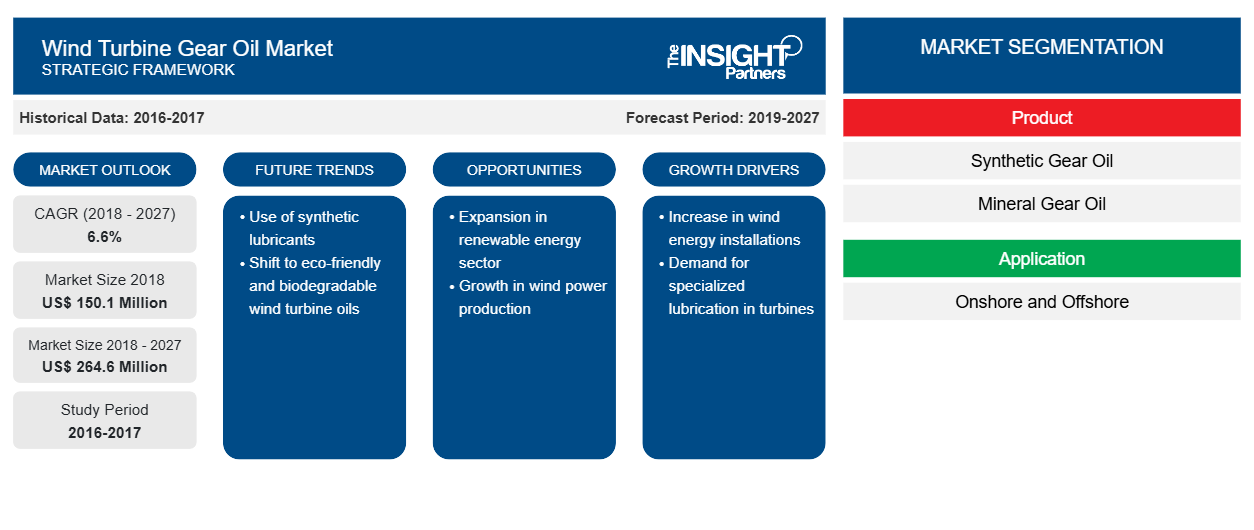

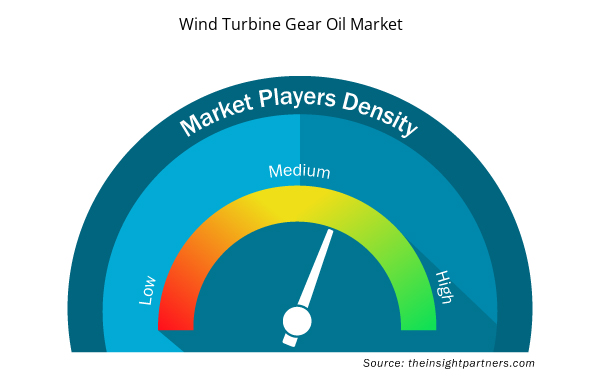

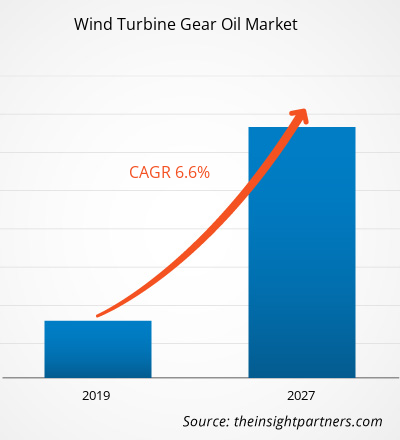

The wind turbine gear oil market accounted for US$ 150.1 Mn in 2018 and is expected to grow at a CAGR of 6.6% during the forecast period 2019 - 2027, to account for US$ 264.6 Mn by 2027.

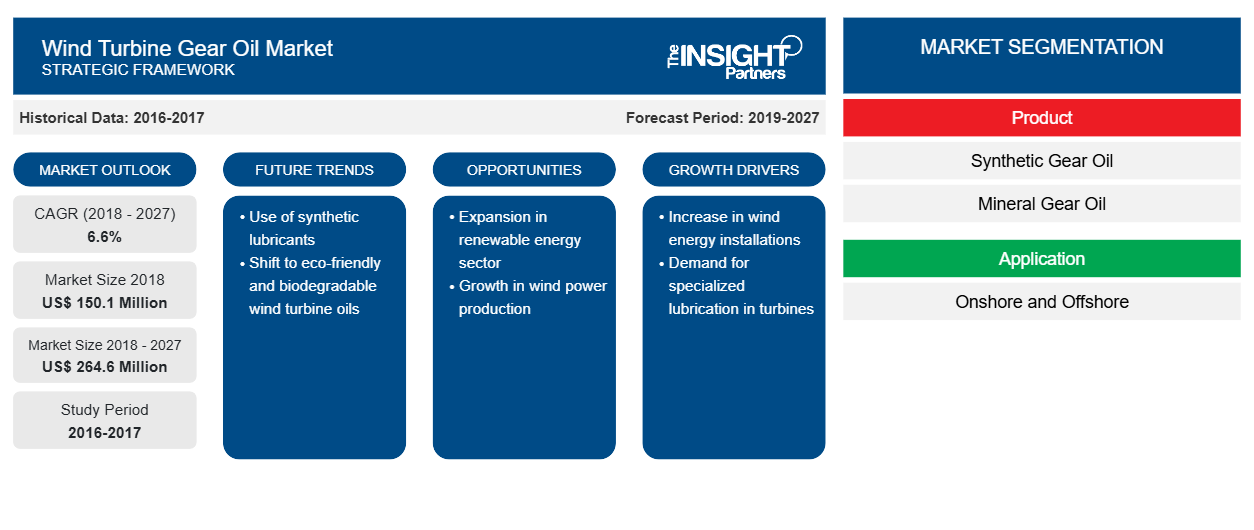

Asia Pacific is dominating the market and holds the largest share in the global wind turbine gear oil market. The largest market share of this region is primarily attributed to the presence of major wind turbine gear oil manufacturers in the region. Also, the rising production activities of wind turbine gear oil is expected to fuel wind turbine gear oil market growth during the forecast period. China leads in the production of wind energy as it has an installed capacity of more than 200 gigawatts. In 2018, China installed wind farms with an additional capacity of 21 gigawatts. The growing number of wind farm projects in China is expected to generate a significantly high demand for wind turbine gear oil market in China. These factors led to the growth of the wind turbine gear oil market in the Asia Pacific region.

Market Insights

Government support to wind energy sector provides an opportunity for the wind turbine gear oil market growth

In an effort to address global warming and mitigate climate change, governments across the world are supporting the production and use of wind energy. The governments and energy industries have made large-scale investments in wind energy projects to harness clean energy as well as to minimize the carbon footprint. The wind energy is witnessing tremendous growth as government bodies are implementing policies such as tax rebates, subsidiaries, and minimum purchase price on wind turbine components and equipment for facilitating a shift from conventional energy to renewable energy. Increased government spending to develop plants for the generation of renewable energy, such as solar and wind energy, is expected to drive the wind turbine gear oil market during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Turbine Gear Oil Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Turbine Gear Oil Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Growing number of wind turbine installations is expected to boost the demand for wind turbine gear oil

Wind energy is one of the renewable energy technologies which is growing at a rapid pace. The global installed capacity of wind energy has increased 75 times in the past two decades. According to the International Renewable Energy Agency, it rose from 7.5 gigawatts in 1997 to ~564 gigawatts in 2018. The demand for wind turbine gear oil is dependent on factors such as new wind turbine installations and the frequency of oil change. The growing number of wind farms in China, Europe, and North America is expected to drive the market for wind turbine gear oil. According to the World Wind Energy Association, the global capacity of windmills reached 597 gigaWatt in 2018. The imperative to achieve the objectives of the Paris Climate Change agreement and the Sustainable Development Goals have accelerated government led investments in new wind farm projects. The growing capacity of wind farms and surge in the number of wind farm projects globally are expected to drive the market for wind turbines, and consequently generate significant demand for wind turbine gear oil.

Product Insights

Based on product, the global wind turbine gear oil market has been segmented into synthetic gear oil, mineral gear oil, and others. Under the product segment, the synthetic gear oil segment led the global wind turbine gear oil market. The use of synthetic oil over mineral and other oils provides benefits through lower evaporation losses and a tendency to form residues, improved lubricity, thermal and oxidation resistance, viscosity-temperature behavior, and low-temperature properties; reduced flammability; and resistance to ambient media. Synthetic oil is refined oil with uniform molecular size, which reduces the coefficient of friction, and hence, this oil is increasingly used in gearboxes of turbines for their excellent lubricating properties. The growing use of synthetic gear oil in turbine gearboxes to increase the gear efficiency is expected to drive the sales of synthetic gear oil during 2019–2027.

Application Insights

The global wind turbine gear oil market by application has been segmented into onshore and offshore. The wind turbine gear oil market for the onshore application accounted for the largest share in the global wind turbine gear oil market. Onshore applications refer to the wind turbines installed on land. They are generally located on barren lands on which there is no restriction to the flow of wind. The cost associated with installing onshore windmill is relatively less compared to that associated with the installation of offshore windmills. The wind turbines gear oil market for the onshore segment is expected to grow at a considerable pace during the forecast period owing to the hike in the number of windmills owned by private companies as well as individuals.

Mergers and acquisitions, product launches, and market initiatives strategies were adopted by the key players in the global wind turbine gear oil market. Few of the recent developments in the global wind turbine gear oil market are listed below:

2019:Global wind industry leaders NGC, CLCP, Envision Energy, and AMSOIL officially became strategic partners in the world's largest renewable energy market. This help the company to enhance its customer base globally.

2019:A new AS/RS warehouse, two production halls and new office space for a total of EUR 16 million is built on the premises of FUCHS LUBRITECH GMBH. The location, which mainly produces lubricants for special applications, now covers a total of 96,000 m

2018:AMSOIL was selected by ZF Wind Power for gearbox lubrication during end-of-line testing at all of its manufacturing locations globally. The agreement between the two companies solidifies AMSOIL as the global leader in wind gearbox oil reliability and performance.

Wind Turbine Gear Oil Market Regional Insights

The regional trends and factors influencing the Wind Turbine Gear Oil Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wind Turbine Gear Oil Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wind Turbine Gear Oil Market

Wind Turbine Gear Oil Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 150.1 Million |

| Market Size by 2027 | US$ 264.6 Million |

| Global CAGR (2018 - 2027) | 6.6% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

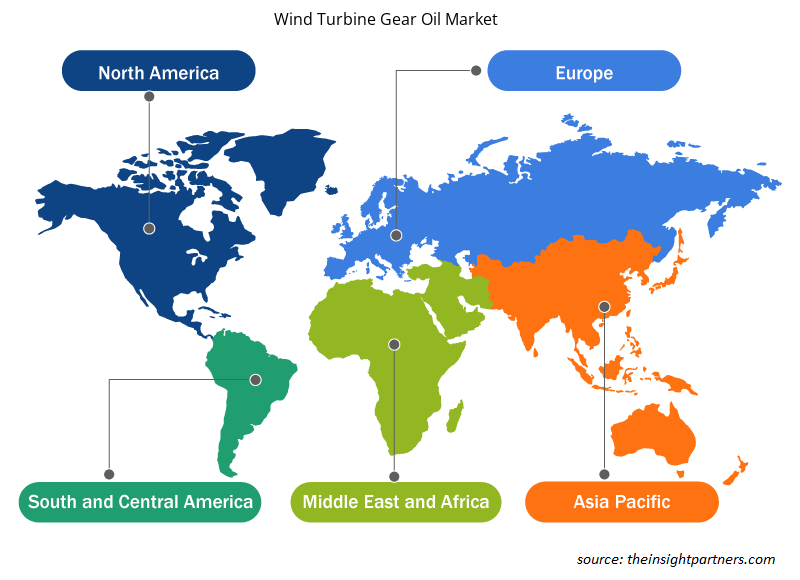

Wind Turbine Gear Oil Market Players Density: Understanding Its Impact on Business Dynamics

The Wind Turbine Gear Oil Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wind Turbine Gear Oil Market are:

- AMSOIL INC.

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- Freudenberg Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wind Turbine Gear Oil Market top key players overview

GLOBAL WIND TURBINE GEAR OIL MARKET SEGMENTATION

By Product

- Synthetic gear oil

- Mineral gear oil

- Others

By Application

- Onshore

- Offshore

By Geography

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- France

- Italy

- UK

- Spain

- Rest of Europe

Asia Pacific

- Australia

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

Middle East and Africa

- Egypt

- South Africa

- Kenya

South America

- Brazil

- Argentina

- Rest of South America

Company Profiles

- Amsoil Inc.

- BP p.l.c. (Castrol Limited)

- Chevron Corporation

- Exxon Mobil Corporation

- Freudenberg Group

- FUCHS Group

- HollyFrontier Corporation (Petro‐Canada Lubricants LLC)

- Royal Dutch Shell Plc.

- Schaeffer Manufacturing Co.

- TOTAL SA

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product , Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies

- AMSOIL INC.

- BP p.l.c.

- Chevron Corporation

- Exxon Mobil Corporation

- Freudenberg Group

- FUCHS Group

- HollyFrontier Corporation.

- Royal Dutch Shell Plc.

- Schaeffer Manufacturing Co.

- TOTAL S.A.

Get Free Sample For

Get Free Sample For