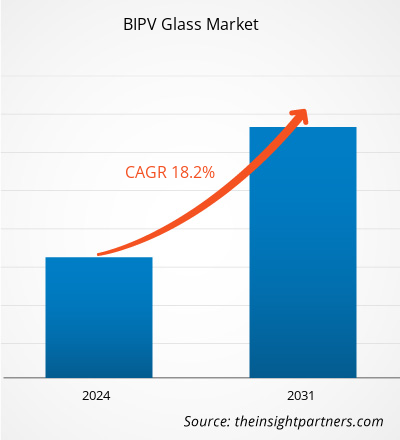

The BIPV glass market size is expected to grow from US$ 4.63 billion in 2023 to US$ 17.62 billion by 2031; it is estimated to register a CAGR of 18.2% from 2023 to 2031.

The global BIPV glass market has experienced notable growth in recent years, driven by increasing demand from commercial and residential settings. Building-Integrated Photovoltaics (BIPV) is the integration of solar cells into the building structures. Photovoltaic materials are used in various applications such as roofing, skylights, facades, canopies, and spandrel glass. BIPV glass serves as a power generator and building envelope material, thus helping reduce energy costs, fossil fuel use, and greenhouse gases, as well as increasing the building value. Growing commercial construction and rising demand for solar energy envelopes drive the BIPV glass market.

BIPV glass offers many advantages compared to conventional photovoltaic panels. BIPV modules help in reducing the energy consumption of buildings by generating solar energy. The integration of BIPV glasses in the buildings offers an aesthetic view, as these panels can be designed to suit existing building architecture. The use of transparent modules allows the natural light into the building thereby reducing lighting costs. The rising demand for sustainable and energy-efficient buildings is increasing. In December 2023, EU defined the energy efficiency targets aiming at decarbonizing building stock and key measures for the utilization of rooftop solar to cover the remaining electricity demand in the EU. The European Parliament also aims to mandate solar installations on new commercial and residential buildings by the end of 2026.

As economies continue to develop and urbanize, there is a parallel surge in the construction and expansion of commercial facilities, fueling the need for BIPV glasses.

GROWTH DRIVERS AND CHALLENGES

The rapid expansion of commercial facilities such as office buildings, shopping centers, and industrial complexes propels the demand for sustainable building materials and energy-efficient solutions, thus, providing several opportunities for the BIPV glass market growth. Manufacturing plants, warehouses, and other industrial facilities require substantial energy consumption for their operations. As businesses seek to optimize energy efficiency and reduce operational costs, BIPV glass emerges as a viable solution to offset electricity consumption and harness renewable energy directly on-site. The versatility and aesthetic appeal of BIPV glass contribute to its growing demand in industrial and commercial applications. BIPV glass offers a dual-purpose solution by serving as a building material and a renewable energy generator. This integration aligns with the sustainability goals of many commercial projects, allowing them to reduce their carbon footprint and energy costs simultaneously. According to the US Census Bureau, nonresidential construction spending increased to US$ 1,190.23 in January 2024 from US$ 1,016.42 in January 2023, a significant growth of 17.1%. In addition, according to the Center for Sustainable Systems, University of Michigan, commercial building floor space is projected to reach 124.6 billion square feet by 2050, a 29% increase from 2022.

As per the Ministry of Statistics and Programme Implementation, the construction sector in India grew by 10.7% in 2022, a rebound from a decrease of 8.6% in 2021 due to the government's augmented focus on infrastructure projects for commercial and residential segments. Countries such as Uzbekistan and Azerbaijan are also undergoing economic development, leading to rising investments in infrastructure and urban development, including the construction of roads, bridges, residential complexes, and industrial facilities. According to the State Committee of the Republic of Uzbekistan on Statistics, between January and August 2022, in Uzbekistan, the value of construction work performed amounted to US$ 9.28 billion, and the growth rate compared to the corresponding period in 2021 reached 106.2%.

The aesthetic appeal of BIPV glass complements modern architectural designs, making it an attractive option for commercial developers seeking functionality and visual appeal. Further, the Department of Energy of the US has expressed interest in better understanding the relationship between builders, roofing companies, and solar PV installers. As of January 1, 2020, the California building code (California Code of Regulations, Title 24, Part 6) requires all new construction homes to have solar panel technology. The California Energy Commission, a key stakeholder in changing the California Code of Regulations to require residential solar power, brought about this change. In November 2019, local laws 92 and 94 (part of the Climate Mobilization Act) took effect in New York City, mandating that any roof undergoing major construction be covered in solar PV panels or a green roof system (a roof covered in vegetation). As businesses increasingly prioritize sustainability and energy efficiency, BIPV glass emerges as a key solution for integrating renewable energy generation into commercial buildings. The ongoing innovations in BIPV technology and continued government support contribute to the global BIPV glass market size.

Lack of government policy support and incentives for BIPV installations increase the installation cost of building integrated photovoltaics (BIPV) glass. BIPV systems are integrated into the building’s architecture by replacing traditional building materials such as glass, roofing materials, and facade elements. This integration of BIPV systems requires specialized design, manufacturing, and installation processes, which adds to the overall cost of the system. The increased investment cost for BIPV systems makes conventional solar photovoltaic systems a more affordable solution for building owners. In addition, the advanced installation equipment and techniques incur high installation costs. BIPV solar modules are costlier by 2.5 to 3 times as compared with traditional solar modules. Furthermore, conventional solar panels tend to possess better energy efficiency as they are designed for the sole purpose of energy generation. However, compared with traditional panels, BIPV solar modules have an average of 5–10% less efficiency. Thus, high capital investments required for the integration of BIPV modules and less energy efficiency as compared to traditional solar modules restrain the BIPV glass market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

BIPV Glass Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

BIPV Glass Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

REPORT SEGMENTATION AND SCOPE

The "Global BIPV Glass Market Forecast to 2031" is a specialized and in-depth study with a significant focus on market trends and opportunities. The report aims to provide an overview of the market with detailed market segmentation on the basis of material, glazing type, component type, end use, and geography. The global BIPV glass market has witnessed significant growth over the past few years and is expected to continue this trend during the forecast period. The report provides key statistics on the use of BIPV glass worldwide, along with their demand in major regions and countries. It also provides a qualitative assessment of various factors affecting the market performance in major regions and countries. The report also includes a comprehensive analysis of the leading market players and their key strategic developments. Several analyses on the market dynamics are also included to help identify the key driving factors, global BIPV glass market trends, and lucrative opportunities that would, in turn, aid in identifying the significant revenue pockets.

Ecosystem analysis and Porter’s five forces analysis also provide a 360-degree view of the global BIPV glass market analysis, which helps understand the entire supply chain and various factors affecting the market growth.

SEGMENTAL ANALYSIS

The global BIPV glass market is segmented on the basis of material, glazing type, component type, and end use. In terms of material, the market is segmented into crystalline silicone, amorphous silicone, and others. By glazing type, the market is bifurcated into single module and double module. Based on component type, the BIPV glass market is segmented into BIPV glass roofs, BIPV glass facades, and others. By end use, the market is segregated into residential, commercial, industrial, and others.

Based on material, the crystalline silicone segment held a significant global BIPV glass market share in 2023. Solar cells are connected and laminated under toughened, high-transmittance glass in crystalline silicon PV cells to produce reliable, climate-resistant PV modules. This type of glass can generate electricity using the same technology as solar panels. Based on glazing type, the double module segment held a major market share in 2023. The double-glazed module contains two sheets of glass. Traditionally, these two panes of glass are separated by a gap of 12mm and 16mm. However, the gap will be 20mm in a modern double-glazed module. Double glazing has better insulation properties and provides customers with better temperature control indoors. Based on component type, the BIPV glass roofs segment led the market with a significant market share in 2023. The BIPV glasses can be used for solar roofing on buildings, independent houses, industrial buildings, schools, colleges, etc. Moreover, canopies and carports use solar roofing with BIPV technology. BIPV solar roof panels are clean, renewable energy sources. The panels are placed on rooftops and angled toward the sun to provide continuous power to the entire building. Based on end use, the commercial segment led the market with a significant market share in 2023. The commercial sector includes sports facilities, government offices, hotels, corporate offices, and other commercial spaces. Different types of BIPV glasses are used to construct these facilities to reduce energy costs.

REGIONAL ANALYSIS

The BIPV glass market report provides a detailed regional overview of the market. Europe accounted for a significant global BIPV glass market share in 2023. The market in the region was valued at ~US$ 2 billion in 2023. France is a major contributor to the market growth in this region. Asia Pacific is also expected to witness notable growth, reaching ~US$ 7 billion by 2031. Furthermore, in North America, there has been a widespread use of BIPV glasses. The North America BIPV glass market growth is driven by factors such as the growing adoption of BIPV glass in the construction of buildings owing to their advantages and the increasing demand for sustainable and energy-efficient buildings. The BIPV glass market in North America is expected to report a CAGR of around 20% from 2023 to 2031.

BIPV Glass Market Regional Insights

BIPV Glass Market Regional Insights

The regional trends and factors influencing the BIPV Glass Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses BIPV Glass Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for BIPV Glass Market

BIPV Glass Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 4.63 Billion |

| Market Size by 2031 | US$ 17.62 Billion |

| Global CAGR (2023 - 2031) | 18.2% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Material

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

BIPV Glass Market Players Density: Understanding Its Impact on Business Dynamics

The BIPV Glass Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the BIPV Glass Market are:

- Koch Industries Inc

- AGC Inc

- Nippon Sheet Glass Co Ltd

- Vitro SAB de CV

- Onyx Solar Group LLC

- MetSolar

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the BIPV Glass Market top key players overview

INDUSTRY DEVELOPMENTS AND FUTURE OPPORTUNITIES

Partnerships, acquisitions, and new product launches are a few prominent strategies adopted by the players operating in the global BIPV glass market.

- In March 2023, Vitro Glass launched Vitro X, which will identify and develop inspired solutions for challenges experienced in the glass industry. It would also support future-focused companies in bringing innovative products and technologies to market.

- In September 2022, Grenzebach Group of Germany, a glass and building materials producer, announced the inauguration of a building-integrated PV (BIPV) module production facility by its subsidiary Envelon in the Germany’s Bavaria region with up to 300,000 sq. mtr. annual capacity.

COMPETITIVE LANDSCAPE AND KEY COMPANIES

Koch Industries Inc, AGC Inc, Nippon Sheet Glass Co Ltd, Vitro SAB de CV, Onyx Solar Group LLC, MetSolar, Mitrex, Roofit.Solar, Grenzebach Envelon GmbH, and Hanergy Holding Group Ltd. are a few major players analyzed in the global BIPV glass market report.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Material, Glazing Type, Component Type, and End Use

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The BIPV glass roofs segment held the largest share of the global BIPV glass market in 2023. The building with BIPV solar roof panel gets most of its energy from sunlight, which helps preserve the earth's resources. Also, the installation of BIPV solar roofs significantly eliminates pollution. Owing to these factors, they are considered environmentally friendly. Federal, state, and local governments provide tax incentives and rebates as solar power roofs benefit the environment. All these factors led to the dominance of BIPV glass roofs segment in 2023.

The commercial segment held the largest share of the global BIPV glass market in 2023. Rising investments in commercial construction projects and growing commercial construction activities across the world propel the demand for BIPV glasses. Moreover, manufacturers are launching BIPV glass solutions for commercial construction to cater to the increasing demand. In March 2021, Vitro Architectural Glass announced the launch of Solarvolt BIPV glass modules to aid CO2-free power generation for commercial buildings. All these factors led to the dominance of commercial segment in 2023.

The crystalline silicone segment held the largest share in the global BIPV glass market in 2023Crystalline silicon is the most suitable material for canopies, spandrel glass, skylight applications, solid walls, and guardrails. Crystalline silicon glass can be easily customized, especially in shape; even trapezoids can be easily fabricated. The glass installations take up less area for a given amount of kWp (kilowatt 'peak' power) to be reached compared to amorphous silicon glass installations. These factors led to the dominance of the crystalline silicone segment in 2023.

In 2023, Europe held the largest share of the global BIPV glass market. The rising adoption of BIPV glass owing to its advantages and government initiatives promoting sustainable construction practices boost the Europe BIPV glass market. Countries such as France, Germany, and Luxembourg have strict regulations regarding incentives for photovoltaic (PV) buildings. This has accelerated the adoption of BIPV in these countries. As a result, the BIPV glass market has huge potential in Europe.

A few players operating in the global BIPV glass market include Koch Industries Inc, AGC Inc, Nippon Sheet Glass Co Ltd, Vitro SAB de CV, Onyx Solar Group LLC, MetSolar, Mitrex, Roofit.Solar, Grenzebach Envelon GmbH, and Hanergy Holding Group Ltd.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - BIPV Glass Market

- Koch Industries Inc

- AGC Inc

- Nippon Sheet Glass Co Ltd

- Vitro SAB de CV

- Onyx Solar Group LLC

- MetSolar

- Mitrex

- Roofit.Solar

- Grenzebach Envelon GmbH

- Hanergy Holding Group Ltd.

Get Free Sample For

Get Free Sample For