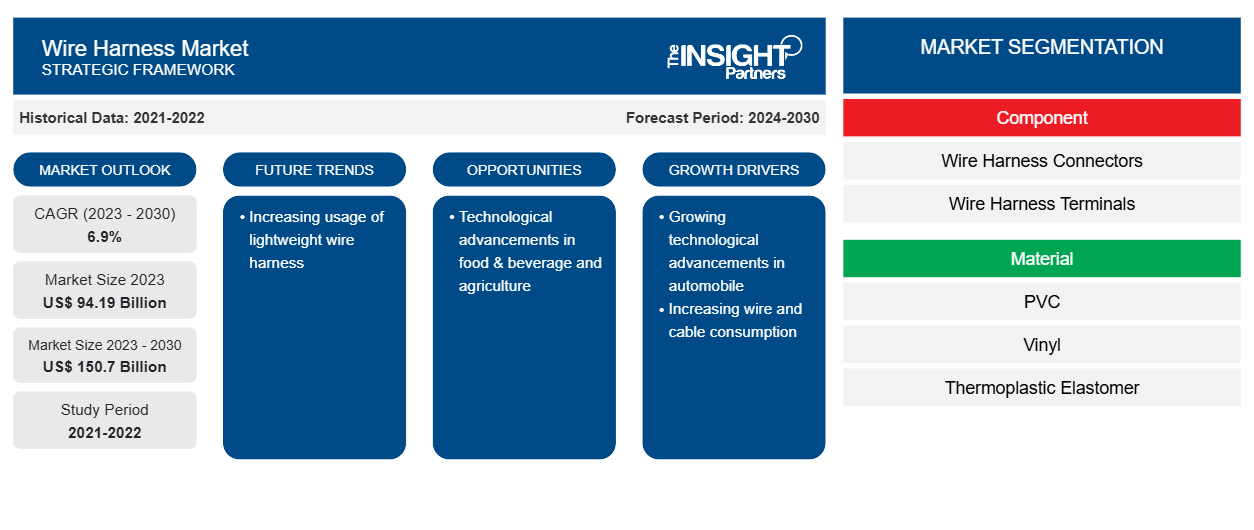

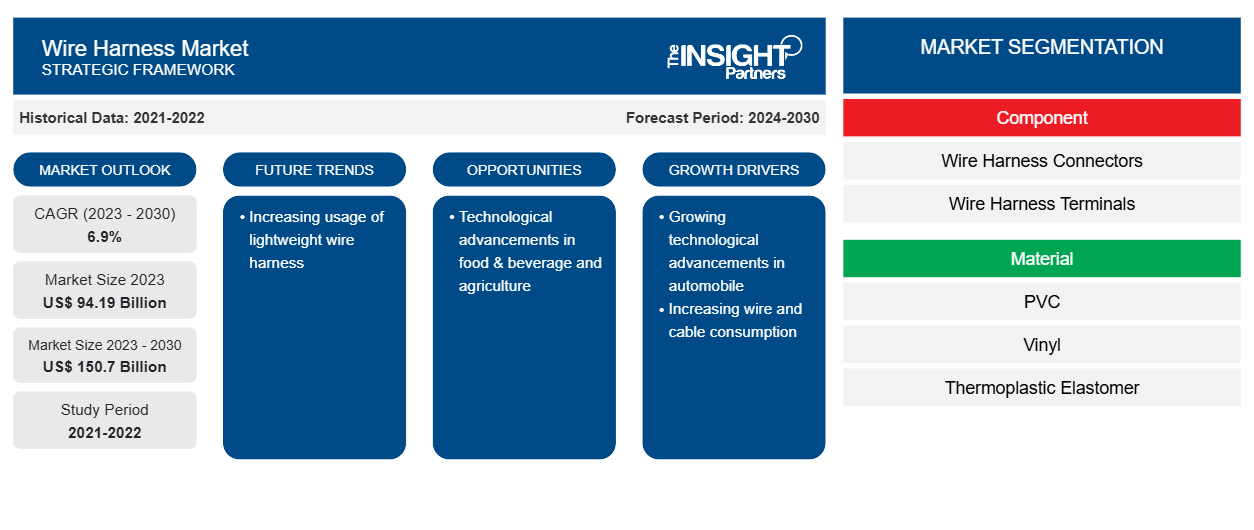

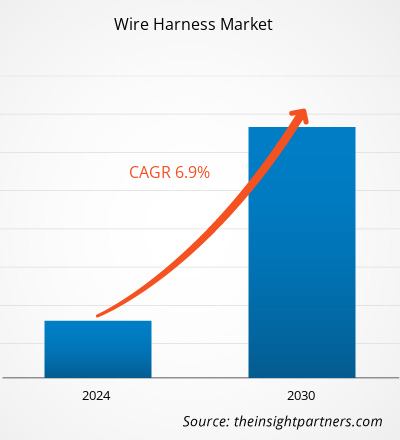

[Research Report] The wire harness market size is projected to reach US$ 150.70 billion by 2030 from US$ 94.19 billion in 2023. It is expected to grow at a CAGR of 6.9% during 2023–2030.

Analyst Perspective:

The governments’ encouragement in various industries is one of the factors contributing to the wire harness market growth. For instance, in December 2021, the Government of India announced an extra tax deduction of US$ 1,879.46 on the purchase of an electric vehicle on loan. Due to this, electric vehicles are gaining traction, leading to the massive demand for wire harnesses. Based on material, the wire harness market is segmented into PVC, vinyl, thermoplastic elastomer, polyurethane, and polyethylene. Wire harnesses manufactured using these materials can withstand varied environmental conditions, thus end users purchase wire harness as per the need. For instance, a wire harness made of polyethylene is suitable for use in moist environment, as polyethylene has ability to resist moisture.

Market Overview:

Wire harness (also known as cable harness) are used to transmit electrical power and signals in industries such as automobile, food & beverage, agriculture, and electronics. The wire harness market players are compelled to follow stringent regulations and standards. One such standard is IPC/WHMA-A-620 Revision D, introduced by IPC and Wiring Harness Manufacturer’s Association (WHMA), for the acceptance and requirements of wire harness assemblies. Fujikura Ltd.; Furukawa Electric Co. Ltd.; Lear; LEONI; Motherson Group; Nexans; Sumitomo Electric Industries, Ltd; THB Group; Yazaki Corporation; Yura Corporation are among the key players profiled during this market study. In addition to these players, several other essential companies were studied and analyzed to get a holistic view of the wire harness market and its ecosystem. Various strategic initiatives by major wire harness market players and government initiatives are driving the market growth. For instance, in September 2020, Furukawa Automotive Systems Inc. opened its new production facility in North America and Japan to accelerate its production capacity of wire harness.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wire Harness Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wire Harness Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Market Driver:

Growing Technological Advancements in Automobiles to Drive Growth of Wire Harness Market

Automobile manufacturers are implementing various technologies in their upcoming models to stay competitive in the market. Technologies such as automatic high beam control, self-driving, cruise control, and automatic lift gates are highly adopted by automobile companies as buyers are largely lured by attractive design, specifications, quality, and features. Some of the technologically advanced vehicles have approximately 40 wire harnesses comprising ~3,000 wires and around 700 connectors. Wire harnesses are one of the most important components of a vehicle’s electrical system. It bundles up to 5 km of cables in an average car. Moreover, in modern vehicles, the majority of components, such as engine, air conditioning, instrumentation, audio speaker, lights, and battery are connected through front, rear, and roof wire harnesses. Owing to the increasing technological advancements, the demand for wire harnesses is growing in the automobile industry. In July 2022, Mahindra, an automobile giant launched new-generation Scorpio – Christened Scorpio N. This car has various technologies and features such as AdrenoX infotainment system, connected car tech, and a 12-speaker Sony audio system. These additional technology integration in the vehicles increase the demand wire harness for better connectivity. In July 2022, Toyota launched a teaser of its new connected car technology, Toyota i-Connect. Moreover, customers are moving toward electric vehicles (EV), which is also a driving factor for the wire harness market. In May 2022, Pacific Gas and Electric Company (PG&E) announced its strategy to produce three pilot programs to check how bidirectional EVs and their chargers can give power to the electric grid and related benefits to the customers. Such factors are propelling the wire harness market growth.

Segmental Analysis:

Based on end user, the wire harness market size is segmented into automotive, marine, aerospace & defense, consumer durables, medical, agriculture, industrial, and others. The automotive segment led the market in 2022, owing to the growing production of vehicles globally as a normal passenger car employs over 3,000 wire harness connectors.

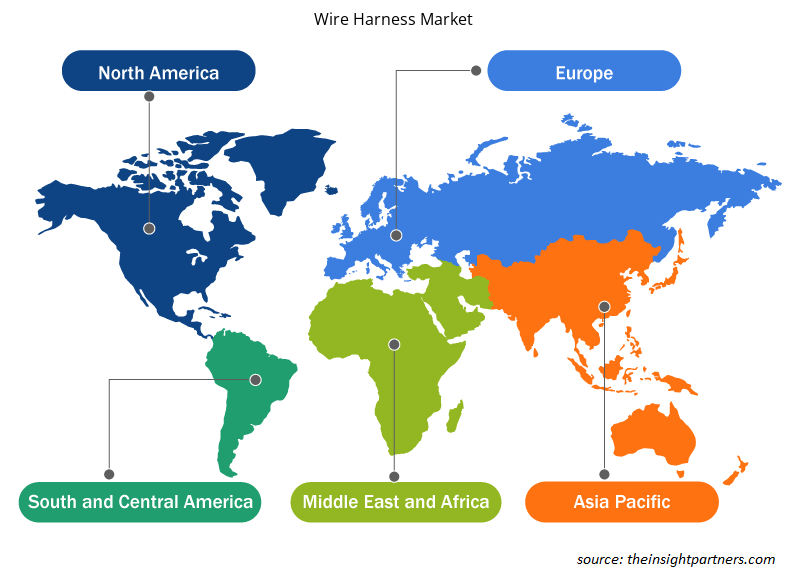

Regional Analysis:

The global wire harness market is divided into five regions: North America, Asia Pacific (APAC), Europe, the Middle East & Africa (MEA), and South America (SAM). Asia Pacific held the highest market share with CAGR 8.9% in the wire harness market in 2022. The region comprises some of the world's fastest growing and leading economies. The Asia Pacific wire harness market is segmented as China, Japan, Australia, India, South Korea, and the Rest of Asia Pacific. The region is characterized by the presence of developed economies such as Japan and Australia along with emerging economies such as China, India, Vietnam, and Malaysia. Some of these are agriculture dominated countries. Moreover, the rise in GDP, large-scale industrialization, and rise in the standard of living are some of the factors propelling the growth of wire harness market in the region.

Key Player Analysis:

The wire harness market consists of the players such as Fujikura Ltd.; Furukawa Electric Co. Ltd.; Lear; LEONI; Motherson Group; Nexans; Sumitomo Electric Industries, Ltd; THB Group; Yazaki Corporation; Yura Corporation. Among the players in the wire harness market Yazaki Corporation Inc and Sumitomo Electric Industries are the top two players owing to the diversified product portfolio offered.

Wire Harness Market Regional Insights

Wire Harness Market Regional Insights

The regional trends and factors influencing the Wire Harness Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wire Harness Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wire Harness Market

Wire Harness Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 94.19 Billion |

| Market Size by 2030 | US$ 150.7 Billion |

| Global CAGR (2023 - 2030) | 6.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Wire Harness Market Players Density: Understanding Its Impact on Business Dynamics

The Wire Harness Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wire Harness Market are:

- Fujikura Ltd.

- Furukawa Electric Co. Ltd.

- Lear

- LEONI

- Motherson Group

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wire Harness Market top key players overview

Recent Developments:

Inorganic and organic strategies such as mergers and acquisitions are highly adopted by companies in the wire harness market. A few recent key market developments are listed below:

- In 2021 Faraday Future, a smart mobility ecosystem company, partnered with DRAXLMAIER Group for the supply of Interior consoles for FF 91 vehicles. Under the partnership agreement, DRAXLMAIER Group would supply front and rear center consoles for FF 19.

- In 2021, Lear entered into a joint venture with Hu Lane Associate Inc., automotive connector products manufacturer. This joint venture extends Lear's ability of connector system products manufacturing and makes it more competitive in the wire harness business.

- In 2021, Lear has become the leading investor for the Series C round of financing in CelLink Corporation, flat and flexible circuit manufacturer.

- In 2021, Sumitomo Electric and Valens Semiconductor formed collaboration for making the Sumitomo's wiring harness systems meets the channel needs of the A-PHY specifications. The collaboration has been made for A-PHY technology and departments.

- In 2021, Lear acquired M&N Plastics, Michigan based engineered plastic components for automotive electrical distribution manufacturer and injection moulding specialist. This acquisition extends Lear's capacity of production of high voltage wire harness.

- In 2021, Nexus expands its production ability by opening of cable harness production facility at Tinjanin, China. With addition of this facility Nexans owns global production capacity of production of more than a million harnessed cables every year.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component, Material, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, Denmark, Finland, France, Germany, India, Indonesia, Italy, Japan, Mexico, Norway, Poland, Russian Federation, Saudi Arabia, South Africa, South Korea, Sweden, Thailand, United Arab Emirates, United Kingdom, United States, Vietnam

Frequently Asked Questions

PVC segment is expected to hold a major market share of wire harness market in 2023

China, India, and South Korea are expected to register high growth rate during the forecast period.

1. Growing Technological Advancements in Automobiles

2. Increasing Wire and Cable Consumption

Yazaki Corporation Inc, Sumitomo Electric Industries, Ltd, Furukawa Electric Co. Ltd., LEONI, and Lear Corporation are the key market players expected to hold a major market share of wire harness market in 2023.

Asia Pacific is expected to register highest CAGR in the wire harness market during the forecast period (2023-2030)

Increasing Usage of Lightweight Wire Harness

The estimated global market size for the wire harness market in 2023 is expected to be around US$ 94.19 billion

The wire harness market is expected to register an incremental growth value of US$ 56.50 billion during the forecast period.

The global market size of wire harness market by 2030 will be around US$ 150.70 billion.

The US is expected to hold a major market share of wire harness market in 2023.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Wire Harness Market

- Fujikura Ltd.

- Furukawa Electric Co. Ltd.

- Lear

- LEONI

- Motherson Group

- Nexans

- Sumitomo Electric Industries, Ltd

- THB Group

- Yazaki Corporation

- Yura Corporation

Get Free Sample For

Get Free Sample For