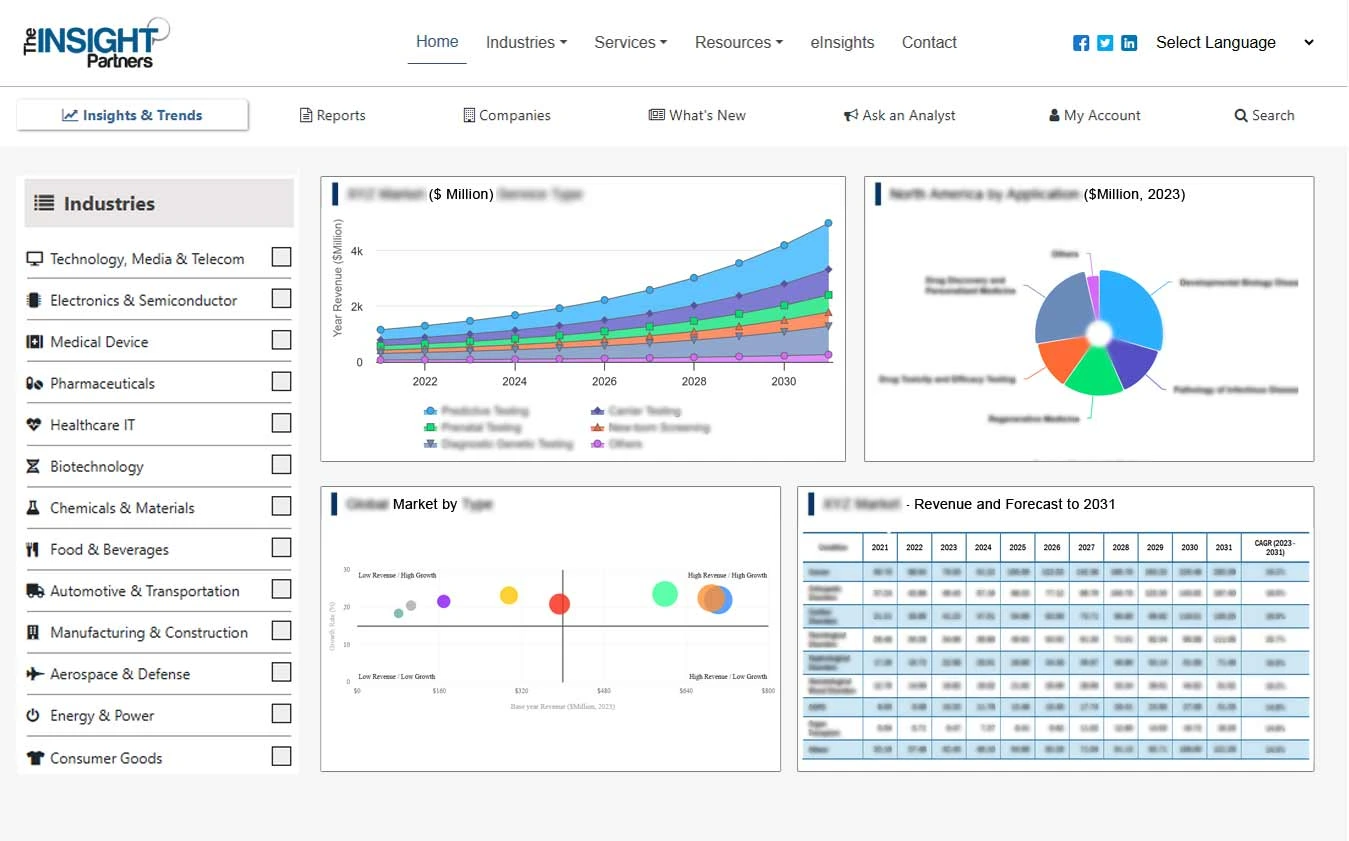

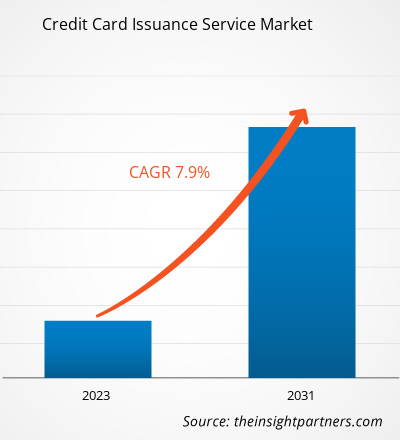

预计信用卡发行服务市场将从 2023 年到 2031 年的复合年增长率为 7.9%。信用卡越来越受欢迎,因为它们携带方便,并且可以替代现金。

信用卡发行服务市场分析

新兴国家对信用卡服务需求的增长正在推动信用卡发行服务行业的发展。信用卡行业还开发了简化的在线信用卡申请、针对特定需求定制的多种类型的信用卡、具有额外支出限制的虚拟卡以及个性化优惠和奖励。此外,非接触式和数字信用卡服务变得越来越流行,人们对现金替代品和低成本信用卡的需求也在增加。

信用卡发卡服务行业概况

信用卡发行机构在信用提供商批准帐户时或之后向客户发行信用卡,信用提供商不必与信用卡发行机构是同一组织。持卡人随后可以使用信用卡在接受该卡的商家处购物。此外,信用卡是提供给持卡人的支付卡,允许他们根据未偿还债务向商家支付产品和服务费用。信用卡提供将资金从一个帐户转移到另一个帐户的高安全性功能,增加了用户对信用卡的需求。

定制研究以满足您的要求

我们可以优化和定制我们的标准产品无法满足的分析和范围。这种灵活性将帮助您获得业务规划和决策所需的准确信息。

信用卡发行服务市场:

复合年增长率(2023 - 2031)7.9%- 2023 年市场规模

XX 百万美元 - 2031 年市场规模

XX 百万美元

市场动态

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

- XXXXXX

关键人物;主力;重要一员

- 费瑟夫公司

- Marqeta 公司

- Stripe 公司

- Giesecke+Devrient 有限公司

- 恩特鲁斯公司

- GPUK律师事务所

- 尼姆私人有限公司有限公司

- 菲斯

- 泰雷兹

- 美国运通公司

区域概况

- 北美

- 欧洲

- 亚太

- 南美洲和中美洲

- 中东和非洲

市场细分

类型

类型- 消费信用卡和商业信用卡

发行人

发行人- 银行

- 信用合作社

- 非银行金融公司

最终用户

最终用户- 个人的

- 商业

- 示例 PDF 通过定性和定量分析展示了内容结构和信息的性质。

信用卡发行服务市场驱动因素和机遇

非接触式和数字信用卡服务的增加将推动信用卡发行服务市场的增长。

非接触式支付的最大优势是速度快,这意味着无需排队。此外,客户通常喜欢无需输入 PIN 码的便利性。非接触式支付通常被称为“一触即付”或“一触即付”,速度可比传统支付方式快 10 倍。此外,许多公司现在提供与智能手机等设备相连的信用卡服务,并使用与非接触式信用卡相同的技术提供另一种非接触式支付方式。例如,Apple Pay 将个人信息和信用卡数据安全地保存在 iPhone 或 Apple Watch 上,让消费者只需触摸一下即可前往参与活动的商店。

信用卡发行服务市场报告细分分析

- 根据类型,信用卡发行服务市场分为消费信用卡和商业信用卡。预计到 2023 年,消费者信用卡领域将占据相当大的信用卡发行服务市场份额。

- 这是由于最近消费者信用卡类别的激增,因为个人更喜欢信用卡来满足日常交易和个人信用需求。

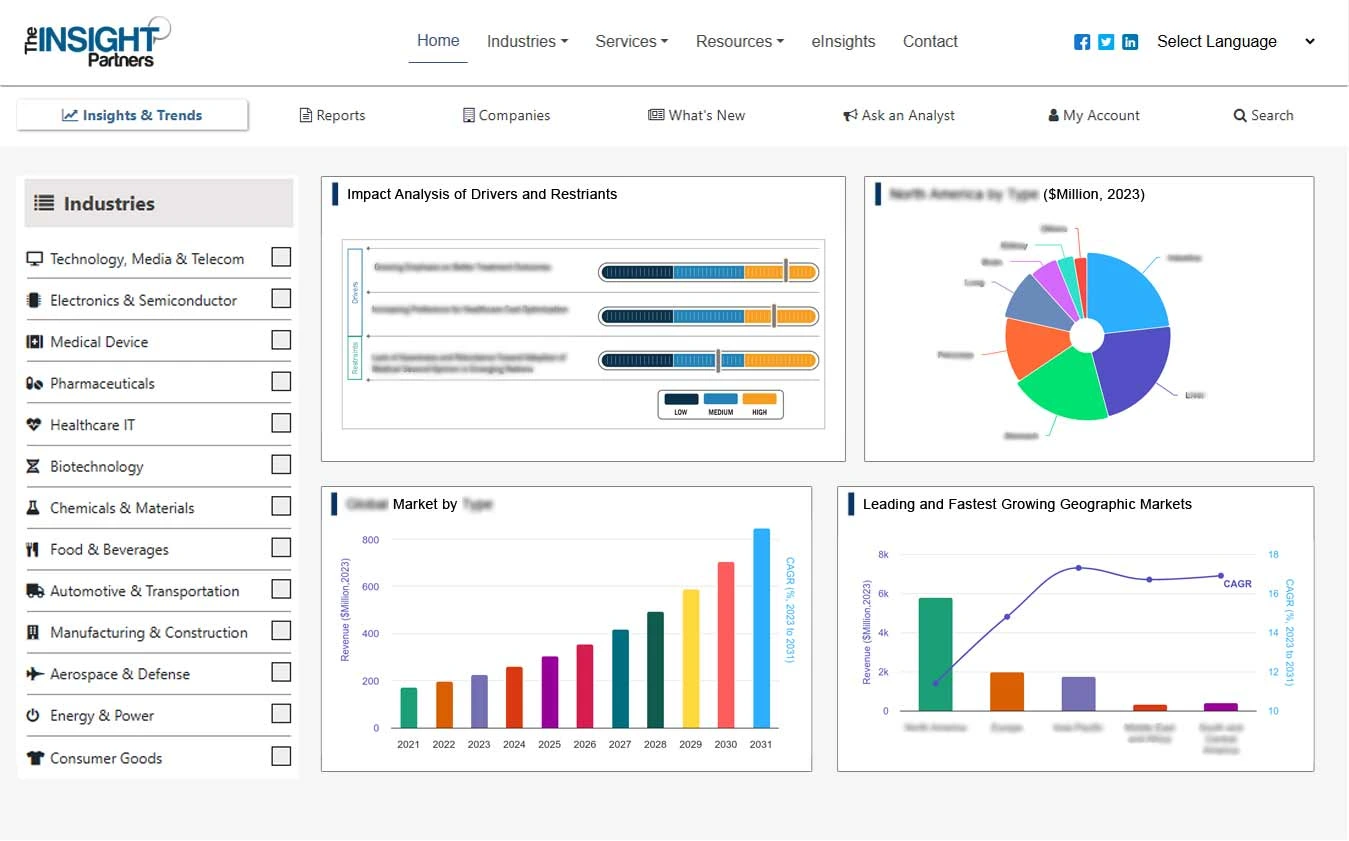

信用卡发行服务市场份额按地区分析

信用卡发行服务市场报告的范围主要分为五个地区——北美、欧洲、亚太地区、中东和非洲以及南美。北美正在经历快速增长,预计将占据相当大的信用卡发行服务市场份额。由于四家主要公司的存在,该地区的信用卡行业正在蓬勃发展:Visa、万事达卡、美国运通和 Discover。此外,信用卡在美国非常受欢迎,约有 1.2 亿个人负债。这些因素推动了该地区的市场增长。

信用卡发行服务市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2023年市场规模 | XX 百万美元 |

| 2031 年市场规模 | XX 百万美元 |

| 全球复合年增长率(2023 - 2031) | 7.9% |

| 历史数据 | 2021-2022 |

| 预测期 | 2023-2031 |

| 涵盖的领域 | 按类型

|

| 覆盖地区和国家 | 北美

|

| 市场领导者和主要公司简介 |

|

- 示例 PDF 通过定性和定量分析展示了内容结构和信息的性质。

《信用卡发行服务市场分析》是根据类型、发行人、最终用户和地理位置进行的。根据类型,信用卡发行服务市场分为消费信用卡和商业信用卡。就发行人而言,市场分为银行、信用合作社和非银行金融公司。根据最终用途,市场分为个人和企业。根据地理位置,市场分为北美、欧洲、亚太地区、中东和非洲以及南美洲。

信用卡发行服务市场新闻及最新发展

公司在行业内采取并购等无机和有机策略信用卡发行服务市场。信用卡发行服务市场预测可以帮助利益相关者规划其增长战略。下面列出了最近的一些主要市场发展:

- 2021 年 3 月,Mastercard Inc. 以约 31.2 亿美元(28 亿欧元)的价格收购了 Nets Group 的账户到账户服务,包括清算、快速支付和电子账单解决方案。Mastercard 的收购增加了其在高增长市场和电子商务领域的曝光度,同时将其业务模式重新集中在商家、发行商和电子安全服务上。Nets Group 成立于丹麦,提供全方位的信用卡发行服务。

[来源:万事达卡公司,公司网站]

[来源:Zuora, Inc.,公司网站]

信用卡发行服务市场报告范围和交付成果

《信用卡发行服务市场规模及预测(2021-2031)》市场报告详细分析了以下领域的市场:

- 范围内涵盖的所有主要细分市场的全球、区域和国家层面的市场规模和预测。

- 市场动态,例如驱动因素、限制因素和关键机遇。

- 未来的主要趋势。

- 详细的 PEST 和 SWOT 分析

- 全球和区域市场分析涵盖主要市场趋势、主要参与者、法规和最新的市场发展。

- 行业格局和竞争分析,包括市场集中度、热图分析、关键参与者和最新发展。

- 详细的公司简介。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST 和 SWOT 分析

- 市场规模价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

常见问题

The global credit card issuance service market is expected to grow at a CAGR of 7.9% during the forecast period 2023–2031.

The increase in contactless and digital credit card services and credit card demand continues to grow in emerging countries. and growth in e-commerce are the major factors that propel the global credit card issuance service market.

Technological advancements transforming credit card issuance services are anticipated to play a significant role in the global credit card issuance service market in the coming years.

The key players holding majority shares in the global credit card issuance service market are Fiserv Inc., Marqeta Inc., Stripe Inc., Giesecke+Devrient GmbH, and Entrust Corporation,

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Fiserv Inc.

- Marqeta Inc.

- Stripe Inc.

- Giesecke+Devrient GmbH

- Entrust Corporation

- GPUK LLP

- Nium Pte. Ltd

- fis

- Thales

- American Express Company

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

获取此报告的免费样本

获取此报告的免费样本