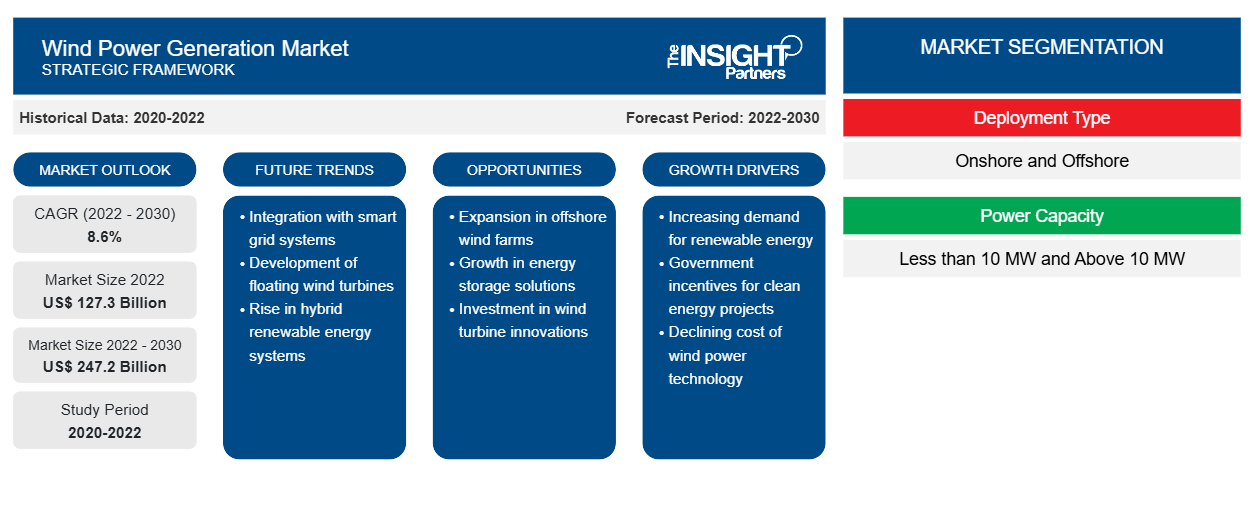

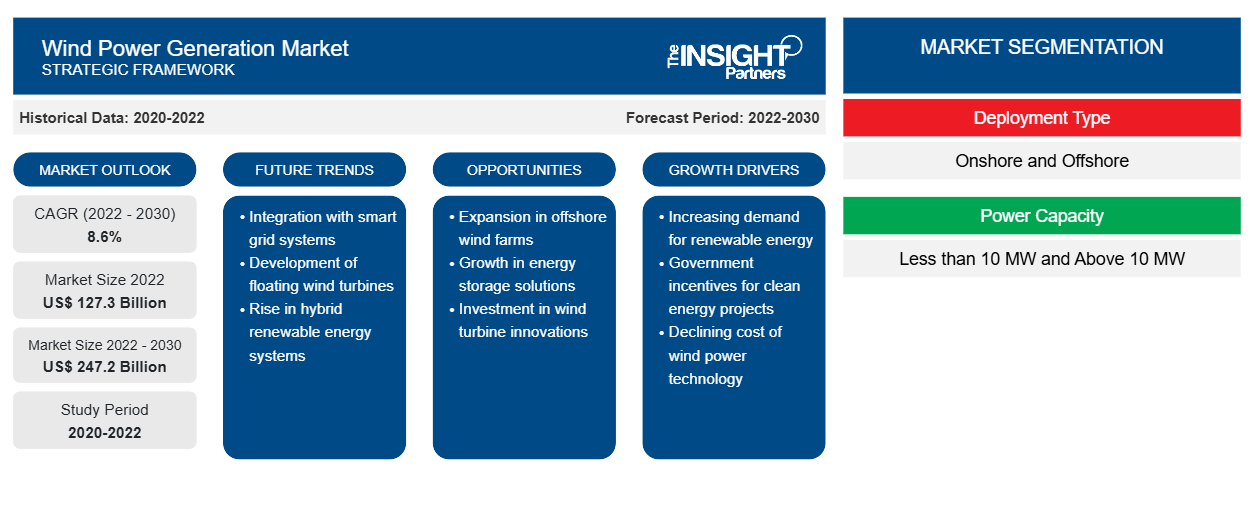

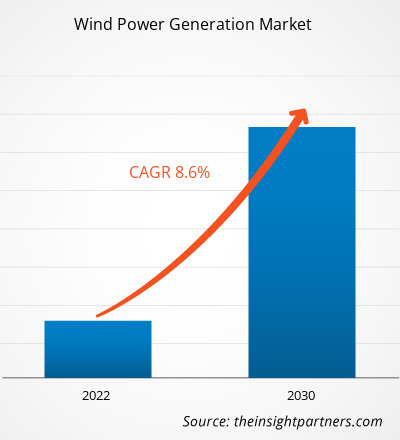

[Research Report] The wind power generation market size was valued at US$ 127.3 billion in 2022 and is projected to reach US$ 247.2 billion by 2030; it is expected to grow at a CAGR of 8.6% during 2022–2030.

Analyst Perspective:

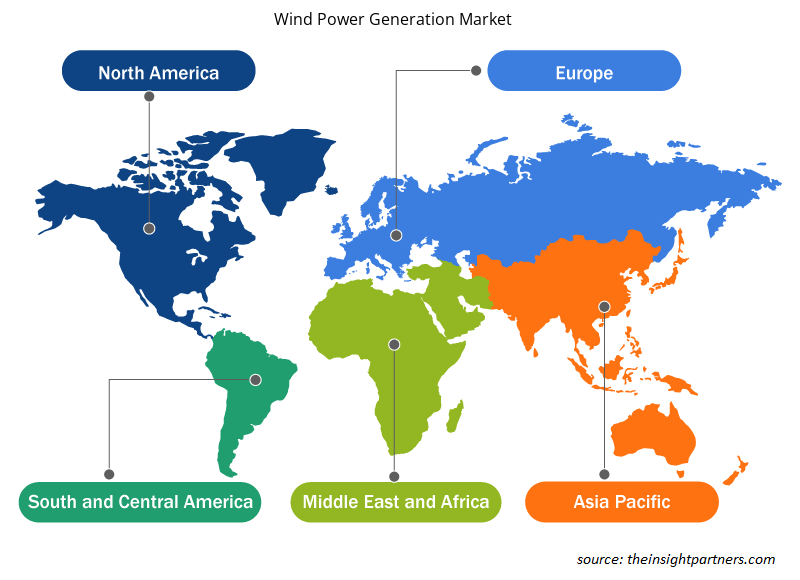

The scope of the wind power generation market report encompasses North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

The wind power generation market is expected to grow at a CAGR of 11.4% during the forecast period. This is owing to the rise in onshore and offshore wind power generation in regions such as Asia Pacific, North America, and Europe. The growth in the global wind power generation market in Asia Pacific is primarily attributed to increasing investment in the renewable industry, exponential increase in industrialization and urbanization, wind energy generation capacity, new electrification projects, and grid-strengthening initiatives. According to a new study, the Asia Pacific wind energy sector is set for rapid expansion. It is expected to make up nearly a quarter of the power capacity mix in the region this decade, as high domestic demand for offshore wind power turns mainland China into the world's largest market by 2030.

Market Overview:

Wind is used to generate electricity by converting the kinetic energy of moving air into power generation. In modern wind turbines, the wind turns the rotor blades, which further converts kinetic energy into rotational energy. This rotational energy is transferred to the wind power generator via a shaft and thus generates electrical energy. According to the IRENA, the installed wind generation capacity globally increased by more than 95% from 2000 to 2022. The global onshore wind capacity grew from 178 GW in 2010 to 699 GW in 2020, while offshore wind grew proportionally more, albeit from a lower level, from 3.1 GW in 2010 to 34.4 GW in 2020.

The upcoming wind projects in the pipeline are expected to commence operating in 2024 and 2025, which will further accelerate the wind power generation capacity. As per the report published by the Swedish Energy Agency in March 2022, the electricity generated from wind is projected to rise from 27.4 TWh in 2021 to 46.9 TWh by 2024 in Sweden. According to the published analysis, Sweden is expected to increase wind power generation by more than 70% by 2024 compared to 2021. This initiative aims to reduce the country's dependence on fossil fuels and oil and gas supplied by Russia. In addition, Ocean Winds, a joint venture between Portugal's main utility, EDP, and Engie, a French company, announced its plans to invest US$ 3.15 billion to develop offshore wind projects by 2025. The equal partners in the venture are targeting to produce ~7GW of new capacity. Thus, such upcoming investment initiatives are projected to benefit the wind power generation market.

As per the US Department of Energy, the US offshore wind market is expected to witness massive growth in the next decade. Decreasing offshore auction prices, increasing water depths of projects, rising turbine capacity, and reduced levelized cost of energy are the prominent future wind power generation market trends which are further expected to benefit the market growth from 2022 to 2030. The impact of COVID-19 was reflected in a slowdown in project commissioning in markets such as the US, India, and Taiwan. Despite the resurgence of COVID-19, the global onshore wind auction activities stayed on track overall in 2021. China played a leading role by allotting a total of 50.6 GW of onshore wind capacity in 2021, followed by Spain, India, South Africa, and Germany. The current global scenario depicts an influx in energy policies, new policy initiatives, and massive investment prospects, which increase the trajectory for wind installations to achieve both net zero emissions and energy security targets.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Power Generation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Power Generation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Government initiatives to promote Installation of Wind farms

Support from various governments in terms of policies and investment for increasing the installation of wind energy projects is expected to fuel the wind power generation market growth over the coming years. The Indian government is promoting wind power projects in the country through private sector investments by providing various fiscal and financial incentives such as Accelerated Depreciation benefits and concessional custom duty exemption on certain components of wind electric generators. In January 2022, the People's Bank of China (PBOC) started providing low-cost loans to fund decarbonization activities. Further, Beijing's current policy initiatives focus on tax breaks and low-interest loans to low-carbon project developers, power market reforms, and grid improvement. In Canada, the Offshore Renewable Energy Regulations (ORER) initiative is expected to support the implementation of Offshore Renewable Energy Projects and Offshore Power Lines by developing modern safety and environmental protection regulations for offshore renewable energy (ORE) projects and power lines in Canada's offshore areas.

Segmental Analysis:

Global wind power generation market analysis by deployment type is segmented into onshore and offshore. The onshore deployment segment accounted for 80.94% of the total wind power generation market share in the year 2022. It is expected to maintain its dominance during the forecast period. The offshore segment is expected to register a growth rate of 10.5% in the global market from 2022 to 2030. This is owing to a rise in investment toward offshore wind power installations in regions such as North America and Europe. The wind power generation market forecast prospects in the adoption of offshore wind technology are primarily attributed to an increase in advancement in technology, associated advantages, and turnkey solutions provided by various service providers. The growing emphasis on achieving clean energy targets is propelling the demand for floating offshore wind power, posing a potential opportunity for the wind power generation market growth in the coming years.

Regional Analysis:

According to The Insight Partners estimates, in 2022, Asia Pacific registered the highest market share of 39.8% and is expected to grow at a CAGR of 10.6% during the analysis timeframe, owing to planned and ongoing wind power project additions in the coming years. Countries in Asia Pacific are engaged in adopting key strategies toward carbon reduction goals and energy security for their people by increasing wind power generation. To meet the carbon emission reduction goals for 2050, many countries in the region are moving toward carbon-free energy generation and utilization. India is the second largest country in the wind power generation market in Asia Pacific, with a total installation of more than 1.5 GW in the year 2022. The rise in demand for clean power generation in the country is anticipated to drive the growth of the wind power generation market. Europe and North America are the key regions that accounted for 28.4% and 23.9% of the total wind power generation market share in the year 2022, respectively.

With the rapid growth of renewable energy in Asia Pacific, solar and wind power will play an increasingly important role in integrating variable renewable energy and ensuring the reliability of the overall power system. In many countries, energy storage markets are still emerging, but there is enormous potential for development. Wind power installation capacity in the world is expected to continue to grow to meet the growing electricity demand and electricity export opportunities and to maximize the benefits of a cost-effective and flexible low-carbon energy source across the globe.

Key Player Analysis:

Siemens Gamesa Renewable Energy SA, General Electric, Mitsubishi Heavy Industries, Vestas Wind Systems, Renewable Energy Systems Americas, EDP Renewables, Orsted A/S, NextEra Energy, Inc., EDF S.A., and Suzlon Energy Limited are among the key players profiled in the global wind power generation market report.

Wind Power Generation Market Regional Insights

Wind Power Generation Market Regional Insights

The regional trends and factors influencing the Wind Power Generation Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wind Power Generation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wind Power Generation Market

Wind Power Generation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 127.3 Billion |

| Market Size by 2030 | US$ 247.2 Billion |

| Global CAGR (2022 - 2030) | 8.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Deployment Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Wind Power Generation Market Players Density: Understanding Its Impact on Business Dynamics

The Wind Power Generation Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wind Power Generation Market are:

- Siemens Gamesa Renewable Energy SA

- General Electric

- Mitsubishi Heavy Industries

- Vestas Wind Systems

- Renewable Energy Systems Americas

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wind Power Generation Market top key players overview

Recent Developments:

Inorganic and organic strategies such as partnership, collaboration, mergers, and acquisitions are highly adopted by companies operating in the global wind power generation market. A few recent developments by the key market players are listed below:

|

|

|

2024 | Department of Energy, US, partnered with states and research institutes. This partnership is aimed at boosting the development of offshore wind power in the region. | North America |

2022 | Vestas partnered with PEC Energia for an 86 MW wind park in Brazil. With this project, Vestas surpasses the milestone of 7 GW of order intake in Brazil for installation of 4 MW platform wind turbines since 2018. | South America |

2022 | Siemens Gamesa formed a new partnership with Azure Power to install 96 turbines with a focus on boosting India's wind industry. This is expected to increase wind power generation in the coming years in India. | Asia Pacific |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Biopharmaceutical Contract Manufacturing Market

- E-Bike Market

- Legal Case Management Software Market

- Trade Promotion Management Software Market

- Dropshipping Market

- Batter and Breader Premixes Market

- Electronic Signature Software Market

- Online Recruitment Market

- Playout Solutions Market

- Sexual Wellness Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment Type, Power Capacity, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Ongoing research and innovation on advanced offshore wind power technologies in potential countries such as Brazil, U.S., India, Japan, and China where the adoption of the above-mentioned technology is maturing at a significant rate is expected to be the key opportunity in the market.

Siemens Gamesa Renewable Energy SA, General Electric, Mitsubishi Heavy Industries, Vestas Wind Systems, Renewable Energy Systems Americas, EDP Renewables, Orsted A/S, NextEra Energy, Inc., EDF S.A., and Suzlon Energy Limited are the key market players operating in the global wind power generation market.

Key role of wind power in future energy transition is anticipated to stimulate the wind power generation market growth in the coming years.

Regions such as Europe, North America and Asia-Pacific will boost the growth of the wind power generation market during the forecast period. This growth is owing to the rise in investment on construction of wind power plant facilities in the regions.

Rise in demand for power generation from less carbon emitting sources, rise in establishment of wind power plants, rise in awareness towards renewable energy resources are contributing to the growth of the wind power generation market.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - Wind Power Generation Market

- Siemens Gamesa Renewable Energy SA

- General Electric

- Mitsubishi Heavy Industries

- Vestas Wind Systems

- Renewable Energy Systems Americas

- EDP Renewables

- Orsted A/S

- NextEra Energy, Inc.

- EDF S.A.

- Suzlon Energy Limited

Get Free Sample For

Get Free Sample For