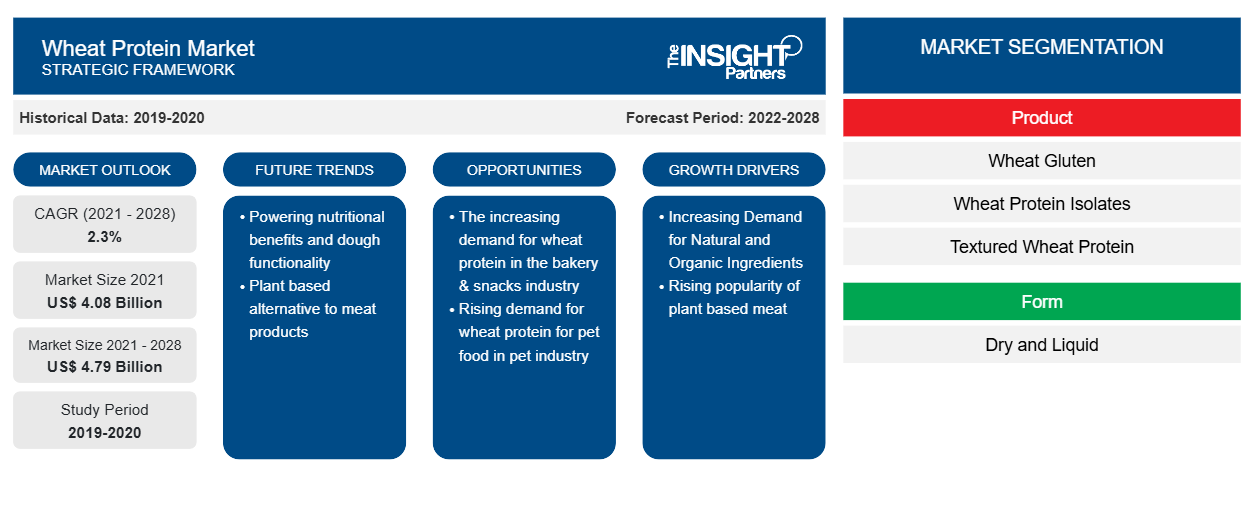

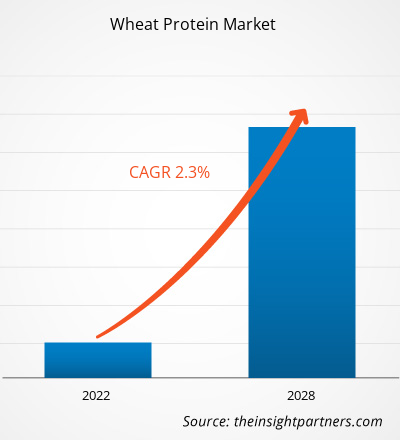

[Research Report] The wheat protein market was valued at US$ 4,083.05 million in 2021 and is projected to reach US$ 4,788.49 million by 2028; it is expected to grow at a CAGR of 2.3% from 2021 to 2028.

Wheat proteins are plant-based proteins primarily obtained by processing wheat using different enzymes. They are insoluble functional proteins that possess unique visco-elastic characteristics and offer elasticity and extensibility to a final product. The proteins are considered a viable alternative for animal-based protein. They are widely used across several end-use industries, such as bakeries & confectionery, cosmetics & personal care, animal feed, and nutrition supplements.

In 2020, Europe held the largest revenue share of the global wheat protein market. The European market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Rising health awareness among consumers propels the demand for numerous plant protein products, such as soy, wheat, and oat. The popularity of the wheat protein has increased across the region, particularly in Germany, France, and the UK. Europeans are increasingly adopting the flexitarian diet, i.e., replacing part or most of their meat consumption with alternative protein food. These factors drive the demand for wheat protein products in Europe.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wheat Protein Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wheat Protein Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Many industries, such as the food & beverage industry, faced unprecedented challenges due to the COVID-19 pandemic. Due to shortage in raw material supply, the shutdown of factories, shortage of labor, and other difficulties in operations under COVID-19 safety protocols, companies involved in the manufacturing of wheat protein faced difficulties during the initial months of the pandemic. The food & beverage sector is the bulk consumer of wheat protein and the ongoing COVID-19 pandemic has negatively influenced the demand for wheat protein. Food and beverage products, such as bakery products, confectionery items, and dairy products, are being pushed back as the supermarkets have reallocated stock priorities toward staples and essential supplies due to the outbreak. However, as the economies are reviving their operations, the demand for wheat protein is anticipated to surge worldwide in the coming months. The COVID-19 pandemic has led to a raised demand for healthy and functional bakery products, which is expected to fuel the growth of the wheat protein market in the coming years.

Market Insights

Increasing Demand for Natural and Organic Ingredients

The importance of organic food items has been understood in the wake of alarming health issues, coupled with rising consciousness about organic certifications and growing preference for high-quality food items. Nowadays, consumers are looking for natural, clean, and simple ingredients with proper labels, which could effectively convey their contents, quality, and intent of the product use. Further, they are largely dependent on organic and natural food products. For instance, the consumption of organic wheat protein has been extensively rising in diverse application sectors, such as food & beverages, and animal and aqua feed. Thus, the manufacturers of wheat protein are focusing on developing and marketing organic wheat protein.

Product Insights

Based on product, the global wheat protein market is segmented into wheat gluten, wheat protein isolates, textured wheat protein, and hydrolyzed wheat protein. In 2020, the wheat gluten segment accounted for the largest revenue share. Vital wheat gluten is used as an additive in baking. It adds elasticity to flours, which would otherwise be low in gluten, such as whole wheat flour or rye. Wheat gluten also improves the rise of the raw dough and enhances the texture and chewiness of the final product.

Form Insights

The wheat protein market, by form, is bifurcated into dry and liquid. In 2020, the dry segment accounted for a larger revenue share. A few of the dry wheat protein properties are high solubility in the water with any pH value, water binding and emulsifying, low viscosity, and acidic and thermal stability. The dry wheat protein is increasingly used in bakeries, pet food, nutritional bars, processed meat, and meat analogs. Thus, the wide applications in the food industry are bolstering the market growth for the dry segment.

Application Insights

The wheat protein market, by application, is segmented into bakery & snacks, pet food, nutritional bars & drinks, processed meat, meat analogs, and others. In 2020, the bakery and snacks segment accounted for the largest revenue share. Numerous bakery products, such as rolls, bread, cookies, pastries, pies, and muffins, are popular among consumers. Wheat proteins are among the common ingredients that optimize dough behavior and enhance the nutritional properties of end products. The increasing demand for wheat protein in the bakery & snacks industry and the trend of the clean label are creating ample opportunities for the players operating in the wheat protein market worldwide.

Archer Daniels Midland Company; Roquette Frères; Glico Nutrition Co., Ltd; Kröner-Stärke GmbH; Cargill, Incorporated; Crespel & Deiters GmbH & Co. KG; CropEnergies AG; Manildra Group; MGP Ingredients Inc.; and Tereos Group are a few well-established players in the global wheat protein market. Companies in the market are adopting various strategies, such as product developments, plant expansions, and mergers and acquisitions, to expand their footprint worldwide and meet the growing demand from end-users. For instance, in 2020, Archer Daniels Midland Company developed new products. The products contain Arcon T textured pea proteins, Prolite MeatTEX textured wheat protein, and Prolite MeatXT non-textured wheat protein.

Report Spotlights

- Progressive industry trends in the global wheat protein market to help players develop effective long-term strategies

- Business growth strategies adopted by developed and developing markets

- Quantitative analysis of the global wheat protein market from 2019 to 2028

- Estimation of the demand for wheat protein across various industries

- Recent developments to understand the competitive market scenario and the demand for wheat protein

- Market trends and outlook coupled with factors driving and restraining the growth of the wheat protein market

- Decision-making process by understanding strategies that underpin commercial interest with regard to the global wheat protein market growth

- Wheat protein market size at various nodes of the market

- Detailed overview and segmentation of the global wheat protein market as well as its dynamics in the industry

- Wheat protein market size in various regions with promising growth opportunitiez

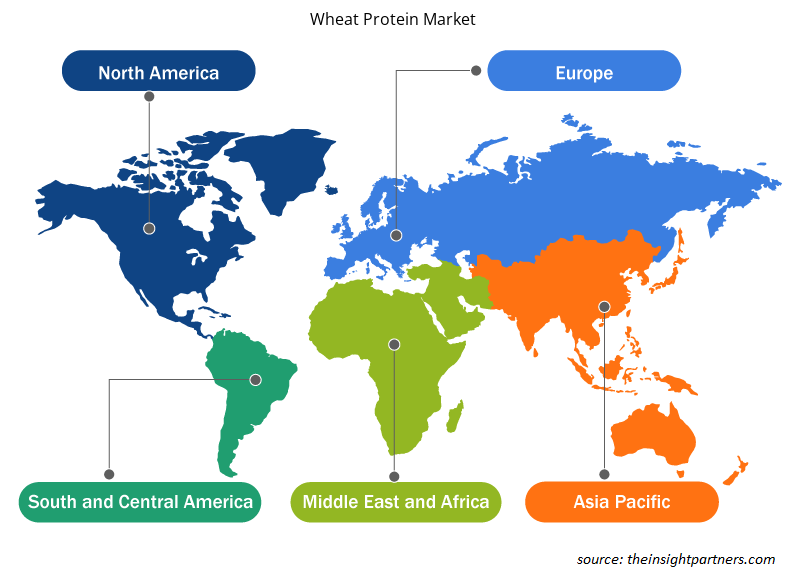

Wheat Protein Market Regional Insights

Wheat Protein Market Regional Insights

The regional trends and factors influencing the Wheat Protein Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wheat Protein Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wheat Protein Market

Wheat Protein Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 4.08 Billion |

| Market Size by 2028 | US$ 4.79 Billion |

| Global CAGR (2021 - 2028) | 2.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Wheat Protein Market Players Density: Understanding Its Impact on Business Dynamics

The Wheat Protein Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wheat Protein Market are:

- Archer Daniels Midland Company

- Roquette Frères

- Glico Nutrition Co.,Ltd

- Kröner-Stärke GmbH

- Cargill, Incorporated

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wheat Protein Market top key players overview

Wheat Protein Market, by

- Product

- Wheat Gluten

- Wheat Protein Isolates

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

Wheat Protein Market, by Form

- Dry

- Liquid

Wheat Protein Market, by Application

- Bakery & Snacks

- Pet Food

- Nutritional Bars & Drinks

- Processed Meat

- Meat Analogs

- Others

Company Profiles

- Archer Daniels Midland Company

- Roquette Frères

- Glico Nutrition Co.,Ltd

- Kröner-Stärke GmbH

- Cargill, Incorporated

- Crespel & Deiters GmbH & Co. KG

- CropEnergies AG

- Manildra Group

- MGP Ingredients Inc.

- Tereos Group

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Radiopharmaceuticals Market

- Pressure Vessel Composite Materials Market

- Dried Blueberry Market

- Batter and Breader Premixes Market

- Sandwich Panel Market

- Truck Refrigeration Market

- Explosion-Proof Equipment Market

- Embolization Devices Market

- Real-Time Location Systems Market

- Fill Finish Manufacturing Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product, Form, and Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Rising application of wheat protein in several end-user industries is one of the key factors for the growth of the global wheat protein market. The change in consumer preference toward ready-to-eat foodstuffs has augmented the demand for bakery products, thereby influencing the growth of the wheat protein market. Further, increasing demand for premium pet food products from developing and developed countries, growing demand for natural and organic ingredients, and rising demand for meat analogs are the other factors driving the wheat protein market.

During the forecast period, Europe is anticipated to account for the largest share of the global wheat protein market. With rising health awareness among consumers, the demand for plant protein products, including soy, wheat, oat, and others, is expected to continue growing during the projected period. The popularity of the wheat protein has increased within the region, particularly in Germany, France, and the UK. Europeans are increasingly adopting the flexitarian diet, i.e., replacing part or most of their meat consumption with alternative protein food. Also, government support is driving the growth of this market.

The major players operating in the global wheat protein market are Archer Daniels Midland Company; Roquette Frères; Glico Nutrition Co.,Ltd; Kröner-Stärke GmbH; Cargill, Incorporated; Crespel & Deiters GmbH & Co. KG; Croproteinses AG; Manildra Group; MGP Ingredients Inc.; and Tereos Group

On the basis of product, the textured wheat protein segment led the global wheat protein market in 2020. Textured wheat protein products have broader applications, as a protein enrichment in baked goods, as a meat extension in meat products, for goulash, pulled products, for toppings, for a firm bite in burgers and fillings, as a meat extension in nuggets, and meat emulsions & raw sausages. Due to the wider application of textured wheat protein products, the market for wheat protein is blooming at a rapid pace.

Based on application, bakery & snacks segment accounted for the largest share in the global wheat protein market in 2020. The growth is attributed to rapidly evolving consumer preferences, greater demand for indulgence foods, increasing health consciousness among consumers. Wheat protein is a crucial source of high-protein, low-carb, and high-fibre, essential for producing bakery & snack products.

Based on form, the dry segment accounted for the largest share in the global wheat protein market. Dry wheat proteins are made from vital wheat gluten and are soluble in water. The dry wheat protein is increasingly used in bakeries, pet food, nutritional bars, processed meat, and meat analogs. Thus, the wide applications in the food industry are bolstering the dry segment growth.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Wheat Protein Market

- Archer Daniels Midland Company

- Roquette Frères

- Glico Nutrition Co.,Ltd

- Kröner-Stärke GmbH

- Cargill, Incorporated

- Crespel & Deiters GmbH & Co. KG

- CropEnergies AG

- Manildra Group

- MGP Ingredients Inc.

- Tereos Group

Get Free Sample For

Get Free Sample For