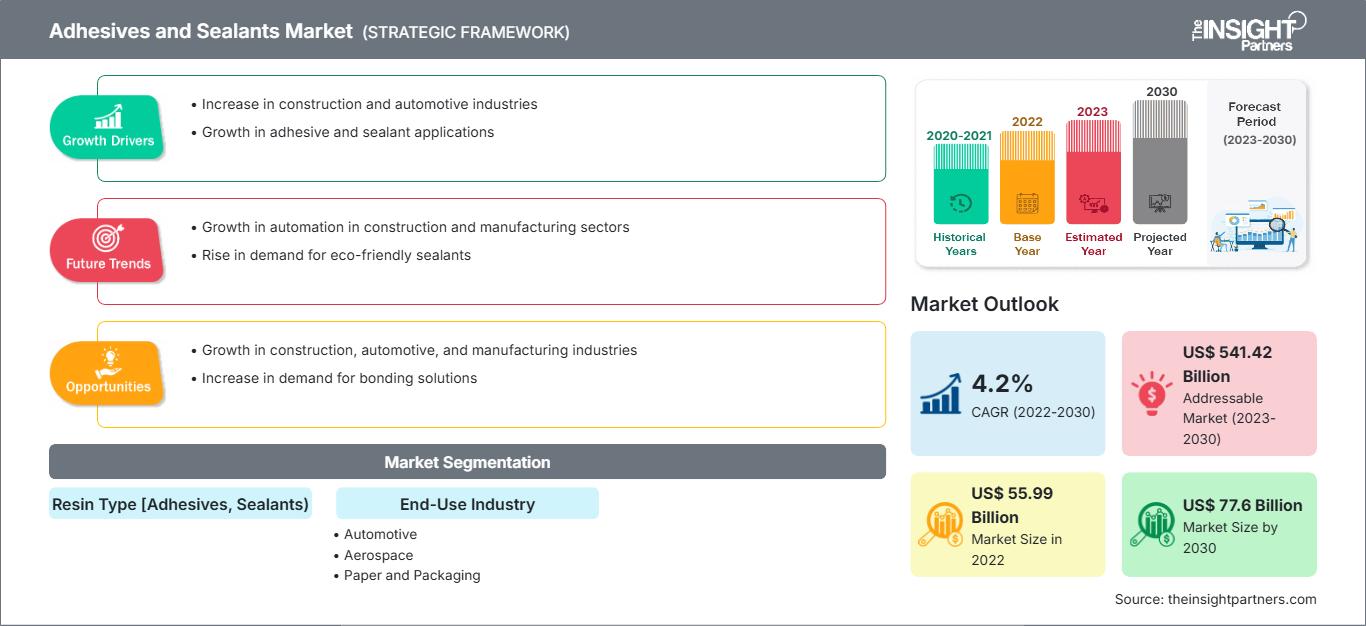

[研究报告] 2022 年粘合剂和密封剂市场规模为 559.8603 亿美元,预计到 2030 年将达到 775.9829 亿美元;预计 2022 年至 2030 年的复合年增长率为 4.2%。

市场分析

粘合剂用于在两个表面之间形成紧密粘合,而密封剂用于填充或密封缝隙以限制液体的流动。粘合剂和密封剂主要应用于建筑、汽车、航空航天、造纸和包装、木工以及电气和电子行业。环氧粘合剂具有高拉伸强度,可与金属有效粘合。环氧和丙烯酸粘合剂也用于玻璃表面粘合,但美观度不佳。根据具体用途,密封胶可分为多种类型,其中硅酮密封胶、聚氨酯密封胶和丙烯酸密封胶应用广泛。

增长动力与挑战

建筑和汽车行业的强劲增长,以及造纸和包装行业对胶粘剂和密封胶需求的不断增长,是推动胶粘剂和密封胶市场发展的因素。基础设施建设包括与道路、港口、铁路、机场和工业基础设施相关的项目。预测期内,包括美国、中国、印度和沙特阿拉伯在内的许多国家的建筑活动不断增加,为胶粘剂和密封胶市场创造了丰厚的机遇。根据欧洲汽车制造商协会发布的一份报告,2020 年至 2021 年,全球机动车产量增长了 1.3%; 2021 年全球共生产了 7910 万辆机动车,其中包括 6160 万辆乘用车。根据美国运输统计局的报告,中国是生产乘用车和商用车的主要市场之一。在汽车工业中,粘合剂和密封剂为汽车内外部件的粘合提供了解决方案。因此,世界各国汽车工业的强劲增长提振了对粘合剂和密封剂的需求。消费者对包装食品的偏好日益增加,对能够长时间保鲜食品的高质量食品包装产品的需求也在不断增长。此外,近年来网上零售业一直在稳步增长。许多国家的电子商务行业都在增长,这对不同包装产品的需求产生了积极的影响。用于制造粘合剂和密封剂的原材料价格波动对粘合剂和密封剂市场构成了挑战。全球经济形势波动导致原油价格上涨,进一步推高了石油树脂的价格。 2022年,DIC株式会社报告称,由于原材料价格上涨及供需缺口,其环氧树脂和环氧树脂固化剂的销售价格已调整。原材料价格上涨导致产品盈利能力和利润率承压。因此,原材料价格波动抑制了粘合剂和密封剂市场的增长。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

粘合剂和密封剂市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

报告细分与范围

《2030年全球粘合剂和密封剂市场分析》是一项专业且深入的研究,主要关注全球市场趋势和增长机遇。本报告旨在概述全球市场,并根据树脂类型、最终用途行业和地域进行详细的市场细分。报告提供了全球粘合剂和密封剂消费量的关键统计数据,以及主要地区和国家的需求。此外,报告还对影响主要地区和国家粘合剂和密封剂市场表现的各种因素进行了定性评估。报告还对粘合剂和密封剂市场的主要参与者及其关键战略发展进行了全面分析。本文还包含几项市场动态分析,旨在帮助识别关键驱动因素、市场趋势和盈利机会,从而帮助确定主要收入来源。

此外,生态系统分析和波特五力模型分析提供了全球粘合剂和密封剂市场的360度视角,有助于了解整个供应链以及影响市场增长的各种因素。

细分分析

全球粘合剂和密封剂市场根据树脂类型和最终用途行业进行细分。根据树脂类型,粘合剂和密封剂市场分为粘合剂(环氧树脂、聚氨酯、丙烯酸等)和密封剂(硅酮密封胶、聚氨酯密封胶、丙烯酸密封胶、聚硫密封胶等)。根据最终用途行业,市场细分为汽车、航空航天、造纸和包装、建筑和施工、电气和电子、医疗等。根据树脂类型,粘合剂在 2022 年占据了粘合剂和密封剂市场的较大份额。粘合剂用于粘合不同的基材,例如热固性塑料和热塑性塑料、复合材料、金属、弹性体、木材和木制品、玻璃和陶瓷以及夹层和蜂窝结构。它们广泛用于建筑、消费品、包装和运输行业。密封剂具有耐久性、硬度、耐暴露性和粘附性等多种特性。最常见的密封剂是水基乳胶、丙烯酸、丁基、聚硫化物、硅、聚异丁烯和聚氨酯。根据最终用途行业,建筑和施工领域在 2022 年占据了最大的市场份额。在建筑和施工行业中,密封剂将各种零件和材料连接并连接到主体结构上。粘合剂用于层压纸张和纸板、粘贴标签以及衬里食品包装(例如饮料罐)。在电气和在电子行业,粘合剂和密封剂直接影响电子零件的制造及其长期运行。在医疗行业,硅胶、聚氨酯、丙烯酸和生物粘合剂等粘合剂和密封剂发挥着至关重要的作用。在航空航天工业中,粘合剂用于飞机的内饰、外饰和发动机舱。粘合剂和密封剂为汽车行业内外部零部件的粘合提供解决方案。

区域分析

本报告详细概述了全球粘合剂和密封剂市场,涵盖五大主要区域——北美、欧洲、亚太地区 (APAC)、中东和非洲 (MEA) 以及南美洲和中美洲。亚太地区在粘合剂和密封剂市场中占有重要份额,2022 年市场价值超过 250 亿美元。电子制造业是包括中国、韩国和日本在内的多个亚洲国家制成品出口的重要组成部分。粘合剂在电子组装过程中提供牢固的粘合力,同时保护组件免受潜在损坏。该地区建筑和包装行业的蓬勃发展,对粘合剂和密封剂的需求巨大。预计到2030年,欧洲粘合剂和密封剂市场规模将达到约170亿美元。欧洲各国政府和私营企业在基础设施建设和施工项目上的投资激增,推动了粘合剂和密封剂市场的增长。此外,在欧洲运营的参与者正专注于采用新产品发布和业务扩张等策略,以保持市场竞争力。在政府对基础设施建设的拨款以及对航空航天工业技术和研究项目不断增加的投资的支持下,北美粘合剂和密封剂市场见证了来自建筑行业的强劲需求。北美粘合剂和密封剂市场预计将出现可观的增长,2022 年至 2030 年的复合年增长率约为 4%。

行业发展和未来机遇

该报告详细概述了全球粘合剂和密封剂市场,涉及五大主要地区——北美、欧洲、亚太地区 (APAC)、中东和非洲 (MEA) 以及南非。中美洲。

- 2023 年,陶氏公司扩展了其用于光伏组件的硅酮密封胶产品,即 DOWSIL PV 产品线,其中包含六种硅酮密封胶和粘合剂解决方案。

- 2023 年,3M 公司推出了一种医用粘合剂,可在皮肤上粘附 28 天,旨在用于各种健康监测器、传感器和长期医疗可穿戴设备。

粘合剂和密封剂市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响粘合剂和密封剂市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的粘合剂和密封剂市场细分和地域分布。

粘合剂和密封剂市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2022 | US$ 55.99 Billion |

| 市场规模 2030 | US$ 77.6 Billion |

| 全球复合年增长率 (2022 - 2030) | 4.2% |

| 历史数据 | 2020-2021 |

| 预测期 | 2023-2030 |

| 涵盖的领域 |

By 树脂类型[粘合剂, 密封剂]By 终端行业

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

粘合剂和密封剂市场参与者密度:了解其对业务动态的影响

粘合剂和密封剂市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 粘合剂和密封剂市场 主要参与者概述

新冠疫情的影响/地缘政治局势的影响/经济衰退的影响

建筑、汽车、电子、造纸和包装等行业一直是粘合剂和密封剂的主要消费者。2020年,由于政府法规和贸易限制导致价值链中断,这些行业不得不放缓运营。此外,各国实施的封锁措施也抑制了许多制造商的库存水平。劳动力短缺导致粘合剂和密封剂的生产和分销业务减少。此外,政府的限制措施和其他与新冠疫情相关的预防措施降低了粘合剂和密封剂价值链中利益相关者的运营能力。

2021年末,随着汽车、航空航天和建筑等终端使用行业的复苏,全球粘合剂和密封剂市场开始从2020年的损失中复苏。化学品和建筑行业产能的扩张亚太地区和北美等许多地区在 COVID-19 疫情后,材料行业的复苏可以为未来几年的粘合剂和密封剂市场创造丰厚的商机。

竞争格局和主要公司

粘合剂和密封剂市场的一些主要参与者包括汉高股份公司 (Henkel AG and Co KGaA)、HB Fuller Company、西卡股份公司 (Sika AG)、3M 公司 (3M Co)、亨斯迈国际有限责任公司 (Huntsman International LLC)、陶氏公司 (Dow Inc)、瓦克化学股份公司 (Wacker Chemie AG)、派克汉尼汾公司 (Parker Hannifin Corp)、戴马斯公司 (Dymax Corporation) 和 Astro Chemical Company Inc.

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 粘合剂和密封剂市场

获取免费样品 - 粘合剂和密封剂市场