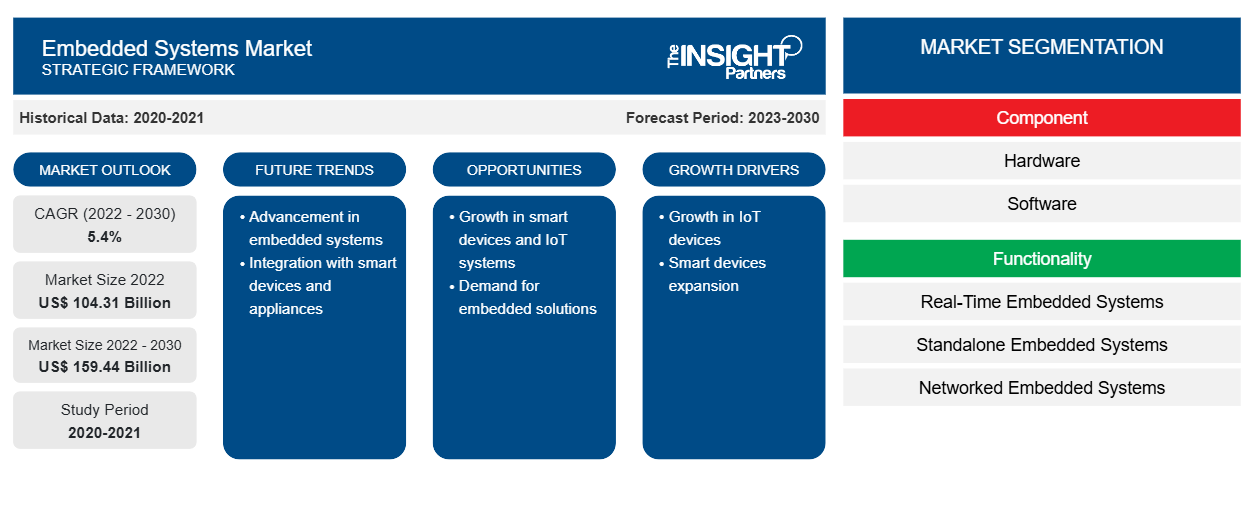

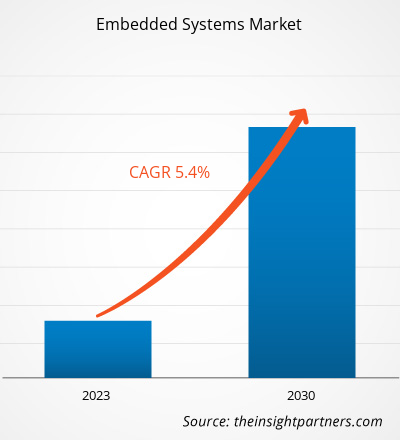

[研究报告] 2022 年嵌入式系统市场价值为 1043.1 亿美元,预计到 2030 年将达到 1594.4 亿美元。预计 2022 年至 2030 年嵌入式系统市场的复合年增长率为 5.4%。

嵌入式系统市场分析师观点:

对自动化、联网设备、微处理器进步、物联网使用、智能家居和建筑以及医疗设备的需求不断增长,推动了嵌入式系统市场的发展。此外,新技术和创新的激增以及对电动和混合动力汽车的需求增长也推动了嵌入式系统市场的发展。物联网 (IoT) 的采用推动了对嵌入式系统的需求,嵌入式系统收集并向基于云的应用程序发送来自链接设备的数据。然后可以分析这些信息并用于决策。微处理器技术的进步,例如小型化、低功耗和高处理能力,推动了过去几十年全球嵌入式系统市场的增长。

嵌入式系统市场概览:

集成到其他设备或系统中以管理或监控其操作的计算机系统称为嵌入式系统。这些系统旨在执行某些任务,并用于各种应用,例如汽车、医疗保健、工业自动化和消费电子产品。它们通常非常可靠和高效,功耗低且体积小。它们可以被编程来控制机器、监控传感器、收集和传输数据以及管理电力和资源等,预计这将在预测期内推动嵌入式系统市场的增长。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

- 获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

市场驱动因素:

汽车行业需求增长推动嵌入式系统市场增长

现代技术的影响塑造了行业。数字技术在世界各地的出现使得在汽车中实施先进的解决方案成为可能。如今,汽车配备了一系列先进的技术,可让用户驾驶更安全、更舒适、更愉快。嵌入式系统在常规汽车和混合动力汽车中都得到了广泛的应用。这些系统在重新设计汽车行业方面发挥着重要作用。这些系统用于电动和混合动力汽车中的 ADAS 技术。对电动和混合动力汽车的不断增长的需求正在推动市场的发展。例如,根据国际能源署 (IEA) 的数据, 2022 年电动汽车销量增加了 1000 万辆。全球销售的所有新车中,电动汽车占 14%。全球电动汽车销量的不断增长提高了汽车制造商对嵌入式系统的采用。这些系统用于监视和控制电动汽车的各种功能,包括充电系统和电池管理系统。

嵌入式硬件集成到车辆系统中,以减少过热和气体释放。这些系统甚至用于豪华汽车,使其更智能、更节能、更安全。汽车行业的扩张推动了嵌入式系统市场的增长。嵌入式系统市场的主要参与者正在合作开发用于自动驾驶汽车的高性能嵌入式系统。例如,2022 年 5 月,麦格纳国际公司与黑莓有限公司合作,为汽车原始设备制造商 (OEM) 开发下一代 ADAS 解决方案。麦格纳国际公司正在利用黑莓有限公司的各种 QNX 软件平台,例如 QNX 软件开发平台、用于 ADAS 的 QNX 平台和用于安全的 QNX OS,用于设计工程、验证和性能优化角色以及系统集成。此次合作帮助麦格纳国际为 ADAS、自动驾驶和信息娱乐系统开发高性能和安全的嵌入式系统,推动嵌入式系统市场的发展。

报告细分和范围:

嵌入式系统市场根据组件、功能和应用进行细分。根据组件,嵌入式系统市场分为硬件和软件。硬件部分进一步细分为传感器、微控制器、处理器和 ASIC、内存等。功能部分进一步分为实时嵌入式系统、独立嵌入式系统、网络嵌入式系统和移动嵌入式系统。根据应用,嵌入式系统市场分为汽车、电信、医疗保健、工业、消费电子等。根据地理位置,嵌入式系统市场分为北美、欧洲、亚太地区、中东和非洲以及南美。

节段分析:

根据组件,嵌入式系统市场分为硬件和软件。硬件部分细分为传感器、微控制器、处理器和 ASIC、内存等。硬件部分在 2022 年占据了嵌入式系统最大的市场份额,预计在 2022-2030 年期间将在市场上实现最高的复合年增长率。传感器使嵌入式系统能够观察周围环境的变化并收集有价值的实时数据。嵌入式系统从传感器接收相关数据,对其进行处理,根据传感器的数据做出决策并根据决策采取行动。在物联网、机器人和人工智能系统中,嵌入式系统和传感器同时运行以执行智能任务。此外,传感器可以根据其功能、输出和测量进行分类。温度、压力、湿度、光、运动、声音和气体传感器是典型传感器类型的例子。每种传感器类型的规格都说明了其性能和特性,例如范围、分辨率、灵敏度、准确度、精度、响应时间和噪声。传感器的这种多功能特性可以作为促进嵌入式系统市场增长的参数。

区域分析:

嵌入式系统市场大致分为五个主要区域:北美、欧洲、亚太地区 (APAC)、中东和非洲 (MEA) 和南美。2022 年,北美占据了嵌入式系统最大的市场份额,其次是亚太地区和欧洲。由于对自动化和软件的投资增加,以及对物联网技术的投资不断增加,该地区在全球嵌入式系统市场中占有相当大的份额。消费者越来越多地采用物联网解决方案,推动了北美嵌入式系统市场的发展。物联网技术在电动汽车 (EV) 中得到广泛应用。制造商正在进行投资以增加其电动汽车供应,以满足不断增长的消费者需求。

例如,根据国际能源署 (IEA) 的数据,2023 年 4 月,电动汽车制造商宣布在北美电动汽车供应链上投资总额约 520 亿美元。嵌入式系统在电动汽车中得到广泛应用,以增强持续通信、信息处理、控制和批评组件,从而增强用户体验。消费者越来越多地采用电动汽车,这推动了嵌入式系统市场的发展。嵌入式系统鼓励 电动汽车中的能源管理系统。该系统通过确保有效利用储存的能量来控制电力循环和能源使用。

在该地区运营的市场参与者也正在提高对嵌入式系统在网络安全实践中提供的好处的认识。例如,2023 年 9 月,Digi International Inc. 宣布将参加 2023 年 10 月在 Arrow University 举行的即将举行的活动。这些活动旨在教育 OEM 以及软件开发人员有关嵌入式系统和软件的设计及其在网络安全实践中的好处。网络攻击的不断增加增加了嵌入式系统的采用。网络安全专家与用户的系统设计团队合作,以确保嵌入式系统具有必要的安全机制来减轻这些攻击造成的损害。该系统通过要求定期固件更新来确保安全性。嵌入式系统在网络安全中被广泛用于入侵检测和预防。它们监视网络流量并自动执行迁移威胁的操作。但是,将嵌入式系统集成到网络安全实践中可以保护用户的系统免受所有类型的恶意行为的侵害。

关键球员分析:

英飞凌科技股份公司、英特尔公司、恩智浦半导体公司、高通公司、瑞萨电子公司、意法半导体公司、德州仪器公司、微芯片科技公司、研华有限公司和 Marvell 科技公司是嵌入式系统市场的顶级参与者,因为他们提供多样化的产品组合。

嵌入式系统市场报告范围

嵌入式系统市场区域洞察

Insight Partners 的分析师已详尽解释了预测期内影响嵌入式系统市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的嵌入式系统市场细分和地理位置。

- 获取嵌入式系统市场的区域特定数据

嵌入式系统市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2022 年市场规模 | 1043.1亿美元 |

| 2030 年市场规模 | 1594.4亿美元 |

| 全球复合年增长率(2022 - 2030 年) | 5.4% |

| 史料 | 2020-2021 |

| 预测期 | 2023-2030 |

| 涵盖的领域 | 按组件

|

| 覆盖地区和国家 | 北美

|

| 市场领导者和主要公司简介 |

|

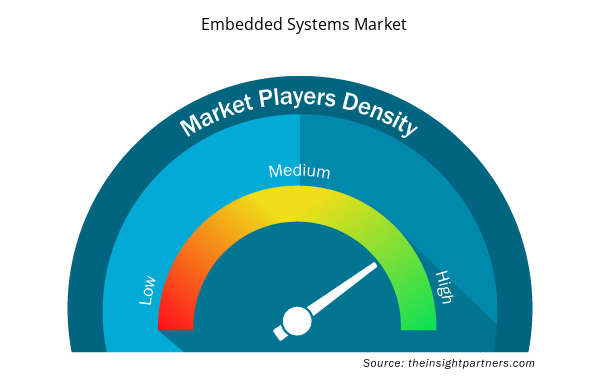

市场参与者密度:了解其对商业动态的影响

嵌入式系统市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求又源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

嵌入式系统市场的主要公司有:

- 英飞凌科技股份公司

- 英特尔公司

- 恩智浦半导体公司

- 高通公司

- 瑞萨电子公司

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 获取嵌入式系统市场顶级关键参与者概览

最新动态:

嵌入式系统市场参与者高度采用无机和有机策略。以下列出了一些近期的关键市场发展:

- 2023 年 7 月,Microchip Technology Inc. 在海得拉巴启动了一个新的研发 (R&D) 设施,并宣布未来五年投资 3 亿美元以扩大其在印度的业务。

- 2023 年 5 月,瑞萨电子推出了三款专为电机控制应用而设计的全新 MCU 产品组。RX 和 RA 系列的设备是瑞萨电子推出的 35 多种新产品之一。凭借多个 MCU 和 MPU 系列、模拟和电源解决方案、传感器、通信设备、信号调节器和其他设备,新 MCU 扩大了市场上领先的电机控制范围。

- 2022 年 9 月,Marvell 推出了 LiquidSecurity 2 (LS2) 硬件安全模块 (HSM) 适配器,旨在用于一般用途和支付处理。LS2 基于该公司的技术,用于顶级超大规模云。新的 Marvell HSM 适配器提供高性能加密加速和处理,以及多达一百万个 AES、RSA 和 ECC 加密密钥的硬件安全存储和 45 个分区,用于多租户用例。

- 2022 年 9 月,英特尔推出了第 12 代英特尔酷睿处理器家族,其中包括全新的第 12 代英特尔酷睿 H 系列移动 CPU,其中最引以为豪的是英特尔酷睿 i9-12900HK,这是有史以来最快的移动处理器。第 12 代英特尔酷睿家族将拥有 60 款处理器和 500 多种设计。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST 和 SWOT 分析

- 市场规模价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

常见问题

The growing research to develop AI-based embedded systems can be a future trend for the embedded system market.

The Embedded Systems Market was US$ 104.31 billion in 2022 and is expected to grow at a 5.4% CAGR from 2022 - 2030.

The key players holding majority shares in the embedded system market include Intel Corporation, Qualcomm Technologies Inc., Texas Instrument, STMicroelectronics, and Infineon Technologies AG.

The US held the largest market share in 2022, followed by China.

China is anticipated to grow with the highest CAGR over the forecast period.

The growing demand in the automotive industry can be a driving factor for the embedded system market.

Trends and growth analysis reports related to Electronics and Semiconductor : READ MORE..

The List of Companies - Embedded Systems Market

- Infineon Technologies AG

- Intel Corp

- NXP Semiconductors NV

- Qualcomm Inc

- Renesas Electronics Corp

- STMicroelectronics NV

- Texas Instruments Inc

- Microchip Technology Inc

- Advantech Co Ltd

- Marvell Technology Inc

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

获取此报告的免费样本

获取此报告的免费样本