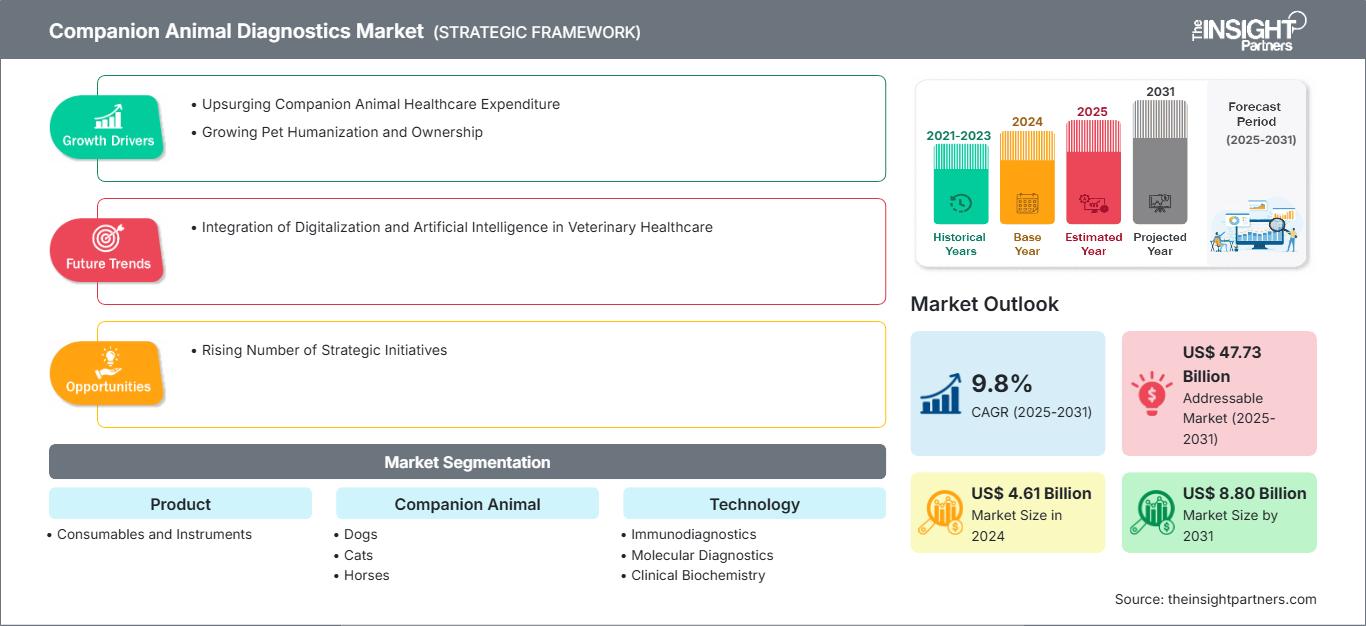

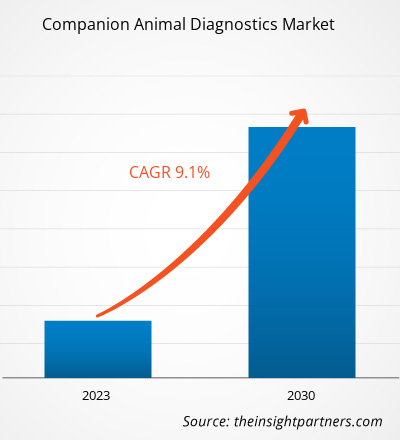

伴侣动物诊断市场规模预计将从2024年的46.1亿美元增至2031年的88亿美元。预计该市场在2025年至2031年期间的复合年增长率为9.8%。数字化和人工智能在兽医医疗保健领域的融合可能会在预测期内带来新的市场趋势。

伴侣动物诊断市场分析

宠物的人性化程度日益提高,全球人口的增长正在重塑兽医医疗保健格局。宠物主人越来越愿意为宠物的健康付费,这推动了对精准、微创诊断解决方案的需求。

伴侣动物极易感染传染病和慢性病。一些参考资料强调了宠物狗的饲养率不断上升以及它们在医疗保健服务方面的相关支出。宠物行业是一个综合体,预计在预测期内,对伴侣动物诊断产品的需求将会增加。根据美国宠物产品协会2023-2024年全国宠物主人调查显示,2023年,美国分别有超过4650万和6510万户家庭饲养猫和狗。根据HealthforAnimals的报告,在英国疫情封锁期间,超过200万人收养了宠物,而在澳大利亚,疫情期间收养的宠物超过100万只。此外,美国、欧盟和中国的家庭收养了超过5亿只猫和狗。大约三分之一的家庭将狗视为最受欢迎的宠物。近四分之一的宠物主人养猫。人口结构的变化、收入水平的提高以及疫情后人们日益增长的宠物偏好,都增加了收养宠物的人数。发达经济体的宠物主人通过购买宠物保险来规避不断上涨的兽医治疗费用。在瑞典和英国等国家,宠物在家庭中的普及率非常高,通常保险计划可以覆盖大量宠物。

因此,宠物拥有量的增长及其人性化程度的提高推动了伴侣动物诊断市场的增长。

伴侣动物诊断市场概览

由于伴侣动物医疗保健支出的激增以及宠物人性化程度的提高和拥有量的增长,伴侣动物诊断市场正在迅速扩张。市场上的知名企业正专注于创新与合作,以提高产品的可用性。然而,诊断产品和基础设施的高成本阻碍了伴侣动物诊断市场的增长。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

伴侣动物诊断市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

伴侣动物诊断市场驱动因素和机遇

伴侣动物医疗保健支出激增

全球在兽医医疗保健方面的支出正在上升。宠物医疗保健支出急剧上升,包括购买宠物食品、非处方药、兽医治疗和宠物保险。宠物护理支出的大幅增加导致对宠物保险的需求不断增长,尤其是在北美和欧洲的主要市场。根据美国宠物产品协会 2023-2024 年的统计数据,美国宠物行业的支出激增。2023 年美国宠物行业的支出为 1436 亿美元,而 2018 年为 1368 亿美元。宠物支出的增长加速了对其护理产品的需求。根据北美宠物健康保险协会 (North American Pet Health Insurance Association Inc.) 的数据,2023 年美国宠物保险总额为 32 亿美元。截至 2022 年底,美国受保宠物总数为 480 万美元,较 2021 年增长 22%。

欧洲的宠物主人在宠物食品、产品、服务和兽医护理方面的支出不断增加。例如,法国每年平均为每只宠物花费 1,224 欧元(约合 1,411 美元)。这些措施旨在通过提供更深入的见解和量身定制的帮助,加快临床决策的信心。许多宠物主人在动物保健方面投入了大量资金,尤其是在兽医护理、诊断和药品方面。宠物健康和预防性诊断检测仍处于早期阶段。

癌症、关节炎和过敏等慢性疾病在动物中很常见,就像人类一样。在宠物中,慢性疾病日益增多,这最终影响了人们在宠物福祉和健康方面的支出。根据澳大利亚动物药品协会的数据,六种最常见的宠物品种每年在澳大利亚宠物相关商品和服务上的支出约为220亿美元。此外,兽医服务支出占比第二高(14%),仅次于食品(51%),2022年兽医服务支出约为31.1亿美元。根据全球动物健康组织(HealthforAnimals)的数据,2022年伴侣动物诊断的支出估计为46亿美元。

兽医健康意识的提高反映了预防医学、先进治疗方法和兽医即时诊断如何帮助维护宠物的健康。成熟经济体的宠物主人通过申请宠物保险来寻求对不断上涨的兽医治疗费用的保障。在瑞典和英国等国家,宠物保险的普及率非常高,通常足以覆盖大量宠物的保险计划。

尽管美国和加拿大的宠物保险普及率低于一些欧洲国家,但其增长势头强劲,这得益于人们对宠物保险益处的认识不断提高,以及人性化的推动。诊断领域也日益普及,兽医因此能够迅速做出治疗决策。定期体检和及早发现潜在健康问题已成为标准做法,这增加了在常规就诊中用于早期病情检测的伴侣动物诊断工具的需求。因此,伴侣动物医疗保健支出的不断增长推动了伴侣动物诊断市场的增长。

战略举措不断增多

在伴侣动物诊断市场运营的大大小小的公司越来越多地采用地域扩张、产品开发和技术进步等战略来增加收入。伴侣动物诊断市场的一些最新发展如下:

- 2025年3月,Antech推出了truRapid FOUR,这是一款全面的内部犬类媒介传播疾病 (CVBD) 筛查检测产品。truRapid FOUR是一种横向流动检测方法,使用全血、血清或血浆,检测犬类针对无形体属、埃立克体属和莱姆病C6(伯氏疏螺旋体)的抗体,以及心丝虫(犬恶丝虫)抗原。

- 2024年12月,Zoetis Inc.推出了其新型无屏即时血液分析仪Vetscan OptiCell。它是兽医血液学领域最重要的基于试剂盒、由人工智能驱动的诊断工具。它提供全血细胞计数 (CBC) 分析,从而提供精准的洞察。

- 2024 年 7 月,EKF Diagnostics 推出了 Biosen C-Line,这是一款最新的葡萄糖和乳酸分析仪,旨在提高易用性。它配备触摸屏和增强的连接选项,可通过 EKF Link 与医院和实验室 IT 系统无缝集成。这款台式分析仪提供精确的葡萄糖和乳酸测量值,可用于临床糖尿病管理,也可用于精英运动队在训练中追踪乳酸生成情况。

- 2024 年 2 月,MiDOG Animal Diagnostics 推出了一款突破性的一体化诊断检测,能够快速诊断各种动物的真菌和细菌感染,包括抗生素耐药性。该测试旨在用高效的分子诊断方法取代传统的测试程序,并资助针对不同动物的广泛治疗策略。

- 2023 年 4 月,玛氏公司 (Mars Incorporated) 收购了 Heska Corporation,后者是全球领先的先进兽医诊断和特种产品供应商。

- 2022 年 9 月,Zomedica(一家兽医保健公司)推出了其最新的检测方法——游离 T4 (fT4),用于 TRUFORMA 诊所内生物传感器测试平台。

- 2022 年 8 月,PepiPets 推出了其最新的移动诊断测试服务,客户可以在家中为宠物进行诊断测试。

- 2022 年 6 月,玛氏宠物护理 (Mars Petcare) 发起了一项创新计划——MARS PETCARE BIOBANKTM。这是一项为期 10 年的努力,通过整合美国境内 20,000 只猫和狗的基因、临床和生活方式信息来彻底改变宠物健康。

- 2022 年 3 月,DJO 的一个部门 Companion Animal Health 是一家全球动物保健公司,专门从事兽医市场的激光和康复治疗以及现场诊断,与 HT Bioimaging 达成战略协议,成为联合品牌并在美国和加拿大独家销售 HTVet 产品。

因此,市场参与者积极参与产品发布、扩展、合作和合并 &预计这些收购将在未来几年为伴侣动物诊断市场创造丰厚的增长机会。

伴侣动物诊断市场报告细分分析

促成伴侣动物诊断市场分析的关键细分市场是产品、伴侣动物、技术、应用和最终用户。

- 根据产品,伴侣动物诊断市场分为耗材和仪器。耗材细分市场在 2024 年占据了更大的市场份额。

- 按伴侣动物划分,伴侣动物诊断市场分为狗、猫、马和其他动物。狗细分市场在 2024 年占据了最大的市场份额。

- 就技术而言,伴侣动物诊断市场分为免疫诊断、分子诊断、临床生物化学、血液学、尿液分析等。 2024年,免疫诊断领域占据了最大的市场份额。

- 根据应用,伴侣动物诊断市场可细分为临床病理学、细菌学、寄生虫学、病毒学等。其中,临床病理学领域在2024年占据了最大的市场份额。

- 就最终用户而言,伴侣动物诊断市场可分为诊断和参考实验室、兽医院和诊所、研究机构等。兽医院和诊所领域在2024年占据了市场主导地位。

按地区划分的伴侣动物诊断市场份额分析

伴侣动物诊断市场报告的地理范围主要集中在五个地区:北美、亚太地区、欧洲、南美和中美以及中东和非洲。就收入而言,北美在 2024 年占据了市场主导地位。预计在预测期内,北美将继续在全球市场占据主导地位。美国是世界上最大的伴侣动物诊断市场。受宠物拥有量增加、兽医医疗保健支出上升以及诊断技术进步的推动,美国伴侣动物诊断市场正在增长。由于伴侣动物各种疾病的患病率上升,试剂和检测试剂盒等消耗品保持了较高的市场份额。

美国的宠物拥有量激增。根据美国宠物产品协会 2021-2022 年全国宠物主人调查,美国的宠物数量已达到异常高位,目前约有 70% 的家庭(约 9100 万户)拥有宠物。同样,根据尼尔森智库 (NielsenIQ) 的数据,2022 年美国宠物主人在宠物身上的支出为 660 亿美元。此外,根据美国宠物产品协会 (American Pet Product Association) 2023 年的数据,宠物拥有量正在上升,美国拥有 9000 万只宠物狗。宠物拥有量的激增得益于社会动态的不断变化以及人们对宠物陪伴在情感和健康方面益处的更多理解。这导致对先进诊断服务的需求大幅增长,这些服务用于检测、监测和管理日益增多的伴侣动物慢性疾病。宠物数量的增加和宠物疾病发病率的上升,需要各种诊断程序才能准确诊断和治疗慢性和急性疾病,这推动了美国伴侣动物诊断市场的增长。

伴侣动物诊断

伴侣动物诊断市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响伴侣动物诊断市场的区域趋势和因素。本节还探讨了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的伴侣动物诊断市场细分和地域分布。

伴侣动物诊断市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2024 | US$ 4.61 Billion |

| 市场规模 2031 | US$ 8.80 Billion |

| 全球复合年增长率 (2025 - 2031) | 9.8% |

| 历史数据 | 2021-2023 |

| 预测期 | 2025-2031 |

| 涵盖的领域 |

By 产品

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

伴侣动物诊断市场参与者密度:了解其对业务动态的影响

伴侣动物诊断市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 伴侣动物诊断市场 主要参与者概述

伴侣动物诊断市场新闻及最新发展

伴侣动物诊断市场评估通过收集一手和二手研究后的定性和定量数据进行,这些数据包括重要的公司出版物、协会数据和数据库。以下是伴侣动物诊断市场的一些关键发展:

- 全球领先的动物保健公司硕腾公司 (Zoetis Inc.) 将于明年 1 月在佛罗里达州奥兰多举行的兽医会议及博览会 (VMX) 上向全球市场推出其新型无屏即时血液分析仪 Vetscan OptiCell。这是首款基于试剂盒、由人工智能 (AI) 驱动的兽医血液学诊断工具,可在几分钟内提供全血细胞计数 (CBC) 分析,从而提供准确的诊断结果。 (来源:Zoetis Inc.,新闻稿,2024 年 12 月)MiDOG Animal Diagnostics LLC 是采用下一代 DNA 测序分析的基于微生物的兽医诊断解决方案的杰出领导者,该公司已于 2024 年公布了改进的品牌战略。更新后的品牌强调了 MiDOG 技术对所有动物物种的适应性,这与之前对犬类诊断的强调不同。 (来源:MiDOG Animal Diagnostics LLC,新闻稿,2024 年 2 月)

伴侣动物诊断市场报告覆盖范围和可交付成果

《伴侣动物诊断市场规模和预测(2021-2031)》报告对市场进行了详细的分析,涵盖以下领域:

- 伴侣动物诊断市场规模以及涵盖范围内所有关键细分市场的全球、区域和国家/地区层面的预测

- 伴侣动物诊断市场趋势以及市场动态,例如驱动因素、限制因素和关键机遇

- 详细的 PEST 和 SWOT 分析

- 伴侣动物诊断市场分析,涵盖关键市场趋势、全球和区域框架、主要参与者、法规和最新市场发展

- 行业格局和竞争分析,涵盖市场集中度、热图分析、知名参与者和伴侣动物诊断市场的最新发展

- 详细的公司个人资料

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 伴侣动物诊断市场

获取免费样品 - 伴侣动物诊断市场