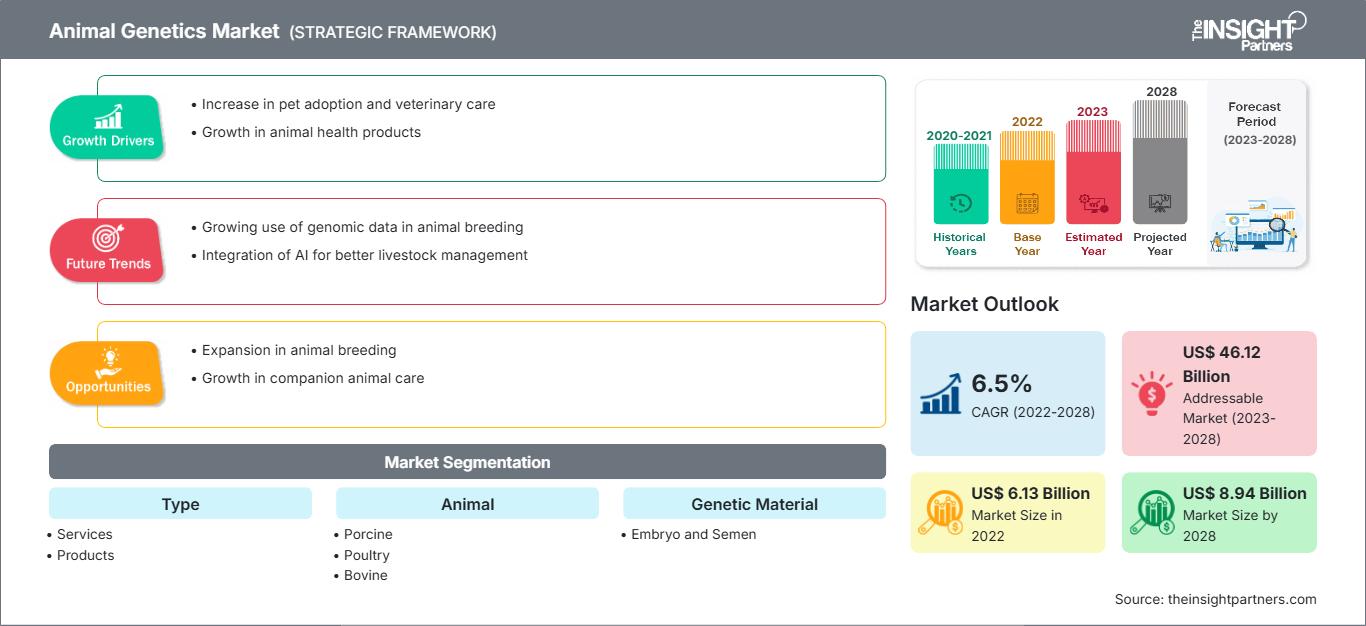

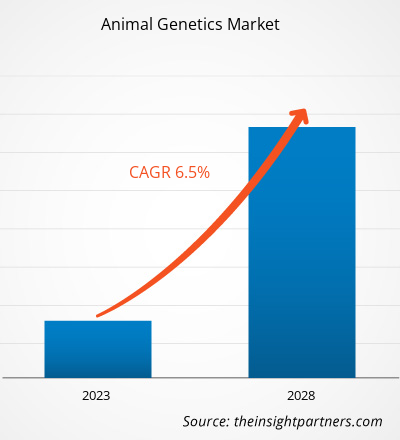

[研究报告] 动物遗传学市场预计将从2022年的61.3264亿美元增长到2028年的89.4190亿美元;预计2022年至2028年期间的复合年增长率为6.5%。

市场洞察和分析师观点:

生物技术行业的技术进步是支持动物遗传学市场增长的主要因素。密集的研发以及对家禽和牛肉日益增长的需求是动物遗传学行业的主要趋势

。

此外,全球范围内宠物饲养的日益普及也鼓励动物遗传学服务提供商提供开发宠物不同表型特征的服务。动物遗传学有助于改变宠物的外观,从而吸引宠物主人。此外,动物遗传学的进步有助于解答与市场上转基因动物的供应情况以及转基因动物衍生食品的供应情况相关的问题

。

了解它们的供应情况使研究人员能够为食品行业提供优质的肉类产品,并有助于提高牲畜的健康水平。在畜牧业是主要产业之一的国家,各国政府通过资金和基础设施建设等方式提供支持,这扩大了动物遗传学市场的规模。这也鼓励市场参与者专注于推动动物遗传学市场增长的发展。增长动力与挑战:

全球人口的增长和快速的城市化导致人们对乳制品和肉类等动物源性食品的偏好日益增长。多项研究证明,转基因奶牛产奶量更高,并且不易感染常见的牛病,例如牛呼吸道疾病综合征和梭菌感染。由于蛋白质在营养中发挥着重要作用,全球肉类和肉制品的消费量不断增加。动物源性蛋白质有助于身体组织的合成,从而促进更新和快速生长。动物源性蛋白质的氨基酸组成在免疫力、环境适应性和其他生物功能方面发挥着重要作用。转基因家禽,例如肉鸡,尽管蛋白质含量高,但易于消化。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

动物遗传学市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

据联合国粮食及农业组织 (FAO) 估计,从 1995 年到 2020 年,全球肉类产品需求增长了 58%。该估计还显示,肉类消费量从 2000 年的 2.33 亿公吨增加到 2020 年的 3 亿公吨。同样,牛奶消费量从 2000 年的 5.68 亿公吨增加到 2020 年的 7 亿公吨。FAO 还估计,2020 年鸡蛋产量增长了 30%。中国和巴西是推动家禽、猪肉和牛奶需求的主要发展中国家之一。相比之下,美国、巴西和泰国等国家是家禽、猪肉和牛奶的最大生产国。因此,动物遗传学正成为满足日益增长的动物源性食品需求的重要工具。另一方面,人们对动物源性疾病和牲畜多样性威胁的日益担忧,导致各国政府对动物遗传学制定了严格的监管规定。与转基因动物的繁殖、出口和保存相关的限制是动物遗传学市场增长的主要制约因素。《生物多样性公约》、《名古屋议定书》和联合国粮食及农业遗传资源委员会(CGRFA)是转基因动物的监管机构之一。此外,粮农组织的《全球动物遗传资源行动计划》严格监测和评估动物遗传资源,以保护牲畜的生物多样性。美国食品药品监督管理局(FDA)负责监管这些动物,并且是负责发放上市许可的主要机构之一。该机构对这些动物的识别、特性、生产和标签制定了严格的规范。此外,每个国家都有各自的遗传动物管理法规。因此,与动物育种计划和基因工程实验相关的严格规则和法规阻碍了动物遗传学市场的扩张。

报告细分和范围:

“全球动物遗传学市场”根据类型、遗传物质、动物和地理位置进行细分。根据类型,市场分为产品和服务。根据遗传物质,动物遗传学市场分为精液和胚胎。就动物而言,市场分为家禽、猪、牛、犬和其他。根据地理位置,动物遗传学市场细分为北美(美国、加拿大和墨西哥)、欧洲(德国、法国、意大利、英国、西班牙和欧洲其他地区)、亚太地区(澳大利亚、中国、日本、印度、韩国和亚太其他地区)、中东和非洲(南非、沙特阿拉伯、阿联酋以及中东和非洲其他地区)和南美洲和中美洲(巴西、阿根廷以及南美洲和中美洲其他地区)。

分部分析:

根据类型,动物遗传学市场分为产品和服务。服务部门在 2022 年占据了更大的市场份额。预计在预测期内,同一部门将在动物遗传学市场中录得最快的复合年增长率。此外,服务市场细分为 DNA 分型、遗传性状测试、遗传疾病测试等。DNA 分型部门在 2022 年占据了动物遗传学服务市场的最大份额。预计在预测期内,遗传疾病测试部门将在市场上录得最高的复合年增长率。市场的增长是由动物育种服务的增加所驱动的,以提高动物性食品和非食品产品的质量和产量。许多实验室正在提供具有成本效益的服务,以促进市场的增长。在美国德克萨斯州休斯顿,由癌症中心支持基金资助的实验室动物遗传服务 (LAGS) 为实验动物研究提供经济高效的定制化基因分析。因此,此类实验室的存在对市场的增长做出了巨大贡献,预计未来几年也将呈现类似的趋势。

根据遗传物质,动物遗传学市场分为精液和胚胎。2022 年,胚胎部分占据了更大的市场份额。预计在预测期内,精液部分将实现更高的复合年增长率。动物育种技术的发展导致动物基因检测的增加

。

根据动物,动物遗传学市场分为家禽、猪、牛、犬和其他动物。2022 年,猪占据了最大的市场份额。另一方面,预计在预测期内,牛部分将实现最高的复合年增长率。牛类动物遗传学市场的增长归因于提供牛基因检测服务的公司数量的增加

以及对牲畜 DNA 检测的需求不断增长。区域分析:

根据地理位置,动物遗传学市场分为五个主要区域:北美、欧洲、亚太地区、南美和中美以及中东和非洲。北美是全球动物遗传学市场中最重要的地区。美国、加拿大和墨西哥是该地区市场的主要贡献者。北美市场的增长归因于对动物遗传学项目的投资不断增加、畜牧业生产和养殖业的增加以及保护和保存牲畜的举措不断增加。美国在该地区占有最大的市场份额,其次是加拿大。此外,墨西哥对未来的市场增长至关重要。在墨西哥,畜牧业活动被视为社会经济领域,这为从事畜牧遗传学业务的公司提供了极具吸引力的商机。墨西哥60%的土地用于畜牧业活动,即超过300万个畜牧生产单位。在过去的几十年里,该国的牛肉、猪肉和奶制品生产取得了宝贵的发展。致力于扩大畜牧业集约化系统的墨西哥企业或组织采用人工授精和胚胎移植等现代技术来改良牲畜的基因。墨西哥近53%的牛饲养者使用人工授精,18%使用胚胎移植。

预计在预测期内,亚太地区将在全球动物遗传学市场中实现最快的复合年增长率。预计市场增长归因于人们对动物源性蛋白质补充剂和食品的偏好日益增长,以及该地区越来越多地采用人工授精和胚胎移植等先进的遗传学实践。中国是亚太地区动物遗传学市场的领先国家。在中国,过去三十年来,畜牧业生产急剧增长。 2021年,农业农村部宣布,国家畜禽遗传育种委员会已批准三个白羽肉鸡新品种——光明2号、盛泽901和沃德188——在中国市场上上市。据同一消息来源称,鸡肉是中国家庭消费最多的肉类,2020年全国鸡肉产量达1860万吨,其中52.4%为白羽肉鸡。此外,消费者更青睐高品质鸡肉,而这源于农场养殖的优良品质。因此,畜牧养殖业的蓬勃发展促进了中国畜牧业的发展。根据美国农业部对外农业服务局的数据,预计到2023年底,中国家禽出口量将比上一年增长5%,达到57.5万吨。动物遗传学的进步正在促进动物育种,从而提高动物基产品的质量。

行业发展和未来机遇:

以下列出了动物遗传学市场主要参与者的各种举措:

- 2023年6月,Charles River扩展了其三重免疫缺陷小鼠模型组合。新的NCG小鼠品系最适合肿瘤学、免疫学和传染病研究。NCG Plus组合通过纳入人源化小鼠,扩大了临床前研究的范围。它可以利用人类外周血单核细胞 (PBMC) 和人类造血干细胞 (HSC) 来模拟人类免疫系统,这使得该模型成为癌症免疫治疗研究的理想选择。

- 2022 年 10 月,Genus Plc 和 Tropic 延长了性状开发合作,将 Tropic 的基因编辑诱导基因沉默 (GEiGS) 技术应用于猪和牛的遗传学。此次延长的合作将使双方能够基于 GEiGS 平台探索更多性状,从而拓展牛和猪物种的动物福利性状。

- 2022 年 6 月,Hendrix Genetics 与澳大利亚国家科学机构 CSIRO 合作,测试创新的产蛋时性别分选技术在蛋鸡产业中的可行性。该项目重点研究 CSIRO 开发的一项技术,该技术使用一种仅在雄性胚胎中存在而在雌性胚胎中不存在的生物标志物蛋白。这使得研究小组能够在卵孵化前的早期发育阶段识别雄性胚胎。这项探索性研究迈出了重要的第一步,有望为一项重大的动物伦理和福利挑战提供解决方案,同时改善蛋品行业的碳足迹和可持续性。

这些公司的进展正在帮助参与者积极促进动物基因产业的发展。

动物遗传学市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响动物遗传学市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的动物遗传学市场细分和地域分布。

动物遗传学市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2022 | US$ 6.13 Billion |

| 市场规模 2028 | US$ 8.94 Billion |

| 全球复合年增长率 (2022 - 2028) | 6.5% |

| 历史数据 | 2020-2021 |

| 预测期 | 2023-2028 |

| 涵盖的领域 |

By 类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

动物遗传学市场参与者密度:了解其对业务动态的影响

动物遗传学市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 动物遗传学市场 主要参与者概述

COVID-19 的影响:

2020 年,COVID-19 疫情期间,基因组实验室的研究活动受到了广泛影响。全球许多进行分子检测的动物实验室将工作重点转向 COVID-19 检测。随着疫情期间对基于 PCR 的 COVID-19 检测的需求增加,动物实验室不得不将工作重点转向这一诊断领域,导致动物基因组学服务延迟。另一方面,疫情过后,由于 SARS-CoV-2 是一种人畜共患病毒,动物遗传学市场迎来了良好的增长机会。一些动物,例如狗、猫、雪貂和水貂,被检测出 COVID-19 呈阳性。因此,缺乏关于 COVID-19 从动物传播给人类的起源的证据,以及对致病性的了解不足,为动物遗传学研究提供了重要的增长机会。

竞争格局和关键公司:

全球动物遗传学市场的一些知名参与者包括 Neogen Corp、Genus Plc、Topigs Norsvin Nederland BV、Zoetis Inc、Hendrix Genetics BV、Inotiv Inc、Animal Genetics Inc、Alta Genetics Inc、GROUPE GRIMAUD LA CORBIERE 和 Charles River Laboratories International Inc。这些公司专注于新产品的推出和地域扩张,以满足全球不断增长的消费者需求,并增加其专业产品组合的范围。它们拥有广泛的全球影响力,这使它们能够服务于大量客户,从而增加其市场份额。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 动物遗传学市场

获取免费样品 - 动物遗传学市场