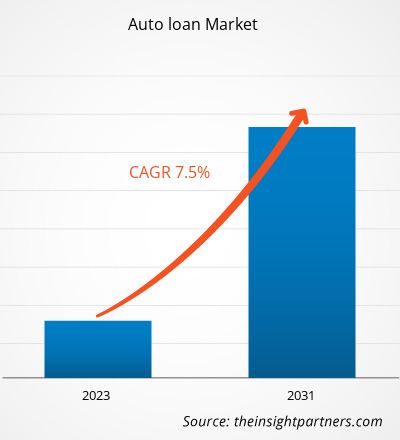

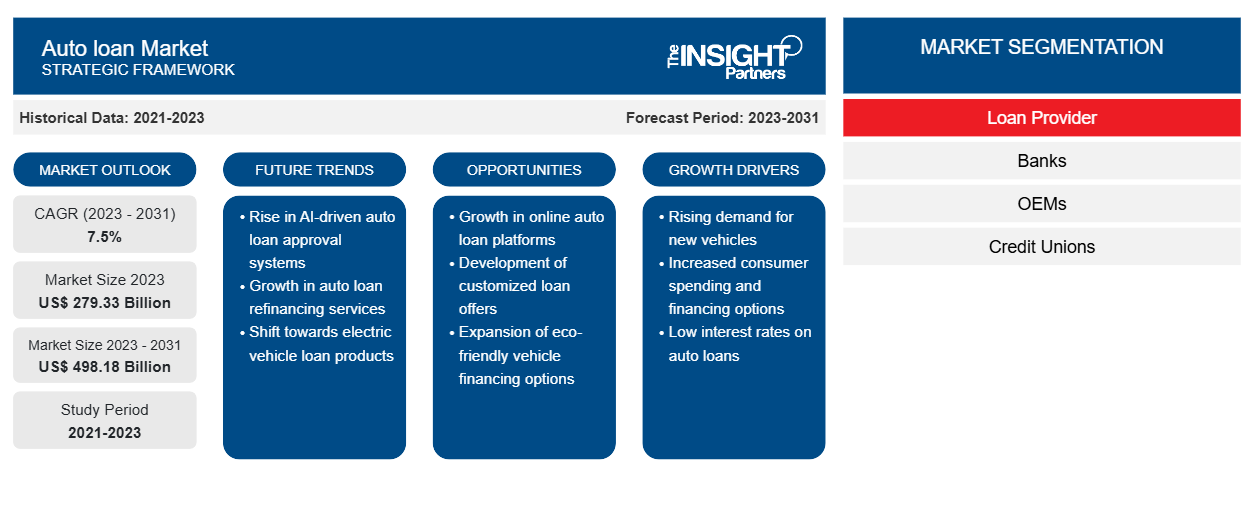

汽车贷款市场规模预计将从 2023 年的 2793.3 亿美元增长到 2031 年的 4981.8 亿美元;预计从 2023 年到 2031 年,汽车贷款市场的复合年增长率将达到 7.5%。汽车行业自诞生以来就呈指数级增长。消费者比以往任何时候都更关注二手车,有些人甚至选择二手车而不是两轮车。这反过来又有望在预测期内推动汽车贷款市场的需求增长。

汽车贷款市场分析

拥有汽车曾经是身份的象征,但近来却成为一种必需品。因此,消费者越来越倾向于拥有汽车并避免乘坐公共交通,这也是全球二手车普及的一个重要因素。数字化程度的提高和拥有新颖商业模式的初创企业正在推动二手车融资市场的发展。数字化有助于存储、检索和保留数据。以数字格式保存信息可减少所需的资本资源并减少存储文档的问题。汽车贷款的数字化浪潮正在不断涌现。此外,包括数字贷款文件和电子签名在内的数字贷款文件为预测期内在汽车贷款市场中获得优势提供了机会。

汽车贷款

行业概览

- 汽车贷款是一种以汽车本身作为抵押的担保贷款。贷款机构为二手车、新车和商用车提供汽车贷款。汽车贷款可通过信用合作社、银行和在线贷款机构获得,需要以汽车作为贷款抵押。

- 汽车贷款是一种融资方式,可用于购买卡车或汽车等车辆,并分期偿还贷款。由于保险和金融行业数字化程度不断提高,汽车贷款市场预计在预测期内将出现增长。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

-

获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

汽车贷款市场驱动因素

提高汽车贷款数字化程度,推动市场增长

- 随着客户购车过程中数字触点的增多,汽车融资数字化已是不可避免的趋势。数字化转型浪潮席卷了众多行业,汽车贷款行业也不例外。因此,随着数字化服务的兴起,所有汽车领域的客户都选择了一种无忧的购车之旅。

- 在线汽车金融应用的出现和汽车价格的上涨推动了全球汽车贷款市场的增长。此外,汽车金融数字技术的实施也对汽车金融市场的增长产生了积极影响。全球各地的汽车贷款机构都在利用生物识别、电子签名和身份证件验证等技术将消费者体验数字化。

- 借助先进的文档扫描技术,所有文档都可以数字化、验证和存储。基于云的平台还可以帮助众多参与者并行访问和处理贷款申请。数字化贷款处理还可以帮助消除多轮讨论和繁琐的文书工作,从而使汽车贷款流程民主化。使用来自开放 API 和信用评分分析的信息对贷款请求进行实时信用风险评估可以大大减少欺诈行为。因此,汽车贷款市场预计将得到保险金融行业数字化的支持。

汽车贷款

市场报告细分分析

- 根据融资者,汽车贷款市场分为银行、原始设备制造商、信用合作社和其他贷款提供商。

- 2023 年,OEM 部门占据了汽车贷款市场的很大份额。OEM 正在观察二手车融资需求的增长。

- 此外,由于银行提供更好的售后服务,预计预测期内银行部门将以最快的速度增长。

汽车贷款

市场区域分析

汽车贷款市场报告的范围主要分为五个地区——北美、欧洲、亚太、中东和非洲以及南美。北美正在经历快速增长,预计将在 2022 年占据值得注意的汽车贷款市场份额。亚太地区的二手车融资市场比较分散。众多无组织和有组织的参与者的存在形成了这样的市场格局。此外,大多数汽车制造商除了提供融资外,还与金融机构和银行合作,为客户提供更广泛的选择。

此外,汽车销量的激增也影响了汽车融资量。根据印度储备银行 (RBI) 公布的数据,截至 2022 年 6 月底,商业银行的汽车贷款增长了 18%。乘用车的增幅大于商用车。因此,预计亚太地区的市场将在预测期内增长。

汽车贷款

汽车贷款市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响汽车贷款市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的汽车贷款市场细分和地理位置。

- 获取汽车贷款市场的区域特定数据

汽车贷款市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023 年的市场规模 | 2793.3亿美元 |

| 2031 年市场规模 | 4981.8亿美元 |

| 全球复合年增长率(2023 - 2031) | 7.5% |

| 史料 | 2021-2023 |

| 预测期 | 2023-2031 |

| 涵盖的领域 |

按贷款提供者

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

汽车贷款市场参与者密度:了解其对业务动态的影响

汽车贷款市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在汽车贷款市场运营的主要公司有:

- 盟友金融

- HDFC 银行

- 追赶

- 富国银行

- 第一资本

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 了解汽车贷款市场顶级关键参与者概况

《汽车贷款市场分析》根据车辆类型、所有权、最终用户、贷款提供商和地理位置进行调查。就车辆类型而言,市场分为乘用车和商用车。就所有权而言,市场分为新车和二手车。就最终用户而言,市场分为个人和企业。就车辆贷款提供商而言,市场分为银行、OEM、信用合作社和其他贷款提供商。根据地理位置,市场分为北美、欧洲、亚太地区、中东和非洲以及南美。

汽车贷款

市场领导者及份额分析

保险 汽车贷款

市场领导者及份额分析

Ally Financial、HDFC Bank、Chase、Wells Fargo、Capital One、Bank of America、ICICI Bank、Credit Agricole、Mashreq Bank 和 Tata Capital 是汽车贷款市场报告中介绍的知名参与者。此外,在研究过程中还研究和分析了其他几家参与者,以全面了解市场及其生态系统。汽车贷款市场预测是根据各种二手和一手研究结果估算的,例如主要公司出版物、协会数据和数据库。

汽车贷款

市场新闻和最新动态

汽车贷款市场中,各公司采取并购等无机和有机战略。以下列出了一些近期的关键市场发展:

- 2021 年 8 月,塔塔汽车与 Sundaram Finance 合作,为选择购买其各种乘用车的客户提供独家优惠。根据与塔塔汽车的合作,Sundaram Finance 同意为新颖的“Forever”系列汽车提供 6 年贷款,并提供 100% 融资,但需要最低首付。

(来源:塔塔汽车,公司网站)

- 2021 年 11 月,Mahindra & Mahindra Financial Service Limited 推出了订阅和租赁业务“Quiklyz”。该合资企业是一个用于汽车租赁和订阅的新型数字平台。该平台允许客户选择汽车并提供灵活性。

(来源:Mahindra & Mahindra,公司网站)

- 2021年7月,玛鲁蒂铃木有限公司推出了一个数字平台,为客户提供端到端的在线汽车融资解决方案。

(来源:玛鲁蒂铃木,公司网站)

- 2023 年 5 月,作为 Dutton 集团的一部分,Albert Automotive Holdings Pty Ltd 是一家二手车批发和零售企业。二手车经销商双日株式会社收购了该业务,以扩大其在国内外市场的影响力。

(来源:双日株式会社,公司网站)

汽车贷款

市场报告范围及交付成果

市场报告《汽车贷款市场规模和预测(2021-2031)》对市场进行了详细分析,涵盖以下领域:

- 范围内涵盖的所有主要细分市场的全球、区域和国家层面的市场规模和预测。

- 市场动态,例如驱动因素、限制因素和关键机遇。

- 未来的主要趋势。

- 详细的 PEST 和 SWOT 分析

- 全球和区域市场分析涵盖主要市场趋势、主要参与者、法规和最新的市场发展。

- 行业格局和竞争分析包括市场集中度、热图分析、关键参与者和最新发展。

- 详细的公司简介。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 汽车贷款市场

获取免费样品 - 汽车贷款市场