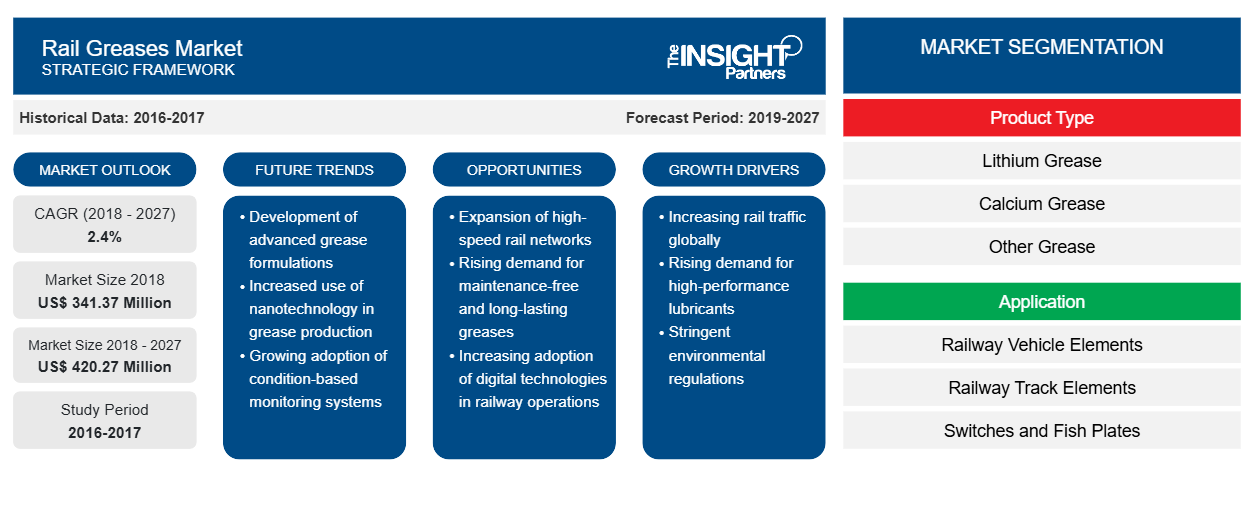

2018 年,铁路润滑脂市场价值为 3.4137 亿美元,预计到 2027 年将达到 4.2027 亿美元;预计年复合增长率为2019 年至 2027 年的

油脂是一种固体或半固体润滑油。它通常由矿物油和增稠剂(如钙基皂和锂基皂)组成。油脂还可能含有额外的润滑颗粒,如二硫化钼、石墨或聚四氟乙烯( PTFE )。不同类型的油脂将油的润滑性能与额外的粘性相结合,使润滑剂能够更好地粘附在表面上。油脂具有高初始粘度等特性,使其具有摩擦性。它广泛用于汽车、铁路、建筑、制药、食品和饮料以及采矿等各种行业。对于轨道,油脂可用于需要经常润滑且润滑油不会停留很长时间的机构。油脂可作为密封剂,防止水和不可压缩材料的侵入。油脂还用于维护各种轨道元件,如铁路车轴和车轮、轴承和链条、制动元件、内部组件、受电弓和铁路轨道组件,因为它可以防止污染物进入或润滑剂流失。

2018 年,亚太地区占据了全球铁路润滑脂市场的主导地位,市场份额最高,预计在预测期内将成为增长最快的地区。该地区铁路润滑脂市场的增长主要归因于经济蓬勃发展、城市化迅速发展以及新兴国家政府对铁路基础设施建设的投资不断增加。该地区各国正在试验最先进的交通技术,使城市铁路系统更加高效、可靠和方便乘客。亚太地区的地铁系统正逐步从半自动转向无人驾驶/无人驾驶列车运行。大多数即将推出的系统都在引入尖端技术解决方案,以确保通勤者的舒适和安全。因此,该地区的铁路润滑脂市场预计将经历快速增长。此外,预测期内,该地区政府在传统铁路网络数字化方面采取的众多举措也将推动铁路润滑脂市场的增长。

定制此报告以满足您的需求

您可以免费定制任何报告,包括本报告的部分内容、国家级分析、Excel 数据包,以及为初创企业和大学提供优惠和折扣

- 获取此报告的关键市场趋势。这个免费样品将包括数据分析,从市场趋势到估计和预测。

COVID-19 疫情对铁路润滑脂市场的影响

2019 年 12 月,COVID-19 疫情起源于中国武汉,此后迅速蔓延至全球。截至 2020 年 7 月,就确诊病例和报告死亡人数而言,美国、俄罗斯、印度、意大利、中国、西班牙、法国和德国是受影响最严重的国家。由于强制封锁、旅行禁令和企业停工,疫情影响了经济和行业。COVID-10 疫情蔓延后,由于供应链中断、封锁导致制造业中断以及疫情导致办公室关闭,各个地区对轨道润滑脂的需求受到阻碍。亚太地区和北美等主要地区多家工厂的封锁影响了轨道润滑脂的制造、交付计划和销售,从而对全球轨道润滑脂市场产生负面影响。

市场洞察

铁路运输中各类零部件的定期维护活动

铁路车辆部件,例如车轴和车轮、轴承和链条、制动元件、内部组件和受电弓,需要经常维护和润滑才能平稳运行并实现高性能。在车轮上涂抹润滑脂具有多种好处,例如可以降低人工成本、延长维修间隔和减少润滑剂消耗。在铁路车辆部件上使用润滑脂具有多种操作优势,例如提高设备可靠性、减少计划外停机时间、降低能源和燃料消耗以及提高设备盈利能力。此外,润滑脂还可以帮助节省能源和降低噪音。车辆轨道系统的轴箱轴承是铁路和火车转向架的重要组成部分,它承受着轨道和转向架之间各种复杂的随机载荷。轴箱轴承的可靠性和使用寿命会影响铁路安全。润滑脂在铁路轴箱轴承的润滑中起着重要作用,因为轴箱轴承的润滑失效可能导致事故,例如热轴切割和轴承烧坏。此外,润滑脂还用于其他铁路部件,例如轨道部件、制动器和内部部件。铁路轨道部件中使用的润滑脂旨在最大限度地减少摩擦、降低温度并防止轮缘和轨道之间的磨损。润滑脂还用于安装铁路轨道元件时使用的螺钉和螺栓,以防止它们生锈。因此,铁路润滑脂主要用于维护活动以及确保铁路车辆部件和铁路轨道部件等不同部件的平稳运行和高性能。这一事实在预测期间推动了铁路润滑脂市场的发展。

基于类型的洞察

根据产品类型,铁路润滑脂市场分为锂基润滑脂、钙基润滑脂和其他润滑脂。2018 年,锂基润滑脂占据了全球铁路润滑脂的主导地位,预计在预测期内将以最快的速度增长。锂基润滑脂是一种多用途润滑脂,具有黄油般的质地,滴点高于 350°F。此外,它还可以在偶尔高达 300°F 的温度下使用。锂基润滑脂具有出色的防水、防分解或防软化性能。锂基润滑脂是铁路应用中最常用的润滑脂,因为它的熔点高于其他润滑脂。锂基润滑脂具有很高的泵送性,可用于铁路和火车的各个部件,如曲齿联轴器、万向轴、轴箱和制动系统。铁路运输中使用的不同部件的定期维护活动预计将在预测期内推动对锂基润滑脂的需求。

基于应用的洞察

根据应用,轨道润滑脂市场细分为铁路车辆元件、铁路轨道元件、道岔和鱼尾板、曲线轨道以及螺钉和螺栓。铁路车辆元件部分在全球轨道润滑脂市场中占据主导地位;而曲线轨道部分预计在预测期内将以最快的速度增长。润滑器广泛用于曲线轨道,以控制车轮和轨道的过度磨损。润滑脂和油通常涂在曲线外侧(高)轨道的轨距面上,除了减少车轮和轨道磨损外,还被证明可以减少轨道端部磨损和波纹增长率。最近的研究表明,有效的润滑具有降低能源和燃料消耗的额外好处,这导致许多铁路工程师更加关注润滑实践。这进一步推动了全球对轨道润滑脂的需求。此外,在曲线路段,高轨(外侧曲线)车轮在轨距面上行驶。这会导致半连续摩擦,从而严重磨损轨距面和车轮轮缘。车轮和轨道接触面之间的强接触摩擦力会导致轨道曲线产生噪音。因此,使用润滑脂来减少摩擦。具体来说,在轨道曲线密集的城市中心地区,润滑系统可以减少臭名昭著的曲线吱吱声。润滑脂用于减少轨距面和轨道顶部的磨损和曲线噪音。因此,为了提高轨道的经济寿命,润滑曲线轨道被认为是一种简单而经济的解决方案。

基于分销渠道的洞察

根据分销渠道,铁路润滑脂市场分为线下和线上。线下部分主导了全球铁路润滑脂市场;而在线部分预计在预测期内将以更快的速度增长。全球数字渠道的日益普及带来了对在线分销渠道的日益重视。互联网使用率和智能手机拥有率在世界各地不断增长,消费者越来越倾向于在线完成从进行研究到做出最终购买决定的所有事情。便利、快速交付和安全的支付方式等多项优势吸引了 B2B 买家在线购买。因此,在铁路润滑脂市场运营的公司在过去几年中优化了分销策略,以跟上竞争步伐并继续发展业务。这些公司正在采用在线分销渠道来瞄准和接触市场上的大量客户,以及传统的线下分销渠道。此外,在线分销渠道可帮助公司在不增加额外成本和费用的情况下接触目标消费者。因此,润滑油和润滑脂制造商正在利用电子商务行业通过开设在线商店并通过这些渠道进行销售来赚取收入。

荷兰皇家壳牌公司 (Shell)、埃克森美孚公司、道达尔公司、BP 澳大利亚有限公司、马来西亚国家石油公司 (Petronas)、斯凯孚集团、福斯、雪佛龙公司、克鲁勃润滑剂公司和中国石化是全球铁路润滑脂市场的主要参与者。该市场中的公司一直专注于产品开发、工厂扩建和并购等战略,以扩大其全球影响力并满足市场日益增长的需求。

铁路润滑脂市场区域洞察

Insight Partners 的分析师已详细解释了预测期内影响铁路润滑脂市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的铁路润滑脂市场细分和地理位置。

- 获取铁路润滑脂市场的区域特定数据

铁路润滑脂市场报告范围

| 报告属性 | 细节 |

|---|---|

| 2018 年市场规模 | 3.4137亿美元 |

| 2027 年市场规模 | 4.2027亿美元 |

| 全球复合年增长率(2018 - 2027) | 2.4% |

| 史料 | 2016-2017 |

| 预测期 | 2019-2027 |

| 涵盖的领域 | 按产品类型

|

| 覆盖地区和国家 | 北美

|

| 市场领导者和主要公司简介 |

|

市场参与者密度:了解其对商业动态的影响

铁路润滑脂市场正在快速增长,这得益于最终用户需求的不断增长,这些需求源于消费者偏好的不断变化、技术进步以及对产品优势的认识不断提高等因素。随着需求的增加,企业正在扩大其产品范围,进行创新以满足消费者的需求,并利用新兴趋势,从而进一步推动市场增长。

市场参与者密度是指在特定市场或行业内运营的企业或公司的分布情况。它表明在给定市场空间中,相对于其规模或总市场价值,有多少竞争对手(市场参与者)存在。

在铁路润滑脂市场运营的主要公司有:

- 荷兰皇家壳牌有限公司(壳牌)

- 埃克森美孚公司

- 总 SA。

- BP澳大利亚有限公司

- 国家石油公司(马来西亚国家石油公司)

免责声明:上面列出的公司没有按照任何特定顺序排列。

- 获取铁路润滑脂市场顶级关键参与者概述

全球铁路润滑脂市场 – 按类型

- 锂基脂

- 钙基润滑脂

- 其他油脂

全球铁路润滑脂市场 – 按应用分类

- 铁路车辆部件

- 铁路轨道元件

- 开关和鱼尾板

- 曲线轨道

- 螺钉和螺栓

全球铁路润滑脂市场 – 按分销渠道

- 离线

- 在线的

公司简介

- 荷兰皇家壳牌有限公司(壳牌)

- 埃克森美孚公司

- 总 SA。

- BP澳大利亚有限公司

- 国家石油公司(马来西亚国家石油公司)

- SKF集团

- 福斯

- 雪佛龙公司

- 克鲁勃润滑剂

- 中国石油化工

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST 和 SWOT 分析

- 市场规模价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

常见问题

In 2018, the lithium grease segment accounted for the largest market share in the global rail greases market by product type. Lithium grease is multi-purpose type grease with a buttery texture and dropping point above 350°F. Moreover, it can also be used with occasional temperatures up to 300°F. Lithium grease has excellent resistance to water and breakdown or softening. Lithium-based greases are the most commonly used in railway applications due to its higher melting point as compared to others. Lithium greases are used in various parts in railways and trains such as curved tooth coupling, cardan shaft, axle boxes, and brake system due to their high pumpability. Regular maintenance activities of different parts used in railway transportation is expected to drive the demand for lithium grease during the forecast period.

The major players operating in the global rail greases market are Royal Dutch Shell Plc, Exxon Mobil Corporation, Total SA, BP Australia Pty Limited, Petroliam Nasional Berhad (Petronas), FUCHS, SKF Group., Chevron Corporation, Klüber Lubrication, and Sinopec Corp among many others.

In 2018, the rail greases market was predominant in Asia-Pacific at the global level. The growth of the rail greases market in this region is primarily due to booming economy, rapid urbanization and growing investment by the government of emerging countries in the development of railway infrastructure. The countries across the region is experimenting with state-of-the-art transport technologies to make urban rail systems more efficient, reliable and passenger friendly. The Asia Pacific metro systems are progressively moving from semi-automatic to driverless/unmanned train operations. Most of the upcoming systems are introducing the deployment of cutting-edge technological solutions for the comfort and safety of commuters. Hence, the rail greases market is expected to experience rapid growth in the region.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Pea Protein Market

- Royal Dutch Shell Plc (Shell)

- Exxon Mobil Corporation

- Total SA.

- BP Australia Pty Limited

- Petroliam Nasional Berhad (Petronas)

- SKF Group

- FUCHS

- Chevron Corporation

- Klüber Lubrication

- Sinopec Corp

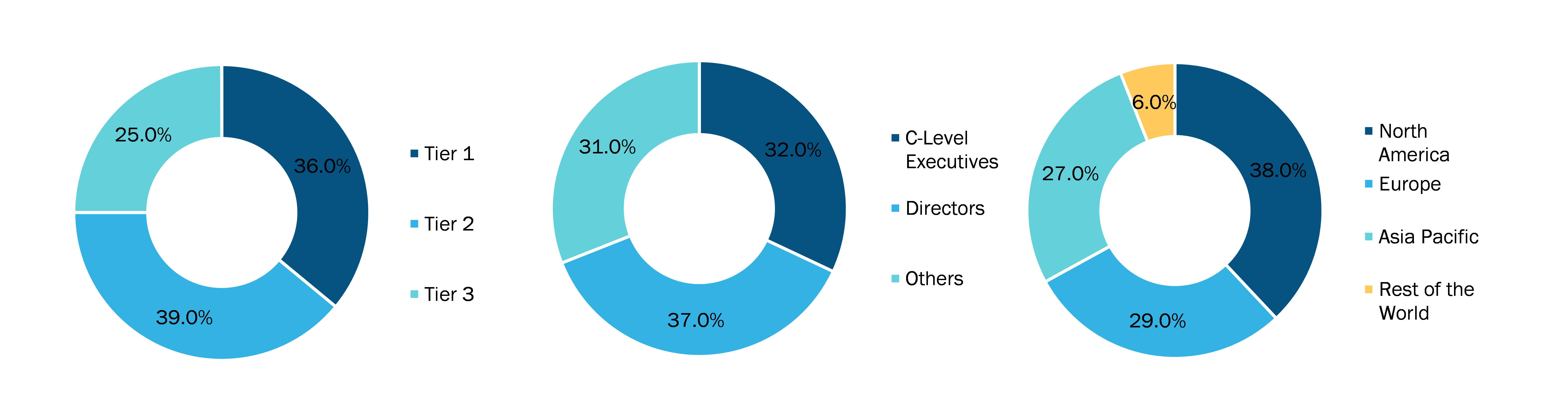

The Insight Partners performs research in 4 major stages: Data Collection & Secondary Research, Primary Research, Data Analysis and Data Triangulation & Final Review.

- Data Collection and Secondary Research:

As a market research and consulting firm operating from a decade, we have published and advised several client across the globe. First step for any study will start with an assessment of currently available data and insights from existing reports. Further, historical and current market information is collected from Investor Presentations, Annual Reports, SEC Filings, etc., and other information related to company’s performance and market positioning are gathered from Paid Databases (Factiva, Hoovers, and Reuters) and various other publications available in public domain.

Several associations trade associates, technical forums, institutes, societies and organization are accessed to gain technical as well as market related insights through their publications such as research papers, blogs and press releases related to the studies are referred to get cues about the market. Further, white papers, journals, magazines, and other news articles published in last 3 years are scrutinized and analyzed to understand the current market trends.

- Primary Research:

The primarily interview analysis comprise of data obtained from industry participants interview and answers to survey questions gathered by in-house primary team.

For primary research, interviews are conducted with industry experts/CEOs/Marketing Managers/VPs/Subject Matter Experts from both demand and supply side to get a 360-degree view of the market. The primary team conducts several interviews based on the complexity of the markets to understand the various market trends and dynamics which makes research more credible and precise.

A typical research interview fulfils the following functions:

- Provides first-hand information on the market size, market trends, growth trends, competitive landscape, and outlook

- Validates and strengthens in-house secondary research findings

- Develops the analysis team’s expertise and market understanding

Primary research involves email interactions and telephone interviews for each market, category, segment, and sub-segment across geographies. The participants who typically take part in such a process include, but are not limited to:

- Industry participants: VPs, business development managers, market intelligence managers and national sales managers

- Outside experts: Valuation experts, research analysts and key opinion leaders specializing in the electronics and semiconductor industry.

Below is the breakup of our primary respondents by company, designation, and region:

Once we receive the confirmation from primary research sources or primary respondents, we finalize the base year market estimation and forecast the data as per the macroeconomic and microeconomic factors assessed during data collection.

- Data Analysis:

Once data is validated through both secondary as well as primary respondents, we finalize the market estimations by hypothesis formulation and factor analysis at regional and country level.

- Macro-Economic Factor Analysis:

We analyse macroeconomic indicators such the gross domestic product (GDP), increase in the demand for goods and services across industries, technological advancement, regional economic growth, governmental policies, the influence of COVID-19, PEST analysis, and other aspects. This analysis aids in setting benchmarks for various nations/regions and approximating market splits. Additionally, the general trend of the aforementioned components aid in determining the market's development possibilities.

- Country Level Data:

Various factors that are especially aligned to the country are taken into account to determine the market size for a certain area and country, including the presence of vendors, such as headquarters and offices, the country's GDP, demand patterns, and industry growth. To comprehend the market dynamics for the nation, a number of growth variables, inhibitors, application areas, and current market trends are researched. The aforementioned elements aid in determining the country's overall market's growth potential.

- Company Profile:

The “Table of Contents” is formulated by listing and analyzing more than 25 - 30 companies operating in the market ecosystem across geographies. However, we profile only 10 companies as a standard practice in our syndicate reports. These 10 companies comprise leading, emerging, and regional players. Nonetheless, our analysis is not restricted to the 10 listed companies, we also analyze other companies present in the market to develop a holistic view and understand the prevailing trends. The “Company Profiles” section in the report covers key facts, business description, products & services, financial information, SWOT analysis, and key developments. The financial information presented is extracted from the annual reports and official documents of the publicly listed companies. Upon collecting the information for the sections of respective companies, we verify them via various primary sources and then compile the data in respective company profiles. The company level information helps us in deriving the base number as well as in forecasting the market size.

- Developing Base Number:

Aggregation of sales statistics (2020-2022) and macro-economic factor, and other secondary and primary research insights are utilized to arrive at base number and related market shares for 2022. The data gaps are identified in this step and relevant market data is analyzed, collected from paid primary interviews or databases. On finalizing the base year market size, forecasts are developed on the basis of macro-economic, industry and market growth factors and company level analysis.

- Data Triangulation and Final Review:

The market findings and base year market size calculations are validated from supply as well as demand side. Demand side validations are based on macro-economic factor analysis and benchmarks for respective regions and countries. In case of supply side validations, revenues of major companies are estimated (in case not available) based on industry benchmark, approximate number of employees, product portfolio, and primary interviews revenues are gathered. Further revenue from target product/service segment is assessed to avoid overshooting of market statistics. In case of heavy deviations between supply and demand side values, all thes steps are repeated to achieve synchronization.

We follow an iterative model, wherein we share our research findings with Subject Matter Experts (SME’s) and Key Opinion Leaders (KOLs) until consensus view of the market is not formulated – this model negates any drastic deviation in the opinions of experts. Only validated and universally acceptable research findings are quoted in our reports.

We have important check points that we use to validate our research findings – which we call – data triangulation, where we validate the information, we generate from secondary sources with primary interviews and then we re-validate with our internal data bases and Subject matter experts. This comprehensive model enables us to deliver high quality, reliable data in shortest possible time.

获取此报告的免费样本

获取此报告的免费样本