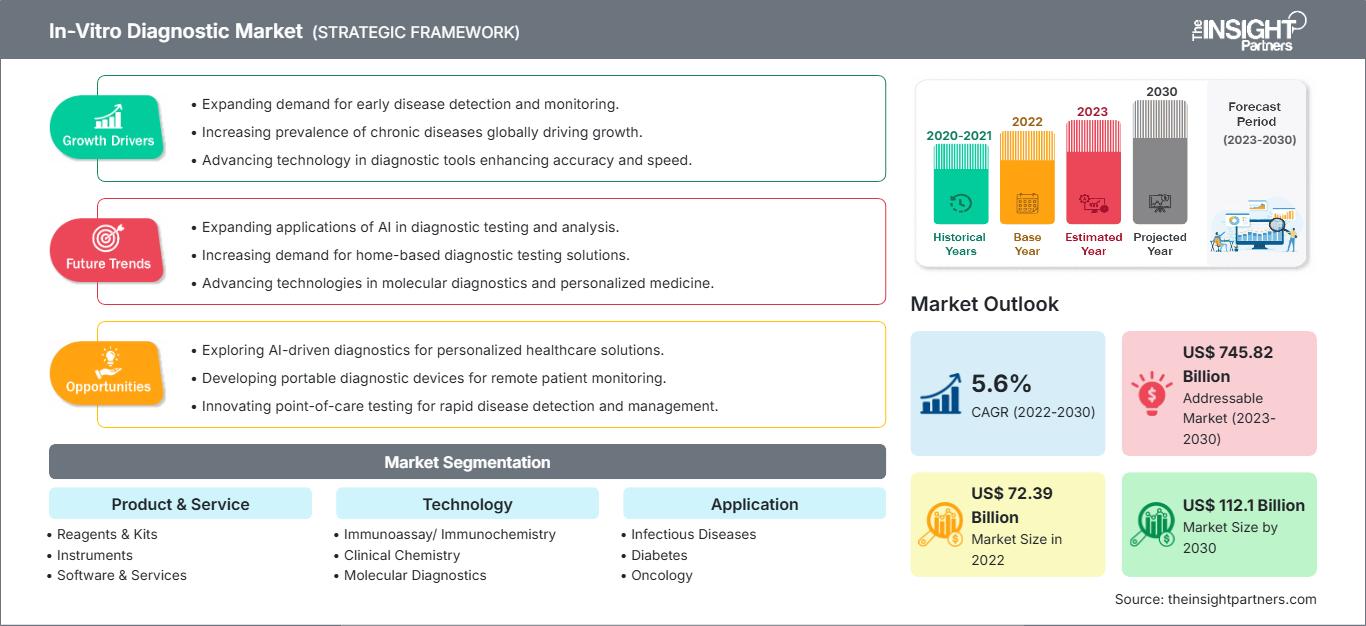

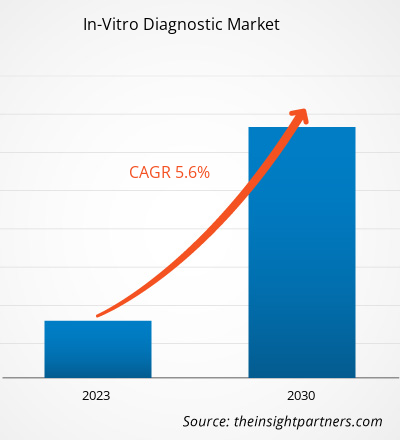

[研究报告] 2022 年体外诊断市场规模为 723.938 亿美元,预计到 2030 年将达到 1121.0351 亿美元;预计 2022 年至 2030 年市场复合年增长率为 5.6%。

市场洞察和分析师观点:

体外诊断包括用于分析从人体获取的生物样本(例如尿液、血液或组织)的实验室检测和医疗设备。这些检测在监测和诊断各种医疗状况方面发挥着至关重要的作用。慢性病患病率的上升、技术进步和老年人口的增长是推动体外诊断市场增长的重要因素。分子诊断技术的进步使世界各地的研究团体和医护人员能够根据个人基因组成改进个性化治疗方案。由于基础设施的进步和健康意识的提高,发展中地区将出现增长机会,这也与体外诊断市场在 2022 年至 2030 年期间的预计增长有关。

增长动力:

根据美国疾病控制与预防中心 (CDC) 的数据,冠状动脉疾病 (CAD) 是成年人死亡的最常见原因。2021 年约有 375,476 人死于 CAD。世界卫生组织在 2022 年国家糖尿病统计报告中发布的估计数字表明,全球约有 4.22 亿人患有糖尿病,其中大多数生活在中低收入国家。此外,每年有 150 万人的死亡与糖尿病直接相关。超重、遗传因素、衰老、久坐的生活方式等因素都在加剧糖尿病的患病率。根据英国癌症研究中心报告估计,2020 年全球报告新增癌症病例约 1810 万例,预计到 2040 年这一数字将增至 2800 万例。因此,心血管疾病、癌症、糖尿病和呼吸系统疾病等传染病和慢性病的患病率不断上升,推动了体外诊断市场的增长。

IVD 用于临床、实验室和门诊环境,旨在帮助检测疾病,从而帮助选择适当的治疗方案。IVD 技术与数字健康解决方案的整合正在全球范围内受到关注。数据分析、人工智能和远程监控提高了诊断测试的价值,从而改善了患者管理和治疗效果。与数字健康解决方案相结合的 IVD 技术可以纳入临床决策支持系统。正如世界卫生组织所承认的,数字健康解决方案可以帮助检测疾病。人工智能健康机器人和其他类似的新兴解决方案可能为患者护理带来机会,并解决高成本和时间要求等挑战。在基于基因组检测的诊断中,深度学习可以识别癌细胞、确定其类型,并根据特定样本的图像预测肿瘤中可能发生的突变。体外诊断中的人工智能和机器学习 (AI/ML) 正在彻底改变医疗器械的开发。这些现代诊断系统促进了基于数字图像分析的诊断,从而改善了医疗决策。智能诊断是极具可扩展性的体外诊断 (IVD) 解决方案,它利用人工智能,以极低的价格获得优于实验室诊断的性能。此外,这类诊断可以通过独特的化学和生物特征检测和分析来获取新兴特征。因此,体外诊断与数字健康技术的融合很可能在未来几年为体外诊断市场带来丰厚的机遇。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

体外诊断市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

报告细分和范围:

全球体外诊断市场细分为产品与服务、技术以及应用。根据产品与服务,市场分为试剂与试剂盒、仪器以及软件与服务。就技术而言,体外诊断市场细分为免疫测定/免疫化学、临床化学、分子诊断、微生物学、血糖自我监测、凝血与止血、血液学、尿液分析等。按应用划分,体外诊断市场分为传染病、糖尿病、肿瘤学、心脏病学、自身免疫性疾病、肾脏病学等。按最终用户划分,体外诊断市场细分为医院、实验室、家庭护理等。根据地域划分,体外诊断市场分为北美(美国、加拿大和墨西哥)、欧洲(德国、法国、意大利、英国、西班牙和欧洲其他地区)、亚太地区(澳大利亚、中国、日本、印度、韩国和亚太其他地区)、中东和非洲(南非、沙特阿拉伯、阿联酋和中东和非洲其他地区)以及南美洲和中美洲(巴西、阿根廷和南美洲和中美洲其他地区)。

分部分析:

根据产品和服务,体外诊断市场细分为试剂和试剂盒、仪器以及软件和服务。2022 年,由于自检试剂盒和 POC 设备的普及,试剂和试剂盒细分市场占据了最大的市场份额。试剂和试剂盒市场的预计增长归因于自检试剂盒和 POC 设备的巨大普及,以及可简化工作并提供准确结果的自动化仪器的可用性和采用率的提高。由于卫生条件不佳,病毒和真菌感染病例不断增加,促进了试剂的使用。除其他消耗品外,试剂和试剂盒经常用于研究过程。体外诊断测试通过尿液、血液、粪便和组织样本进行,以诊断各种疾病,从轻微感染到危及生命的疾病,例如癌症。雅培、F. Hoffmann-La Roche Ltd 和 Bio-Rad Laboratories, Inc. 是提供试剂盒和试剂的主要公司之一。各国政府在 COVID-19 疫情期间实施了大规模筛查计划,这推动了体外诊断市场的增长。 2020 年,雅培实验室 (Abbott Laboratories) 加大了 COVID-19 检测试剂盒的产量,其中包括一款可实现大规模 COVID-19 筛查的新工具。

体外诊断市场根据应用细分,包括传染病、糖尿病、肿瘤学、心脏病学、自身免疫性疾病、肾脏病学等。2022 年,传染病领域占据了最大的市场份额。预计该领域在 2022-2030 年期间的复合年增长率最高。

根据技术,体外诊断市场细分为免疫测定/免疫化学、临床化学、分子诊断、微生物学、血糖自我监测、凝血和止血、血液学、尿液分析等。2022 年,免疫测定/免疫化学领域占据了最大的市场份额。然而,由于新产品的推出和技术的持续发展,预计分子诊断领域将在2022年至2030年期间实现最快的复合年增长率。此外,新冠疫情对免疫测定和分子诊断产生了积极影响。

根据最终用户,体外诊断市场可细分为医院、实验室、家庭护理和其他。2022年,医院领域占据了最大的市场份额。此外,医疗基础设施的持续扩张将导致现有医院设施的改善,这可能会引发对这些设施中进行的体外诊断(IVD)检测的需求。住院人数的增加,加上慢性病患病率的上升,预计将在2022年至2030年期间推动医院领域体外诊断市场的增长。发展中国家对先进医院环境的需求巨大,以应对日益增长的患者群体和日益严重的公共卫生问题。因此,预计越来越多的医院将因其卓越的优势而推动体外诊断的应用。此外,医院提供的优势,例如以患者为中心的适当护理和报销设施的可用性,也推动了该细分市场的增长。

区域分析:

根据地域,体外诊断市场分为五个主要区域:北美、欧洲、亚太地区、南美和中美以及中东和非洲。对北美市场的分析主要集中在三个主要国家——美国、加拿大和墨西哥。2022 年,美国占据北美体外诊断市场的最大份额。预计在预测期内,美国将在北美体外诊断市场中占据最大份额。该国市场的增长归因于慢性病和传染病的日益流行、对高效疾病诊断的关注以及对先进医疗保健系统的更高需求。癌症和心血管疾病等慢性疾病是美国致残和死亡的主要原因。根据美国国家慢性疾病预防和健康促进中心的数据,该国每 10 人中就有 6 人患有至少一种慢性疾病。美国疾病控制和预防中心 (CDC) 的报告显示,2021 年,美国 20 岁及以上成年人中约有 1,820 万人患有冠状动脉疾病 (CAD)。CAD 是该国人口死亡的主要原因。

美国医院协会还估计,约有 1.33 亿人患有至少一种慢性疾病,预计到 2030 年这一数字将达到 1.7 亿。慢性病的高发病率导致对诊断程序的巨大需求,这反过来又推动了美国体外诊断市场的发展。对预防保健的日益重视和医疗设施可及性的提升将在未来几年进一步推动市场增长。

体外诊断市场机遇:

体外诊断 (IVD) 用于临床、实验室和门诊环境,旨在帮助检测疾病,从而帮助选择合适的治疗方案。IVD 技术与数字健康解决方案的融合正在全球范围内日益受到关注。数据分析、人工智能和远程监控提升了诊断测试的价值,从而改善了患者管理和治疗效果。IVD 技术与数字健康解决方案的融合可以纳入临床决策支持系统。正如世界卫生组织所承认的,数字健康解决方案可以帮助检测疾病。人工智能健康机器人和类似的新兴解决方案可能为患者护理带来机会,并解决高成本和高时间要求等挑战。在基于基因组检测的诊断中,深度学习可以根据特定样本的图像识别癌细胞、确定其类型并预测肿瘤中可能发生的突变。体外诊断中的机器学习和人工智能正在彻底改变医疗器械的开发。这些现代诊断系统基于数字图像分析,有助于诊断,从而改善医疗决策。智能诊断是极具可扩展性的体外诊断 (IVD) 解决方案,它利用人工智能,以远低于实验室诊断的价格提供更佳性能。此外,这类诊断可以通过独特的化学和生物特征检测和分析来获取新兴特征。因此,将体外诊断 (IVD) 与数字医疗技术相结合,有望在未来几年为体外诊断市场带来丰厚的机遇。

体外诊断市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响体外诊断市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的体外诊断市场细分和地域分布。

体外诊断市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2022 | US$ 72.39 Billion |

| 市场规模 2030 | US$ 112.1 Billion |

| 全球复合年增长率 (2022 - 2030) | 5.6% |

| 历史数据 | 2020-2021 |

| 预测期 | 2023-2030 |

| 涵盖的领域 |

By 产品与服务

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

体外诊断市场参与者密度:了解其对业务动态的影响

体外诊断市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 体外诊断市场 主要参与者概述

竞争格局和重点公司:

全球体外诊断市场中一些著名的体外诊断制造商包括雅培实验室 (Abbott Laboratories)、罗氏公司 (F. Hoffmann-La Roche Ltd)、丹纳赫公司 (Danaher Corp)、西门子股份公司 (Sysmex Corp)、赛默飞世尔科技公司 (Thermo Fisher Scientific Inc)、碧迪公司 (Becton Dickinson and Co)、生物梅里埃公司 (bioMerieux SA)、伯乐实验室 (Bio-Rad Laboratories Inc) 和凯杰公司 (Qiagen NV)。这些公司专注于新技术研发、现有产品的改进和地域扩张,以满足全球日益增长的消费者需求,并扩大其专业产品组合的范围。例如,2020 年 10 月,雅培与 Quanterix 公司签署了一项非排他性的专利许可协议。根据该协议,雅培获得了 Quanterix 用于体外诊断 (IVD) 应用的微珠技术专利组合的使用权。此外,Quanterix 还获得了初始许可费、监管和发布里程碑费、与雅培未来发展相关的成就相关的里程碑费以及许可产品销售的特许权使用费。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 体外诊断市场

获取免费样品 - 体外诊断市场