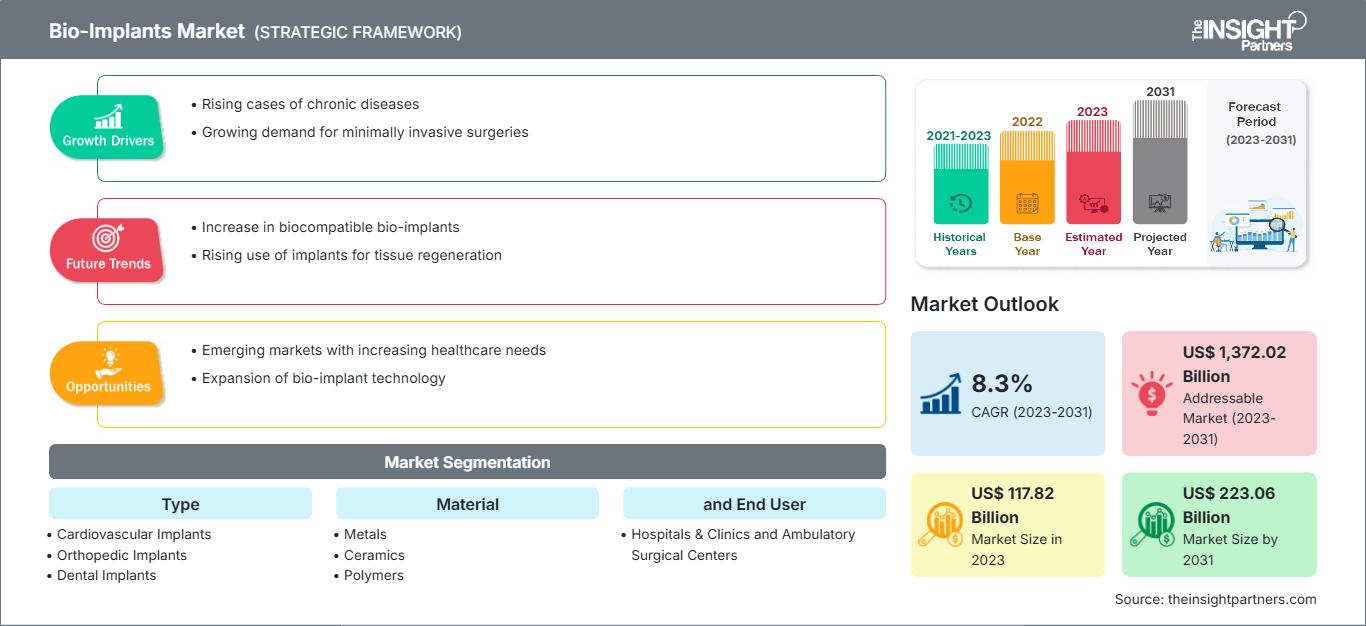

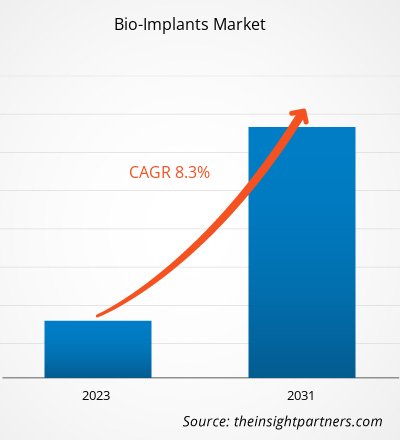

[研究报告] 2023年,生物植入物市场规模为1178.2亿美元,预计到2031年将达到2230.6亿美元;预计2023年至2031年期间,该市场的复合年增长率将达到8.3%。

分析师观点:

本报告根据当前生物植入物市场趋势和影响市场增长的驱动因素,展望了增长前景。生物植入物市场规模不断增长的主要因素包括慢性病病例的增加(尤其是老年人口)以及可支配收入的增加。发达国家和发展中国家的医疗保健基础设施预计将进一步改善,从而显著推动生物植入物市场的发展。

全球民众对美容植入物有效性和技术进步的认识有所提高。由于牙科问题病例的增多,全球生物植入物市场正在蓬勃发展。由于心血管和骨科疾病发病率的上升,对骨科植入物和起搏器的需求也在增长。由于北美地区医疗保健基础设施的完善、人们对美容植入物认知度的提升以及生物植入物市场的主要参与者,生物植入物控制产品的整体销售额预计将持续增长。此外,由于医疗保健技术的快速进步、对非侵入性生物植入物的需求增长以及老年人口的激增,欧洲已成为全球第二大生物植入物市场。然而,生物植入物手术成本的不断上涨以及生物植入物产品的合理使用阻碍了生物植入物市场的增长。

市场概览:

推动生物植入物市场增长的关键因素包括老年人群骨质疏松症病例的增多、对微创手术的需求不断增长以及生活方式障碍病例的增多。此外,医疗保健领域的技术发展预计将对未来几年的生物植入物市场预测产生重大影响。尽管医疗保健行业多年来取得了重大技术进步,但严重疾病发病率的上升阻碍了生物植入物市场的发展。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

生物植入物市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

糖尿病、心血管疾病和骨关节炎等生活方式障碍在世界范围内日益普遍,是导致发病和死亡的主要原因。生物植入物(例如支架和骨棚)可以治疗这些疾病,并正在成为传统永久性植入物颇具吸引力的替代方案。根据美国心脏协会2021年发表的一篇文章,美国每年约有4万名儿童接受先天性心脏手术。英国心脏基金会于2022年发布的《2022年1月英国概况》指出,2021年,约有760万人患有心脏和循环系统疾病,其中近400万男性和360万女性患有心脏病和循环系统疾病。因此,心血管疾病的日益流行导致对早期诊断和治疗的需求日益增加,预计这将推动对介入心脏病学手术以及心血管植入物(生物植入物)的需求。此外,口腔健康问题的急剧增加预计将增加对生物植入物的需求。例如,根据世界卫生组织(WHO)2021年全球疾病负担研究,预计口腔疾病将影响全球约一半的人口。约有35.8亿人患有龋齿和其他牙齿疾病。生物植入物

此外,生物植入物还有助于管理和控制肌肉骨骼疾病等疾病中的特定药物输送。根据《骨科》2021年1月发表的一篇文章,北京社区中年人群腰椎滑脱的总体患病率为17.26%(男性15.98%,女性18.80%),其中60岁及以上女性患腰椎滑脱的几率更高。世界卫生组织表示,肌肉骨骼损伤和疾病十分普遍,影响着全球17.1亿人,是全球致残的主要原因。《柳叶刀风湿病学》杂志发表的一项新研究显示,到2050年,预计将有超过10亿人患有关节、肌肉、骨骼、韧带、肌腱和脊柱疾病,而2020年这一数字约为5亿。随着人口老龄化加剧,患有肌肉骨骼疾病及相关功能障碍的人数正在迅速增加。患者中肌肉骨骼疾病的增多导致对植入手术和住院治疗的需求增加,从而推动了生物植入物市场的发展。

分段分析:

生物植入物市场分析通过考虑以下细分市场进行:类型、材料和最终用户。

根据类型,生物植入物市场细分为心血管植入物、骨科植入物、牙科植入物、眼科植入物等。心血管植入物细分市场在 2023 年占据了更大的市场份额。该细分市场的增长归因于开发新型心脏植入物产品的研发活动的快速增长。例如,2022 年 2 月,医疗技术公司雅培宣布在其 AVEIR DR i2i 关键临床试验中,完成了全球首例无线双腔起搏器系统患者植入。雅培实验性双腔无导线起搏器的植入是无导线起搏器技术的一个重要技术里程碑;这是全球首个进入关键临床试验的起搏器。

生物植入物市场按材料细分为金属、陶瓷和聚合物。速释胶囊在2023年占据了最大的市场份额。预计在预测期内,该领域将实现最高的复合年增长率。这些金属因其卓越的机械强度、耐腐蚀性和生物相容性而成为植入应用的理想选择。钛因其卓越的耐用性、轻量化设计和与人体组织的相容性,成为骨科、牙科和心血管植入物中极为流行的材料。由于金属具有延展性、导电性和惰性,它们在心脏电极和神经探针等特殊植入应用中备受青睐。慢性病发病率的上升以及材料科学和制造技术的进步推动了生物植入物对生物材料金属的需求。这巩固了生物材料金属作为生物植入物市场最受欢迎材料类别的地位。

根据最终用户,市场分为医院和诊所以及门诊手术中心。医院和诊所部门在 2023 年占据了更大的生物植入物市场份额,预计在 2023 年至 2031 年期间将实现更高的复合年增长率。医院和诊所由于其广泛的医疗项目和多学科的患者护理方法,通常吸引大量患者,包括需要专门植入治疗的患者。医院通常与研究中心和医疗器械制造商合作,以方便获得尖端的植入物突破和技术。医院和诊所是生物植入物市场的重要参与者,因为它们提供必要的植入物相关服务,并对与生物植入物相关的商品和工艺产生大量需求。因此,越来越多的医院和诊所预计在预测期内,人们对药物的需求不断增长的诊所将支持该细分市场的增长。

区域分析:

生物植入物市场报告的范围包括北美、欧洲、亚太地区、中东和非洲以及南美洲和中美洲。2023 年北美市场价值为 505.1 亿美元,预计到 2031 年将达到 966.9 亿美元;预计 2023 年至 2031 年期间的复合年增长率为 8.5%。北美市场分为美国、加拿大和墨西哥。北美市场的增长归因于慢性病患病率的上升和医疗基础设施的改善。 2022年7月,美国疾病控制与预防中心(CDC)的最新数据显示,冠状动脉疾病是最常见的心脏病之一,美国约有2010万20岁及以上的成年人患有冠状动脉疾病。此外,根据CDC的数据,每40秒就有一人心脏病发作,即近80.5万人。预计预测期内,慢性病的增加将增加对生物植入物的总体需求。

根据医疗保险和医疗补助服务中心的数据,到 2028 年,全国医疗保健支出预计将达到 6.2 万亿美元,2019 年至 2028 年的年均增长率 (AAR) 为 5.4%。由于全国医疗保健支出预计将增加 1.1 个百分点,预计 2028 年医疗保健在经济中的份额将增长 19.7%,高于 2019 年至 2028 年的年均 GDP 增长速度。因此,预计医疗保健支出的增加将为市场参与者在预测期内开发生物植入物创造机会。

2023 年,欧洲占据第二大生物植入物市场份额。该地区市场的增长归因于医疗保健技术的进步、对非手术生物植入物的需求增加以及老年人口的增长。欧洲市场的增长归因于政府对医疗保健的资助和支持、骨科疾病发病率的上升以及医疗保健研发活动的增加。此外,由于该地区心血管疾病发病率的上升导致心血管手术数量的增加,推动了该地区生物植入物市场的发展。

预计亚太地区将在 2023 年至 2031 年期间在全球生物植入物市场中实现最高的复合年增长率。该地区市场的增长归因于老年人口的增长、可支配收入的增加、医疗保健投资的增加和市场参与者的扩张,以及交通事故增多导致脊髓损伤病例的增加。亚太地区正在经历显著的增长,尤其是在中国和印度等新兴市场。扩大医疗保健基础设施和增加该领域的投资以提供高效的患者服务,推动了该地区生物植入物市场的发展。例如,根据日本庆应义塾大学 2019 年的一份出版物,日本约有 100,000 名患者因脊髓损伤而瘫痪。然而,iPS 技术的批准预计将在不久的将来帮助该国的这些患者,这可能为未来几年的生物植入物市场提供机会。根据联合国亚洲经济社会委员会和太平洋社会发展部的数据,2016年,亚洲超过12.4%的人口年龄在60岁以上,预计到2050年底,这一数字将达到13亿。

生物植入物市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响生物植入物市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的生物植入物市场细分和地域分布。

生物植入物市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2023 | US$ 117.82 Billion |

| 市场规模 2031 | US$ 223.06 Billion |

| 全球复合年增长率 (2023 - 2031) | 8.3% |

| 历史数据 | 2021-2023 |

| 预测期 | 2023-2031 |

| 涵盖的领域 |

By 类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

生物植入物市场参与者密度:了解其对业务动态的影响

生物植入物市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 生物植入物市场 主要参与者概述

LifeNet Health;Smith & Nephew;Arthrex, Inc.;Clinic Lemanic;Alpha Bio Tec;MiMedx Group;Medtronic;St Jude Medical (Abbott);Stryker Cooperation;DePuy Synthes;Biomet (Zimmer);Exactech, Inc.;Cochlear Ltd 和 Straumann AG 是生物植入物市场报告中介绍的关键参与者。

最新发展:

在市场上运营的公司采用并购等方式。根据公司新闻稿,以下是一些最新关键发展:

- 2023 年 2 月,旨在修复弯曲骨骼骨折的医疗器械开发商 CurvaFix, Inc. 宣布推出其直径较小的 7.5 毫米 —CurvaFix IM 植入物。它旨在简化手术程序,并在小骨骼中提供牢固、稳定的固定,旨在帮助有骨骼的患者。

- 2022 年 6 月,ZimVie 在美国推出了 T3 专业工程植入物和 Encode Emergence 愈合基台,并获得了美国食品药品监督管理局 (FDA) 的批准。

- 2021 年 6 月,医疗器械公司 Intelligent Implants Ltd. 的骨科植入物技术 SmartFuse 获得了美国 FDA 的突破性批准。SmartFuse 平台旨在远程刺激、控制和监测骨骼生长,以做出实时临床决策。该产品适用于接受腰椎融合术的初次使用患者。

- 2021 年 2 月,美敦力推出了 TYRX 可吸收抗菌鞘,这是一款可吸收的一次性抗菌鞘,旨在稳定心脏植入式电子设备或植入式神经刺激器。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 生物植入物市场

获取免费样品 - 生物植入物市场