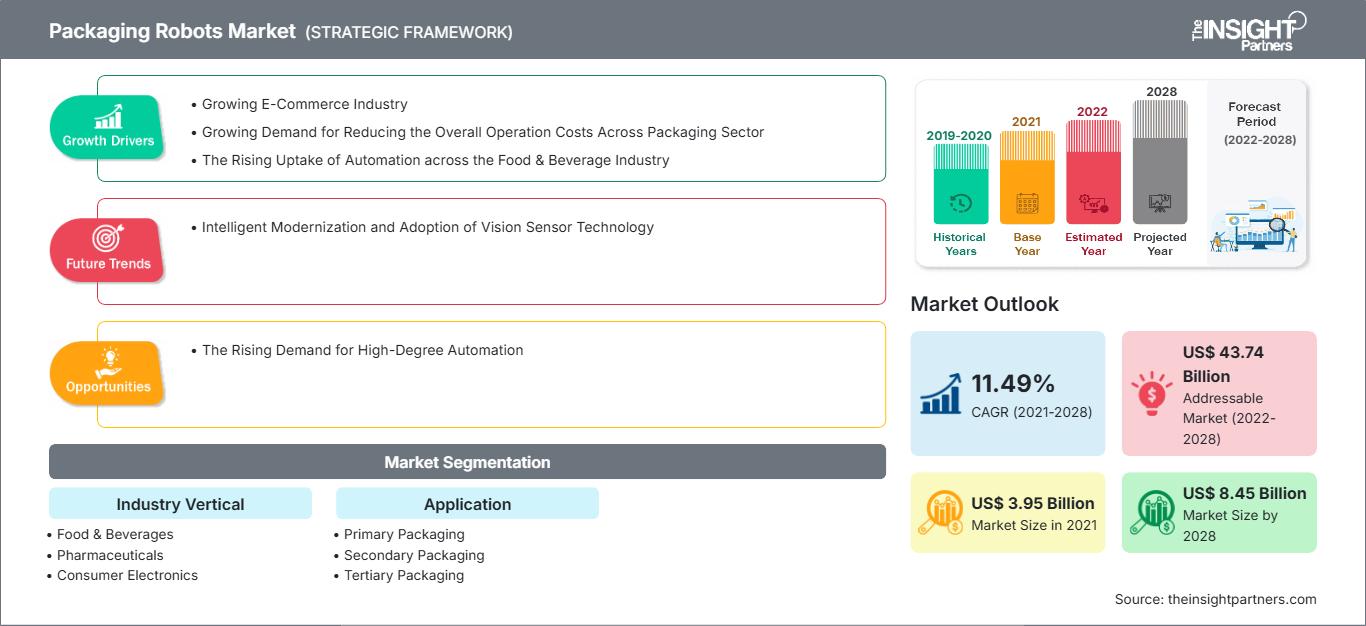

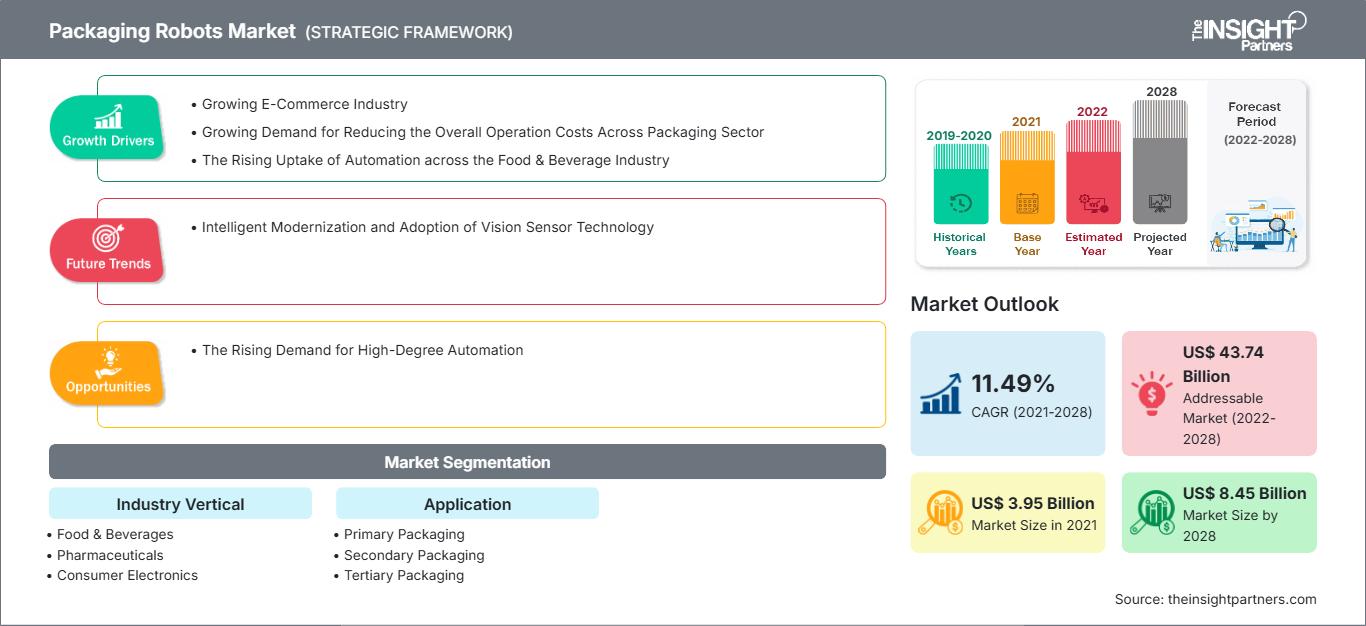

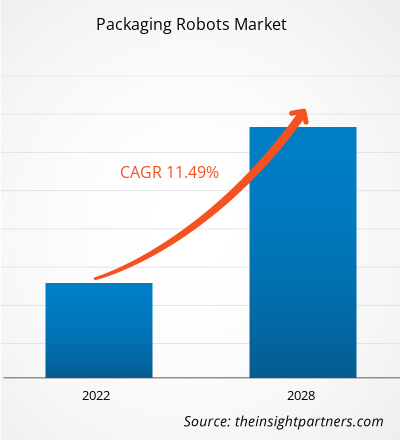

[研究报告] 预计包装机器人市场规模将从 2021 年的 39.4543 亿美元增长到 2028 年的 84.4821 亿美元;预计 2021 年至 2028 年期间的复合年增长率为 11.49%。

分析师观点:

包装机器人为物料搬运操作带来了准确性、速度和生产力,因此,许多制造商都在采用包装机器人来提高产量。此外,由于包装机器人可以一次搬运更多产品,因此它们的正常运行时间远高于人工,并降低了人工成本和整体运营成本,从而推动了包装机器人市场的增长。此外,在食品和饮料行业,协作机器人越来越多地用于填充数百个包装和瓶子,并比人类更高效地执行其他复杂任务,这也推动了包装机器人市场的增长。此外,全球电子商务行业的蓬勃发展也是推动包装机器人市场增长的另一个因素。此外,对高度自动化的需求不断增长,预计将为预测期内包装机器人市场的增长创造机会。

市场概览:

包装机器人是指经过编程,可沿预定路线移动的机器人,用于从不同的存储位置拾取物品并将其放置在货架上。这些机器人无需人工协助即可工作,可通过精简生产线和减少过多的人工干预来节省时间。它们通过提供速度、准确性和生产力,为不同的工业领域带来许多重要优势,同时,如果部署得当,还能带来相对较快的投资回报 (ROI)。根据机械臂末端工具 (EOAT),包装机器人可以完成许多不同的任务。通常,包装机器人用于打开、填充、运输、码垛、密封、编码和贴标产品包装。由于上述优势,它们最常用于那些需要精确、一致、高质量地包装产品以保护产品完整性的行业。工业领域大量使用包装机器人来缩短周期并提高生产效率,而食品和饮料行业也出于类似原因使用包装机器人。

自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

包装机器人市场: 战略洞察

- 获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

包装机器人市场: 战略洞察

- 获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

包装机器人市场驱动力:

食品饮料行业自动化程度的不断提高推动了包装机器人市场的增长

食品饮料行业的自动化是指将技术集成到各个生产流程中,例如检查、包装和储存。多年来,食品饮料公司通过集成自动化系统(例如自动导引车、Delta 机器人和机械臂)优化了不同的生产流程,以符合各监管机构制定的食品安全和质量标准,并降低整个生产现场的总体劳动力成本。

此外,包装食品饮料需要高精度和重复性的包装过程,这对人类来说是一个挑战。这一因素增加了对用于各种活动的机器人技术的需求,包括一次包装、二次包装和码垛。

此外,食品饮料行业对视觉引导机器人的需求也在不断增长。自动化在饮料行业应用广泛,这得益于其在完成各种重复性任务(如箱体拾取、瓶子处理和托盘装载)方面的高效性。此外,自动化还有诸多优势,包括提高效率、增强可追溯性和提高灵活性,这些都推动了食品饮料行业对自动化的需求。这些因素鼓励食品饮料生产商增加对生产设施中自动化技术整合的投资。例如,2021 年,美国零食品牌 Utz Brands Inc. 宣布计划在其生产工厂中整合自动化解决方案,以降低总体运营成本。同样,2022 年,荷美尔食品也宣布计划在其生产设施中引入自动化。泰森食品和嘉吉公司等其他食品饮料品牌也在致力于采用自动化技术。因此,食品饮料行业对自动化投资的不断增加饮料行业正在推动包装机器人市场的增长。

细分分析:

根据行业垂直划分,包装机器人市场细分为食品饮料、制药、消费电子产品等。食品饮料领域在 2021 年占据了最大的市场份额,而制药领域预计在 2021-2028 年期间的复合年增长率最高。食品饮料行业正在见证自动化解决方案的快速整合。包装机器人可以加快包装速度,同时确保质量控制。包装机器人的集成还提高了工人的安全性,端到端可追溯性可以提高产量、减少浪费和降低劳动力成本,使生产更加灵活。由于这些优势,各食品公司正在致力于使用视觉引导机械臂、自动导引车、Delta 机器人和先进的检测系统来优化其流程,以确保食品安全和质量标准并满足不断增长的需求。因此,食品和饮料行业越来越多地采用自动化来升级其现有基础设施,这推动了市场增长。

区域分析:

预计在预测期内,亚太地区的包装机器人市场将显着增长。在该地区,中国将在 2021 年占据最大的市场份额,而印度将在 2021-2028 年期间实现最高的复合年增长率。为提高生产率和降低成本而不断增加的自动化投资正在帮助制造商满足日益增长的消费者需求。此外,由于机器人的集成有助于提高包装效率并降低运营成本,因此各个垂直行业对其的需求都在增加。此外,该地区蓬勃发展的电子商务行业也推动了对自动化的需求。根据国际航空运输协会 (IATA) 的数据,亚太地区引领全球电子商务市场的增长,其中中国占增长的很大一部分。根据国际贸易管理局的数据,中国是全球最大的电子商务市场,占全球交易总额的近50%。同样,亚太地区其他国家的电子商务市场也正在经历显著增长。例如,根据国际贸易管理局的数据,澳大利亚——全球第十一大电子商务市场——预计到 2024 年将达到 323 亿美元。根据印度品牌资产基金会 (IBEF) 的数据,印度电子商务市场预计到 2025 年将达到 1880 亿美元。因此,不断发展的自动化和电子商务行业正在推动亚太地区市场的增长。

主要参与者分析:

ABB 有限公司、Brenton Engineering、FANUC 株式会社、克朗斯股份公司、库卡机器人有限公司、三菱电机株式会社、Remtec Automation LLC、罗伯特·博世有限公司、施耐德电气和安川美国是包装机器人市场的主要参与者。这些包装机器人市场参与者专注于持续的产品开发和创新。

包装机器人市场区域洞察

The Insight Partners 的分析师已详尽阐述了预测期内影响包装机器人市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的包装机器人市场细分和地域分布。

包装机器人市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2021 | US$ 3.95 Billion |

| 市场规模 2028 | US$ 8.45 Billion |

| 全球复合年增长率 (2021 - 2028) | 11.49% |

| 历史数据 | 2019-2020 |

| 预测期 | 2022-2028 |

| 涵盖的领域 |

By 垂直行业

|

| 覆盖地区和国家 | 北美

|

| 市场领导者和主要公司简介 |

|

包装机器人市场参与者密度:了解其对业务动态的影响

包装机器人市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的不断变化、技术进步以及对产品优势的认知度不断提高。随着需求的增长,企业正在扩展产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 包装机器人市场 主要参与者概述

最新动态:

市场上的企业广泛采用产品发布、合作伙伴关系、协作以及并购等有机和无机策略。以下列出了这些公司近期的一些关键市场动态:

- 2023年4月,Shemesh宣布推出TKS-C60全套机器人增强型化妆品包装生产线,该生产线旨在处理整个包装流程——各种形状和尺寸的化妆品的进料、灌装、封盖、贴标、装箱和码垛。 TKS-C60 可确保为从面霜和粉底到香水和指甲油等一系列产品提供无缝、不间断的装瓶生产线,生产速度为每分钟 60 瓶。

- 2023 年 3 月,定制装瓶和包装行业自动化系统制造商 Proco Machinery 宣布推出一款新型协作机器人包装机,以解决包装行业日益严重的劳动力短缺问题。这款新型 Proco 协作机器人包装机旨在与人类操作员协同工作,以提高效率和性能。新型机器人包装机可以执行一系列任务,从测试容器到将其装入箱体。

- 2023 年 2 月,Rapid Robotics 宣布与 Universal Robots (UR) 建立新的合作伙伴关系,根据该合作伙伴关系,这家丹麦协作机器人 (cobot) 制造商将为 Rapid Robotics 在北美各地部署的协作机器人工作单元提供协作机械臂。此外,即使 Rapid Robotics 继续扩大其在全国范围内的业务,Universal Robots 也能帮助 Rapid Robotics 服务更多客户,并保持其期望的快速部署速度。这些协作机器人拥有丰富的功能,例如码垛、装箱和包装,以及需要更大有效载荷或更大工作范围的操作。

- 2022 年 11 月,全球领先的人工智能电商机器人公司 OSARO 宣布与 SVT Robotics 合作,以加速为电商和物流企业集成拾放机器人系统。SVT Robotics 突破性的 SOFTBOT 平台使企业能够在短短几天或几周内集成和部署所需的机器人、自动化和物联网设备。根据协议,SVT Robotics 已加入 OSARO 的合作伙伴计划,该计划为希望在订单履行过程中部署机器人解决方案的企业提供一站式服务。

- 2022 年 7 月,ABB 宣布将在其 FlexPicker Delta 机器人产品组合中新增 IRB 365。IRB 365 拥有五轴和 1.5 公斤的有效载荷,灵活且速度在同类产品中名列前茅,可用于重新定向包装的轻型产品,例如饼干、巧克力、辣椒、糖果、小瓶装产品和包裹。为了应对电子商务的兴起和对即上架包装商品日益增长的需求,IRB 365 专为食品饮料、制药和消费品等应用而开发,这些应用对生产线速度和适应性至关重要。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 包装机器人市场

获取免费样品 - 包装机器人市场