预付卡市场规模及趋势

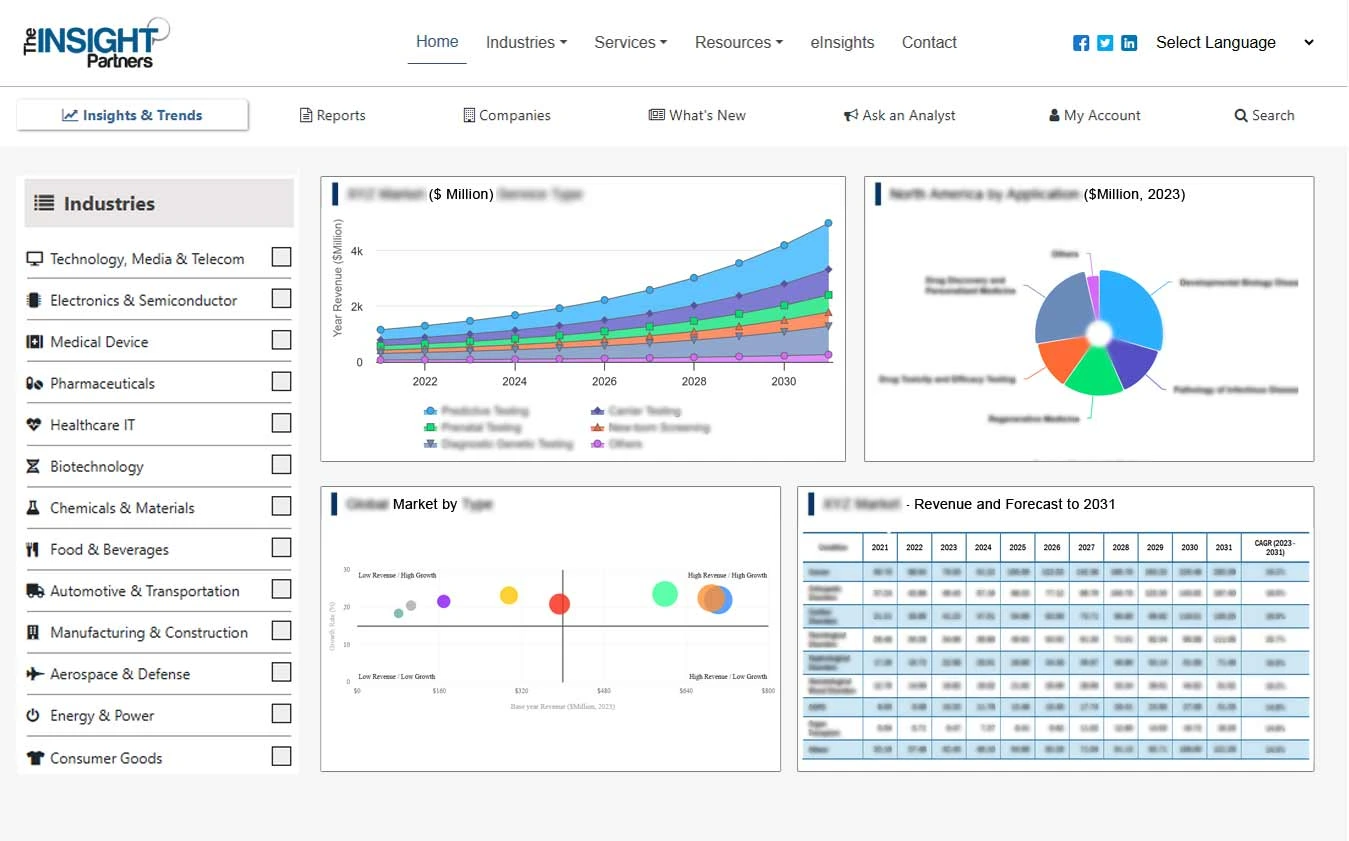

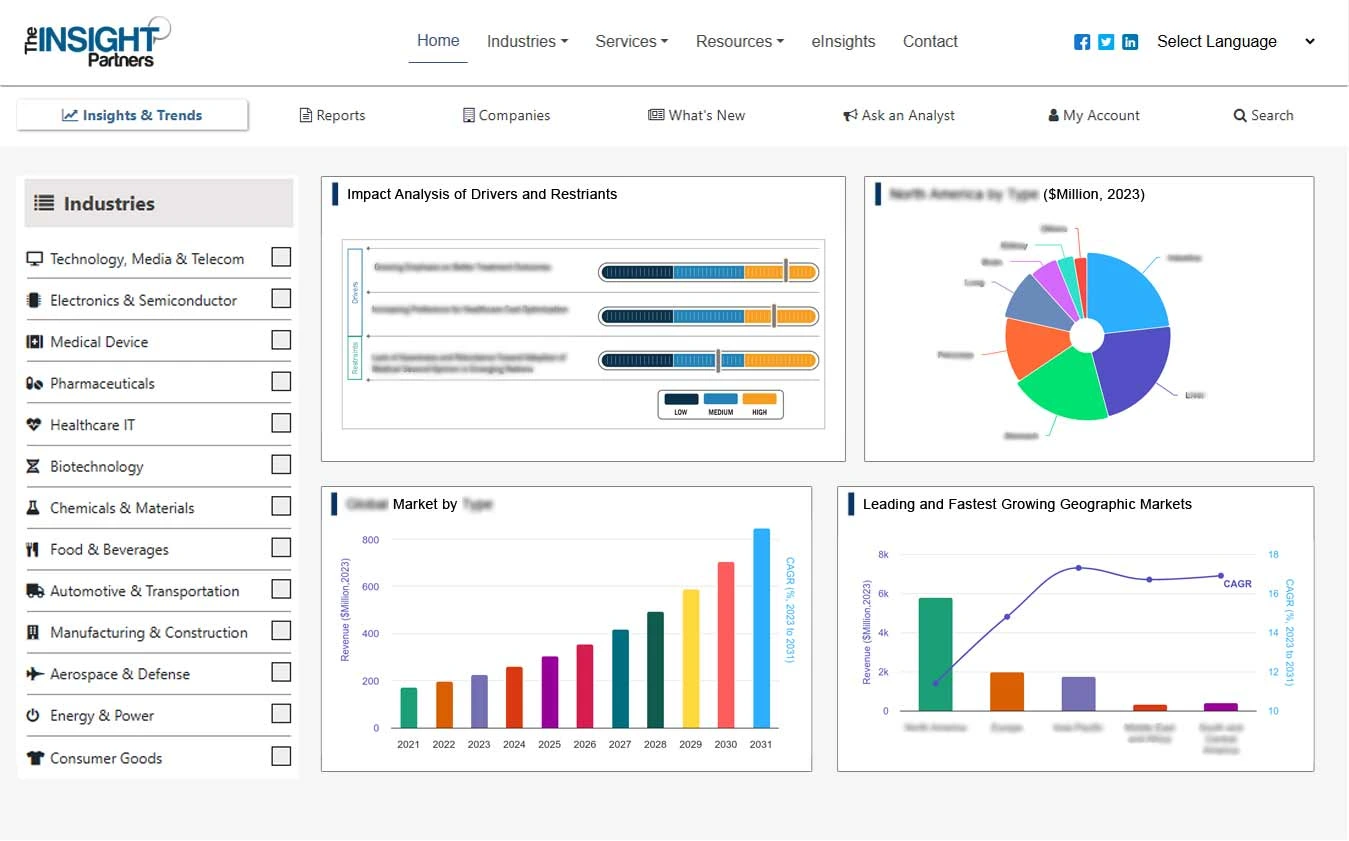

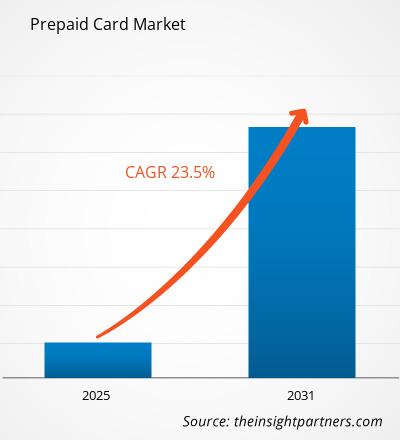

预付卡市场规模预计将从2023年的29,835亿美元增长到2031年的122,747.9亿美元;预计 2023 年至 2031 年复合年增长率将达到 19.3%。许多引人注目的驱动因素影响着市场格局。汇款中对预付卡的需求增加极大地促进了预付卡市场的增长。随着越来越多的人在世界各地工作和居住,对经济高效且便捷的汇款方式提出了更高的要求。

预付卡市场分析

预付卡市场预计在预测期内将呈现更高的增长,因为它提供类似于借记卡或信用卡的便利性,并且能够允许最终用户根据预算设置支出限额。此外,预付卡是携带现金的另一种选择。预付卡已经取代了支票、现金和其他支付卡,企业或消费者希望采用电子支付方式,而不将支付与借记卡或信用卡挂钩。此外,对于没有银行账户的个人来说,预付卡是典型银行产品的有益替代品,因为它们通常用于网上购物、预算和旅行。

战略见解

预付卡 行业概况

- 预付卡是指银行卡消费者可以使用预付卡账户预存的钱进行购物。预付卡不与银行信用合作社的股份汇票账户或支票账户关联。该卡最多可用于预充值的消费。

- 预付卡有时也称为储值卡或预付借记卡。预付卡可在在线平台和各种线下商店购买。金额用完或用完后,持卡人可以重新充值。可充值预付卡包括多种将钱存入卡余额的方式,包括银行间转账和直接存款。

- 预付卡是收款人获取资金的一种直接方式,同时最大限度地减少了与传统汇款相关的复杂性和费用接近。这些卡为跨境转移支付提供了安全的平台,并且通常提供具有吸引力的汇率。

- 此外,对现金替代品的需求激增促进了预付卡行业的发展,因为客户试图找到安全、便捷、安全的支付方式。灵活的支付解决方案,无需使用传统现金即可享受电子交易的优势。

预付卡市场驱动力

无银行账户和无银行账户的人数增加银行服务不足的用户推动市场增长

- 许多群体都记录了银行服务不足和无银行账户利率,包括受教育程度较低和收入较低的家庭-收入家庭等。预付费工具已融入人们日常生活的一个证据是,支出模式已经改变,客户愿意检查预付费卡的可能性。因此,无银行账户人群对预付卡接受度的增长预计将为预付卡市场增长带来有吸引力的机会。

预付卡 市场报告细分分析

- 根据卡类型,预付卡市场分为闭环预付卡和开环预付卡。

- 闭环预付卡细分市场在 2023 年占据了重要的预付卡市场份额。这是因为它们与企业或某些商店相关,提供促销、专门激励和品牌忠诚度优势,吸引寻求个性化体验的客户。

- 另一方面,开环预付卡预计将成为预测期内增长最快的细分市场。这是因为它们具有更广泛的可用性,功能类似于标准信用卡或借记卡,并且能够灵活地进行各种购买、ATM 取款和在线交易,从而吸引了广泛的客户。

预付卡 市场区域分析

预付卡市场报告的范围主要分为五个区域 -北美、欧洲、亚太地区、中东和非洲非洲、南美洲。北美正在快速增长,预计到 2022 年将占据显着的预付卡市场份额。这可以归功于该地区完善的货币基础设施、技术改进和数字支付的使用,所有这些都促进了预付卡市场的增长。此外,电子商务、在线购物和移动支付选项的接受与预付卡所提供的安全性和简单性相契合。该地区的差异化人口(包括无银行账户和有银行账户的人)增加了对灵活支付选择的需求。反过来,预计这将在预测期内推动北美地区的市场。

预付卡 市场报告范围

“预付卡市场分析”是根据产品、卡类型、最终用户和地理位置进行的。在产品方面,市场分为礼品卡、政府福利/支出卡、激励/工资卡和通用可充值卡。从卡类型来看,市场分为闭环预付卡和开环预付卡。就最终用户而言,市场分为零售机构、企业和政府/公共部门。根据地理位置,市场分为北美、欧洲、亚太地区、中东和中东地区。非洲和南美洲。

报告属性 | 详情 |

2023年市场规模 | 美元 29,835亿 span> |

2031 年市场规模 < /td> | 美元 122,747.9 亿< /p> |

全球复合年增长率(2023-2031) | 19.3% |

实际数据 | 2021年 2023年 |

预测时期 | 2024年 2031年 | 报告覆盖范围 | 市场规模和预测(美元)、市场驱动因素和预测趋势分析、PEST 分析、关键机会、区域和地区国家分析、竞争格局、公司概况 |

涵盖的细分市场 | 按产品分类(礼品卡、政府福利/支付卡、激励/工资卡、通用可充值卡、其他);按卡类型(闭环、开环);按最终用户(零售机构、企业);和地理 |

覆盖地区 | 北美、欧洲、亚太地区、南美洲、MEA |

涵盖的国家/地区< /p> | 美国;加拿大;墨西哥;英国;德国;法国、俄罗斯、意大利;中国;印度;日本、澳大利亚;韩国;巴西;阿根廷;沙特阿拉伯;阿联酋;南非 |

市场领导者和主要公司简介 | 美国运通公司、PayPal Holdings, Inc.、通济隆外国硬币服务有限公司、万事达卡、Kaiku Finance LLC、Mango Financial, Inc.、Green Dot Corporation、Visa Inc.、NetSpend Corporation、摩根大通和公司 |

预付卡 市场领导者和股票分析

通济隆Foreign Coin Services Limited、Mango Financial, Inc.、PayPal Holdings, Inc.、Kaiku Finance LLC、NetSpend Corporation、Green Dot Corporation、American Express Company、Mastercard、JPMorgan Chase Co. 和 Visa Inc. 是预付卡市场报告中介绍的知名参与者。此外,研究期间还对其他几家参与者进行了研究和分析,以全面了解市场及其生态系统。预付卡市场预测是根据各种二次和主要研究结果进行估计的,例如主要公司出版物、协会数据和数据库。

预付卡< /strong> 市场新闻和最新动态

公司在预付卡市场采取并购等无机和有机策略。下面列出了近期的一些关键市场动态:

- 2022 年 11 月,Visa 通过试点支付创新扩大了预付卡服务,包括即时发行的具有动画卡片艺术和面部生物识别支付功能的预付卡。

(来源:Visa,公司网站)

- 例如2023 年 6 月,I&M 银行与万事达卡合作,宣布推出一套多币种预付卡和优质世界借记卡,使客户能够在国际和国内市场进行交易。

(资料来源:I&M 银行、公司网站)

预付卡 市场报告覆盖范围和市场报告可交付成果

市场报告“预付卡市场规模和预测(2021年-2031年)”提供了对以下领域市场的详细分析-

- 市场规模和市场规模对范围内涵盖的所有关键细分市场进行全球、区域和国家层面的预测。

- 市场动态,例如驱动因素、限制因素和关键机遇。

- 主要未来趋势。

- 详细的 PEST 和分析SWOT 分析

- 全球和区域市场分析,涵盖主要市场趋势、关键参与者、法规和近期市场发展。

- 行业格局和竞争分析,涵盖市场集中度、热图分析、关键参与者和近期发展。

- 详细的公司简介。

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST 和 SWOT 分析

- 市场规模价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

常见问题

The global prepaid card market is expected to grow at a CAGR of 23.5% during the forecast period 2023 - 2031.

The rise in demand for prepaid cards in remittances and the diversification of financial Institutions are the major factors that propel the global prepaid card market.

The key players holding majority shares in the global prepaid card market are Green Dot Corporation, American Express Company, JPMorgan Chase And Co., PayPal Holdings, Inc., and Mastercard.

Growing fintech companies and digital transformation, which is anticipated to play a significant role in the global prepaid card market in the coming years.

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

- Green Dot Corporation

- American Express Company

- JPMorgan Chase And Co.

- PayPal Holdings, Inc.

- Mastercard;

- Visa Inc.

- NetSpend Corporation

- Mango Financial, Inc.

- Kaiku Finance LLC

- Travelex Foreign Coin Services Limited

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

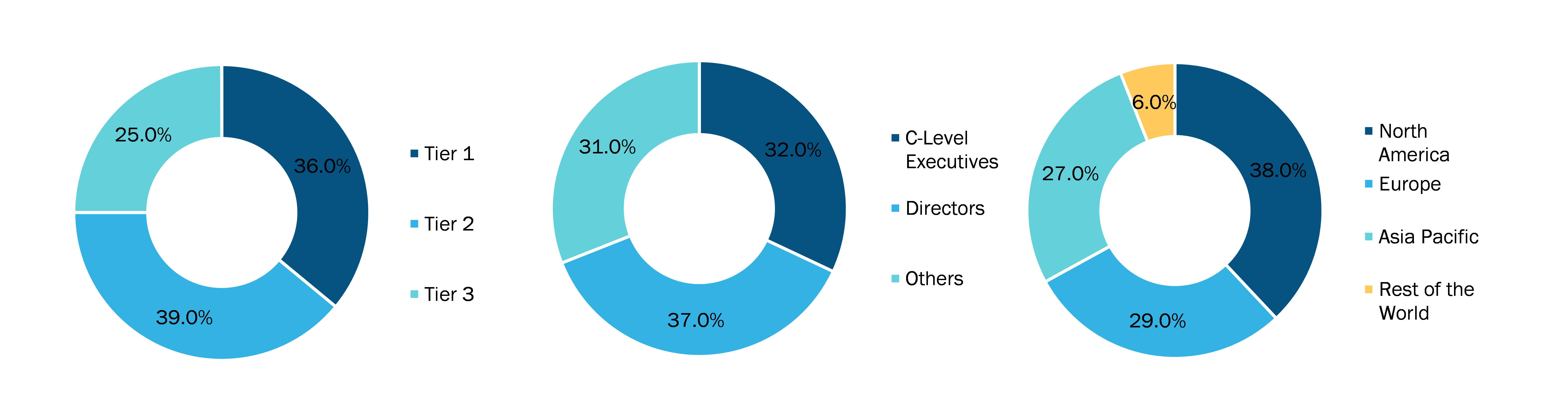

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

获取此报告的免费样本

获取此报告的免费样本