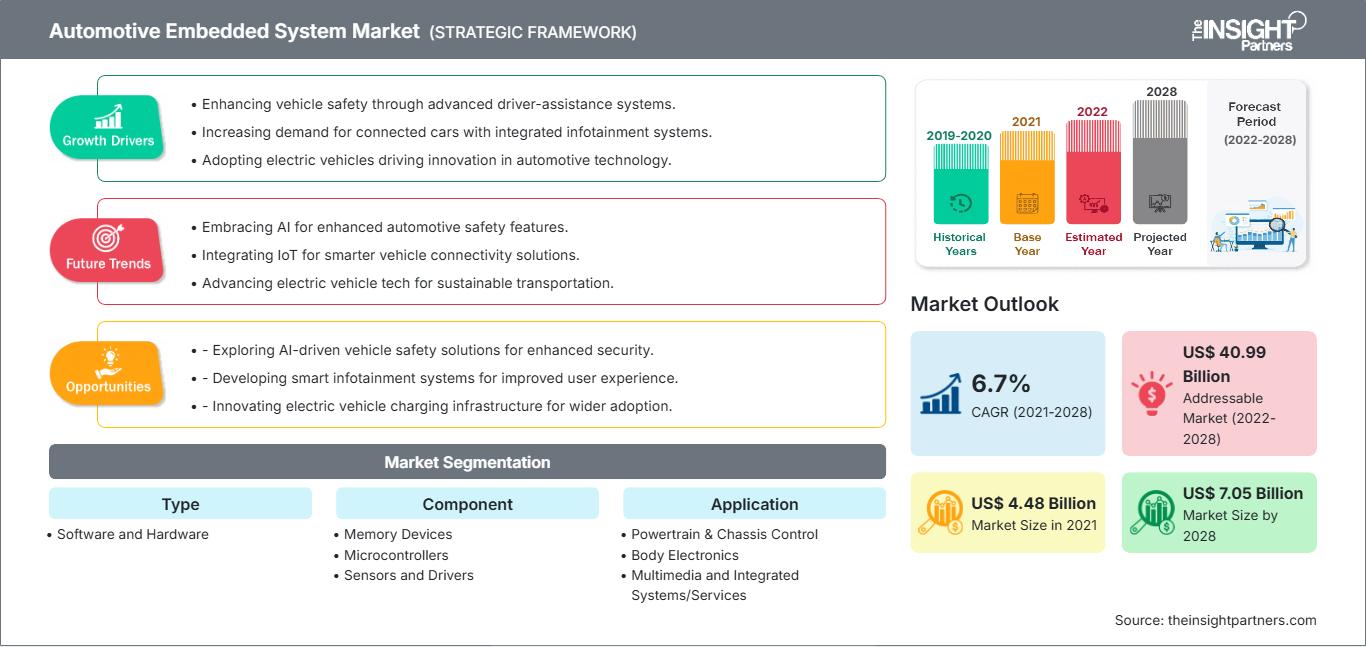

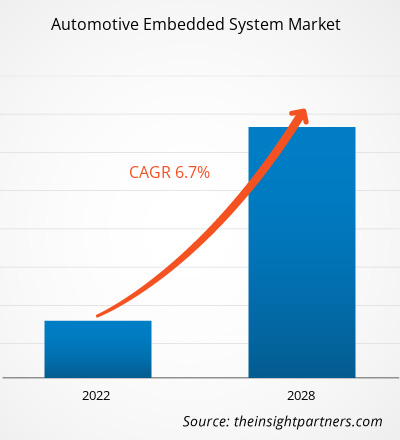

预计到 2028 年,汽车嵌入式系统市场规模将从 2021 年的 44.8381 亿美元增至 70.5111 亿美元;预计 2021 年至 2028 年的复合年增长率为 6.7%。

汽车嵌入式系统是内置于汽车中并控制多项任务的计算机系统。它旨在规范数据和服务机制。汽车嵌入式系统高度依赖于软件。大多数汽车嵌入式系统用于汽车节能减排,并满足高可靠性和安全性标准。它们还有助于满足最终用户的安全性、舒适性和成本标准。系统设计和软件开发的变革以及集成服务的进步将开辟新的商业前景。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

汽车嵌入式系统市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

全球对电动汽车的需求不断增长,以及由于嵌入式系统能够减少污染和提高效率而使其在电动和混合动力汽车中的应用日益普及,预计将在预测期内推动全球汽车嵌入式系统市场的增长。消费者对汽车安全性能的日益关注、汽车行业自动化程度的不断提高以及政府在限制排放和提高燃油效率方面的努力,预计将在预测期内促进汽车嵌入式系统市场的增长。此外,对联网汽车的需求不断增长,以及对车辆传感器和工程系统的需求不断增长,可能会在未来几年推动市场增长。

交通电气化是21世纪的主要发展之一。据《福布斯》报道,2018 年全球电动汽车销量增长了 65%,达到 210 万辆,2019 年销量保持稳定。世界各国政府正在推出各种政策并采取行动鼓励使用电动汽车。印度的“加快采用和制造混合动力和电动汽车”(FAME)计划、加州的零排放汽车计划以及欧盟的“绿色汽车倡议”等计划通过提供补贴、税收减免和其他激励措施来鼓励人们使用电动汽车。许多政府还与私营企业合作启动了多个项目,以建设充电基础设施。这些活动促进了全球电动汽车行业的发展,从而推动了对这些汽车制造中嵌入式系统的需求。燃料价格上涨和全球化石燃料储量的枯竭促使人们转向可再生能源。汽车厂商正在制造更具吸引力的新型电动汽车车型。此外,商用车队车主正在将老旧车辆替换为电动汽车,以享受成本节约的益处。此外,电动汽车成本的下降也提振了全球电动汽车行业,进而推动了汽车嵌入式系统市场的发展。

新冠疫情对汽车嵌入式系统市场的影响

由于整个汽车价值链的供需中断,新冠疫情在一定程度上对2020年全球汽车嵌入式系统市场的整体增长率产生了不利影响。然而,随着疫苗接种运动的突然增长和 COVID-19 安全协议的不断更新,政府的限制正在放松,这可能会提高民用和车身电子产品的生产能力,从而使预测期内汽车嵌入式系统市场的增长正常化。

市场洞察

不断增长的信息娱乐需求推动汽车嵌入式系统市场增长

随着出行行业的转型,信息娱乐系统的范围正在扩大,为车内乘客提供更强大的安全特性、附加功能和娱乐选择。智能手机连接允许用户通过 Wi-Fi 和蓝牙连接访问消息和信息,使旅途中工作变得更加轻松。这些信息娱乐系统通过数字助理、多个屏幕和各种输入法在车辆中提供数字体验。数字接口的加入使汽车供应商和原始设备制造商 (OEM) 能够创建以更合适的方式显示实时数据的界面。数字接口还赋予了更广泛的功能,使制造商能够执行包括ADAS在内的一系列安全关键功能。

类型细分洞察

嵌入式系统是硬件和软件组件的组合,基于微处理器或微控制器,旨在执行汽车领域的特定任务。汽车嵌入式软件允许驾驶员记录可扩展数据,从而获得有关车辆性能和驾驶员行为的重要洞察。嵌入式汽车软件解决方案有助于预测维护需求并避免汽车事故。此外,联网汽车的兴起迫使汽车公司提升其嵌入式汽车软件开发能力,以弥合汽车与移动生态系统之间的差距,并进一步基于车载和车外数据提升车辆性能。各公司正在发布新的软件解决方案,以提供全方位的帮助。Intellias提供嵌入式软件服务,以改进多媒体系统、车载网络、远程信息处理、ADAS、车身电子设备、动力传动系ECU和变速箱ECU组件的运行。该公司拥有丰富的知识,能够基于 ASPICE 认证的方法设计用于 ECU 固件更新、远程信息控制单元软件、车辆跟踪系统、动力总成控制器软件以及其他类似系统和组件的复杂系统。

组件细分洞察

根据组件,汽车嵌入式系统市场细分为存储设备、微控制器以及传感器和驱动器。汽车传感器是一种认知传感器,可用于调节和处理油压、温度、污染水平、冷却液液位和其他变量。汽车中使用多种类型的传感器,但了解它们的工作原理至关重要。各公司根据应用需求提供先进的传感器。这些传感器收集车辆功能管理、自适应和反应所需的数据,这些数据可用于提高车辆的安全性、舒适性和效率。传感器和驱动器用于许多现代神经系统,包括汽车、卡车、公共汽车和越野车。 TE 的汽车传感器均按照严格的标准设计和制造,通常为定制产品。

应用细分洞察

根据应用,汽车嵌入式系统市场细分为动力传动系统和底盘控制、车身电子以及多媒体和集成系统/服务。汽车多媒体和集成系统 (MIDS) 是提供音频或视频娱乐的硬件和软件的组合。汽车导航系统、视频播放器、USB 和蓝牙连接、车载电脑、车载互联网和 Wi-Fi 是主要的车载娱乐系统,它们兼容收音机播放器和磁带或 CD 播放器。除了简单的仪表盘旋钮和刻度盘外,ICE 系统现在还可以配备方向盘音频控制、免提语音控制、触摸感应预设按钮以及高端设备上的触摸显示屏。

汽车嵌入式系统市场参与者专注于新产品创新和开发,通过集成先进技术和功能来与竞争对手竞争。 2021 年 1 月,日本电装株式会社 (DENSO Corporation) 与高通公司 (Qualcomm Incorporated) 的子公司高通技术公司 (Qualcomm Technologies, Inc.) 宣布就下一代座舱技术展开合作。电装将提升集成座舱系统和车载信息娱乐产品的可用性,并为这些系统开发车载解决方案技术。

汽车嵌入式系统市场 — 按类型- 软件

- 硬件

- 存储设备

- 微控制器

- 传感器和驱动器

- 动力总成和底盘控制

- 车身电子

- 多媒体和集成系统/服务

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 法国

- 德国

- 意大利

- 英国

- 俄罗斯

- 欧洲其他地区

- 亚太地区 (APAC)

- 中国

- 印度

- 韩国

- 日本

- 澳大利亚

- 亚太地区其他地区

- 中东和非洲 (MEA)

- 南非

- 沙特阿拉伯

- 阿联酋

- MEA 其他地区

- 南美洲 (SAM)

- 巴西

- 阿根廷

- SAM 其他地区

汽车嵌入式系统市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响汽车嵌入式系统市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的汽车嵌入式系统市场细分和地域分布。

汽车嵌入式系统市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2021 | US$ 4.48 Billion |

| 市场规模 2028 | US$ 7.05 Billion |

| 全球复合年增长率 (2021 - 2028) | 6.7% |

| 历史数据 | 2019-2020 |

| 预测期 | 2022-2028 |

| 涵盖的领域 |

By 类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

汽车嵌入式系统市场参与者密度:了解其对业务动态的影响

汽车嵌入式系统市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展其产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 汽车嵌入式系统市场 主要参与者概述

汽车嵌入式系统市场 – 公司简介

- 大陆集团

- 电装株式会社

- Garmin 有限公司

- 哈曼国际

- 英飞凌科技股份公司

- 三菱电机株式会社

- 恩智浦半导体

- 松下公司

- 罗伯特·博世有限公司

- System Controls Technology Solutions Pvt. Ltd.

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 汽车嵌入式系统市场

获取免费样品 - 汽车嵌入式系统市场