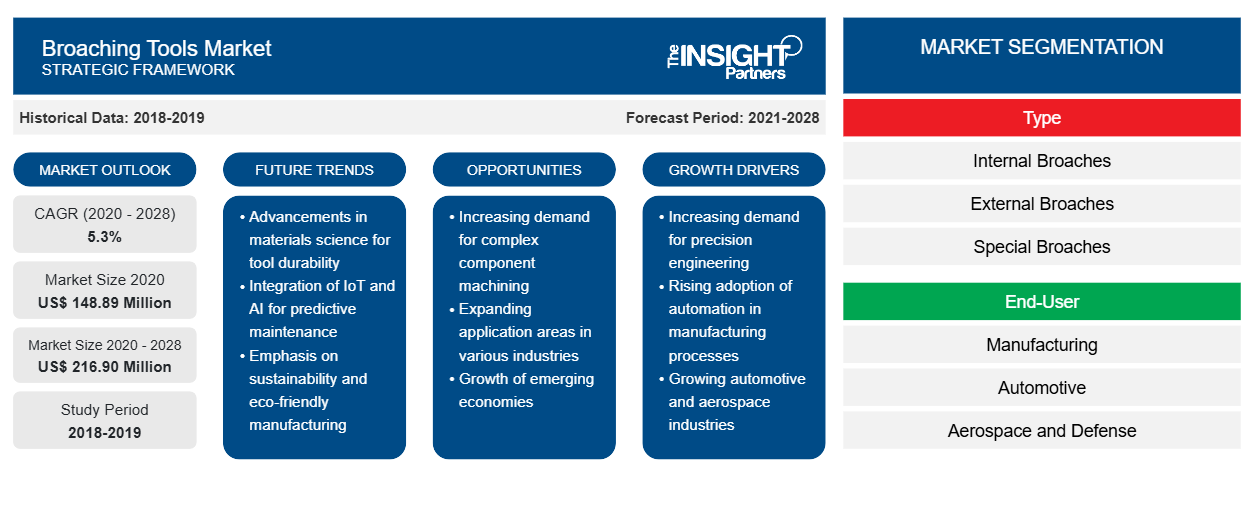

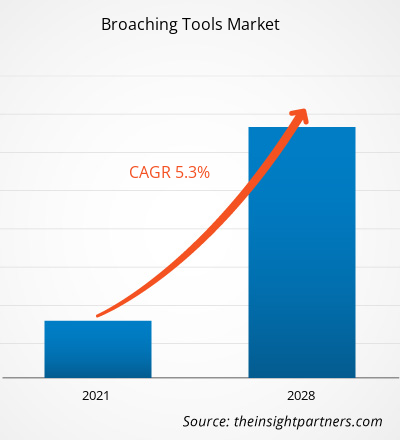

2020 年拉削工具市场价值为 1.4889 亿美元,预计到 2028 年将达到 2.169 亿美元;预计 2021-2028 年期间的复合年增长率为 5.3%。

由于全球经济增长,制造业在过去二十年中获得了显著的发展,尤其是在亚太地区的新兴经济体。拉削工具广泛用于生产各种工业零部件和子装配零件。汽车、航空航天和国防以及建筑等终端使用行业对高速和精确精加工工艺的需求不断增长,这促使拉削工具制造商向市场推出先进的工具。制造业是亚太地区经济增长的主要驱动力之一。低劳动力成本、年轻人口增加以及政府以子公司和税收优惠形式提供的福利等因素吸引着各组织在亚太地区建立更大的制造基地。此外,中国制造 2025 和印度制造等政府举措正在推动亚太地区制造业的增长。此外,群众可支配收入的增加导致该地区越来越多地采用现代生活方式,从而推动了对消费电子产品和汽车的需求。这一因素正在促进制造业的发展。因此,不断增长的制造业正在推动亚太地区拉削工具市场的增长。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

- 获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

COVID-19 疫情对拉削工具市场的影响

COVID-19 疫情对全球各行各业产生了不利影响,这种破坏性影响在 2021 年也将继续存在。疫情对制造业、医疗保健、能源和电力、电子和半导体、航空航天和国防以及建筑等主要行业造成了重大破坏。上述行业活动的大幅下降对拉削工具市场的表现产生了负面影响。重新实施的旅行限制、贸易禁令和工作场所的劳动力限制等遏制措施扰乱了各种业务的制造、供应和销售,包括拉削工具等工业设备。

拉削刀具市场洞察

汽车产量不断上升

近年来,高端汽车需求不断增长,导致汽车产量增加,主要是在北美和欧洲等发达地区。此外,商用车和乘用车的需求也在增加,主要是在发展中国家。拉削刀具广泛应用于汽车行业,用于制造齿轮、传动轴、方向盘轮毂、转向节叉等。根据非盈利组织汽车研究中心的数据,2018 年,FCA、通用、福特、现代、日产、大众和丰田等汽车制造商在汽车行业投资了 48 亿美元。此外,欧洲汽车研发 (R&D) 投资增长了 6.7%,达到每年 670.9 亿美元。因此,高端汽车需求的增加和汽车产量的增加正在推动汽车行业采用拉削刀具。

基于类型的市场洞察

根据类型,拉削工具市场分为内拉刀、外拉刀和特殊拉刀。内拉刀部分在 2020 年占有最大份额。由于对立式拉削机的需求不断增加,预计内拉刀部分市场在预测期内将以更快的速度增长。内拉技术广泛用于生产各种精密部件,例如汽车和机械齿轮、枪支部件和紧固件。随着全球工业化的稳步增长,拉削工具市场预计将在预测期内出现显着增长。

拉削工具市场的参与者专注于合并、收购和市场计划等策略,以保持其在市场中的地位。以下列出了一些主要参与者的发展:

- 2020 年,Blohm Jung GmbH 推出了带换刀装置的 PROFIMAT XT。该工具可自动更换砂轮。这款灵活的 PROFIMAT XT 将四种磨削技术融合在一台机器中:往复式、缓进给、CD 和速度冲程磨削。

- 2018 年,Blohm Jung GmbH 在 IMTS 上首次推出了新产品 PROFIMAT XT。此次发布是其磨床产品组合的扩展。

拉削工具市场区域洞察

Insight Partners 的分析师已详尽解释了预测期内影响拉削工具市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的拉削工具市场细分和地理位置。

- 获取拉削工具市场的区域特定数据

拉削工具市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2020 年市场规模 | 1.4889亿美元 |

| 2028 年市场规模 | 2.169亿美元 |

| 全球复合年增长率(2020 - 2028) | 5.3% |

| 史料 | 2018-2019 |

| 预测期 | 2021-2028 |

| 涵盖的领域 | 按类型

|

| 覆盖地区和国家 | 北美

|

| 市场领导者和主要公司简介 |

|

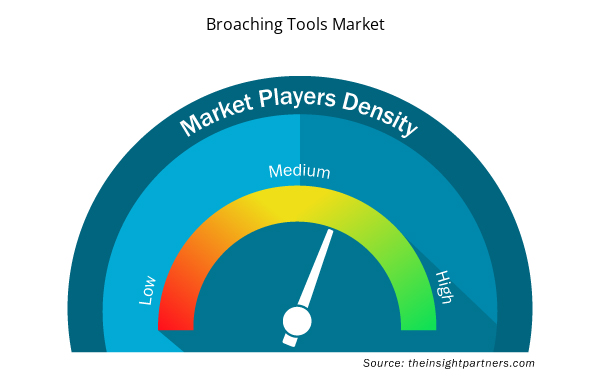

市场参与者密度:了解其对商业动态的影响

拉削工具市场正在快速增长,这得益于最终用户需求的不断增长,这些需求源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明相对于给定市场空间的规模或总市场价值,有多少竞争对手(市场参与者)存在于该市场空间中。

在拉削工具市场运营的主要公司有:

- 美国拉刀与机械公司

- Arthur Klink 有限公司

- 殖民工具集团公司

- Ekin S 库普

- Blohm Jung 有限公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 获取拉削工具市场顶级关键参与者概览

全球拉削工具市场细分如下:

拉削刀具市场 – 按类型

- 内拉刀

- 外圆拉刀

- 特殊拉刀

拉削刀具市场 – 按最终用户划分

- 制造业

- 汽车

- 航空航天和国防

- 建造

- 其他的

拉削刀具市场——按地区划分

北美

- 我们

- 加拿大

- 墨西哥

欧洲

- 法国

- 德国

- 意大利

- 俄罗斯

- 英国

- 欧洲其他地区

亚太地区 (APAC)

- 中国

- 印度

- 日本

- 澳大利亚

- 韩国

- 亚太地区其他地区

中东和非洲 (MEA)

- 沙特阿拉伯

- 阿联酋

- 南非

- MEA 其他地区

南美洲 (SAM)

- 巴西

- 阿根廷

- 其余的骗局

公司简介

- 美国拉刀与机械公司

- Arthur Klink 有限公司

- 殖民工具集团公司

- Ekin S 库普

- Blohm Jung 有限公司

- 梅塞尔 Räumtechnik 有限公司

- 三菱重工机床有限公司

- 那智不二越公司

- 拉刀大师股份有限公司

- 米勒拉刀

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST 和 SWOT 分析

- 市场规模价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

常见问题

The carbide tools market is led by internal broaches segment is expected to dominate in the forecast period. Internal broaching is a process of sharping the inside surface of the workpiece. Internal broaching consists of two techniques: rotary broaching and vertical broaching. A rotating broach tool is used in rotary broaching technique for sharping the internal surface of workpiece, while vertical broaching uses push or pull-down applications for sharping the internal surface of workpiece. The internal broaching technique is widely used for producing various precision components, such as automobile and machinery gears, firearm components, and fasteners. With the steady growth of industrialization across the world, the broaching tools market is expected to witness a significant growth during the forecast period.

Rising automotive production is driving the demand for broaching tools. In recent years, there is an increase in demand for high-end automotive, resulting in increased vehicle production, mainly in the developed regions such as North America and Europe. Moreover, the demand for commercial vehicles and passenger cars, primarily in developing nations, is increasing. Broaching tools are widely utilized in automotive sector to manufacture gears, transmission shafts, steering wheel hubs, steering yokes, and others. According to the Center for Automotive Research, a non-profit organization, in 2018, automakers such as FCA, GM, Ford, Hyundai, Nissan, Volkswagen, and Toyota invested US$ 4.8 billion in the automotive industry. In addition, automotive investment in research and development (R&D) has increased by 6.7% to reach US$ 67.09 billion annually in Europe. Thus, rising demand for high-end vehicles and increasing vehicle production is boosting the adoption of broaching tools in the automotive industry.

The rapid change in modern warfare has been urging the governments to allocate higher funds toward respective military forces. The higher military budget allocation enables the military forces to engage themselves in the development of robust arms and ammunition, indigenous technologies, rugged devices, and various other technologies. At present, the soldier and military vehicle modernization practices are peaking among most military forces to keep the personnel and vehicles ready for mission. With an objective to modernize armed forces, ministries across the world are investing substantial amounts. Countries such as the US, China, India, Russia, Saudi Arabia, France, and Germany are increasing their defense budgets year-on-year. The broaching tools are widely used in manufacturing various components of arms and ammunition, armed vehicles, military aircrafts, battle tanks, IFVs, and communication and computing devices. Thus, increasing defense budget will subsequently create growth opportunities for market players.

Trends and growth analysis reports related to Manufacturing and Construction : READ MORE..

The List of Companies - Broaching Tools Market

- American Broach & Machine Company

- Arthur Klink GmbH

- Colonial Tool Group Inc.

- Ekin S coop

- Blohm Jung GmbH

- Messer Räumtechnik GmbH & Co. KG

- Mitsubishi Heavy Industries Machine Tool Co., Ltd.

- Nachi-Fujikoshi Corp.

- The Broach Masters, Inc.

- Miller Broach

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

获取此报告的免费样本

获取此报告的免费样本