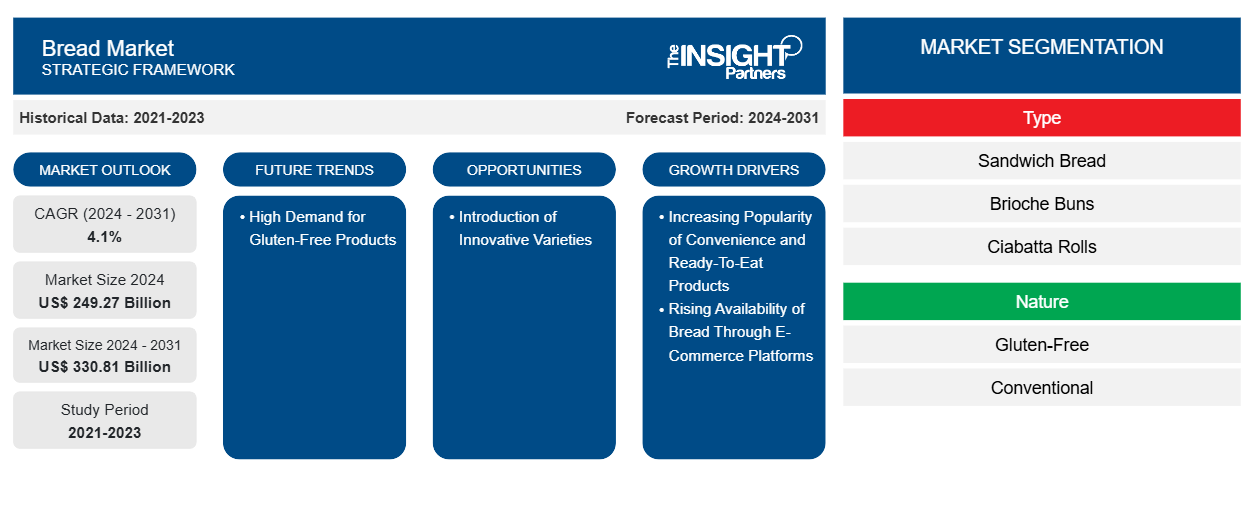

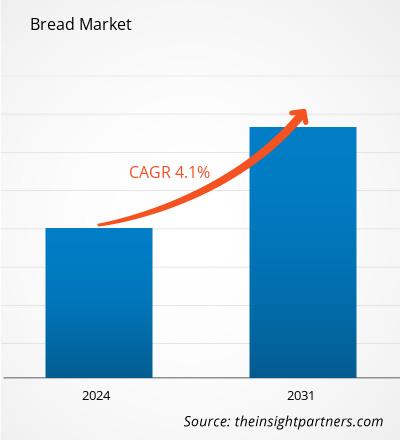

The bread market size is projected to reach US$ 330.81 billion by 2031 from US$ 249.27 billion in 2024. The market is expected to register a CAGR of 4.1% during 2024–2031. The rising popularity of gluten-free products is likely to bring new trends in the market during the forecast period.

Bread Market Analysis

Companies in the bread market across the world are experiencing a surge in demand due to the increasing preference for convenience and ready-to-eat products. Predominantly hectic lifestyles, along with the need for quick and simplified meal solutions, have led to a significant rise in bread consumption worldwide. The consumers select gluten-free, low-carb, high-fiber, or whole-grain bread products based on ingredient specifications provided on labels. Evolving consumer priorities and increasing preference for healthier alternatives have resulted in the demand for organic bread, baguettes, bagels, and buns and rolls. In response, bread manufacturers are also extensively innovating their products, offering artisanal bread, functional bread, and fortified bread by incorporating functional ingredients such as seeds, nuts, ancient grains, vegetables, and different vitamins and minerals. Therefore, evolving consumer needs in terms of taste have resulted in a high demand for specialty and functional bread, which is expected to provide lucrative opportunities for bread producers.

Bread Market Overview

Bread is a staple food appreciated worldwide. It has a rich history that spans thousands of years, and it has been an unintegral part of the culinary traditions of diverse cultures. From sliced bread to baguettes and bagels, each region has unique bread varieties reflecting local flavors and customs. It is made from dough prepared using flour (wheat, barley, oats, rye, and other flour), yeast, and sugar, often by baking. It has been a major food in vast parts of the globe. It is one of the oldest manufactured baked goods, and it has been of considerable significance since the beginning of agriculture. It has also been instrumental in the recreation of an essential part of religious ceremonies and everyday culture. It is a regular food product in households, restaurants, and cafes; moreover, it is also commonly incorporated in recipes such as sandwiches and rolls. The expanding class of working professionals, hectic work schedules, and busy lifestyles result in considerable demand for convenient and ready-to-eat food products, including bread, which can be consumed in breakfast, snacks, or meals with less preparation requirements. Also, the increasing urbanization and growing influence of Western cuisine are expected to generate lucrative opportunities for the growth of the bread market worldwide during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bread Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Bread Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Bread Market Drivers and Opportunities

Rising Availability of Bread Through E-Commerce Platforms Fuels Market Growth

As consumers increasingly shift toward online shopping for convenience, the bread market is poised to benefit from greater visibility and wider product availability. E-commerce channels provide consumers with the convenience of ordering baked goods from the comfort of their homes. Consumers can browse through a wide variety of bread, compare prices, and choose the trusted brands' products by referring to the labeling instructions and reviews of other consumers before placing orders. This convenience aspect of e-commerce is particularly appealing to busy individuals or those who may not have easy access to physical grocery stores. According to Agriculture Canada, in the US, grocery e-commerce sales grew 26.4% annually from 2019 to 2023. Further, as per Ecommerce Europe, the total B2C European e-commerce turnover saw a modest growth of 3% in 2023, recording an increase from €864 billion to €887 billion. E-commerce platforms provide bread producers with a direct channel to reach consumers worldwide. By leveraging e-commerce platforms, bread manufacturers can overcome traditional barriers such as geographic limitations and distribution challenges, and tap into new markets beyond their local regions. Moreover, these platforms offer them the flexibility of showcasing their products and communicating directly with consumers, subsequently enhancing brand visibility and customer engagement.

Further, by bypassing the intermediaries and traditional retail channels, bakery manufacturers can better understand consumer preferences, receive feedback, and tailor their offerings accordingly. Thus, the major players such as Grupo Bimbo SAB de CV, Dr Schar AG, Dimpflmeier Bakery Ltd, Campbell Soup Co., and Wonder Brands Inc. operating in the market are catalyzing their business by distributing their baked goods through e-commerce platforms, which, in turn, bolsters the global bread market growth.

Introduction of Innovative Varieties to Create Growth Opportunities in Market

Consumers select gluten-free, low-carb, high-fiber, or whole-grain bread products based on ingredient specifications provided on labels. Evolving consumer priorities and increasing preference for healthier alternatives have resulted in the demand for organic bread, baguettes, bagels, and buns and rolls. In response, bread manufacturers are also extensively innovating their products, offering artisanal bread, functional bread, and fortified bread by incorporating functional ingredients such as seeds, nuts, ancient grains, vegetables, and different vitamins and minerals. Some bakers also create traditional breads and loaves using an unusual combination of ingredients such as carrots, beetroot, spinach, and other vegetables. Moreover, cumin, turmeric, and cinnamon are gaining recognition as special ingredients to experiment with flavors. Sara Lee, a brand of Grupo Bimbo SAB de CV bread makers, announced “White Bread Made with Veggies” in January 2023 as the latest addition to its product portfolio. Baked with an equivalent of one cup of vegetables per loaf, the newly launched product is enriched with vitamin A, D, and E, highlighting practical ways to add some extra nutrients to any meal. In May 2024, Bimbo Bakeries USA, a subsidiary of Grupo Bimbo SAB de CV, launched Hawaiian bakery bread and buns to its Sara Lee Artesano portfolio. The two new bread products deliver delicious, sweet bread and buns with the perfect tropical twist without artificial flavors, preservatives, or high-fructose corn syrup. Nature's Harvest (a brand of Grupo Bimbo SAB de CV) announced the relaunch of its full line of bread products across California (US) in June 2022. The relaunch was intended to introduce two new varieties into its “Butter and White made with Whole Grain” portfolio, which featured updated packaging with a refreshed look and feel. The reintroduction entailed consumer insight-driven improvements to Nature’s Harvest varieties, taste, and packaging. With this move, the brand emphasized its commitment to baking each loaf locally in California.

Bread Market Report Segmentation Analysis

Key segments that contributed to the derivation of the bread market analysis are type, nature, category, and application.

- By type, the bread market is segmented into sandwich bread, brioche buns, ciabatta rolls, baguettes, panini and focaccia bread, hamburger buns, hotdog buns, and others. The sandwich bread segment held the largest share of the market in 2024.

- Based on nature, the market is bifurcated into gluten-free and conventional. The conventional segment dominated the market in 2024.

- Based on category, the market is segmented into frozen and ambient, and refrigerated. The ambient and refrigerated segment held a larger market share in 2024.

- In terms of end use, the market is segmented into retail and food service. The retail segment held a larger share of the market in 2024.

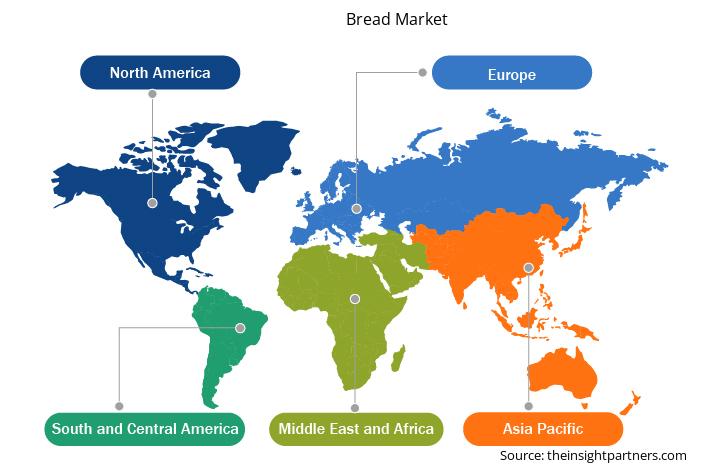

Bread Market Share Analysis by Geography

The geographic scope of the bread market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The bread market in Asia Pacific is expected to grow significantly during the forecast period.

The bakery industry in Asia Pacific has exhibited significant growth owing to the rising consumption in India, Japan, and China, among other countries. The demand for different bread types is increasing in the region due to a rising consumer preference for convenient and ready-to-eat foodstuffs, especially baked goods (bread, baguettes, and buns and rolls), along with a surge in the appeal of Western diets. Amid the continuous urbanization, lifestyles are becoming increasingly hectic in the region, which drives consumers toward quick and convenient meal options, making bread an attractive choice. In addition to this, awareness buildup regarding health and wellness prompts consumers to look for healthier bread options, such as whole-grain, multigrain, and gluten-free varieties offering nutritional benefits. Therefore, consumers in the region are increasingly opting for millet-based food products in their meals. To cater to the millet-based bakery products demand, bakery brands operating in Asia Pacific are increasingly launching new products. However, traditional food habits and cultural preferences are prevalent in India, China, South Korea, and other Asian countries; subsequently, people in these countries prioritize rice, wheat, millet, pulses, dairy, vegetables, fruits, noodles, and other staple foods over bread, which limits the market in this region.

Bread Market Regional Insights

Bread Market Regional Insights

The regional trends and factors influencing the Bread Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Bread Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Bread Market

Bread Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 249.27 Billion |

| Market Size by 2031 | US$ 330.81 Billion |

| Global CAGR (2024 - 2031) | 4.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

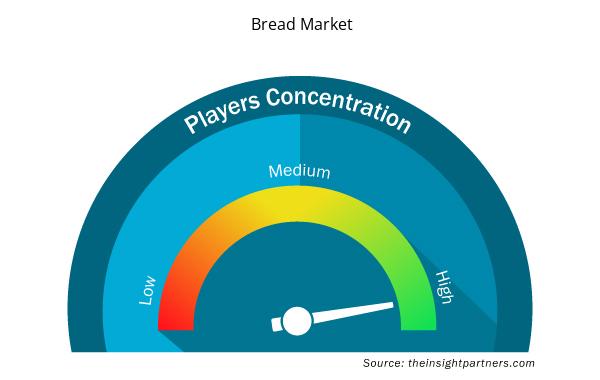

Bread Market Players Density: Understanding Its Impact on Business Dynamics

The Bread Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Bread Market are:

- Lantmannen Unibake

- Rich Products Corp

- La Brea Bakery

- Flowers Foods Inc

- Grupo Bimbo SAB de CV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Bread Market top key players overview

Bread Market News and Recent Developments

The bread market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the bread market are as follows:

- In April 2023, Britannia, a brand of Bonn Group, launched "Millet Bread," without Maida, for Indian consumers. This bread product is incorporated with ragi, jowar, bajra, and oats, and has notable amounts of fibers and minerals that provide consumers with a convenient way to include millet-based options in their meals. (Source: Britannia, Company Website, April 2024)

- Lantmännen Unibake Sweden relaunched a series of hamburger buns and hotdog rolls with more wholegrain and fiber. The goal is to make it more interesting for Swedish consumers to choose healthier alternatives to conventional fast-food products. (Source: Lantmännen Unibake Sweden, Press Release, April 2024)

Bread Market Report Coverage and Deliverables

The "Bread Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Bread market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Bread market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Bread market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the bread market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Type, Category, Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Europe accounted for the largest share of the market in 2024.

The increasing popularity of convenience and ready-to-eat products, and the rising availability of bread through e-commerce platforms are major factors contributing to market growth.

High demand for gluten-free products is likely to bring key trends in the market in the future.

Lantmannen Unibake, Rich Products Corp, La Brea Bakery, Flowers Foods Inc, Grupo Bimbo SAB de CV, Fiera Foods Company, La Lorraine Bakery Group, EUROPASTRY, SA, Bäckerhaus Veit GmbH, Schripps European Bread, Vandemoortele NV, Upper Crust, FGF Brands Inc, VIVESCIA, and Conagra Brands Inc. are a few key players operating in the market.

The market size is projected to reach US$ 330.81 billion by 2031.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Bread Market

- Lantmannen Unibake

- Rich Products Corp

- La Brea Bakery

- Flowers Foods Inc

- Grupo Bimbo SAB de CV

- Fiera Foods Company

- La Lorraine Bakery Group

- FGF Brands Inc

- VIVESCIA

- Conagra Brands Inc.

Get Free Sample For

Get Free Sample For