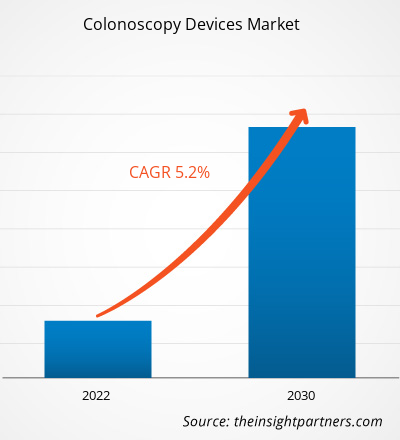

[研究报告] 结肠镜设备市场预计将从 2024 年的 23 亿美元增长到 2031 年的 33.6 亿美元,2025-2031 年期间的复合年增长率为 5.7%。

市场洞察和分析师观点:

结肠镜检查设备市场预测可以帮助该市场的利益相关者规划其增长战略。该报告包含增长前景、结肠镜检查设备市场趋势及其在预测期内可预见的影响。

结肠镜检查使用可重复使用的内窥镜进行。它们是柔性光纤仪器,可插入肛门并直接穿过结肠。结肠镜有助于内镜医师发现慢性疾病,并检查患者是否患有恶性肿瘤或癌前病变。50岁及以上人群应将结肠镜检查作为常规癌症筛查方案的一部分。在医院或门诊手术中心(ASC),结肠镜检查通常在轻度镇静下进行。结直肠癌患病率的上升以及制造商在结肠镜检查设备方面的技术进步,促进了结肠镜检查设备市场规模的不断增长。然而,直肠疾病替代诊断方法的匮乏阻碍了市场的增长。

增长动力:

结直肠癌患病率上升推动结肠镜检查设备市场增长

结直肠癌是发生于直肠或结肠组织的恶性肿瘤。由于直肠癌和结肠癌具有共同的特征,因此常被归为一类。根据世界卫生组织(WHO)的数据,结肠癌在全球癌症死亡病例中位居第二。2020年,全球结直肠癌新发病例超过190万,死亡人数超过93万。不同地区结直肠癌的发病率和死亡率存在显著差异。欧洲、澳大利亚和新西兰的发病率最高,而东欧的死亡率最高。根据欧洲癌症信息系统(ECI)的数据,2020年,欧盟27国结直肠癌占所有新发癌症病例的12.7%,占该疾病导致的总死亡人数的12.4%。在欧洲,结直肠癌的发病率高,是仅次于乳腺癌的第二大癌症,也是仅次于肺癌的第二大死亡原因。据世界卫生组织统计,2020年全球结直肠癌新发病例超过190万例,预计到2040年全球结直肠癌年发病负担将上升至320万例(增长63%),死亡病例将上升至160万例(增长73%)。

在美国,结直肠癌是每年确诊的第三大常见癌症类型(不包括皮肤癌)。根据美国癌症协会的数据,2023年,美国约有15.3万人被诊断出患有结直肠癌。其中包括106,950例结肠癌新发病例(男性54,420例,女性52,550例),以及46,050例直肠癌新发病例(男性27,440例,女性18,610例)。对于结直肠癌而言,结肠镜检查是一项重要的筛查测试,已成为常规癌症筛查的一部分。因此,结直肠癌患病率的上升推动了结肠镜检查设备市场的增长。

结肠镜检查的替代方法包括乙状结肠镜检查(一种侵入性较小的结肠镜检查方式)和粪便样本检测(一种非侵入性方法)。自21世纪初以来,医生们一直广泛推荐结肠镜检查用于筛查50岁及以上患者的结肠癌。然而,近年来,他们感到需要改变策略。他们担心结肠镜检查的费用和麻烦,这使得人们不愿接受这些筛查程序。此外,与结肠镜检查相比,还有其他同样有效的、侵入性更小、更轻松的检查方法。因此,替代诊断测试的出现阻碍了结肠镜检查设备市场的增长。

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

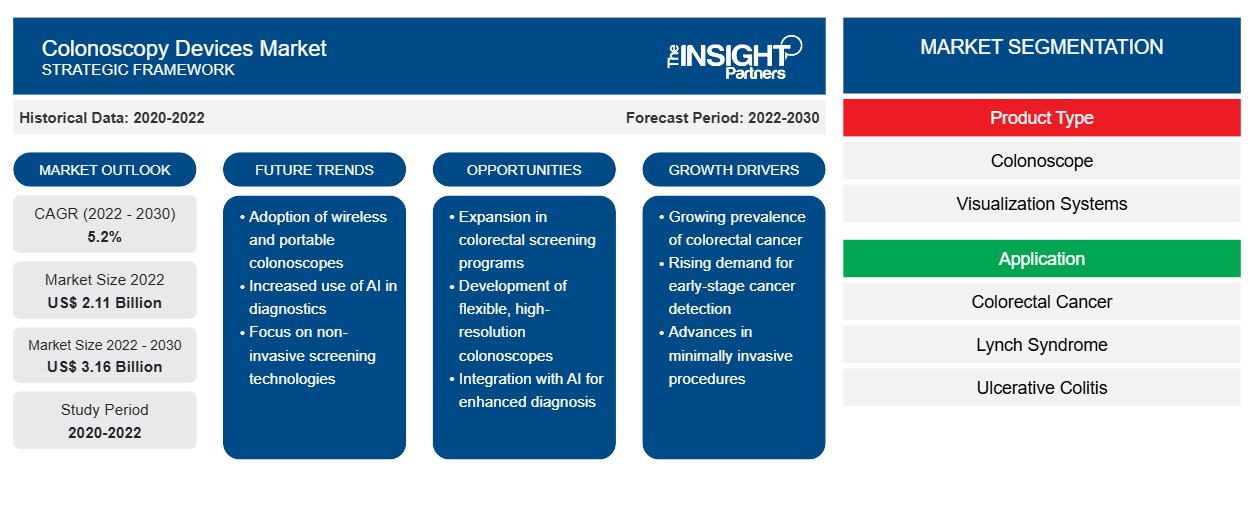

结肠镜检查设备市场:战略洞察

- 获取此报告的顶级关键市场趋势。此免费样品将包括数据分析,从市场趋势到估计和预测。

报告细分和范围:

结肠镜检查设备市场分析是通过考虑以下几个部分进行的:产品类型、应用和最终用户。

节段分析:

按产品类型,结肠镜设备市场细分为结肠镜、可视化系统和其他。结肠镜细分市场在2022年占据了最大的市场份额。然而,可视化系统细分市场预计将在2022年至2030年期间实现最高的复合年增长率。

结肠镜设备市场按应用细分为结直肠癌、林奇综合征、溃疡性结肠炎、克罗恩病及其他。结直肠癌领域在2022年占据了结肠镜设备市场的最大份额,预计该领域在2022-2030年期间的复合年增长率最高。结肠镜检查可以高精度地检测和切除恶性和恶性病变。它是结直肠癌筛查的重要诊断工具。几乎所有国内外胃肠道和癌症协会都建议将其作为首选筛查方法。

按最终用户划分,结肠镜检查设备市场可分为医院、门诊手术中心和其他类型。2022年,医院占据了结肠镜检查设备最大的市场份额,预计在2022-2030年期间将实现最高的复合年增长率,这得益于医院采用先进技术以及医院筛查数量的增加。

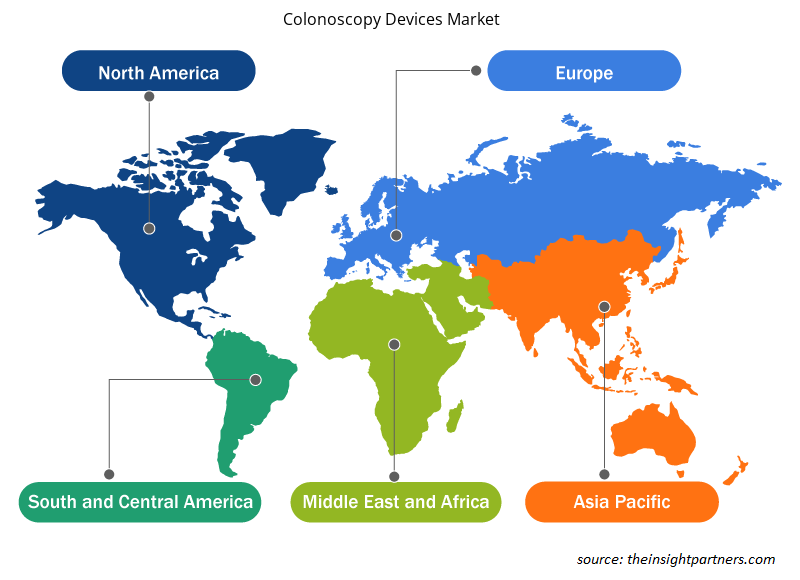

区域分析:

结肠镜设备市场报告的地理范围涵盖北美、欧洲、亚太地区、中东和非洲以及南美和中美。北美在2022年占据了最大的市场份额。北美市场的增长受到人口老龄化负担加重、产品上市数量增加以及开发先进结肠镜设备的研发活动的推动。

结肠镜检查设备市场区域洞察

Insight Partners 的分析师已详尽阐述了预测期内影响结肠镜检查设备市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美的结肠镜检查设备市场细分和地域分布。

- 获取结肠镜检查设备市场的区域特定数据

结肠镜检查设备市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2024年的市场规模 | 23亿美元 |

| 2031年的市场规模 | 33.6亿美元 |

| 全球复合年增长率(2025-2031) | 5.7% |

| 史料 | 2021-2023 |

| 预测期 | 2025-2031 |

| 涵盖的领域 | 按产品类型

|

| 覆盖地区和国家 | 北美

|

| 市场领导者和主要公司简介 |

|

结肠镜检查设备市场参与者密度:了解其对业务动态的影响

结肠镜检查设备市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

市场参与者密度是指特定市场或行业内企业或公司的分布情况。它表明特定市场空间内竞争对手(市场参与者)的数量相对于其规模或总市值而言。

在结肠镜检查设备市场运营的主要公司有:

- 救护车

- 富士胶片

- 恩多梅德系统有限公司

- 奥林巴斯

- 宾得

- 胃肠道视图

免责声明:以上列出的公司没有按照任何特定顺序排列。

- 获取结肠镜设备市场主要参与者的概述

竞争格局和重点公司:

AMBU AS、富士胶片、Endomed systems gmbh、奥林巴斯、Steris PLC、GI View、波士顿科学公司、宾得医疗、Avantis Medical Systems 和 SonoScape Medical Corp 是结肠镜设备市场报告中介绍的知名公司。这些公司专注于开发新技术、升级现有产品并扩大其地域覆盖范围,以满足全球日益增长的消费者需求。根据各公司新闻稿,以下是近期的一些关键进展:

- 2021年4月,富士胶片医疗系统公司推出了G-EYE 700系列结肠镜。G-EYE是由Smart Medical开发的一项技术,可在常规检查中提供辅助。G-EYE 700系列结肠镜扩展了富士胶片创新的结肠镜产品组合。G-EYE将作为700系列结肠镜系列的扩展产品,与富士胶片的ELUXEO内窥镜视频成像系统兼容。

- 2020年10月,奥林巴斯获得510(k)许可,其两款结肠镜PCF-H190T和PCF-HQ190正式上市。这两款产品进一步增强了医生诊断和治疗胃肠道疾病的能力。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 结肠镜检查设备市场

获取免费样品 - 结肠镜检查设备市场