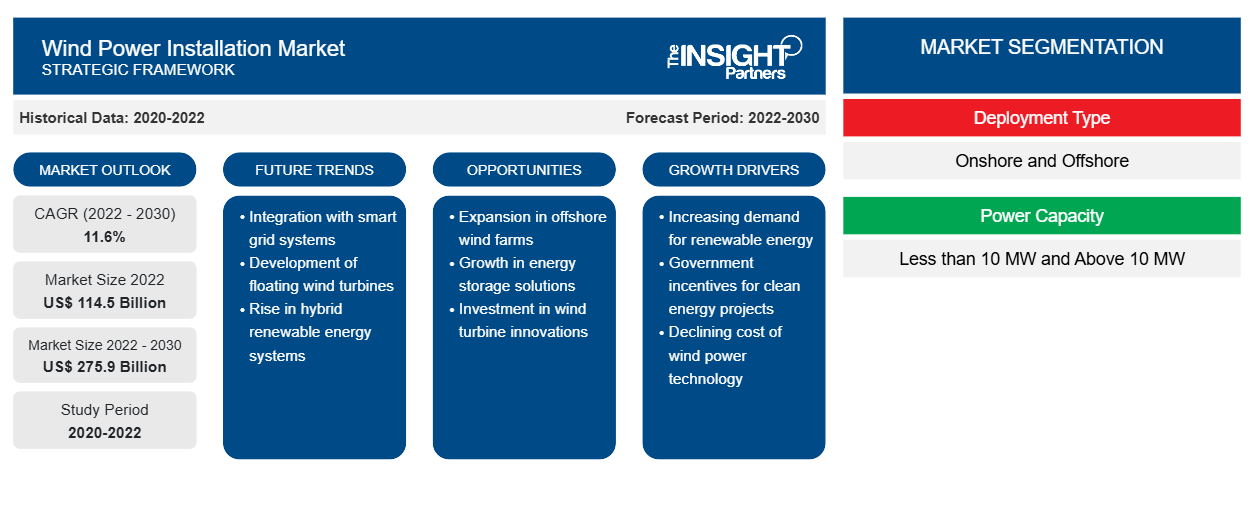

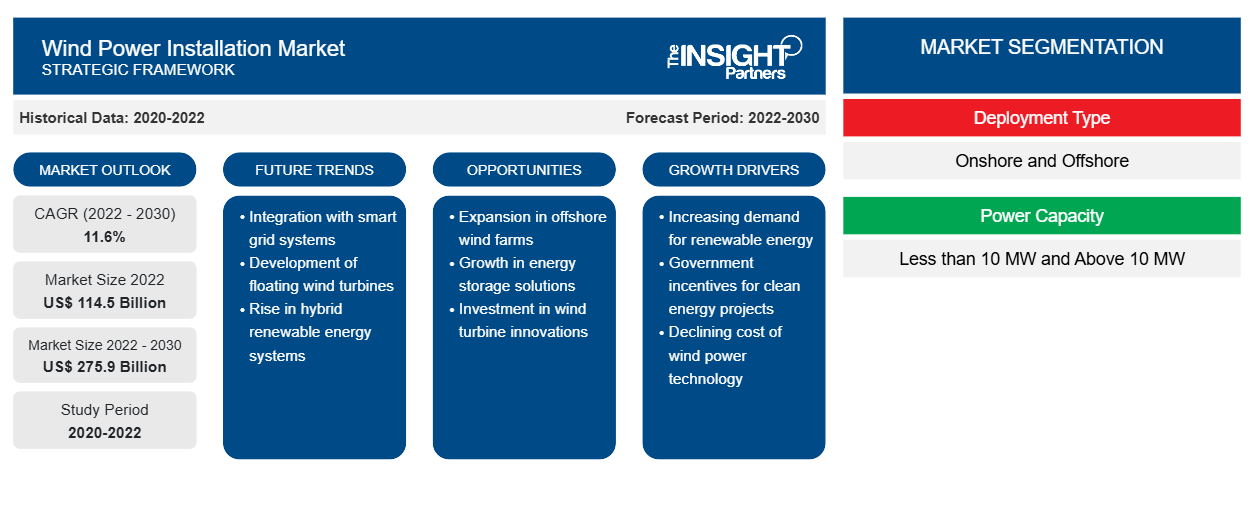

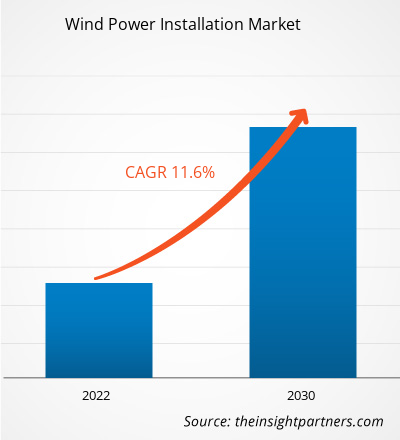

[Research Report] The wind power installation market size was valued at US$ 114.5 billion in 2022 and is projected to reach US$ 275.9 billion by 2030; it is expected to grow at a CAGR of 11.6% during 2022–2030.

Analyst Perspective:

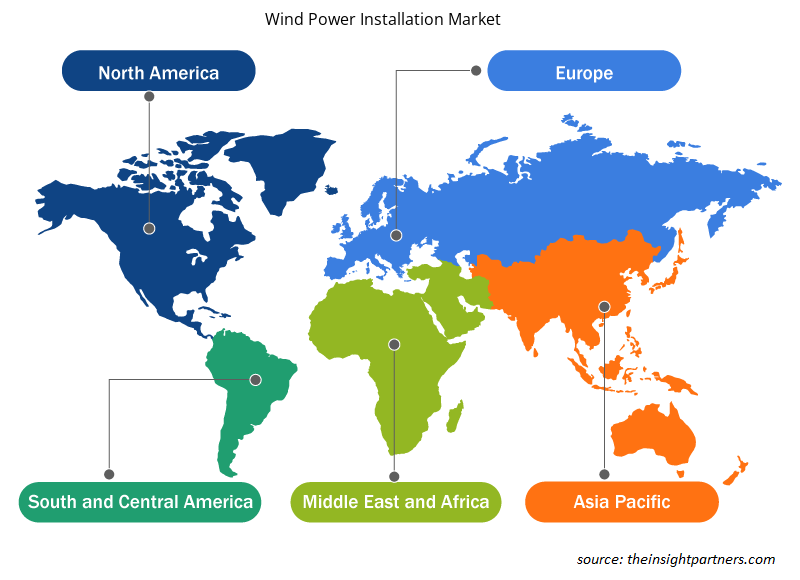

The global wind power installation market report has been segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South America (SAM).

The wind power installation market is expected to grow considerably owing to the rise in onshore and offshore wind power installations in regions such as Asia Pacific, North America, and Europe. Increasing investment in the renewable industry, an exponential rise in industrialization and urbanization, wind energy generation capacity, new electrification projects, and grid strengthening initiatives significantly contribute to the growing global wind power installation market size in Asia Pacific. Asia Pacific wind energy sector is set for rapid expansion. It is expected to make up nearly a quarter of the power capacity mix in the area this decade, according to a new study, as high domestic demand for offshore wind power turns mainland China into the world's largest market by 2030.

Market Overview:

Wind energy uses wind turbines to produce electricity using the kinetic energy created by air in motion. The amount of power that can be harnessed from wind depends on the size of the turbine and the length of its blades. Wind power generation has gained a high level of attention and acceptability across the globe compared to other renewable energy technologies. New developments in technology in designing wind power blades, turbines, shafts, and other components have contributed to significant advancements in wind energy penetration and in achieving optimum power from available wind. As per the International Renewable Energy Agency, the global wind installed capacity increased from 731,763 MW in 2020 to 824,874 MW in 2021. Thus, such an exponential rise in the installed capacity of wind owing to the advantages of wind energy and favorable policies, incentives, and tax rebates are expected to favor the market.

The upcoming wind projects in the pipeline are expected to start operation by 2024 and 2025, which will further accelerate the wind power generation capacity. As per the report published by the Swedish Energy Agency in March 2022, the electricity generated from wind is projected to rise from 27.4 TWh in 2021 to 46.9 TWh by 2024 in Sweden. According to the published analysis, Sweden is expected to increase wind power generation by more than 70% by 2024 compared with the level of 2021. This initiative aims to reduce the country's dependence on fossil fuels and oil and gas supplied by Russia. In addition, Ocean Winds, a joint venture between Portugal's main utility, EDP, and Engie, a French company, planned to invest US$ 3.15 billion to develop offshore wind projects by 2025. The equal partners in the venture are targeting to produce ~7GW of new capacity. Thus, such upcoming investment initiatives are contributing to the wind power installation market growth.

As per the US Department of Energy, the US offshore wind market is expected to witness massive growth in the next decade. Decreasing offshore auction prices, increasing water depths of projects, rising turbine capacity, and declining levelized cost of energy are the prominent wind power installation market trends expected to benefit the market. The impact of COVID-19 was reflected in a slowdown in project commissioning in markets such as the US, India, and Taiwan. Despite the resurgence of COVID-19, the global onshore wind auction activities stayed on track overall in 2021. China has played a leading role by allotting a total of 50.6 GW of onshore wind capacity in 2021, followed by Spain, India, South Africa, and Germany. The current global scenario depicts an influx in energy policies, new policy initiatives, and massive investment prospects, which increase the trajectory for wind installations to achieve both net zero emissions and energy security targets.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Power Installation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Power Installation Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Government Initiatives to Promote Installation of Wind Farms

Support of various governments of different countries in terms of policies and investment for increasing the installation of wind energy projects is expected to drive the wind power installation market. The Indian government is promoting wind power projects in the country through private sector investments by providing various fiscal and financial incentives such as accelerated depreciation benefits and concessional custom duty exemption on certain components of wind electric generators. In January 2022, the People's Bank of China (PBOC) started providing low-cost loans to fund decarbonization activities. Further, Beijing's current policy initiatives focus on tax breaks and low-interest loans to low-carbon project developers, power market reforms, and grid improvement. In Canada, the Offshore Renewable Energy Regulations (ORER) initiative will support the implementation of Offshore Renewable Energy Projects and Offshore Power Lines by developing modern safety and environmental protection regulations for offshore renewable energy (ORE) projects and power lines in Canada's offshore areas.

Segmental Analysis:

Based on deployment type, the wind power installation market is segmented into onshore and offshore wind power deployment. The onshore segment accounted for 79.53% of the total wind power installation market share in 2022. The offshore segment is expected to register the highest growth rate of 13.8% during the global wind power installation market forecast period. This is owing to a rise in investment toward offshore wind power installations in regions such as North America and Europe. The growth prospects in the adoption of offshore wind technology are primarily attributed to an increase in advancement in technology, associated advantages, and turnkey solutions provided by various service providers. The growing awareness of various countries' achieving clean energy targets is propelling the demand for floating offshore wind power, which is creating a potential opportunity for the wind power installation market growth.

Regional Analysis:

According to The Insight Partners wind power installation market analysis, in 2022, Asia Pacific registered the highest wind power installation market share of 52.8% and is expected to grow at a CAGR of 11.1% during the forecast period, owing to planned and ongoing wind power projects additions in the coming years. Countries in Asia Pacific are engaged in adopting key strategies toward carbon reduction goals and energy security for their people from wind power generation. To meet the carbon emission reduction goals for 2050, many countries in the region are moving toward carbon-free energy generation and utilization. India is the 2nd largest country in the Asia Pacific wind power installation market, with a total wind power installation of more than 1.5 GW in 2022. The rise in demand for clean power generation in the country is anticipated to drive the growth of the wind power installation market in the coming years. Further, Europe and North America are the key regions that accounted for 28.5% and 11.0% of the total wind power installation market in 2022, respectively.

With the rapid growth of renewable energy in Asia Pacific, solar and wind power will play an increasingly important role in integrating variable renewable energy and ensuring the reliability of the overall power system. In many developing countries in the region, energy storage markets are still emerging, but there is enormous potential for development. The installation of wind power plants is expected to grow in order to maximize the utilization of cost-effective and flexible low-carbon energy sources and fulfill the growing electricity demand.

Wind Power Installation Market Regional Insights

Wind Power Installation Market Regional Insights

The regional trends and factors influencing the Wind Power Installation Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wind Power Installation Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wind Power Installation Market

Wind Power Installation Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 114.5 Billion |

| Market Size by 2030 | US$ 275.9 Billion |

| Global CAGR (2022 - 2030) | 11.6% |

| Historical Data | 2020-2022 |

| Forecast period | 2022-2030 |

| Segments Covered |

By Deployment Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

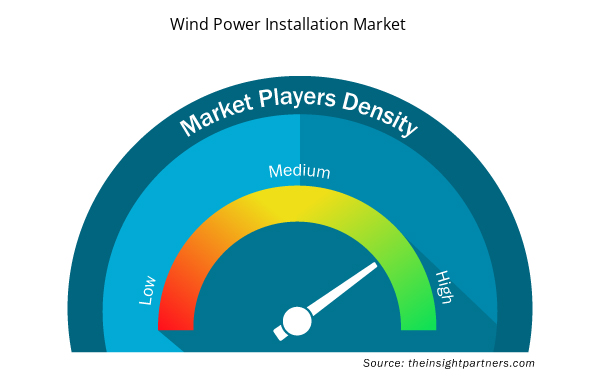

Wind Power Installation Market Players Density: Understanding Its Impact on Business Dynamics

The Wind Power Installation Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wind Power Installation Market are:

- Siemens Gamesa Renewable Energy SA

- General Electric

- Mitsubishi Heavy Industries

- Vestas Wind Systems

- Senvion SA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wind Power Installation Market top key players overview

Key Player Analysis:

Siemens Gamesa Renewable Energy SA, General Electric, Mitsubishi Heavy Industries, Vestas Wind Systems, Senvion SA, Wind World Limited, Indowind, DNV GL, Goldwind, and Bergey Wind Power are among the key players profiled in the global wind power installation market report.

Recent Developments:

Inorganic and organic strategies such as partnerships, collaborations, and mergers and acquisitions are highly adopted by companies in the global wind power installation market. A few recent developments by key wind power installation market players are listed below:

|

|

|

2022 | Vestas partnered with PEC Energia to build an 86 MW wind park in Brazil. With this project, Vestas surpassed the milestone of 7 GW of order intake in Brazil for 4 MW platform wind turbines since 2018. | South America |

2022 | Siemens Gamesa formed a new partnership with Azure Power to install 96 turbines with a focus on boosting India's wind industry. | Asia Pacific |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Deployment Type, Power Capacity, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

Key role of wind power in future energy transition is anticipated to stimulate the wind power installation market growth in the coming years.

Regions such as Europe, North America and Asia-Pacific will boost the growth of the wind power installation market during the forecast period. This growth is owing to the rise in investment on construction of wind power plant facilities in the regions.

Rise in demand for power generation from less carbon emitting sources, rise in establishment of wind power plants, rise in awareness towards renewable energy resources are contributing to the growth of the wind power installation market.

Siemens Gamesa Renewable Energy SA, General Electric, Mitsubishi Heavy Industries, Vestas Wind Systems, and Senvion SA are the key market players operating in the global wind power installation market.

Ongoing research and innovation on advanced offshore wind power technologies in potential countries such as Brazil, U.S., India, Japan, and China where the adoption of the above-mentioned technology is maturing at a significant rate is expected to be the key opportunity in the market.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - Wind Power Installation Market

- Siemens Gamesa Renewable Energy SA

- General Electric

- Mitsubishi Heavy Industries

- Vestas Wind Systems

- Senvion SA

- Wind World Limited

- Indowind

- DNV GL

- Goldwind

- Bergey Wind Power

Get Free Sample For

Get Free Sample For