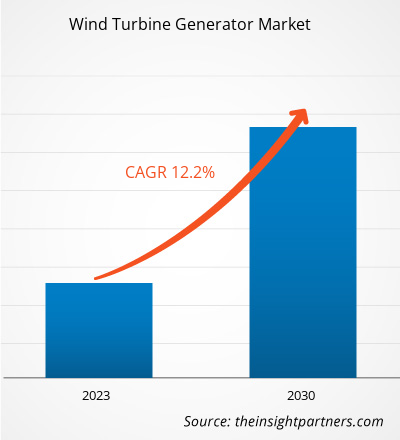

[Research Report] The wind turbine generator market was valued at US$ 3,483.84 million in 2022 and is projected to reach US$ 8,772.57 million by 2030; it is expected to grow at a CAGR of 12.2% during 2022–2030.

Analyst Perspective:

The North America wind turbine generator market is sub-segmented into the US, Canada, and Mexico. Owing to stringent government regulations, an increase in investment in wind power projects, favorable policies, and reduced cost of wind energy, the wind industry across the region is expected to register remarkable growth. With the growing consumer awareness of climate change and the role of renewable energy, the demand for wind turbines is expected to increase in North America. In 2022, the US (Texas) alone installed land-based wind turbines worth of 4,028 MW of power. Also, in 2022, the other US states, such as Nebraska and Oklahoma, added a wind power capacity of 600 MW each. All such government initiatives are driving the growth of wind turbine generator market share in the US.

The Canadian government is investing in renewable energy and working with indigenous partners to get major projects built. For instance, in May 2022, the Minister of Natural Resources announced an investment of ~US$ 50 million for the Burchill Wind Limited partnership between Wolumseket and Natural Forces Development to deploy renewable energy and grid modernization technologies. In March 2022, Canada announced its plans to invest US$ 7.2 billion in wind and solar projects to meet carbon emissions reduction targets by 2030. In November 2021, Siemens Gamesa Renewable Energy announced that they had signed an agreement with Renewable Energy Systems (RES) in Canada to supply wind turbines for the 100 MW Hilda wind project in Alberta. This deal will help the country in meeting its 30% goal of renewable energy generation by 2030. Under this agreement, Siemens Gamesa will supply 20 SG 5.0-145 turbines, providing clean and affordable power for ~50,000 homes. Also, according to the Canadian Renewable Energy Association (CanREA), in 2022, Canada installed a total of 1.8 GW of wind and solar power capacity. Thus, such investment prospects in erecting wind energy projects and the rise in the adoption of clean energy are fueling the wind turbine generator market share of North America. Various wind turbine generator market players such as TPI Composites Inc., Marmen Inc., Valmont Industries Inc., and The Timken Co. are developing innovative and more efficient components to cater to this rising demand.

The government of Mexico has invested a significant amount in the construction of wind turbines in the country. According to the Asociación Mexicana de Energía Eólica (AMDEE), an investment of ~US$ 1.3 billion was planned to develop the Mexican wind energy sector in 2020. Thus, this investment made the country enter the top 3 most attractive wind energy producers in Latin America. This allocated fund will be invested in 11 wind energy projects in Coahuila, Yucatan, and Tamaulipas.

Thus, all the above factors are fueling the growth of the North America wind turbine generator market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Turbine Generator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wind Turbine Generator Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Overview:

Generators convert the mechanical energy generated from the rotor blades into electrical energy through magnetic fields. In the majority of cases, generators use alternating current to operate at a constant speed that allows them to generate utility-grade 60Hz AC power. Different types of generators, including induction generators (with fixed RPM and variable RPM), doubly fed induction generators (variable RPM), and permanent magnet direct drive generators, are used in wind turbines. They have different features and operational capabilities that are used based on the requirements of wind turbine installation and power generation.

The growing government initiative for adopting wind energy for electricity generation is creating lucrative opportunities for the wind turbine generator market. The rising demand for floating wind technology for offshore wind turbines is projected to favor the growth of the wind turbine generator market during the forecast period. The technology will help in the development of offshore wind turbines where the water is very deep.

Market Driver:

Increasing Product Launches is Driving the Wind Turbine Generator Market Growth

According to the Global Wind Energy Council (GWEC), as of 2022, a total of 906 GW of wind capacity has been installed globally, of which 93% is onshore and 7% offshore. It is expected that the wind energy markets will grow fourfold in the coming 20 years, further raising the demand for advanced wind turbine components. The growing demand for wind energy will require advanced turbine components such as rotor blades, nacelle, gearbox, generator, tower, and pitch systems. This has compelled the market players to boost their investment in developing new and innovative products. Various wind turbine generator manufacturers are working on deploying advanced products to cater to the growing customer needs. For instance, in September 2023, Adani New Industries Ltd announced that it would produce a 5.2 MW series of wind turbine generators for the international wind turbine generator market.

Such advancements in wind turbine components, supported by high investments from global manufacturers and government policies for climate control to enhance their product portfolio, are fueling the growth of the wind turbine generator market. Also, the rising demand for recyclable components to protect the environment is pushing manufacturers to develop more recyclable components. In addition, manufacturers are coming up with more efficient components, which will help produce more electricity from wind turbines by reducing turbine downtime. Thus, the growing product innovation as per the changing customer requirements is driving the growth of the wind turbine generator market.

Segmental Analysis:

Based on generator type, the wind turbine generator market is bifurcated into Direct Current and AC Synchronous. In 2022, the AC Synchronous segment acquired a larger share of the global wind turbine generator market owing to its compatibility with the grid and operational efficiency. In addition, in the case of offshore wind farms, AC generators are particularly advantageous. They are well-suited for long-distance power transmission from offshore installations to the mainland, as AC power can be efficiently transported over extended undersea cable distances. Growing offshore investment is anticipated to drive the demand for AC synchronous generators in the wind turbine generator market. For instance, in 2023, the UK's Octopus announced its plans to invest US$ 20 billion in offshore wind farms. Such initiatives are expected to drive the AC synchronous generator's demand.

Regional Analysis:

The government of Italy is investing a significant amount of capital in integrating renewable energy, further propelling the wind turbine generator market share of the country. For instance, in June 2022, ERG announced that they had placed a 101MW order for the Mineo Militello Vizzini wind park in Sicily. This project adds to the more than 5.4 GW wind turbines installed or under construction by Vestas in Italy, which accounts for a market share of more than 40%. Also, in July 2021, Eni announced that they had signed an agreement to acquire 100% of a portfolio of 13 onshore wind farms in Italy, having a total capacity of 315 MW, from Glennmont Partners ("Glennmont") and PGGM Infrastructure Fund ("PGGM"). The Italian government is also working on incentives to boost the roll-out of offshore wind facilities. Also, the government has set goals to achieve 65% of the country's electricity demand through renewables, which is another major factor likely to generate new opportunities for wind turbine generator market vendors during the forecast period.

Wind Turbine Generator Market Regional Insights

Wind Turbine Generator Market Regional Insights

The regional trends and factors influencing the Wind Turbine Generator Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wind Turbine Generator Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wind Turbine Generator Market

Wind Turbine Generator Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 3.48 Billion |

| Market Size by 2030 | US$ 8.77 Billion |

| Global CAGR (2022 - 2030) | 12.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Wind Turbine Generator Market Players Density: Understanding Its Impact on Business Dynamics

The Wind Turbine Generator Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wind Turbine Generator Market are:

- XINJIANG GOLDWIND SCIENCE & TECHNOLOGY CO LTD

- Vestas Wind Systems AS

- General Electric,

- Zhejiang Windey Co., Ltd.

- Suzlon Energy Limited

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wind Turbine Generator Market top key players overview

Key Player Analysis:

Siemens Gamesa Renewable Energy S.A.; ENVISION Group; Mingyang Smart Energy; Nordex SE; Xinjiang Goldwind Science & Technology Co., Ltd.; Vestas Wind Systems AS; General Electric; Zhejiang Windey Co., Ltd.; Suzlon Energy Limited; Enercon GmbH; and Nordex Group are among the key wind turbine generator market players operating in the wind turbine generator market.

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the wind turbine generator market. A few recent developments by the key wind turbine generator market players are listed below:

Date | News | Region |

October-2023 | Mingyang Smart Energy has announced plans for a new offshore wind turbine that, at 22 M.W., will be the world's largest offshore wind turbine. According to the business, the typhoon-resistant MySE 22MW is appropriate for both fixed-bottom and floating applications. The turbine will be built between 2024 and 2025, according to the business. | APAC |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Wire Harness Market

- Identity Verification Market

- Sports Technology Market

- Electronic Toll Collection System Market

- Aircraft Landing Gear Market

- 3D Mapping and Modelling Market

- Resistance Bands Market

- Environmental Consulting Service Market

- Virtual Event Software Market

- Genetic Testing Services Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Deployment Type, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Asia Pacific wind turbine market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. Asia Pacific is one of the leading regions in the wind turbine generator market owing to favorable government policies, a rise in investment in wind energy projects, and reduced cost of wind energy. Countries such as India, China, and Japan are the dominating countries holding a large portion of the market share, which is further expected to increase during the forecast period.

Siemens Gamesa Renewable Energy S.A., Nordex SE, Xinjiang Goldwind Science & Technology Co., Ltd., Vestas Wind Systems AS, and General Electric are the key market players operating in the global wind turbine generator market.

According to the Global Wind Energy Council (GWEC), as of 2022, a total of 906 GW of wind capacity has been installed globally, of which 93% is onshore and 7% offshore. It is expected that the wind energy markets will grow fourfold in the coming 20 years, further raising the demand for advanced wind turbine components. The growing demand for wind energy will require advanced turbine components such as rotor blades, nacelle, gearbox, generator, tower, and pitch systems.

The rise in demand for renewable energy and its advantages in protecting the environment are expected to promote wind energy projects globally. Governments of various countries are supporting the construction of wind energy projects in terms of policies and investments.

Asia Pacific is one of the major regions in the wind turbine towers market owing to favorable government mandates and policies, growing investment in wind energy projects, and lowered cost of wind energy. China, India, Australia, South Korea, and Japan are some of the major markets in Asia Pacific for wind turbine towers. China, India, and Japan are the dominating countries holding a large share of the market, which is further estimated to increase during the forecast period.

Trends and growth analysis reports related to Energy and Power : READ MORE..

The List of Companies - Wind Turbine Generator Market

- XINJIANG GOLDWIND SCIENCE & TECHNOLOGY CO LTD

- Vestas Wind Systems AS

- General Electric,

- Zhejiang Windey Co., Ltd.

- Suzlon Energy Limited

- Enercon GmbH

- NORDEX SE

- ENVISION ENERGY USA LTD

- MINGYANG SMART ENERGY GROUP CO

- SIEMENS GAMESA RENEWABLE ENERGY SA

Get Free Sample For

Get Free Sample For