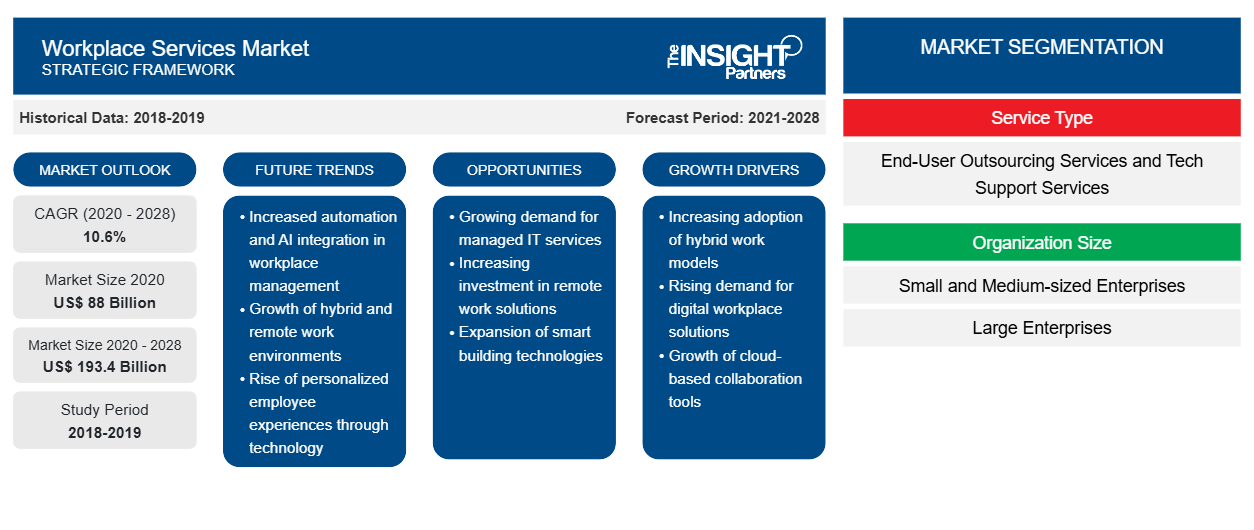

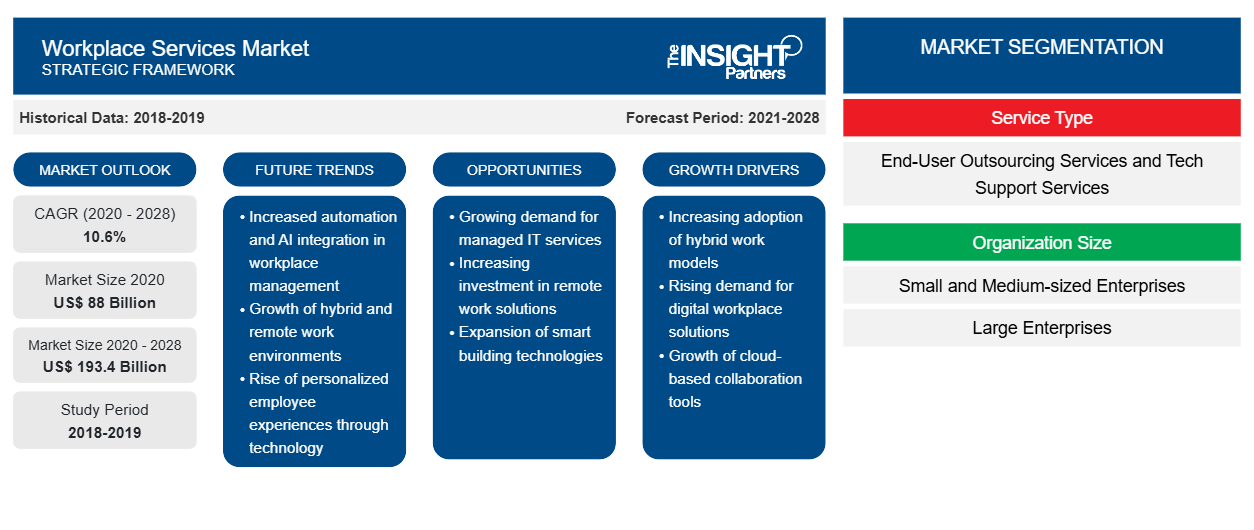

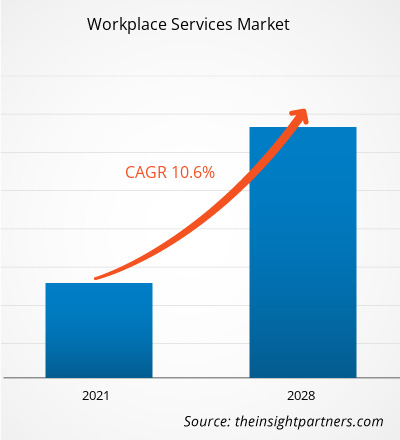

The workplace services market was valued at US$ 88.0 billion in 2020 and is projected to reach US$ 193.4 billion by 2028; it is expected to grow at a CAGR of 10.6% from 2021 to 2028.

Technology offers numerous advantages for business. An exponential growth in applications, devices, and networks is creating positive impact in the working culture. Safer work environments, hybrid workplace, additional cybersecurity, and globally dispersed workforce are some of the aspects contributing toward the concept of modern workplace, and thereby influencing the growth of workplace services. Therefore, the well-established IT infrastructure and small & medium and large enterprises across all the regions are demanding workplace services. Enterprises of all sizes are anticipated to invest in innovative and latest technologies to operate their business effectively. Enterprises across the world are using workplace services to boost their businesses and optimize their business efforts to ensure the lowest possible investment requirements in various processes.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Workplace Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Workplace Services Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Impact of COVID-19 Pandemic on Workplace Services Market

The COVID-19 pandemic has shaken several industries. The tremendous growth in the spread of the virus has urged governments worldwide to impose strict restrictions on the movement of vehicles and humans. Due to travel bans, mass lockdowns, and business shutdowns, the pandemic is adversely affecting economies and countless industries in various countries. The workplace services market vendors continued their operations remotely to offer the best services to their end users. Even in the pandemic, several market players continued to be well-positioned to support their end users through the crisis. The COVID-19 pandemic has propelled businesses to boost their digital transformations, which results in the eradication of traditional barriers to progress. Companies continue to help their end users by engaging virtually, modernizing and migrating applications to the cloud, allowing a remote workforce, and focusing on cybersecurity and IT resiliency.

Workplace Services Market Insights

Growing Significance of Enterprise Mobility

Enterprise mobility is a wide term that includes mobile virtualization, mobile device management, and mobile virtualization that drive productivity, enhance services, and improve user experience. The enterprise mobility industry has developed immensely since enterprises seek services that can handle all features of mobile security, ranging from device and software to data protection. In today’s time, the demand for enterprise mobility in the workforce is at the peak, especially due to the COVID-19 outbreak, which is compelling the remote working concept. Growing adoption of enterprise mobility allows businesses to control, update, and even wipe data off of devices from a distance. Enterprise mobility enables employees to safely access sensitive enterprise data without deploying applications/software on their devices. Thus, all of these advantages are propelling the demand for workplace services among all the verticals across the world.

Service Type-Based Market Insights

Based on service type, the end-user outsourcing services segment dominated the market. The end-user outsourcing services comprise network management services, remote support services, standard and ad hoc reporting and documentation, hosted virtual desktop services, software services, mobility, and security services.

Organization Size-Based Market Insights

Based on organization size, the large enterprises segment dominated the market. Large enterprises across the world are focused on cost optimization, along with increasing overall productivity. Increasing need for an integrated platform for the huge amount of data from various industries and to make critical decisions associated with aspects, such as strategy, marketing, and team management, is driving the demand for workplace services among large enterprises.

Vertical-Based Insights

Based on vertical, the telecom – IT and ITES segment continues to hold a significant share in the market. Growing telecommunications, IT, and ITES industries are highly demanding workplace services for adopting an end-to-end approach in workflow processes through mobility, collaboration, and user support while mitigating operational IT costs. The services cater to the modern requirement of digitally optimized workplaces in this sector.

The players operating in the workplace services market focus on strategies, such as partnerships mergers, acquisitions, and market initiatives, to maintain their positions in the market. A few developments by key players are listed below:

In February 2021, Unisys Corporation announced that it had partnered with Lenovo. Under this partnership, Unisys Corporation would support Lenovo's Internet of Think (IoT) Solutions with Unisys Corporation’s Digital Workplace Services.

In June 2020, Wipro announced that it had partnered with Citrix and Microsoft. Under this partnership, Wipro would leverage host services offered by Citrix and Microsoft for rapid and secure deployment of reliable digital workspaces (including application suites).

In December 2020, DXC Technology announced that it had partnered with Microsoft. Under the partnership, DXC Technology would leverage Microsoft’s suite of services, such as Dynamics 365 and Power Platform, and Microsoft 365 and Teams, to improve and enhance DXC Technology Modern Workplace Services and solution.

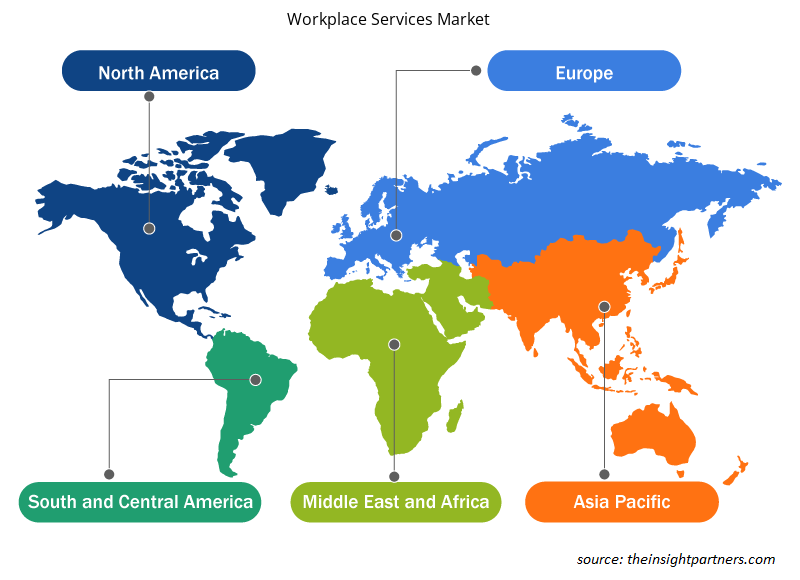

Workplace Services Market Regional Insights

The regional trends and factors influencing the Workplace Services Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Workplace Services Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Workplace Services Market

Workplace Services Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2020 | US$ 88 Billion |

| Market Size by 2028 | US$ 193.4 Billion |

| Global CAGR (2020 - 2028) | 10.6% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Service Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

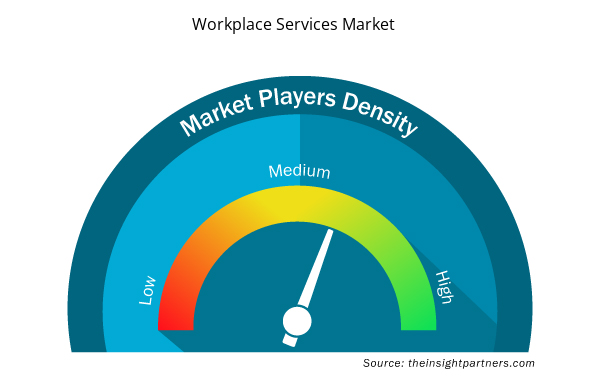

Workplace Services Market Players Density: Understanding Its Impact on Business Dynamics

The Workplace Services Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Workplace Services Market are:

- DXC Technology

- Wipro

- IBM Corporation

- HCL Technologies

- TCS

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Workplace Services Market top key players overview

By Service Type

- End-User Outsourcing Services

- Tech Support Services

By Organization Size

- SMEs

- Large Enterprises

By Vertical

- Telecom – IT and ITES

- BFSI

- Manufacturing

- Consumer Goods and Retail

- Healthcare and Life Science

- Government and Public Sector

- Energy and Utilities

- Media and Entertainment

- Education

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- Russia

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

- Australia

- Rest of APAC

- Middle East & Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

- South America (SAM)

- Brazil

- Argentina

- Rest of SAM

Company Profiles

- DXC Technology

- Wipro

- IBM Corporation

- HCL Technologies

- TCS

- NTT Data

- CompuCom Systems Inc.

- ATOS

- UNISYS

- Fujitsu Ltd.

- Cognizant

- Accenture PLC

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Service Type , and Vertical , Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

The end-user outsourcing services is the leading service type in the market. The end-user outsourcing services comprise network management services, remote support services, standard and ad hoc reporting and documentation, hosted virtual desktop services, software services, mobility, and security services. The end-user outsourcing services held the largest market share in the workplace services market in 2020. The lack of skilled IT professionals and lower IT budgets allow the organization to opt for outsourcing services. The BFSI industry requires a largely complex IT infrastructure to maintain and handle a large volume of data. This creates opportunities for end-user outsourcing service providers to deliver their robust services to the industry.

Robust IT security expertise in various industries collaborating with workplace outsource service providers can relieve regulatory compliance burdens from the organization. The provider also enables access to personalized customer support, 24/7 monitoring and management of the networks, and reporting, which prepares the organization for compliance audits and assessments. Besides, it relaxes the in-house IT staff to focus on business-critical projects and ensures security to keep the data safe and protected. Thus, shifting the burden of compliance to workplace service providers is driving the global market.

North America led the workplace services market in 2020. With continuous technological advancements, such as machine learning and availability of big data, use of digital services is gaining high momentum. The BFSI, retail, healthcare, and IT & telecom companies support digital transformation that contributes toward boosting employee’s productivity. Advancements in mobile technologies and dynamic workforce demographics are some of the aspects that promote digital workplace transformation services in the region. By facilitating smart & connected enterprise, companies ensure open environment under which shared data & knowledge is always accessible. This further helps in raising business velocity and agility. The US, Canada, and Mexico are contributing toward the growth of the workplace services market in North America, out of which, nearly three-fourths of the market share is hold by the US.

Trends and growth analysis reports related to Technology, Media and Telecommunications : READ MORE..

The List of Companies - Workplace Services Market

- DXC Technology

- Wipro

- IBM Corporation

- HCL Technologies

- TCS

- NTT Data

- CompuCom

- ATOS

- UNISYS

- Fujitsu

- Cognizant

- Accenture PLC

Get Free Sample For

Get Free Sample For