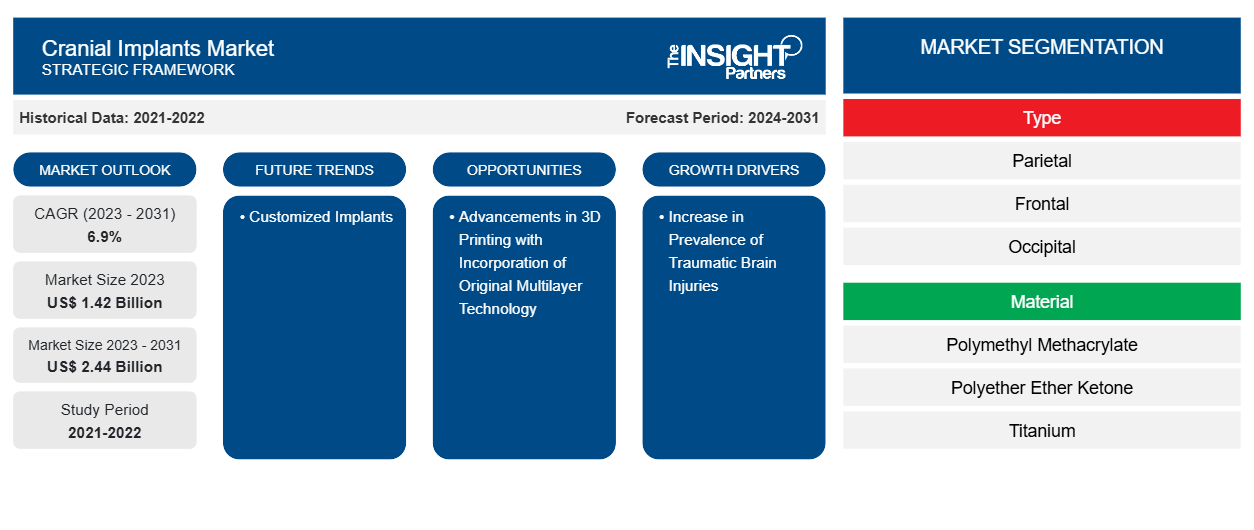

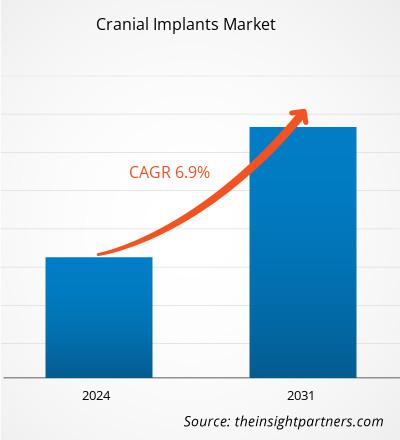

The cranial implants market size is projected to reach US$ 2.44 billion by 2031 from US$ 1.42 billion in 2023. The market is expected to register a CAGR of 6.9% during 2023–2031. Customized implants are likely to bring in new market trends during the forecast period.

Cranial Implants Market Analysis

Traumatic brain injuries (TBIs) constitute one of the significant public health concerns as they interrupt the normal functioning of the brain due to external mechanical force. The common causes of TBIs include falls, motor vehicle accidents, and sports injuries, mainly affecting younger adults and older adults. TBIs vary from mild concussions to severe injuries that result in lifelong cognitive, physical, and emotional disabilities. According to a report published in The Lancet Neurology Commissions in 2022, TBI is one of the leading causes of injury-related death and disability, affecting 55 million people worldwide and costing over US$ 400 billion every year. Similarly, as per the Brain Injury Association of Waterloo-Wellington, TBIs occur in 500 out of 100,000 people yearly in Canada; over 6,000 patients become permanently disabled each year due to a TBI. Moreover, according to the Bolt Burdon Kemp 2024 report, about 10,000–20,000 severe traumatic brain injuries occur every year in the country. The demand for effective treatment options, particularly cranial implants, is on the rise due to the increasing number of TBI cases. These implants play a crucial role in treating patients with severe head injuries by safeguarding the brain from further trauma and assisting in the restoration of the skull's protective function. As the prevalence of TBI continues to rise, the demand for cranial implants is expected to surge in the coming years as well.

Cranial Implants Market Overview

The cranial implants market is rapidly expanding due to the increase in prevalence of TBIs, and the surge in elderly populations. Prominent players operating in the market are focusing on innovation and collaboration for enhanced product availability. However, the risk of implant failure hinders the cranial implants market growth.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cranial Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Cranial Implants Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Cranial Implants Market Drivers and Opportunities

Surge in Elderly Populations Fuels Market Growth

According to the Population Reference Bureau, the number of Americans aged 65 and older is projected to rise from 58 million in 2022 to 82 million by 2050, marking a 47% increase. As per the data published by the Fraser Institute, the share of Canada's population aged 65 or older increased from 14% in 2010 to 19% in 2022, and it is further expected to reach 22.5% by 2030. The aging population is increasing rapidly in Brazil. According to the data from the Pan American Health Organization (PAHO), Brazil has ~30 million people aged 60 and above (i.e., 13% of the country's population). The population of this age group is further expected to reach ~50 million (i.e., 24% of the total population) by 2030. The Eurostat statistics indicate that over one-fifth (21.1%) of Europe's population was aged 65 or more in 2022. According to an UpToDate Inc. article published in August 2021, the incidence rate of epilepsy rises with age and is highest among patients aged 75 and above.

Older adults are more vulnerable to falls and accidents that raise the risk of head trauma. Aging, coupled with a higher prevalence of neurological diseases, is driving demand for cranial implants. Surgical intervention is often necessary to repair fractured skulls after such injuries, and cranial implants are vital for restoring the skull's structural integrity and protecting the brain. Healthcare systems are focusing on improving the quality of life for older adults, resulting in a greater adoption of these implants in trauma and reconstructive surgeries.

Advancements in 3D Printing with Incorporation of Original Multilayer Technology to Create Lucrative Opportunities in Market

3D printing, also known as additive manufacturing, allows for the creation of highly customized, patient-specific cranial implants that offer improved fit and functionality compared to traditional implants. The design and production of cranial implants have evolved with the progress in this technology, enabling precise replication of an individual's skull geometry, which reduces the risk of surgical complications and enhances recovery outcomes. The integration of multilayer technology in 3D printing further enhances these benefits. This technology enables the creation of implants with multiple layers, each designed with different properties tailored to specific functions. For instance, one layer might be engineered for structural strength, while another could focus on biocompatibility or flexibility. Multilayered 3D-printed implants can improve osseointegration (bone growth into the implant), reduce the risk of implant rejection, and offer superior protection for the brain.

3D printing allows for faster production times, lower manufacturing costs, and greater flexibility in adapting to complex cranial deformities. These advancements not only improve patient outcomes but also reduce the overall cost of treatment, making cranial implants more accessible to a broader patient population. As a result, advancements 3D printing with the integration of original multilayer technology, offering improved surgical precision, reduced complications, and better long-term performance, present significant opportunities for the cranial implant market.

Cranial Implants Market Report Segmentation Analysis

Key segments that contributed to the derivation of the cranial implants market analysis are type, material, and end user.

- Based on type, the cranial implants market is segmented into parietal, frontal, occipital, temporal, and sphenoid. The parietal segment held the largest share of the market in 2023.

- In terms of material, the cranial implants market is categorized into polymethyl methacrylate, porous polyethylene, and titanium. The polymethyl methacrylate segment dominated the market in 2023.

- In terms of end user, the cranial implants market is categorized into hospitals, trauma centers, and ambulatory surgical centers. The hospitals segment dominated the market in 2023.

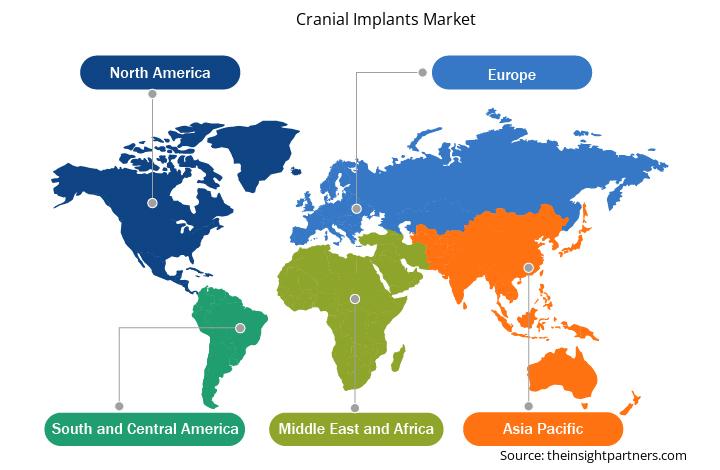

Cranial Implants Market Share Analysis by Geography

The geographic scope of the cranial implants market report mainly focuses on five regions: North America, Asia Pacific, Europe, South & Central America, and the Middle East & Africa. In terms of revenue, North America dominated the market in 2023. It is estimated to dominate the global market during the forecast period. The US is the largest market for cranial implants in the world, and it is estimated to dominate the market during the forecast period as well. TBIs are the cause of a significant number of deaths and emergency room visits in the US. As per Centers for Disease Control and Prevention (CDC) data, the US recorded more than 69,000 TBI-related deaths in 2021, i.e., ~190 deaths per day. There were nearly 214,110 TBI-related hospitalizations in 2020 in the country. TBIs are among the most significant causes of cranial deformities, requiring surgical intervention through implants, contributing to an increased demand for cranial implants. According to the Sports Injury Statistics by Johns Hopkins University, about 30 million children and adolescents participate in some form of sports in the US, and more than 3.5 million children of age 14 or less suffer sports-related injuries each year. These injuries and falls are the common causes of TBIs, leading to a higher demand for cranial implants for surgical interventions and reconstruction.

In April 2024, 3D System received the US Food and Drug Administration (FDA) 510(k) clearance for its VSP PEEK Cranial Implant. The use of an additive manufacturing solution allows the creation of patient-specific cranial implants with up to 85% less material utilization than similar implants produced by traditional machining, leading to significant cost savings on expensive raw materials, such as implantable PEEK. In addition, in April 2024, Longeviti Neuro Solutions (a Maryland-based neurotechnology company) secured a US patent for its ClearFit prosthetic translucent cranial implant, intended for use during neurosurgical procedures.

Cranial Implants Market Regional Insights

The regional trends and factors influencing the Cranial Implants Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Cranial Implants Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Cranial Implants Market

Cranial Implants Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1.42 Billion |

| Market Size by 2031 | US$ 2.44 Billion |

| Global CAGR (2023 - 2031) | 6.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

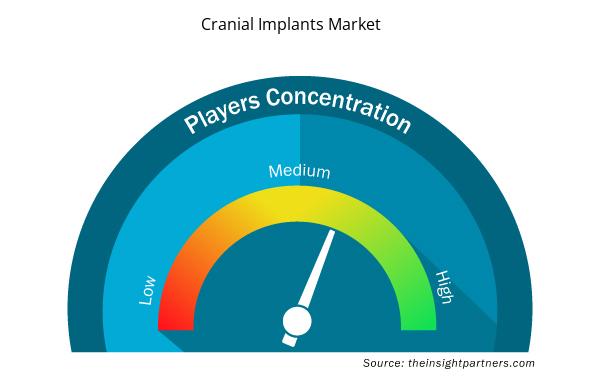

Cranial Implants Market Players Density: Understanding Its Impact on Business Dynamics

The Cranial Implants Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Cranial Implants Market are:

- evonos GmbH & Co. KG

- B Braun SE

- UAB Ortho Baltic

- EUROS SAS

- GPC Medical Ltd

- Bioplate Inc

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Cranial Implants Market top key players overview

Cranial Implants Market News and Recent Developments

The cranial implants market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. Below is a key development witnessed in the cranial implants market:

- Medtronic launched a range of software, hardware, and imaging solutions for spine and cranial procedures. (Source: Medtronic Website, September 2024)

- 3D Systems provided the Food and Drug Administration (FDA) 510(k) clearance for its 3D-printed, patient-specific cranial implant solution—VSP PEEK Cranial Implant. This implant includes a complete FDA-cleared workflow comprising segmentation and 3D modeling software, the 3D Systems EXT 220 MED 3D printer, Evonik VESTAKEEP i4 3DF PEEK (polyether ether ketone), and a pre-defined production process. (Source: 3D Systems, Press Release, April 2024)

- CRANIOFIT launched customized PEEK plates. CranioFit customized craniofacial PEEK plates are made to address a wide range of complex anatomies. They are manufactured using a clinically proven, bioengineered material for strength, comfort, and durability. CranioFit plates provide individualized solutions as the company plans to partner with the physician to ensure an optimal result. (Source: CRANIOFIT, Press Release, February 2023)

Cranial Implants Market Report Coverage and Deliverables

The "Cranial Implants Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Cranial implants market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Cranial implants market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Cranial implants market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the cranial implants market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Data Annotation Tools Market

- Electronic Data Interchange Market

- Advanced Planning and Scheduling Software Market

- Intraoperative Neuromonitoring Market

- Power Bank Market

- Diaper Packaging Machine Market

- Radiopharmaceuticals Market

- Sports Technology Market

- Drain Cleaning Equipment Market

- Public Key Infrastructure Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

North America dominated the market in 2023.

An increase in the prevalence of traumatic brain injuries, and a surge in elderly populations are among the most significant factors fueling the market growth.

The cranial implants market value is expected to reach US$ 2.44 billion by 2031.

Customized implants are likely to emerge as new growth trends in the market in the coming years.

Evonos GmbH & Co. KG, B Braun SE, UAB Ortho Baltic, EUROS SAS, GPC Medical Ltd, Bioplate Inc, 3D Systems Corp, Biocomposites Ltd, Medprin Biotech GmbH, Kelyniam Global Inc, Stryker Corp, Zimmer Biomet Holdings Inc, Integra LifeSciences Holdings Corp, OsteoMed SA, Anatomics Pty Ltd, Matrix Surgical Holdings LLC, Calavera Surgical, Medtronic Plc, Xilloc Medical BV, and Johnson & Johnson are among the key players operating in the market.

The market is expected to register a CAGR of 6.9% during 2023–2031.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Cranial Implants Market

- Evonos GmbH & Co. KG

- B Braun SE

- UAB Ortho Baltic

- EUROS SAS

- GPC Medical Ltd

- Bioplate Inc

- 3D Systems Corp

- Biocomposites Ltd

- Medprin Biotech GmbH

- Kelyniam Global Inc

- Stryker Corp

- Zimmer Biomet Holdings Inc

- Integra LifeSciences Holdings Corp

- OsteoMed SA

- Anatomics Pty Ltd

- Matrix Surgical Holdings LLC

- Calavera Surgical

- Medtronic Plc

- Xilloc Medical BV

- Johnson & Johnson

Get Free Sample For

Get Free Sample For