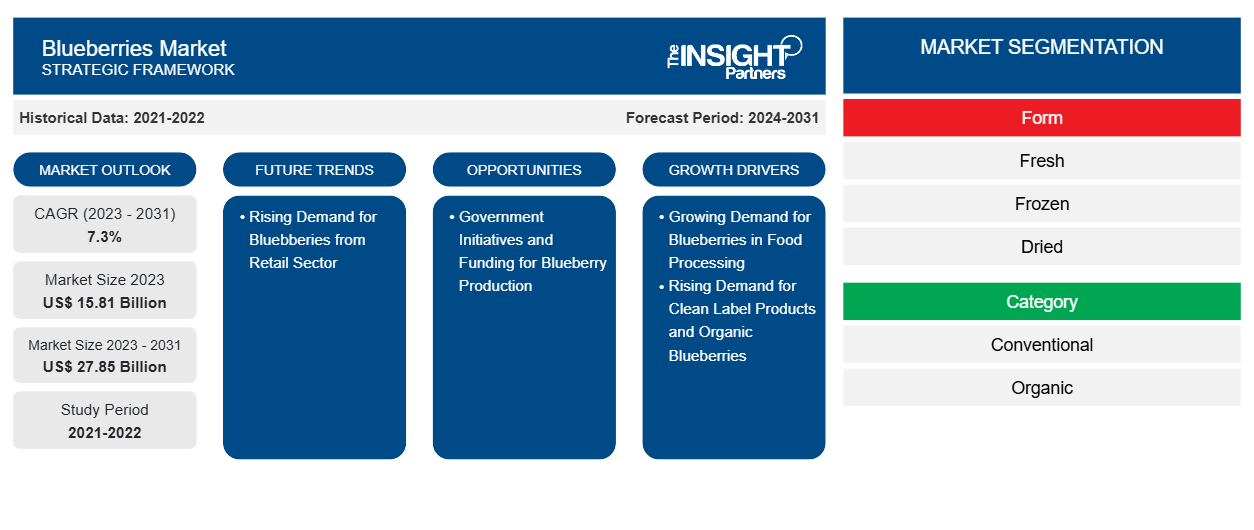

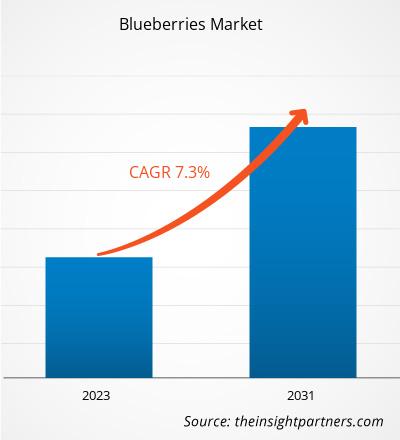

The blueberries market size is projected to reach US$ 27.85 billion by 2031 from US$ 15.81 billion in 2023; it is estimated to register a CAGR of 7.3% during 2023–2031. Rising demand for blueberries in food retail contributes to the growth of the global blueberries market.

Blueberries Market Analysis

The growing demand for blueberries in food processing and rising demand for clean label products and organic blueberries are major factors contributing to the market growth. In addition, increasing government initiatives and funding for blueberries production has further created a growth opportunity for the market. For instance, in May 2024, Eyre Trailers was offered funding of ~US$ 400,000 for the automated blueberry harvesting project to develop and demonstrate a fully automatic machine for harvesting blueberries.

Blueberries Market Overview

The rising awareness of the nutritional benefits of blueberries among consumers, increasing demand from the food service and food processing sectors, and surging imports of fresh blueberries in developing countries have contributed to the market growth. Blueberries are low-calorie fruits with high vitamin C and vitamin K content. They are packed with antioxidants, particularly anthocyanins, that help curb the free radical oxidative stress, which offers anti-cancer effects. Blueberries have a low glycemic index, which does not cause a spike in blood sugar levels. Further, people are also consuming blueberries with low-calorie food items to aid their weight loss process. Thus, the rich nutrition profile of blueberries and rising health consciousness are the key factors driving the market. The demand for blueberries has surged in the Asia Pacific region. China, Japan, and India are among the largest contributors to the market in Asia Pacific. The growing demand for blueberries from food retail and food processing in the regions is expected to boost the blueberries market growth in Asia Pacific over the forecast period

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blueberries Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Blueberries Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Blueberries Market Drivers and Opportunities

Rising Demand for Clean Label Products and Organic Blueberries

The demand for clean label products and organic blueberries is growing with the evolving consumer preferences for transparent, nutritious, and sustainable products. With the growing awareness of dietary choices, consumers are seeking minimally processed products that include natural ingredients and are free from artificial additives. Clean label products generally include ingredients that align with consumer preference for authenticity. Further, organic blueberries provide a perception of healthy and environment-friendly grown varieties. Health-conscious consumers demand clean label and organic foods, including blueberries. Organic farming practices often emphasize soil health, while organic blueberries are recognized as a sustainable alternative to conventionally grown options. In the food and beverages industry, clean label products and organic blueberries are highly incorporated into a broad range of products such as snacks, beverages, breakfast cereals, baked goods, and dairy products.

According to the Center for the Promotion of Imports, the Ministry of Foreign Affairs, Germany, Denmark, Austria, and Luxembourg were the largest markets for retail sales of organic food in Europe in 2022. The rise of plant-based diets and vegan diets has contributed to the demand for clean label and organic blueberries. With the shift in consumer demand toward plant-based and minimally processed food, organic blueberries are gaining popularity as a natural and plant-based ingredient. Plant-based snacks, smoothie bowls, vegan desserts, and fortified beverages are incorporated with organic blueberries to maintain the clean label appeal of the product. Thus, the increasing demand for clean label products and organic blueberries fuels the growth of the blueberries market.

Government Initiatives and Funding for Blueberry Production

Governments of major blueberry-producing countries are implementing multiple policies, financial incentives, campaigns, and research programs, especially to enhance productivity and improve quality. Such government initiatives aim at boosting domestic production and enhancing the country's position as an exporter of blueberries worldwide. In the US, the Federal Government has implemented programs to support blueberry growers. In November 2023, the US Department of Agriculture funded a US$ 497,827 grant under the Agriculture and Food Research Initiative for the project titled "Expanding Southern Highbush Blueberries to Underserved Regions of Southeastern US." The project was conducted by Auburn University professors and Alabama Agricultural Experiment Station researchers.

In August 2024, the government of Australia granted ~US$ 100,000 for the development of its robotic blueberry picking device that will reduce labor costs and increase the yield efficiency of produce. In addition, Peruvian blueberries benefit from the US-Peru Free Trade Agreement, allowing Peru to export tariff-free blueberries to the US. The governments also collaborate with international agricultural organizations to provide training and technical assistance to farmers to boost blueberry productivity and quality. Thus, government initiatives and funding for blueberry production are expected to create lucrative opportunities for the blueberries market during the forecast period.

Blueberries Market Report Segmentation Analysis

Key segments that contributed to the derivation of the blueberries market analysis are form, category, and end use.

- Based on form, the market is segmented into dried, fresh, and frozen. The fresh segment held the largest share of the market in 2023.

- In terms of category, the market is divided into organic and conventional. The conventional segment held a significant share of the market in 2023.

- Based on end use, the market is segmented into food service, food processing, and food retail. The food retail segment held the largest share of the market in 2023.

Blueberries Market Share Analysis by Geography

The geographic scope of the blueberries market report is mainly divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America.

Asia Pacific is expected to register the highest CAGR during 2023–2031. In Asia Pacific, the increased health awareness and product availability foster the growth of the blueberries market in Asia Pacific. The consumption of imported fruits by Asian consumers has grown significantly in the past few years due to a shift in consumer dietary patterns and development in the supply chain. As per the US Department of Agriculture, blueberries are cultivated in 26 Chinese provinces. China is the largest importer of blueberries, mainly from Peru and Chile, accounting for 99.9% of total Chinese imports. The marketing initiatives by Driscoll's and Joyvio have played a crucial role in creating awareness among Chinese consumers about the taste profile of blueberries and their health benefits, thereby driving the market.

Blueberries Market Regional Insights

The regional trends and factors influencing the Blueberries Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Blueberries Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Blueberries Market

Blueberries Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 15.81 Billion |

| Market Size by 2031 | US$ 27.85 Billion |

| Global CAGR (2023 - 2031) | 7.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Form

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

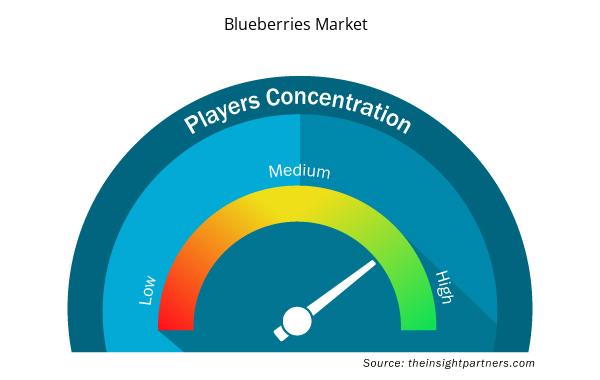

Blueberries Market Players Density: Understanding Its Impact on Business Dynamics

The Blueberries Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Blueberries Market are:

- SanLucar Fruit SLU

- Surexport Compania Agraria SL

- North Bay Produce Inc

- Agrovision Corp

- Agroberries SpA

- Costa Group Holdings Ltd

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Blueberries Market top key players overview

Blueberries Market News and Recent Developments

The blueberries market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A recent key development in the blueberries market is mentioned below:

- KERSIA GROUP acquired Bioarmor to strengthen its position and enhance animal welfare standards. This strategic move was underpinned by the identification of significant synergies, both from a strategic and commercial perspective, as well as by the shared values concerning corporate social responsibility (CSR) and environmental respect between KERSIA GROUP and Bioarmor. Furthermore, the merger significantly bolstered the positions of both entities within the global livestock solutions market, thereby granting them access to new export markets, notably in Asia, the Middle East, and South America. (Source: KERSIA GROUP, Company Website, May 2021)

Blueberries Market Report Coverage and Deliverables

The "Blueberries Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Blueberries market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Blueberries market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Blueberries market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the blueberries market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The rising demand for blueberries in the food retail sector is likely to emerge as a key trend in the market in the future.

North America accounted for the largest share of the market in 2023.

SanLucar Fruit SLU, Surexport Compania Agraria SL, North Bay Produce Inc, Agrovision Corp, Agroberries SpA, Costa Group Holdings Ltd, Qualiprim, Zalar Agri Sarl, Naturipe Farms LLC, RIKA, Raimy Societe Agricole SARL, iBerry Morocco, DAIFRUITS SL, Reiter Affiliated Companies LLC, and FRESHROYAL SL are among the key players operating in the blueberries market.

The blueberries market size is projected to reach US$ 27.85 billion by 2031.

Growing demand for blueberries in food processing and rising demand for clean label products and organic blueberries are major factors contributing to the growth of the market.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Blueberries Market

- SanLucar Fruit SLU

- Surexport Compania Agraria SL

- North Bay Produce Inc

- Agrovision Corp

- Agroberries SpA

- Costa Group Holdings Ltd

- Qualiprim

- Zalar Agri Sarl

- Naturipe Farms LLC

- RIKA

- Raimy Societe Agricole SARL

- iBerry Morocco

- DAIFRUITS SL

- Reiter Affiliated Companies LLC

- FRESHROYAL SL

Get Free Sample For

Get Free Sample For