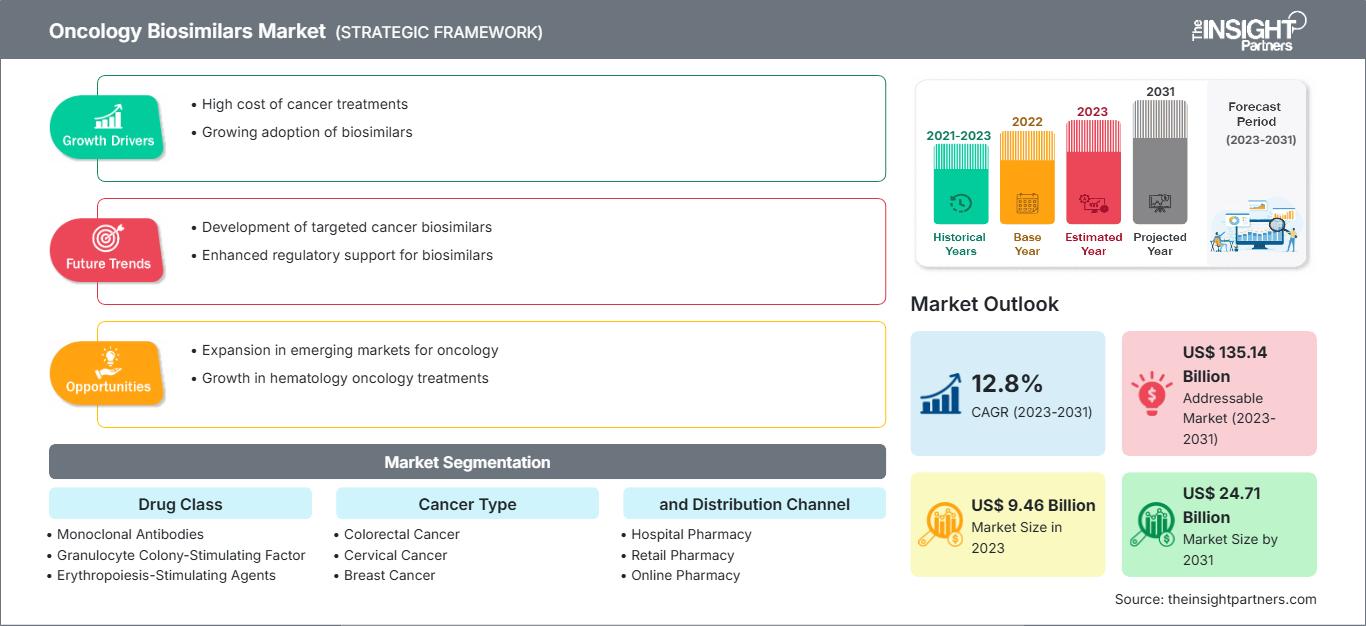

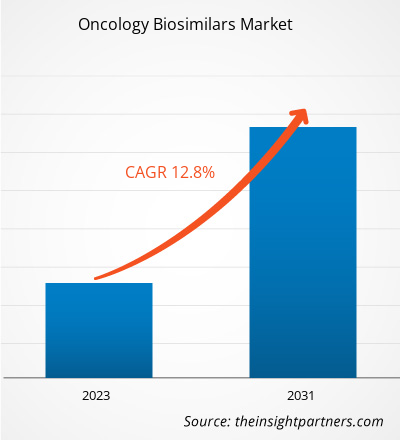

[研究报告] 2023 年肿瘤生物仿制药市场规模为 94.6 亿美元,预计到 2031 年将达到 247.1 亿美元;预计 2023 年至 2031 年的复合年增长率为 12.8%。

市场洞察和分析师观点:

生物仿制药是指在安全性、有效性和质量方面与现有参考生物药物非常相似但不完全相同的生物制药产品。单克隆抗体等生物仿制药及其辅助药物,包括非格司亭、培非格司亭、依伯汀α和依伯汀ζ,可用于治疗各种类型的癌症。癌症发病率激增、生物仿制药的成本效益以及肿瘤生物仿制药获批数量的增加等因素都对生物仿制药市场产生了影响。此外,生物仿制药制造商之间的合作以及临床试验预计将在未来几年带来新的肿瘤生物仿制药市场趋势。然而,生物仿制药产品制造的高成本和复杂性是市场阻碍因素之一。

肿瘤生物仿制药市场规模和份额 – 市场驱动因素:

据世界卫生组织 (WHO) 统计,2022 年全球报告新增癌症病例约 2000 万例,癌症死亡人数约 970 万例。此外,世卫组织全球癌症观察站的最新估计显示,2022 年,10 种不同类型的癌症约占全球新增癌症病例和死亡人数的三分之二。其中,肺癌是全球最常见的癌症,新增病例约 250 万例,占新增病例总数的 12.4%。女性乳腺癌位居第二,发病率为 230 万例,占新增病例总数的 11.6%,其次是结直肠癌,占新增病例总数的 9.6%。前列腺癌位居第四,发病率为 150 万例,胃癌位居第五,发病率为 97 万例。更实惠的肿瘤生物仿制药作为一种医疗装备的出现,可以减轻医疗支出负担,并提高获得有效癌症治疗的可及性,因为它们在现实世界中已被证实具有安全性和有效性,并且有临床证据和理化质量数据。例如,多学科数字出版研究所 (MDPI) 于 2023 年 7 月发表的一篇文章进行了一项比较描述性研究,以评估用于治疗癌症的生物仿制药单克隆抗体 (mAb) 与相应参考药物的安全性信息,并评估上市后药物警戒数据。研究得出结论,贝伐单抗、曲妥珠单抗和利妥昔单抗生物类似药与其原研药的安全性并无显著差异。结果验证了生物类似药的安全性等效性,并支持将其作为生物制剂原研药的竞争性替代品。因此,日益加重的癌症负担和由此导致的死亡人数不断增加,催生了对可负担治疗药物的需求,从而推动了肿瘤生物类似药市场的增长。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

肿瘤生物仿制药市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

细分和范围:

《肿瘤生物仿制药市场分析与预测(2030 年)》是一项专业且深入的研究,重点关注全球市场动态,以帮助确定关键驱动因素、未来市场趋势和有利可图的市场机会,从而有助于确定主要收入来源。该报告旨在提供市场概览,并根据药物类别、癌症类型和分销渠道进行详细的市场细分。该报告还对领先的市场参与者及其关键战略发展进行了全面的分析。肿瘤生物仿制药市场报告的范围包括对北美、欧洲、亚太地区、南美和中美以及中东和非洲地区市场表现的评估。非洲。

分段评估:

根据药物类别,市场细分为单克隆抗体、粒细胞集落刺激因子和红细胞生成刺激剂 (ESA)。2023 年,单克隆抗体细分市场占据肿瘤生物仿制药市场最大份额,预计 2023 年至 2031 年期间的复合年增长率最高。单克隆抗体可以通过多种方式破坏癌细胞,例如通过阻断配体-受体生长和存活途径。主要作用机制包括抗体依赖性细胞毒作用 (ADCC) 和补体介导的细胞毒作用。截至 2019 年 12 月,利妥昔单抗、曲妥珠单抗和贝伐单抗是欧洲药品管理局 (EMA) 和美国食品药品监督管理局 (FDA) 批准用于治疗癌症的几种生物仿制药单克隆抗体。

根据癌症类型,市场分为结直肠癌、宫颈癌、乳腺癌、支持性治疗、淋巴瘤等。支持性治疗部分在 2023 年占据了最大的市场份额。预计结直肠癌在 2023 年至 2031 年期间的复合年增长率最高。据世界卫生组织称,癌症是一个严重的健康问题,也是全球死亡的主要原因。随着癌症患病率的不断上升,许多肿瘤生物仿制药制造商正致力于开发和向市场推出新产品。例如,Celltrion 的 CT-P16、Prestige Biopharma 的 163 HD204、Cipla Biotech 的 CBT124 和北京天广实生物科技的 MIL60 都是贝伐单抗的潜在生物仿制药,目前正在进行 3 期研究,并在安全性和有效性参数上进行比较。他们还在评估其治疗非小细胞肺癌患者的能力。

根据分销渠道,市场分为医院药房、零售药房和网上药房。2022 年,医院药房占据了最大的市场份额。预计网上药房领域在 2023 年至 2031 年期间的复合年增长率最高。医院药房是患者购买生物仿制药等处方药的主要平台。

区域

分析:

就收入而言,北美在 2023 年占据了肿瘤生物仿制药市场的主要份额,其次是欧洲。预计在预测期内,癌症病例的增加、用于治疗癌症的生物仿制药获批数量的增加以及先进的医疗保健基础设施是推动北美肿瘤生物仿制药市场发展的因素。

癌症病例的增加、用于治疗癌症的生物仿制药获批数量的增加以及先进的医疗保健基础设施是推动北美肿瘤生物仿制药市场发展的因素。生物制剂是美国最昂贵的药物。预计生物仿制药将比其参考产品更具成本效益。在 PubMed Central 于 2022 年 10 月发表的一篇文章中,使用基于截至 2021 年 6 月美国药品价格的每单位生物制剂和生物仿制药的平均批发价 (AWP) 进行了成本比较。分析表明,生物仿制药可以为贝伐单抗节省 15% 至 23%。在贝伐单抗生物类似药中,Zirbes 与原研药 Avastin 相比,可显著节省成本。用于辅助性癌症治疗的生物类似药(例如非格司亭生物类似药)与其参考产品相比,可节省 17.3% 至 34% 的费用,而聚乙二醇非格司亭生物类似药则可节省 33% 至 37% 的费用。此外,Epogen 生物类似药可节省 33.5% 的费用。根据 2022 年发布的 Cardinal Health 生物类似药报告,美国食品药品监督管理局 (FDA) 已在美国批准 33 种生物类似药,其中 21 种已上市。其中 17 种用于癌症治疗。根据同一来源,预计到 2025 年,生物仿制药将使美国药品支出减少 1330 亿美元。因此,在美国,生物仿制药在降低生物药物成本、使患者更容易获得护理以及创造创新和科学突破方面具有巨大潜力,从而推动该地区肿瘤生物仿制药市场的发展。

肿瘤生物仿制药

肿瘤生物仿制药市场区域洞察The Insight Partners 的分析师已详尽阐述了预测期内影响肿瘤生物仿制药市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的肿瘤生物仿制药市场细分和地域分布。

肿瘤生物仿制药市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2023 | US$ 9.46 Billion |

| 市场规模 2031 | US$ 24.71 Billion |

| 全球复合年增长率 (2023 - 2031) | 12.8% |

| 历史数据 | 2021-2023 |

| 预测期 | 2023-2031 |

| 涵盖的领域 |

By 药物类别

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

肿瘤生物仿制药市场参与者密度:了解其对业务动态的影响

肿瘤生物仿制药市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 肿瘤生物仿制药市场 主要参与者概述

行业发展和未来机遇:

肿瘤生物仿制药市场预测可以帮助该市场的利益相关者规划其增长战略。根据公司新闻稿,以下是肿瘤生物仿制药市场主要参与者的一些关键发展和举措:

- 2022年11月,Organon在加拿大推出了Avastin的生物仿制药AYBINTIO。该疗法适用于加拿大患有某些侵袭性癌症的患者,包括转移性结直肠癌(mCRC)、转移性肺癌、铂敏感和耐药性复发性上皮性卵巢癌(包括输卵管癌和原发性腹膜癌)以及胶质母细胞瘤。此次发布旨在扩大公司的生物仿制药产品组合。

- 2022 年 5 月,Biocon Biologics 和 Viatris 推出了 Abemy,这是罗氏 Avastin(贝伐单抗)的生物仿制药。Biocon Ltd. 的子公司 Biocon Biologics Ltd. 和 Vietris Inc. 宣布在加拿大推出这种肿瘤生物仿制药。由 Biocon Biologics 和 Vietris 共同开发的 bevy 已获得加拿大卫生部的批准,可用于治疗四种癌症。

- 2020 年 4 月,辉瑞获得欧盟委员会 (EC) 批准其 RUXIENCE,这是一种单克隆抗体 (mob),是 Mather(利妥昔单抗)的生物仿制药。此项批准用于治疗某些癌症,例如非霍奇金淋巴瘤 (NHL)、慢性淋巴细胞白血病 (CLL) 和自身免疫性疾病。

- 2020 年 1 月,Chorus Biosciences 与 Innocents Biologics Co., Ltd. 达成许可协议,在美国和加拿大开发和商业化任何剂型和形式的贝伐单抗 (Avastin) 生物仿制药。

竞争格局和主要公司:

CELLTRION, Inc.;Teva Pharmaceutical Industries Ltd;辉瑞公司;山德士集团;Biocon;安进公司;三星 Bioepis;Coherus BioSciences;BIOCAD 和礼来公司是肿瘤生物仿制药市场报告中介绍的顶级参与者。这些公司专注于推出新的高科技产品、现有产品的技术进步以及地域扩张,以满足全球日益增长的消费者需求。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

相关报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 肿瘤生物仿制药市场

获取免费样品 - 肿瘤生物仿制药市场