. With the increasingly busy lifestyle of consumers in Asian countries such as Australia, China, and India, they are gradually shifting their preference toward convenience food, which reduces their cooking time and provides them instant food. Wheat flour is used in various convenience food products such as bakery products, snacks, noodles, pasta, among others.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wheat Flour Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

The COVID-19 outbreak, which began in Wuhan (China) in December 2019, has spread around the globe at a fast pace. As of August 2020, the US, Russia, India, China, Italy, Spain, France, and Germany are among the worst-affected countries in terms of positive cases and reported deaths. According to the WHO figures updated in August 2020, 17,660,523 confirmed cases and 680,894 deaths have been reported globally. The outbreak has affected economies and industries due to lockdowns, travel bans, and business shutdowns. Food and beverages is one the world’s major industries suffering serious disruptions such as supply chain breaks, technology events cancellations, and office shutdowns as a result of this pandemic. China is the global manufacturing hub and is the largest raw material supplier for various industries; however, it is also one of the worst-affected countries by the COVID-19 pandemic. The lockdown of various plants and factories in China is affecting the global supply chains and adversely impacting the manufacturing and sales of various types of wheat flour. The overall market collapse due to COVID-19 is also affecting the wheat flour market growth due to shutting down of factories, obstacle in supply chain, and downturn in world economy.

Market Insights

Rise in Demand for Convenience Food

The global demand for wheat flour is witnessing a steady increase, primarily fueled by the rising consumer inclination toward convenience and processed food products. As lifestyles become increasingly fast-paced—particularly in urban settings—consumers are gravitating toward food options that offer ease of preparation without compromising on taste or quality. Wheat flour serves as a fundamental ingredient in a wide range of convenience food categories, including bakery and confectionery products, ready-to-eat meals, snacks, and instant mixes. Its functional properties, such as improving texture, binding, and extending shelf life, make it an indispensable component in modern food processing.

The robust expansion of the food and beverage sector, coupled with favorable economic conditions in both developed and emerging markets, has amplified the demand for convenience foods. A shift in consumer behavior—driven by dual-income households, evolving dietary preferences, and limited cooking time—is contributing significantly to this trend. Furthermore, rapid urbanization and the rise of nuclear family structures have cemented convenience food as a staple in the modern diet. Diversified distribution channels, including hypermarkets, supermarkets, online platforms, and convenience stores, have played a pivotal role in broadening consumer access to ready-to-use food products. These retail advancements not only enhance product visibility but also foster brand competition and innovation in wheat flour applications.

The burgeoning demand for clean-label and organic products has led to the introduction of organic wheat flour variants, further expanding application scope across health-conscious consumer segments. Manufacturers are leveraging this shift by reformulating products with organic or fortified wheat flour to meet nutritional and labeling requirements. Demographic factors such as population growth, rising disposable incomes, and globalization of food preferences are also instrumental in sustaining demand. As a response, leading wheat flour producers are focusing on innovation in product formulation, improving production efficiency, and expanding distribution networks to tap into emerging opportunities across domestic and international markets.

Thus, the escalating demand for convenience foods is expected to be a long-term growth driver for the wheat flour market, prompting industry stakeholders to adopt agile strategies and invest in capacity expansion, R&D, and market penetration initiatives.

Product Type Insights

Based on product type, the wheat flour market is segmented into all-purpose flour, bread flour, semolina and durum flour, whole wheat flour, and others. The bread flour segment accounted for the largest share in market in 2019, and the whole wheat flour segment is expected to register the fastest CAGR during 2020–2027. The all-purpose flour is prepared from the combination of hard and soft wheat in 4:1 ratio, and it is considered to be the most popular form of wheat flour worldwide. It is obtained from the finely ground part of the wheat kernel known as the endosperm, which gets detached from the bran and germ at the time of milling process. All-purpose flour has rich nutritional profile and is a rich source of vitamins such as niacin, riboflavin thiamin and folic acid (vitamin B family), and minerals such as iron. All-purpose wheat flour is commercially available in bleached and unbleached forms. During bleaching, chemicals are used as a preservative to protect the flour from developing an off flavor or from spoiling after a short period. All-purpose flour is ideal for the preparation of all types of baked goods, including cakes, cookies, pizza, yeast breads, biscuits, and muffins, and it is also used to provide thick consistency to gravies and sauces. It is also used as a coating agent in meat, vegetables, and other products while frying or sautéing.

End User Insights

Based on end-user, the wheat flour market is segmented into residential and commercial. The commercial segment accounted for the largest share in the market in 2019, and the residential segment is expected to register the highest CAGR during 2020–2027. With the growth of food processing industries as well as increasing demand for healthy and innovative food products, the demand for commercial purpose wheat flour has increased manifolds. The commercial segment is further segmented into HORECA, institutional and food service, and other manufacturers. The commercial purpose flour mills process wheat flours with a small number of additives. Other than this, bleaching agents such as benzoyl peroxide and oxidizing agents such as potassium bromate and chlorine oxide are also added while processing to make the flour look white. Commercial applications of wheat flour include food and bakery items such as breads, cakes, cookies, pastries, muffins, and cookies. Apart from this, it is extensively used in preparation of snacks, noodles, pasta, etc. Wheat flour also finds application in a biofuel industry and in feeding purpose. The US Department of Agriculture has adopted several standards in terms of testing of wheat flour for commercial use. Such standards ensure purity and detection of any adulterations present in terms of wheat flour market.

Application Insights

Based on application, the wheat flour market has been segmented into bread, bakery products, noodles and pasta, and others. The bread segment accounted for the largest share in the global wheat flour market in 2019, and bakery products segment is expected to register the highest CAGR during 2020–2027. Wheat flour is the most common base ingredient used in bread preparation. Wheat flour consists of gluten that is considered to be key source of protein and a significant ingredient in yeast-leavened breads. Gluten is a rubbery substance that helps provide structure and elasticity to the bread dough by trapping air and gas molecules; this action helps enhance the texture of the baked items. Wheat flour such as all-purpose flour, white bread flour, fine French bread flour, high gluten flour, and semolina flour are significantly used in preparation of different varieties of breads. These flours can be used alone or can be blended with other types of wheat flours, depending on the type of bread being developed. The rise in the consumption of bread as a part of breakfast, along with rapid innovations in the same, is likely to boost the demand for wheat flour in bread-making.

Distribution Channel Insights

Based on distribution channel, the wheat flour market has been segmented into hypermarket/supermarket, convenience stores, online, and others. The hypermarket/supermarket segment accounted for the largest share in the global wheat flour market in 2019, and the market based on other channels is expected to grow at the fastest CAGR during the forecast period. Manufacturers opt for various channels of distribution to make their products easily available to consumers. Among several distribution channels, supermarkets and hypermarkets have gained relatively greater importance. Producers sell their products to distributors who provide these products to hypermarkets and supermarkets, depending upon their demand. This proves to be beneficial as the products get a good sales image in these stores; moreover, there would be no wastage of products as the manufacturing is undertaken only on demand and in specific numbers. Apart from this, these stores simultaneously present a large variety of products to buyers, which allows easy comparison among them and accessibility to several brands. The sales of wheat flour through the hypermarkets and supermarkets are growing at high pace. The increasing number of hypermarkets and supermarkets has positively impacted this rise. Wheat flour types are extensively available in the supermarkets and hypermarkets around the globe.Mergers and acquisitions, and research and development are commonly adopted strategies by companies to expand their footprint worldwide. The wheat flour market players such as Archer Daniels Midland Company, FoodMaven, and ITC Limited have been implementing these strategies to enlarge the customer base and to gain significant market share in the world, which also allows them to maintain their brand name globally.

- In July 2019, Aashirvaad, under ITC Limited, announced the launch of a new range comprising Gluten-Free Flour, Ragi Flour and Multi Millet Mix Flour under the umbrella of Aashirvaad Nature’s Super Foods.

- In February 2020, FoodMaven announced the company’s partnership with The Annex by Ardent Mills (The Annex), a business unit of Ardent Mills, LLC, to sell its transitional wheat flour to FoodMaven’s foodservice customers.

- In September 2019, Archer Daniels Midland Company opened its new, state-of-the-art flour mill in Mendota, Illinois. It is the largest flour mill ever built in North America. The new, 30,000-cwts facility can mill spring, winter, and soft wheat varieties plus two types of whole wheat.

The regional trends and factors influencing the Wheat Flour Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Wheat Flour Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Wheat Flour Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2019 | US$ 181.38 Billion |

| Market Size by 2027 | US$ 220 Billion |

| Global CAGR (2019 - 2027) | 2.8% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Wheat Flour Market Players Density: Understanding Its Impact on Business Dynamics

The Wheat Flour Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Wheat Flour Market top key players overview

Global Wheat Flour Market – by Product Type

- All-Purpose Flour

- Bread Flour

- Semolina and Durum Flour

- Whole Wheat Flour

- Others

Global Wheat Flour Market – by End-User

- Residential

- Commercial

Global Wheat Flour Market – by Application

- Bread

- Bakery Products

- Noodles and Pasta

- Others

Global Wheat Flour Market – by Distribution Channel

- Hypermarket/Supermarket

- Convenience Stores

- Online

- Others

Company Profiles

- Archer Daniels Midland Company

- Acarsan Holding

- Allied Pinnacle

- Ardent Mills

- General Mills Inc

- George Weston Foods Limited

- ITC Limited

- The King Arthur Baking Company

- KORFEZ Flour Group

- Manildra Group

Frequently Asked Questions

What is the forecast outlook of residential segment in the wheat flour market?

Can you list some of the major players operating in the Global Wheat Flour Market?

Based on end-user, what was the largest segment of the global wheat flour market?

What is the scope of wheat flour in the global market?

Based on type, why is the all-purpose flour segment expected to grow at the highest rate during 2021-2028?

Why is Asia Pacific expected to grow at the highest rate during 2021-2028?

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For