Wind Turbine Composites Market Dynamics and Trends by 2030

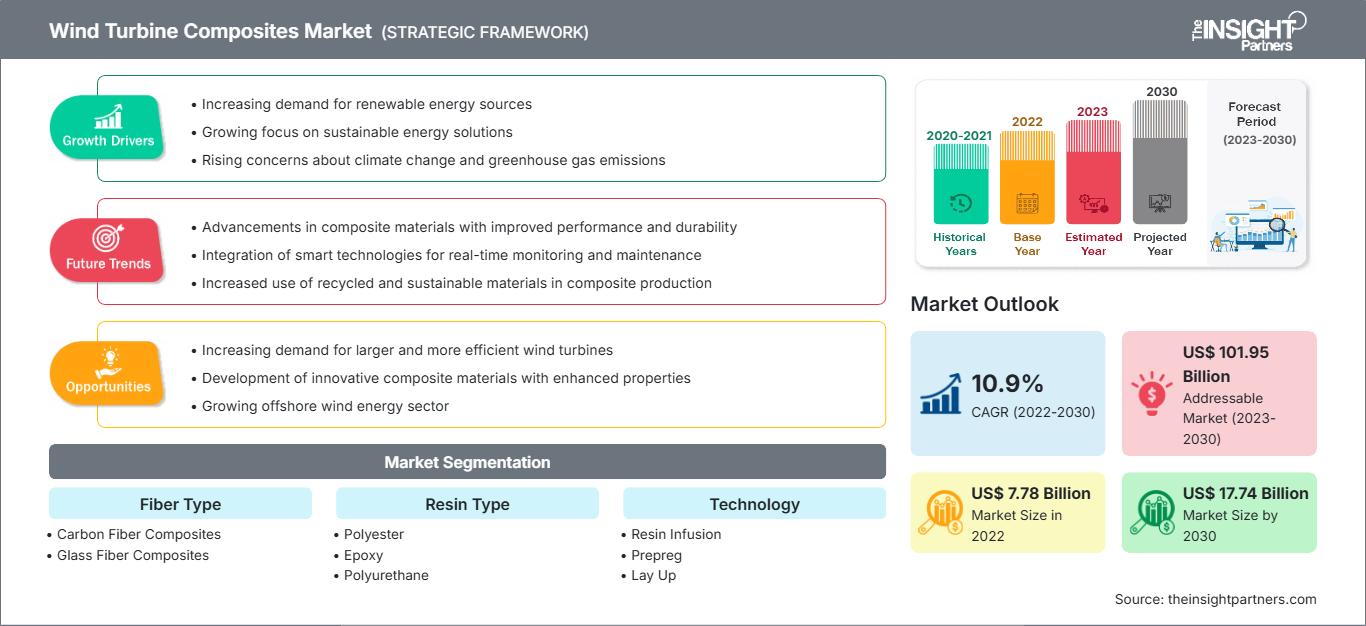

Historic Data: 2020-2021 | Base Year: 2022 | Forecast Period: 2023-2030Wind Turbine Composites Market Size and Forecasts (2020 - 2030), Global and Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Fiber Type (Carbon Fiber Composites, Glass Fiber Composites, and Others), Resin Type (Polyester, Epoxy, Polyurethane, Vinyl Ester, and Others), Technology (Resin Infusion, Prepreg, Lay Up, and Others), and Application (Blades and Nacelles)

- Report Date : Sep 2023

- Report Code : TIPRE00007971

- Category : Chemicals and Materials

- Status : Published

- Available Report Formats :

- No. of Pages : 215

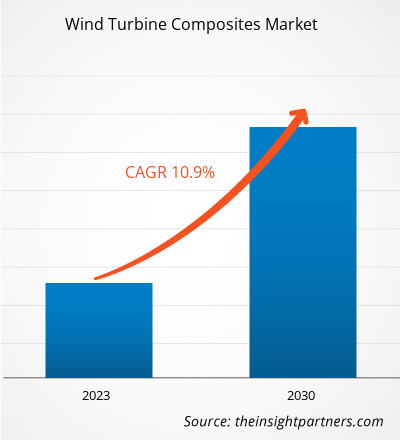

[Research Report] The wind turbine composites market size was valued at US$ 7,777.37 million in 2022 and is projected to reach US$ 17,740.86 million by 2030; it is expected to record a CAGR of 10.9% from 2022 to 2030.

MARKET ANALYSIS

Wind turbine composites are defined as the composites or components that are utilized in the production of wind turbine parts, such as blades and nacelles. The use of composites helps in the production of lightweight components with excellent characteristics, low maintenance cost, resistance to corrosion, and long life of products. The growing focus on renewable forms of energy coupled with rising demand for wind turbine composites from various end use industries and positive government efforts to support wind energy projects are a few factors that are expected to increase the demand for wind turbine composites in the global market in the coming years.

GROWTH DRIVERS AND CHALLENGES

Wind power is considered a clean and renewable energy source that provides electricity without burning fuel or polluting the air. Wind energy helps reduce reliance on fossil fuels. Hence, there is an increasing interest in wind energy among various countries, which has resulted in rapid growth in their installed wind capacity.

As per the below figure, in 2020, global new wind power installations surpassed 90 GW, registering 53% growth compared to 2019, which resulted in a total installed capacity of 743 GW, i.e., surge of 14% compared to last year. In 2020, new installations in the onshore wind farms reached 86.9 GW, while the offshore wind farms reached 6.1 GW, making 2020 the highest and the second-highest year in history for new wind installations for onshore and offshore, respectively.

As per the Global Wind Energy Council, the US expanded their wind turbine capacity in 2020 than in any other year. The wind industry in the US increased their wind capacity by 13,413 megawatts (MW) in 2021, reaching a cumulative total of 135,886 MW. This is the second-highest wind capacity installed in one year in the US after 2020. Governments of various countries across the globe are also supporting wind power by subsidizing massive amounts of taxpayer’s salaries with the help of the Production Tax Credit (PTC). Hence, most renewable energy industries are heavily reliant upon the subsidies offered by the government, along with constant taxpayer support. However, most of these wind installations are not economical on the open market, which leads to a never-ending cycle of subsidies. Also, without the help of guaranteed subsidies and profit from the government, the renewable energy industry is focusing on innovation to improve reliability, efficiency, and cost-effectiveness. Thus, wind energy is largely dependent upon government subsidies and tax rebates, which restricts the growth of the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Turbine Composites Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global Wind Turbine Composites Market Forecast to 2030" is a specialized and in-depth study with a major focus on the global wind turbine composites market trends and opportunities. The report aims to provide an overview of the market with detailed market segmentation based on fiber type, resin type, technology, application, and geography. The global wind turbine composites market has been witnessing high growth over the recent past and is expected to continue this trend during the forecast period. The report provides key statistics on the use of wind turbine composites worldwide along with their demand in major regions and countries. In addition, it provides a qualitative assessment of various factors affecting the wind turbine composites market performance in major regions and countries. The report also includes a comprehensive analysis of the leading market players and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, market trends, and lucrative wind turbine composites market opportunities that would, in turn, aid in identifying the major revenue pockets.

Further, ecosystem analysis and Porter’s five forces analysis provide a 360-degree view of the global wind turbine composites market, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global wind turbine composites market is categorized on the basis of fiber type, resin type, technology, and application. In terms of fiber type, the market is segmented into carbon fiber composites, glass fiber composites, and others. By resin type, the market is categorized into polyester, epoxy, polyurethane, vinyl ester, and others. In terms of technology, the global wind turbine composites market is classified into resin infusion, prepreg, lay up, and others. By application, the market is divided into blades and nacelles.

Based on fiber type, the glass fiber composites segment held a significant global wind turbine composites market share in 2022. Glass fiber composite is a thermoset plastic resin reinforced with glass fibers. Glass fiber composites are produced by various manufacturing technologies and are used in a wide range of applications. Glass fibers showcase several properties, including high strength, flexibility, durability, and resistance to chemical damage. They can be in the form of roving, chopped strands, yarns, fabrics, and mats. By resin type, the epoxy segment held the largest share in the global wind turbine composites market in 2022. Epoxy resins show high strength and low shrinkage during curing. Due to their toughness and chemical resistance, these are widely used in manufacturing blades. Depending on the formulation, epoxy resins are used as casting, resin binders, potting agents, and laminating resins in fiberglass or composite construction. By technology, the resin infusion segment dominated the wind turbine composites market in 2022. The resin infusion molding process is extensively deployed in producing large thermoset composite wind rotor blades owing to their complex airfoil geometry, large sizes, and cost-effectiveness. The adoption of resin infusion technologies has helped improve the quality of wind turbine composites. By application, the blades segment led the global wind turbine composites market with the largest market share in 2022. Wind turbine blades are defined as airfoil-shaped blades that are involved in harnessing wind energy and driving the rotor of a wind turbine. The airfoil-shaped design applies a lift perpendicular to the wind direction in the blades. Wind turbine blades are considered the most critical yet significant part of wind turbines.

REGIONAL ANALYSIS

The report provides a detailed overview of the global wind turbine composites market with respect to five major regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and South & Central America. APAC accounted for a significant part of the global wind turbine composites market share and was valued at over US$ 3 billion in 2022. The wind turbine composites market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China is a major contributor to the market growth in this region. The country has been the largest and fastest-growing renewable energy producer for more than a decade across the world. Europe is also expected to witness notable growth, reaching approximately US$ 4 billion by 2030. The Europe wind turbine composites market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Various countries in the region are harnessing technological capabilities to achieve their sustainability goals. Furthermore, in North America, there has been a widespread usage of wind turbine composites. This has created lucrative opportunities in the wind turbine composites market. The wind turbine composites market in North America is expected to grow at a CAGR of ~11% from 2022 to 2030.

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnerships, acquisitions, and new product launches are a few prominent strategies adopted by the players operating in the global wind turbine composites market.

In April 2022, Avient Corporation announced the acquisition of DSM Protective Materials to add its Dyneema brand and its unique technologies to Avient. This acquisition was aimed to expand its growing composites portfolio. Avient Corporation also announced the plan to explore sale options for its Avient Distribution business.

IMPACT OF COVID-19 Pandemic/IMPACT OF GEOPOLITICAL SCENARIO/IMPACT OF RECESSION

Lockdowns, travel restrictions, and business shutdowns due to the COVID-19 pandemic adversely affected economies and industries in various countries across the globe. The crisis disturbed supply chains, manufacturing activities, delivery schedules, and essential and nonessential product sales. These disruptions restricted the availability of wind turbine composites. It caused delays in production and increased costs, negatively impacting the overall supply of wind turbine composites. Many manufacturing facilities were temporarily halted or scaled back during the COVID-19 pandemic to comply with lockdown measures and ensure the safety of workers. In addition, the pandemic impacted the global economy, leading to fluctuations in commodity prices and reduced demand for resins and fibers.

The global marketplace is recovering from the losses as governments of different countries have announced relaxation in the restrictions. Manufacturing activities are rebounding as countries gradually recover from the pandemic and vaccination efforts continue. Manufacturers are permitted to operate at full capacity to overcome the supply gap. Increased infrastructure investments and stimulus packages in many regions drive the demand for composites. Thus, the global wind turbine composites market is anticipated to grow significantly during the forecast period.

Wind Turbine Composites Market Regional InsightsThe regional trends and factors influencing the Wind Turbine Composites Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Wind Turbine Composites Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Wind Turbine Composites Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 7.78 Billion |

| Market Size by 2030 | US$ 17.74 Billion |

| Global CAGR (2022 - 2030) | 10.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Fiber Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Wind Turbine Composites Market Players Density: Understanding Its Impact on Business Dynamics

The Wind Turbine Composites Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Wind Turbine Composites Market top key players overview

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Avient Corp, Toray Industries Inc, SGL Carbon SE, Owens Corning, Gurit Holding AG, Hexion Inc, Hexcel Corp, Exel Composites Oyj, EPSILON Composite SA, and Covestro AG are a few of the key players operating in the global wind turbine composites market.

Frequently Asked Questions

Based on technology, which segment is leading the global wind turbine composites market during the forecast period?

Which region held the largest share of the global wind turbine composites market?

Can you list some of the major players operating in the global wind turbine composites market?

Based on resin type, which segment is leading the global wind turbine composites market during the forecast period?

Based on application, which segment is leading the global wind turbine composites market during the forecast period?

Habi is a seasoned Market Research Analyst with 8 years of experience specializing in the Chemicals and Materials sector, with additional expertise in the Food & Beverages and Consumer Goods industries. He is a Chemical Engineer from Vishwakarma Institute of Technology (VIT) and has developed deep domain knowledge across industrial and specialty chemicals, paints and coatings, paper and packaging, lubricants, and consumer products. Habi’s core competencies include market sizing and forecasting, competitive benchmarking, trend analysis, client engagement, report writing, and team coordination—making him adept at delivering actionable insights and supporting strategic decision-making.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Related Reports

Testimonials

The Insight Partners' SCADA System Market report is comprehensive, with valuable insights on current trends and future forecasts. The team was highly professional, responsive, and supportive throughout. We are very satisfied and highly recommend their services.

RAN KEDEM Partner, Reali Technologies LTDsI requested a report on a very specific software market and the team produced the report in a few days. The information was very relevant and well presented. I then requested some changes and additions to the report. The team was again very responsive and I got the final report in less than a week.

JEAN-HERVE JENN Chairman, Future AnalyticaWe worked with The Insight Partners for an important market study and forecast. They gave us clear insights into opportunities and risks, which helped shape our plans. Their research was easy to use and based on solid data. It helped us make smart, confident decisions. We highly recommend them.

PIYUSH NAGPAL Sr. Vice President, High Beam GlobalThe Insight Partners delivered insightful, well-structured market research with strong domain expertise. Their team was professional and responsive throughout. The user-friendly website made accessing industry reports seamless. We highly recommend them for reliable, high-quality research services

YUKIHIKO ADACHI CEO, Deep Blue, LLC.This is the first time I have purchased a market report from The Insight Partners.While I was unsure at first, I visited their web site and felt more comfortable to take the risk and purchase a market report.I am completely satisfied with the quality of the report and customer service. I had several questions and comments with the initial report, but after a couple of dialogs over email with their analyst I believe I have a report that I can use as input to our strategic planning process.Thank you so much for taking the extra time and making this a positive experience.I will definitely recommend your service to others and you will be my first call when we need further market data.

JOHN SUZUKI President and Chief Executive Officer, Board Director, BK TechnologiesI wish to appreciate your support and the professionalism you displayed in the course of attending to my request for information regarding to infectious disease IVD market in Nigeria. I appreciate your patience, your guidance, and the fact that you were willing to offer a discount, which eventually made it possible for us to close a deal. I look forward to engaging The Insight Partners in the future, all thanks to the impression you have created in me as a result of this first encounter.

DR CHIJIOKE ONYIA MANAGING DIRECTOR, PineCrest Healthcare Ltd.Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For