自定义此报告以满足您的要求

您将免费获得任何报告的定制,包括本报告的部分内容,或国家级分析、Excel 数据包,以及为初创企业和大学提供超值优惠和折扣

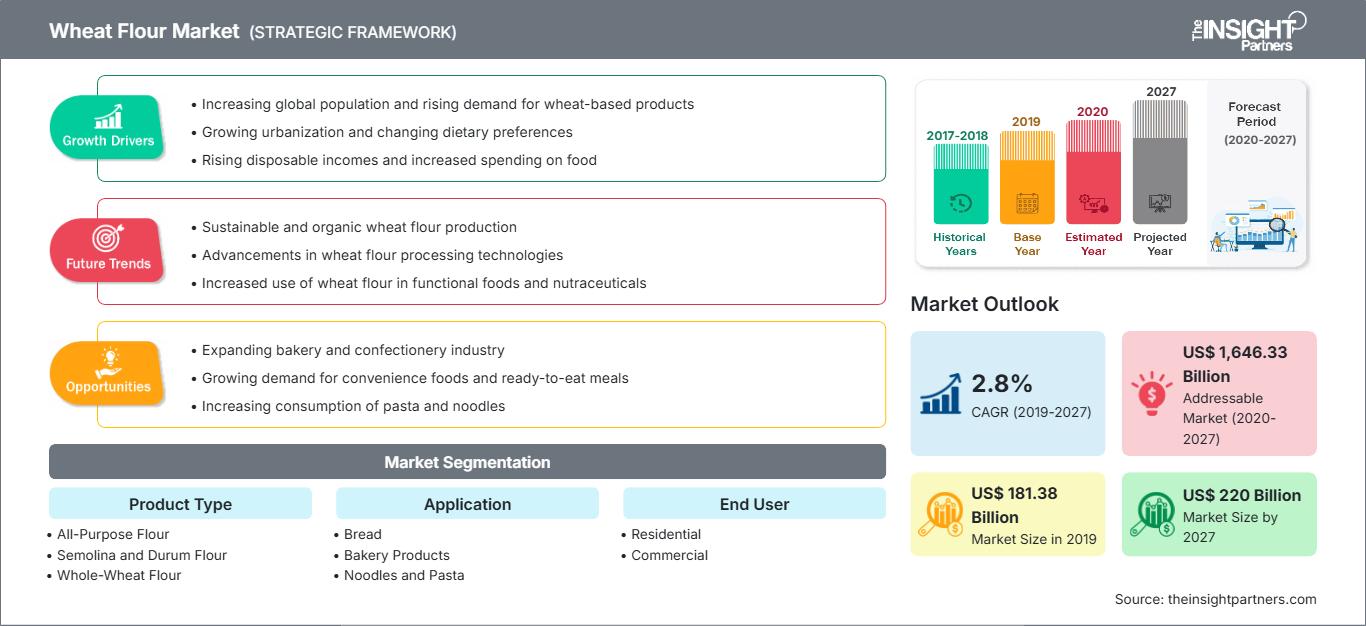

小麦粉市场: 战略洞察

-

获取本报告的主要市场趋势。这个免费样本将包括数据分析,从市场趋势到估计和预测。

市场洞察:方便食品需求上升

全球对小麦粉的需求正在稳步增长,这主要得益于消费者对方便食品和加工食品日益增长的偏好。随着生活方式节奏越来越快——尤其是在城市地区——消费者越来越倾向于选择易于准备且不影响口味和质量的食品。小麦粉是各种方便食品的基本原料,包括烘焙食品和糖果产品、即食食品、零食和速食混合食品。小麦粉的功能特性,例如改善质地、粘合性和延长保质期,使其成为现代食品加工中不可或缺的组成部分。食品饮料行业的强劲扩张,加上发达市场和新兴市场的良好经济条件,扩大了对方便食品的需求。消费者行为的转变——由双收入家庭、不断变化的饮食偏好和有限的烹饪时间所驱动——对这一趋势起了重要作用。此外,快速的城市化和核心家庭结构的兴起,巩固了方便食品作为现代饮食主食的地位。多元化的分销渠道,包括大卖场、超市、线上平台和便利店,在扩大消费者获得即食食品的渠道方面发挥了关键作用。这些零售业的进步不仅提高了产品的知名度,也促进了品牌竞争和小麦粉应用领域的创新。

对清洁标签和有机产品日益增长的需求,促使有机小麦粉品种的推出,进一步扩大了其在注重健康的消费群体中的应用范围。制造商正利用这一转变,采用有机或强化小麦粉重新配制产品,以满足营养和标签要求。人口增长、可支配收入增加以及食品偏好全球化等人口因素也有助于维持需求。为此,领先的小麦粉生产商正专注于产品配方创新、提高生产效率和扩展分销网络,以挖掘国内外市场的新兴机遇。

因此,对方便食品日益增长的需求预计将成为小麦粉市场的长期增长动力,促使行业利益相关者采取灵活的战略,并投资于产能扩张、研发和市场渗透计划。

产品类型洞察

根据产品类型,小麦粉市场细分为通用面粉、面包粉、粗粒小麦粉和硬质小麦粉、全麦粉和其他。面包粉在2019年占据了最大的市场份额,预计全麦粉将在2020年至2027年期间实现最快的复合年增长率。通用面粉由硬质小麦和软质小麦以4:1的比例混合而成,被认为是全球最受欢迎的小麦粉类型。它来自小麦粒的精磨部分,即胚乳,胚乳在研磨过程中与麸皮和胚芽分离。通用面粉营养丰富,富含烟酸、核黄素、硫胺素和叶酸(维生素B族)等维生素以及铁等矿物质。市售通用小麦粉有漂白和未漂白两种形式。漂白过程中,会使用化学防腐剂来防止面粉产生异味或在短时间内变质。通用面粉是制作各种烘焙食品的理想选择,包括蛋糕、曲奇、披萨、酵母面包、饼干和松饼,也可以用来制作浓稠的肉汁和酱汁。它还在煎炸或煸炒肉类、蔬菜和其他产品时用作裹粉剂。最终用户洞察

根据最终用户,小麦粉市场分为住宅和商业。商业领域在 2019 年占据了最大的市场份额,预计住宅领域在 2020 年至 2027 年期间的复合年增长率最高。随着食品加工行业的发展以及对健康和创新食品需求的不断增长,对商业用途小麦粉的需求成倍增加。商业领域进一步细分为 HORECA、机构和食品服务以及其他制造商。商业用途面粉厂使用少量添加剂加工小麦粉。除此之外,在加工过程中还会添加漂白剂(如过氧化苯甲酰)和氧化剂(如溴酸钾和氧化氯),使面粉看起来更白。小麦粉的商业应用包括食品和烘焙制品,例如面包、蛋糕、饼干、糕点、松饼和曲奇。除此之外,它还广泛用于制作零食、面条、意大利面等。小麦粉还可用于生物燃料行业和饲料用途。美国农业部已采用多项标准来测试商用小麦粉。这些标准确保了小麦粉的纯度并可检测到市场上存在的任何掺假物。应用洞察

根据应用,小麦粉市场可细分为面包、烘焙产品、面条和意大利面等。2019 年,面包部分占全球小麦粉市场的最大份额,预计烘焙产品部分将在 2020 年至 2027 年期间实现最高的复合年增长率。小麦粉是面包制作中最常用的基础原料。小麦粉含有麸质,麸质被认为是蛋白质的主要来源,也是酵母发酵面包的重要成分。麸质是一种橡胶状物质,它通过捕获空气和气体分子来赋予面包面团结构和弹性,从而提升烘焙食品的口感。小麦粉,例如全功能面粉、白面包粉、法式面包粉、高筋面粉和粗粒小麦粉,在制作不同种类的面包时被广泛使用。这些面粉可以单独使用,也可以与其他类型的小麦粉混合使用,具体取决于要制作的面包类型。面包作为早餐一部分的消费量增加,以及早餐的快速创新,可能会刺激面包制作中对小麦粉的需求。分销渠道洞察

根据分销渠道,小麦粉市场细分为大卖场/超市、便利店、线上渠道和其他渠道。大卖场/超市在 2019 年占据全球小麦粉市场的最大份额,而基于其他渠道的市场预计在预测期内将以最快的复合年增长率增长。制造商选择各种分销渠道,以便消费者轻松购买产品。在众多分销渠道中,超市和大卖场占据了相对重要的地位。生产商将产品销售给分销商,分销商根据需求将产品供应给大卖场和超市。事实证明,这种模式非常有利,因为产品在这些商店中树立了良好的销售形象;此外,由于生产是按需定额生产,因此不会造成产品浪费。此外,这些商店同时向买家提供种类繁多的产品,方便他们进行比较,并方便他们选择多个品牌。通过大卖场和超市销售的小麦粉正在快速增长。大卖场和超市数量的增加对这一增长产生了积极的影响。世界各地的超市和大卖场都提供各种小麦粉。并购和研发是企业常用的全球扩张策略。阿彻丹尼尔斯米德兰公司 (Archer Daniels Midland Company)、FoodMaven 和 ITC Limited 等小麦粉市场参与者一直在实施这些策略,以扩大客户群并在全球获得显著的市场份额,这也使他们能够在全球范围内维护自己的品牌名称。- 2019 年 7 月,ITC Limited 旗下的 Aashirvaad 宣布推出一系列新产品,包括无麸质面粉、Ragi 面粉和多种小米混合面粉,均属于 Aashirvaad Nature’s Super Foods 品牌。

- 2020 年 2 月,FoodMaven 宣布与 Ardent Mills, LLC 的业务部门 The Annex by Ardent Mills(The Annex)合作,向 FoodMaven 的餐饮服务客户销售其过渡性小麦粉。

- 2019 年 9 月,阿彻丹尼尔斯米德兰公司在伊利诺伊州门多塔开设了新的最先进的面粉厂。这是北美有史以来最大的面粉厂。这座新建的3万英担面粉厂可以加工春小麦、冬小麦和软小麦,以及两种全麦。

小麦粉市场

The Insight Partners 的分析师已详尽阐述了预测期内影响小麦粉市场的区域趋势和因素。本节还讨论了北美、欧洲、亚太地区、中东和非洲以及南美和中美洲的小麦粉市场细分和地域分布。

小麦粉市场报告范围

| 报告属性 | 细节 |

|---|---|

| 市场规模 2019 | US$ 181.38 Billion |

| 市场规模 2027 | US$ 220 Billion |

| 全球复合年增长率 (2019 - 2027) | 2.8% |

| 历史数据 | 2017-2018 |

| 预测期 | 2020-2027 |

| 涵盖的领域 |

By 产品类型

|

| 覆盖地区和国家 |

北美

|

| 市场领导者和主要公司简介 |

|

小麦粉市场参与者密度:了解其对业务动态的影响

小麦粉市场正在快速增长,这得益于终端用户需求的不断增长,而这些需求的驱动因素包括消费者偏好的演变、技术进步以及对产品优势的认知度的提升。随着需求的增长,企业正在扩大产品线,不断创新以满足消费者需求,并抓住新兴趋势,从而进一步推动市场增长。

- 获取 小麦粉市场 主要参与者概述

- 通用面粉

- 面包粉

- 粗粒小麦粉和硬质小麦粉

- 全麦粉

- 其他

全球小麦粉市场 – 按最终用户

- 住宅

- 商业

全球小麦粉市场 – 按应用

- 面包

- 烘焙产品

- 面条和意大利面

- 其他

全球小麦粉市场 –

按分销渠道- 大卖场/超市

- 便利店

- 线上

- 其他

公司简介

- Archer Daniels Midland Company

- Acarsan Holding

- Allied Pinnacle

- Ardent Mills

- General Mills Inc

- George Weston Foods Limited

- ITC Limited

- The King Arthur Baking Company

- KORFEZ Flour Group

- Manildra Group

- 历史分析(2 年)、基准年、预测(7 年)及复合年增长率

- PEST和SWOT分析

- 市场规模、价值/数量 - 全球、区域、国家

- 行业和竞争格局

- Excel 数据集

近期报告

客户评价

购买理由

- 明智的决策

- 了解市场动态

- 竞争分析

- 客户洞察

- 市场预测

- 风险规避

- 战略规划

- 投资论证

- 识别新兴市场

- 优化营销策略

- 提升运营效率

- 顺应监管趋势

获取免费样品 - 小麦粉市场

获取免费样品 - 小麦粉市场