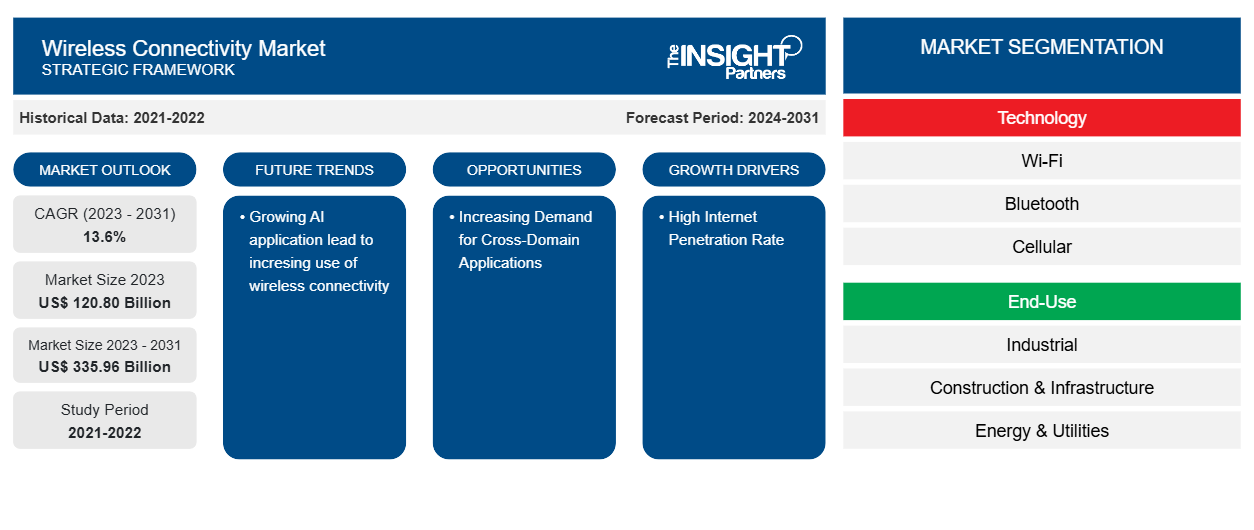

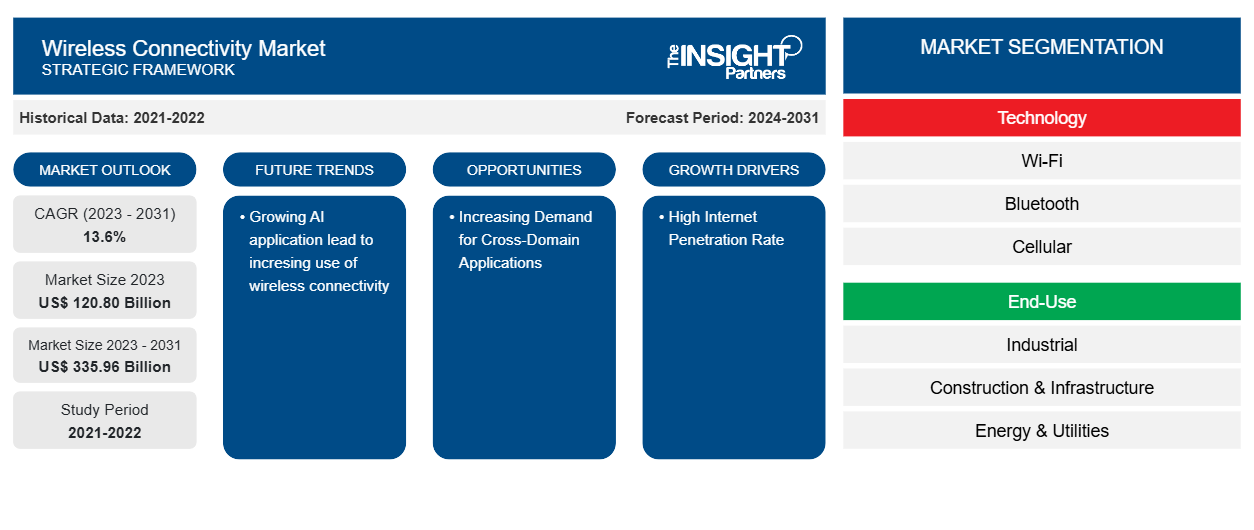

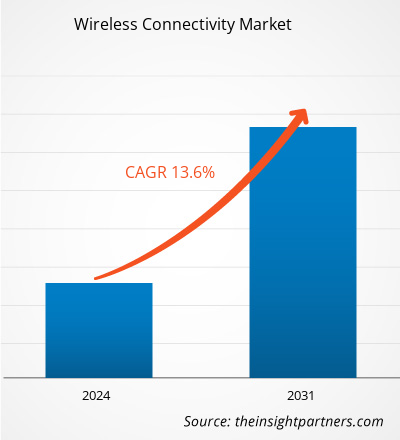

The wireless connectivity market size is projected to reach US$ 335.96 billion by 2031 from US$ 120.80 billion in 2023. The market is expected to register a CAGR of 13.6% in 2023–2031. The global wireless connectivity market is forecast to increase significantly over the forecast period, owing to rising demand for cloud computing and related technologies.

Wireless Connectivity Market Analysis

Furthermore, wireless connectivity allows customers to send data with notably low latency and find their cars with accuracy. Modern communication networks like LTE and LTE Advanced can be used to communicate with smart automobiles. Smart driving will be efficiently managed by an enhanced 5G network and the Internet of Things. Numerous advancements in the wireless communications sector, including the impending rollout of long-term evolution (LTE), enhanced smart device use, increased mobility, and the rapid growth of mobile data traffic, are driving the demand for wireless technology. Newer wireless technologies ask for greater energy and spectrum. The two mobile technologies that are expanding the fastest are LTE and 5G, and they will keep developing in the future.

Wireless Connectivity Market Overview

The increasing demand for consumer electronic gadgets will fuel the market's growth. Furthermore, sophisticated technologies such as AI, IoT, AR, and VR are projected to stay popular across a variety of end-user industries. The global development of smart infrastructure is also a major driver of demand for wireless sensor networks.

Infotainment systems can be linked to smartphones and other smart devices through wireless connectivity, such as Wi-Fi and Bluetooth. Infotainment systems can be paired with users' gadgets. It can handle hands-free mode to accept calls while driving, react to voice instructions, and easily and conveniently operate systems.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wireless Connectivity Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Wireless Connectivity Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Wireless Connectivity Market Drivers and Opportunities

High Internet Penetration Rate to Favor Market

The rate of internet penetration in developed North American and European countries has expanded dramatically during the last decade. According to Internet World Usage Statistics, in 2022, 54.2% of Internet users were in Asia, Europe, and 66% in North America. The Middle East and Africa are having the highest growth rate in internet adoption. Internet usage on mobile devices is increasing. As internet access becomes more important, there will be a greater need for wireless smart gadgets. Over the next five years, the global number of machine-to-machine (M2M) connections is predicted to increase by more than double. M2M connections occur in manufacturing facility delivery vehicles and warehouse asset tracking systems.

Increasing Demand for Cross-Domain Applications

To fully utilize wireless technology, cross-domain skills and cooperation are essential. The IoT and cloud computing ecosystems offer exponential development prospects for organizations and businesses. Organizations can react to emerging cloud and IOT trends, as well as technology breakthroughs. Organizational performance depends on cross-sector relationships and business strategies. Huawei Technologies (China) has launched LiteOS7, a new operating system aimed at various segments such as wearable devices, smart homes, the Internet of Vehicles, smart meters, and the industrial internet. Huawei Technologies (China) expanded into multiple market categories within the IoT ecosystem. This enables the organization to target a variety of applications in IoT.

Wireless Connectivity Market Report Segmentation Analysis

Key segments that contributed to the derivation of the wireless connectivity market analysis are technology and end-use.

- Based on technology, the wireless connectivity market is segmented into Wi-Fi, Bluetooth, cellular, ZigBee, GNSS, and others.

- Based on end-use, the wireless connectivity market is segmented into industrial, construction & infrastructure, energy & utilities, automotive & transportation, healthcare, consumer, and others.

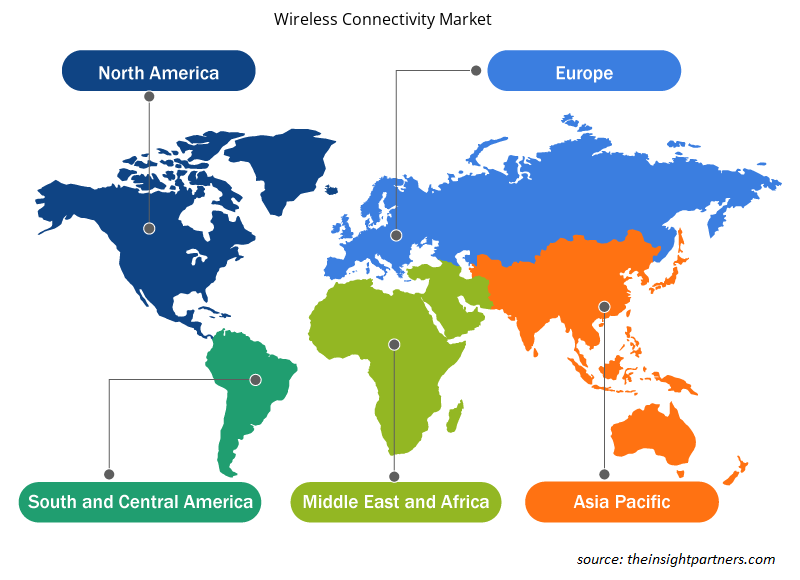

Wireless Connectivity Market Share Analysis by Geography

The geographic scope of the wireless connectivity market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South America/South & Central America. The Asia-Pacific market is expected to experience the fastest growth for wireless connectivity systems. For example, the US-China Economic and Security Review Commission estimates that government investment in smart city initiatives in China will reach USD 38.92 billion this year. The growth of smart infrastructure is likely to create new opportunities for wireless communication systems.

Wireless Connectivity Market Regional Insights

The regional trends and factors influencing the Wireless Connectivity Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Wireless Connectivity Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Wireless Connectivity Market

Wireless Connectivity Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 120.80 Billion |

| Market Size by 2031 | US$ 335.96 Billion |

| Global CAGR (2023 - 2031) | 13.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Wireless Connectivity Market Players Density: Understanding Its Impact on Business Dynamics

The Wireless Connectivity Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Wireless Connectivity Market are:

- Broadcom Inc.

- Cypress Semiconductor Corporation

- Intel Corporation

- Media Tek Inc.

- Microchip Technology Incorporated

- NXP Semiconductors N.V

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Wireless Connectivity Market top key players overview

Wireless Connectivity Market News and Recent Developments

The wireless connectivity market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. The following is a list of developments in the market:

- In February 2022, Verizon announced the expansion of its Internet service, allowing customers to access dependable, fast plug-and-play wireless Internet services across the country, including over 30 million homes and more than 2 million businesses.

(Source: Verizon, Company Website, 2022)

- In August 2022, AT&T announced intentions to expand its Fiber Internet Service to Arizona, with availability expected in 2023. The startup promised to provide fiber-based broadband rates of up to 5 gigabits per second to over 100,000 homes in and around Mesa.

(Source: AT&T, Company Website, 2022)

Wireless Connectivity Market Report Coverage and Deliverables

The "Wireless Connectivity Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Market dynamics such as drivers, restraints, and key opportunities

- Key future trends

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Global and regional market analysis covering key market trends, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Technology, and End-Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Frequently Asked Questions

The global wireless connectivity market is expected to reach US$ 335.96 billion by 2031.

The key players holding the majority of shares in the global wireless connectivity market are Broadcom Inc., Cypress Semiconductor Corporation, Intel Corporation, Media Tek Inc., and Microchip Technology Incorporated.

Growing AI applications will lead to the incresing use of wireless connectivity to play a significant role in the global wireless connectivity market in the coming years.

High internet penetration rates are the major factors that propel the global wireless connectivity market.

The global wireless connectivity market was estimated to be US$ 120.80 billion in 2023 and is expected to grow at a CAGR of 13.6% during the forecast period 2023 - 2031.

Get Free Sample For

Get Free Sample For