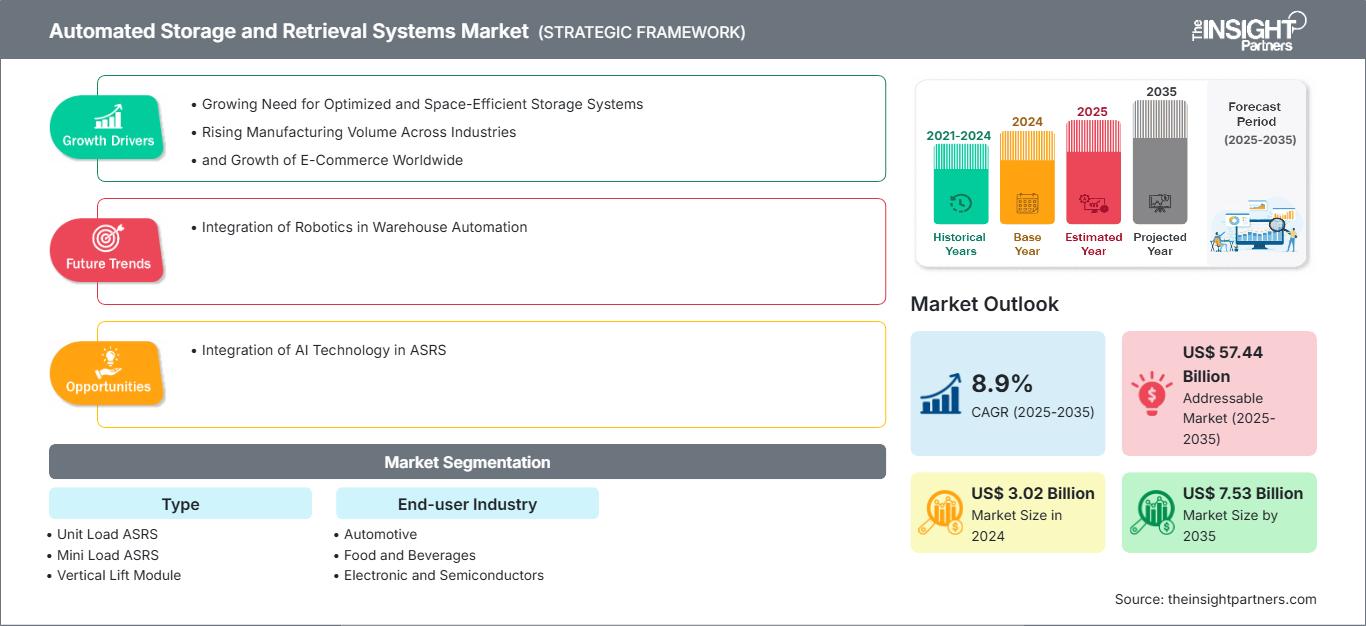

The automated storage and retrieval systems market size was valued at US$ 3.02 billion in 2024 and is projected to reach US$ 7.53 billion by 2035; it is expected to register a CAGR of 8.9% during 2025–2035. The integration of robotics in warehouse automation is likely to remain a key market trend.

Automated Storage and Retrieval Systems Market Analysis

ASRS is highly effective at places where high volumes of capacity need to be moved, stored, or retrieved more economically. These systems increase the storage density of loads and overcome the space constraint issues faced by several end users. These systems are used mainly at manufacturing sites, distribution centers, and institutions. ASRS helps in automatically bringing items directly to the operator. It can be operated as a standalone system or integrated into a linked system. Common operations of ASRS include consolidation, order picking, buffering, kitting, inventory storage, parts handling, and buffer storage. ASRS systems eliminate walk and search time, thereby increasing productivity and efficiency. Space-efficient ASRS systems also help reduce underutilized floor space by storing all the materials in one compact area, thus providing larger storage capacity than shelving and racking in aisles. Furthermore, it helps reduce labor costs since the automation of processes reduces the involvement of several individuals, and it generally requires one person to operate such systems.

Automated Storage and Retrieval Systems Market Overview

The e-commerce industry expansion, the growing need for optimized and space-efficient storage systems, and the emergence of automation in storage and retrieval tasks are among the main factors driving the demand for automated storage and retrieval systems worldwide. The rising manufacturing volume across industries and the need for an efficient supply chain are fueling the market. The integration of AI technology in ASRS and the increasing demand for cold storage ASRS are expected to create lucrative opportunities in the market during the forecast period. Further, soaring research and development activities, integration of robotics in warehouse automation, and evolution of next-generation ASRS are expected to generate future growth opportunities in the market.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Automated Storage and Retrieval Systems Market: Strategic Insights

-

Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Automated Storage and Retrieval Systems Market Drivers and Opportunities

Growing Need for Optimized and Space-Efficient Storage Systems

The growing population worldwide is remarkably impacting the demand for multiple product categories in industries such as automotive, pharmaceutical, retail, electronics, and food & beverages. The rise in production activities leads to an enormous demand for spaces to store products until they are shipped to customers, distributors, or retail locations. In 2024, a corrugated packaging product manufacturer invested US$ 140 million to start the construction of a 550,000 sq. ft manufacturing and warehouse facility at 9423 Koessl Court in Pleasant Prairie, Wisconsin, US. The increased production demands extensive storage spaces, efficient in terms of both occupied floor space and cost incurred. Warehouses, storage centers, and distribution centers play a vital role in maintaining the stocks of consumer goods for various companies in order to prevent stockouts and manage inventory effectively. Minimal damage to the product while storage, limited storage costs, and fast pick and drop of goods are the factors that manufacturers and supply chain partners are opting for storage purposes and further movement of goods.

Industries focus on optimizing storage systems by enhancing cost-saving features through the adoption of ASRSs. These systems enable industries to maximize vertical and horizontal storage capacity within warehouses and distribution centers, allowing for high-density storage layouts. ASRS collects and stores goods in confined places using precise, automated handling technology such as cranes, shuttles, and carousels, decreasing the need for vast corridors and manual access areas.

Storage solutions such as unit load, mid-load, carousels, and vertical lift modules (VLMs) serve various purposes to their users with added value, thereby helping them reduce costs. For instance, VLMs save more than 80% of floor space by stacking the material on vertical shelves. Also, these storage systems are designed so that storing and picking up goods becomes less time-consuming and more efficient, and helps increase productivity at the workplace. Similarly, horizontal and vertical carousels are used for storing small parts and tools used either on the manufacturing plant's shop floor or for storing consumer goods. Thus, the need for fast, space-efficient, and cost-effective storage systems, along with maximum throughput and productivity, is driving the market for ASRS across industries.

Integration of AI Technology in ASRS

Technologically advanced companies worldwide are highly focused on developing new technologies across industries. Artificial intelligence (AI) is positioned at the core of the next-generation software technologies in the automated storage and retrieval system market. It helps users optimize storage layouts and retrieval paths, reducing the time required to process orders. Machine learning (ML) models predict demand trends that support warehouse managers in reducing stock discrepancies and overstock situations. AI-based systems automatically respond to shifting workloads, maintaining consistent performance during peak periods.

ASRSs integrated with AI support operators to manage, control, and optimize the storage and retrieval of items in warehouses and distribution facilities. These advanced systems continuously analyze real-time data and make intelligent decisions related to inventory placement, path optimization, and workload balance, thereby reducing human interaction, fewer errors, and higher throughput. AI-based ASRS helps industries in quick order fulfillment and optimizing the use of vertical storage space by increasing operational productivity. The growing demand for AI-based ASRS among industries encourages market players to develop advanced systems. For instance, in July 2024, Rapyuta Robotics launched Rapyuta ASRS in the US market. The Rapyuta ASRS is integrated with multi-agent coordination and control algorithms, unique materials, and a modular framework. The AI-based Rapyuta ASRS ensures seamless productivity for picking operations and effective inventory management while also allowing for the flexibility to scale up or adjust the structure as evolving business needs. In March 2024, Applied Manufacturing Technologies (AMT) launched ROBiN, a Robotic Induction System, a flexible material handling solution that improves the operational efficiency of the warehousing industry. ROBiN is a robotic AI-powered system that improves the process of removing and sorting layers of products on pallets, which is further integrated into ASRS. ROBiN is developed to support a wide range of case sizes and shapes, irrespective of the number of cases on a layer, their specific placement, or orientation. This functionality enables ROBiN to optimize the fill density of totes, resulting in increased warehouse efficiency. Thus, the integration of AI to revolutionize ASRS is creating lucrative opportunities in the market.

Automated Storage and Retrieval Systems Market Report Segmentation Analysis

Key segments that contributed to the derivation of the automated storage and retrieval systems market analysis are type and end-use industry.

- Based on type, the automated storage and retrieval system (ASRS) market is segmented into unit load ASRS, mini load ASRS, vertical carousels, horizontal carousels, vertical lift modules, AutoStore, and others. The vertical lift modules segment segment dominated the market in 2024.

- Based on end-user industry, the automated storage and retrieval system market is segmented into automotive, food & beverages, electronics & semiconductor, e-commerce, chemicals, aerospace, retail, pharmaceuticals, and others. The e-commerce segment segment dominated the market in 2024.

Automated Storage and Retrieval Systems Market Share Analysis by Geography

- The automated storage and retrieval systems market is segmented into five major regions: North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and South & Central America. Europe dominated the automated storage and retrieval systems market in 2024. North America is the second-largest contributor to the global automated storage and retrieval systems market, followed by Asia Pacific.

- The automated storage and retrieval systems market in Europe is segmented into France, Germany, Italy, the UK, Spain, Sweden, the Netherlands, and the Rest of Europe. As sectors such as retail, automotive, and pharmaceuticals undergo modernization, the demand for automation continues to rise. Technological innovation, coupled with government initiatives supporting Industry 4.0, is accelerating the adoption of ASRS solutions across warehouses and distribution centers throughout Europe. Players across Europe are emphasizing ASRS. For example, in February 2025, OPEX Corporation, a global leader in Next Generation Automation for document, mail, and warehouse operations, showcased its latest innovations in goods-to-person (G2P) technology and automated storage and retrieval systems (AS/RS) at LogiMAT, Europe’s premier international trade fair for intralogistics and process management solutions. The major players in Europe offering ASRS solutions include System Logistics SpA, Swisslog Holdings AB, KNAPP AG, Vanderlande Industries, and SSI Schaefer Systems International. These players are highly engaged in developing and installing advanced ASRS to fulfill their customers' demands worldwide. For instance, in February 2025, KNAPP AG installed the Evo Shuttle system at GC Corporation’s distribution center in Leuven, Belgium. Evo Shuttle system is combined with SAP extended warehouse management (EWM) material flow system (MFS) to boost storage and picking capacities.

The regional trends and factors influencing the Automated Storage and Retrieval Systems Market throughout the forecast period have been thoroughly explained by the analysts at The Insight Partners. This section also discusses Automated Storage and Retrieval Systems Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

Automated Storage and Retrieval Systems Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3.02 Billion |

| Market Size by 2035 | US$ 7.53 Billion |

| Global CAGR (2025 - 2035) | 8.9% |

| Historical Data | 2021-2024 |

| Forecast period | 2025-2035 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Automated Storage and Retrieval Systems Market Players Density: Understanding Its Impact on Business Dynamics

The Automated Storage and Retrieval Systems Market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

- Get the Automated Storage and Retrieval Systems Market top key players overview

Automated Storage and Retrieval Systems Market News and Recent Developments

The automated storage and retrieval systems market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the automated storage and retrieval systems market are listed below:

- Daifuku Intralogistics India Pvt. Ltd. (a subsidy of Daifuku Co., Ltd.) headquartered in Hyderabad, Telangana, India, announced the opening of a new manufacturing plant in Hyderabad, launching full-scale operations in April 2025. This plant handles systems for the general manufacturing and distribution industries.

(Source: Daifuku Co., Ltd, Press Release, April 2025)

- SSI SCHAEFER (one of the world’s leading solution providers for all areas of intralogistics) and BD Rowa (the specialist for pharmaceutical logistics) have decided to extend their partnership, which has been ongoing since 2015, by three years and included a fixed option for continuation until 2030.

(Source: SSI SCHAEFER, Press Release, April 2025)

Automated Storage and Retrieval Systems Market Report Coverage and Deliverables

The "Automated Storage and Retrieval Systems Market Size and Forecast (2021–2031)" provides a detailed analysis of the market covering the areas mentioned below:

- Automated storage and retrieval systems (ASRS) market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Automated storage and retrieval systems (ASRS) market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Automated storage and retrieval systems (ASRS) market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the automated storage and retrieval systems market

- Detailed company profiles

Frequently Asked Questions

Which region is holding the major market share of automated storage and retrieval systems (ASRS) market?

What is the estimated global market size for the automated storage and retrieval systems (ASRS) market in 2024?

What will be the automated storage and retrieval systems (ASRS) market size by 2035?

Which are the key players holding the major market share of automated storage and retrieval systems (ASRS) market?

What are the driving factors impacting the automated storage and retrieval systems (ASRS) market?

What are the future trends of the automated storage and retrieval systems (ASRS) market?

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Recent Reports

Testimonials

Reason to Buy

- Informed Decision-Making

- Understanding Market Dynamics

- Competitive Analysis

- Identifying Emerging Markets

- Customer Insights

- Market Forecasts

- Risk Mitigation

- Boosting Operational Efficiency

- Strategic Planning

- Investment Justification

- Tracking Industry Innovations

- Aligning with Regulatory Trends

Get Free Sample For

Get Free Sample For