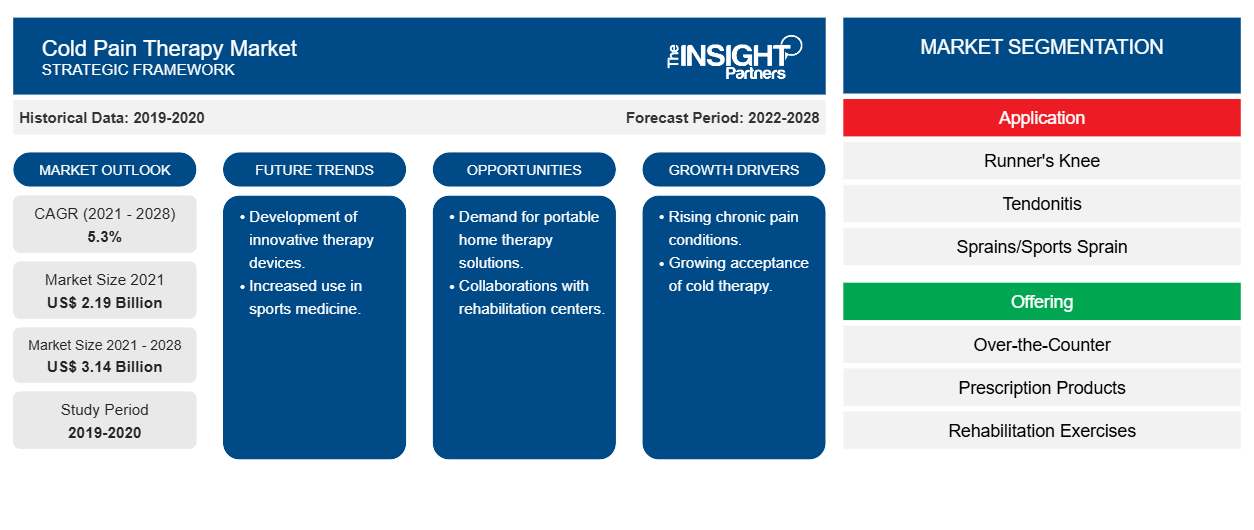

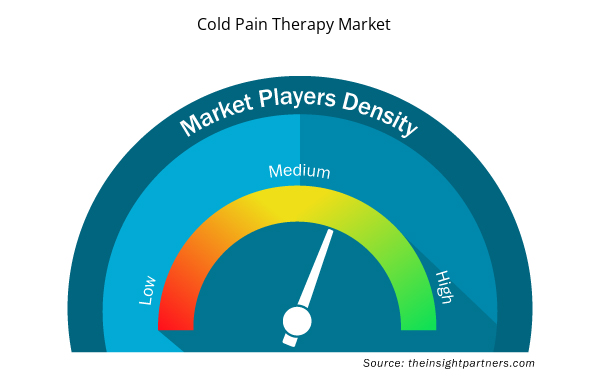

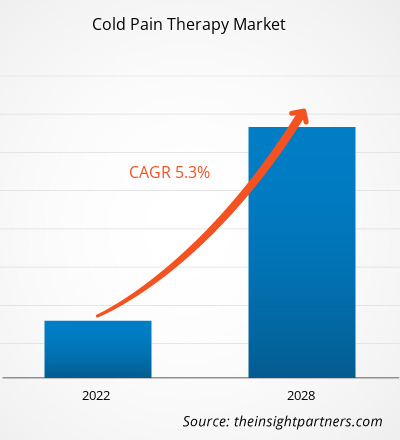

[Research Report] The global cold pain therapy market was valued at US$ 2,189.94 million in 2021; it is estimated to grow at a CAGR of 5.3% from 2022 to 2028.

The rising number of orthopedic surgeries due to the increasing cases of sports injuries drives the overall cold pain therapy market growth. Further, high adoption of cold pain therapy in emerging economies provide lucrative opportunities in the global market.

A large population is opting for an active lifestyle, which has increased physical activities such as gymming and sports. This has led to a surge in the cases of sports-related injuries such as rotator cuff injuries, ligament tears, tendon rupture, sprains & strains, and swollen muscles. According to the Hopkins Medicine report, ~3.5 million cases of sports injuries are reported in the US annually. As per Hospital for Special Surgery, rotator cuff injuries are highly common and affect 2-4 million people in the country every year. Rotator cuff conditions develop over time among athletes that can cause trauma.

Further, the increasing geriatric population is highly prone to various orthopedic conditions such as joint disorders, joint replacement, osteoarthritis, and rheumatoid arthritis. According to the Center Orthopedic & Neurosurgical Care & Research, by 2030, total knee replacement surgeries are projected to grow by 673% to reach 3.5 million procedures per year. As a result, the increasing number of orthopedic surgeries creates the demand for cold pain therapy in pain management as postoperative care. Additionally, the rising prevalence of musculoskeletal disorders is expected to increase the need for cold pain therapy to treat various musculoskeletal disorders including trauma, back pain, tendinitis, sarcopenia, osteopenia, and low back injuries. According to World Health Organization (WHO), the musculoskeletal disease affects ~1.71 billion people globally, and low back pain is the leading cause of disability in 160 countries. Moreover, an increase in road accidents and trauma cases is contributing to a major share of orthopedic surgeries. As per the US Department of Transportation, more than 6 million car accidents occur every year in the US. In Florida, more than 350,000 drivers are involved in road accidents, which accounts for 200,000 injuries every year, including spine injuries and knee injuries.

Thus, the increase in sports and physical activities and the surge in orthopedic surgeries owing to sports injuries, a large geriatric population, and a high number of trauma cases are driving the cold pain therapy market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cold Pain Therapy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cold Pain Therapy Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

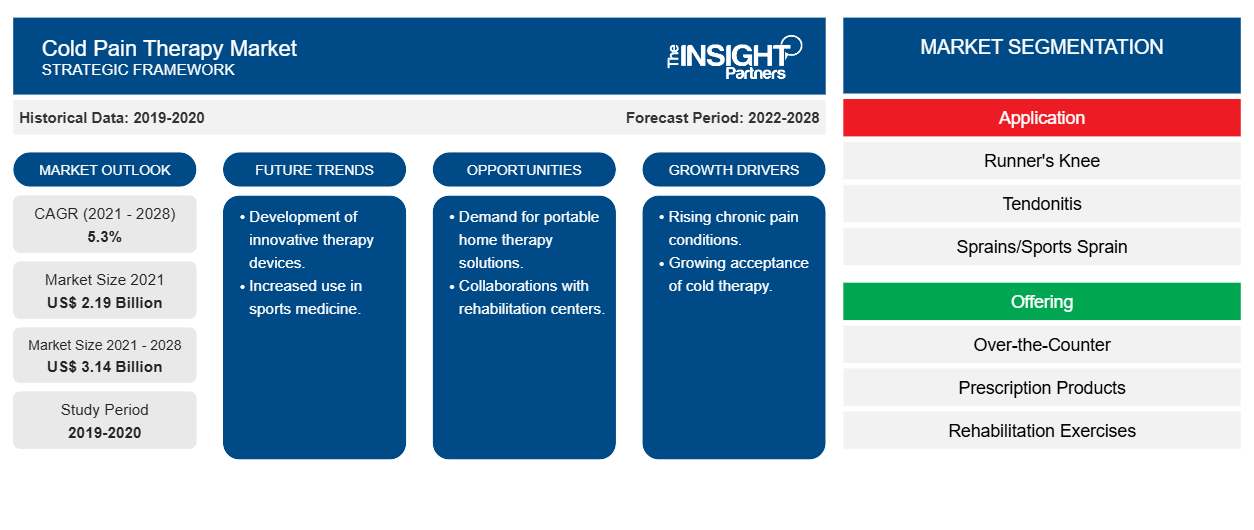

Regional Overview

China has a well-established healthcare system. According to the UNICEF China report, injuries are the top health problem among children in China. For example, thousands of children die due to drowning, road accidents, or other injuries involving suffocation, poisoning, or falls every year. Additionally. as per the survey conducted by the US Census Bureau, the older population in China would be 17.2% of the world’s total population by 2030. With an increase in the aging population, the number of orthopedic conditions has constantly increased over the previous years. According to the International Osteoporosis Foundation, almost 70 million people in the country above 50 years of age suffer from osteoporosis in a year, which leads to almost 687,000 cases of fractures per year in China. An increase in orthopedic procedures in China owing to the rising geriatric population across the country is supporting the cold pain therapy market growth.

In Australia, the cold pain therapy market is growing due to the increasing prevalence of osteoporosis, rising awareness about orthopedic injuries, and the availability of advanced healthcare infrastructure in the hospitals. Based on data from the Australian Orthopedic Association National Joint Replacement Registry (AOANJRR 2022), 68,466 knee replacement surgeries and 52,787 hip replacement surgeries (including primary partial, primary partial, primary total, and revision procedures) were reported in 2021. Furthermore, there are various market players in the global market. The players are involved in various strategic activities such as product launch, geographical expansion, and product approval, which are further expected to contribute the overall market growth. For instance, in February 2021, Breg, Inc. partnered with Australian-based distributor Club Warehouse to expand delivery of its premium, high-value orthopedic products in the Australian market including cold pain therapy products. The company offers its products to orthopedic practices and sports organizations across the continent, including the Australian Football League (AFL), National Rugby League (NRL) and Rugby Union Clubs. The aforementioned factors accelerate demand for cold pain therapy products, fueling the overall growth of the cold pain therapy market during 2022–2028.

Application Based Insights

Based on application, the cold pain therapy market is segmented into Runner's knee, tendonitis, sprains/sports sprain, arthritis pain, pain & swelling after a hip or knee replacement, pain & swelling under a cast or a splint, surgery recovery, lower back pain, and others. The surgery recovery segment held the largest share of the market in 2021, and the market in the same segment is expected to grow rapidly during the forecast period. According to the Centers for Disease Control and Prevention (CDC) report, ~300,000 hip replacement procedures are performed on individuals aged 45 and above in the US in 2021. According to the CDC report, hip replacement surgery is becoming common among patients in their 30s and 40s.

Adopting cold and compression therapy machines is one of the most recommended rehabilitation methods for hip replacement surgeries. Traditional ice and compression therapies following hip replacement surgery can be improved due to the adoption of cold therapy machines. Top competitive players offer innovative product. For instance, Breg, Inc. designed the Polar Care Cube Cold Therapy System, a simple and reliable product utilized by clinics, hospitals, and home care. The product is the best fit for post-operative surgery among patients, generally involving reconstructive procedure, general surgery, post-trauma, chronic pain, and others. With the high volume of procedural surgeries, ice machines without compression increase and other innovative products are acting as a standalone factor responsible for market growth in the surgery segment.

Companies operating in the cold pain therapy market adopt the product innovation strategy to meet the customer demands across the world, which also permits them to maintain their brand name in the market.

Cold Pain Therapy Market – Segmentation

Based on By Application (Runner's Knee, Tendonitis, Sprains/Sports Sprain, Arthritis Pain, Pain or Swelling After A Hip or Knee Replacement, Pain or Swelling Under A Cast or A Splint, Surgery Recovery, Lower Back Pain, And Others). Offering (Over-the-Counter, Prescription Products, Rehabilitation Exercises, Ice wrap and cold packs, Pads, Compression Therapy, Ice Buckets without Compression, and Others); End User (Hospitals, Clinics, Rehabilitation Centers, Ambulatory Surgical Centers, Individuals, and Others). Based on geography, the market is primarily segmented into North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Cold Pain Therapy Market Regional Insights

The regional trends and factors influencing the Cold Pain Therapy Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cold Pain Therapy Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cold Pain Therapy Market

Cold Pain Therapy Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 2.19 Billion |

| Market Size by 2028 | US$ 3.14 Billion |

| Global CAGR (2021 - 2028) | 5.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

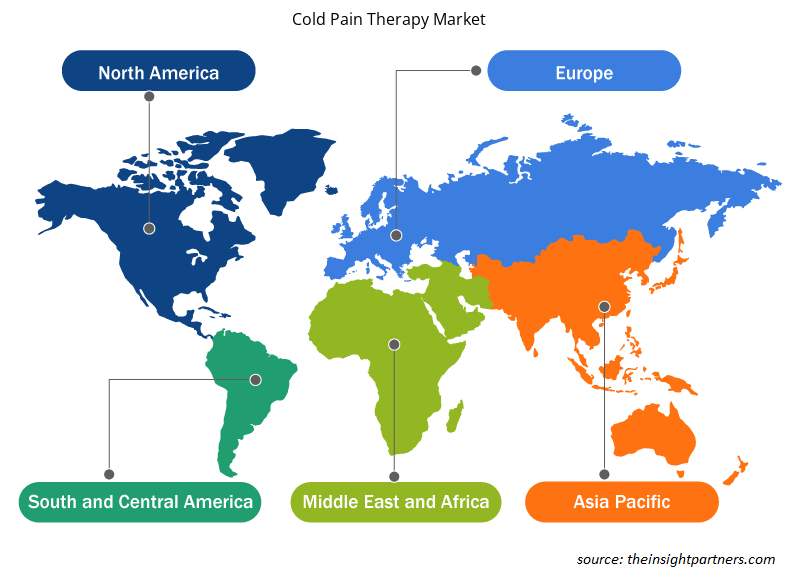

Cold Pain Therapy Market Players Density: Understanding Its Impact on Business Dynamics

The Cold Pain Therapy Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cold Pain Therapy Market are:

- Brownmed Inc

- Bruder Healthcare Co LLC

- DJO Global Inc

- Ossur hf

- Cardinal Health Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cold Pain Therapy Market top key players overview

Company Profiles

- Brownmed Inc

- Bruder Healthcare Co LLC

- DJO Global Inc

- Ossur hf

- Cardinal Health Inc

- Vive Health LLC

- Battle Creek Equipment Co

- ThermoTek Inc

- Advanced Therapeutics of LI LLC

- Sichuan Jiuyuan Medical Technology Co Ltd.

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Application, Offering, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Saudi Arabia, South Africa, South Korea, Spain, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Cold pain therapy market is segmented by countries comprising of North America, Europe, Asia Pacific, the Middle East & Africa, and South & Central America.

Brownmed Inc, Bruder Healthcare Co LLC, DJO Global Inc, Ossur hf, Cardinal Health Inc, Vive Health LLC, Battle Creek Equipment Co, ThermoTek Inc, Advanced Therapeutics of LI LLC, Sichuan Jiuyuan Medical Technology Co Ltd among others are among the leading companies operating in the cold pain therapy market.

The over-the-counter segment dominated the cold pain therapy market and accounted for the largest market share in 2021.

Based on the end user, hospital segment took the forefront leaders in the worldwide market by accounting largest share in 2021 and is expected to continue to do so till the forecast period.

Based on application, the surgery recovery segment took the forefront leaders in the worldwide market by accounting largest share in 2021 and is expected to continue to do so till the forecast period.

Increasing sports injuries and orthopedic surgeries and significant rise in geriatric and obese population are the most significant factors responsible for the overall market growth.

Cold Pain Therapy is also known as cryotherapy which comprises the use of cold materials for pain management in orthopedic conditions, soft tissue injuries, and musculoskeletal disorders. Cold pain therapy reduces the blood flow to the affected area which helps in the reduction of pain, swelling, and inflammation.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Cold Pain Therapy Market

- Brownmed Inc

- Bruder Healthcare Co LLC

- DJO Global Inc

- Ossur hf

- Cardinal Health Inc

- Vive Health LLC

- Battle Creek Equipment Co

- ThermoTek Inc

- Advanced Therapeutics of LI LLC

- Sichuan Jiuyuan Medical Technology Co Ltd

Get Free Sample For

Get Free Sample For