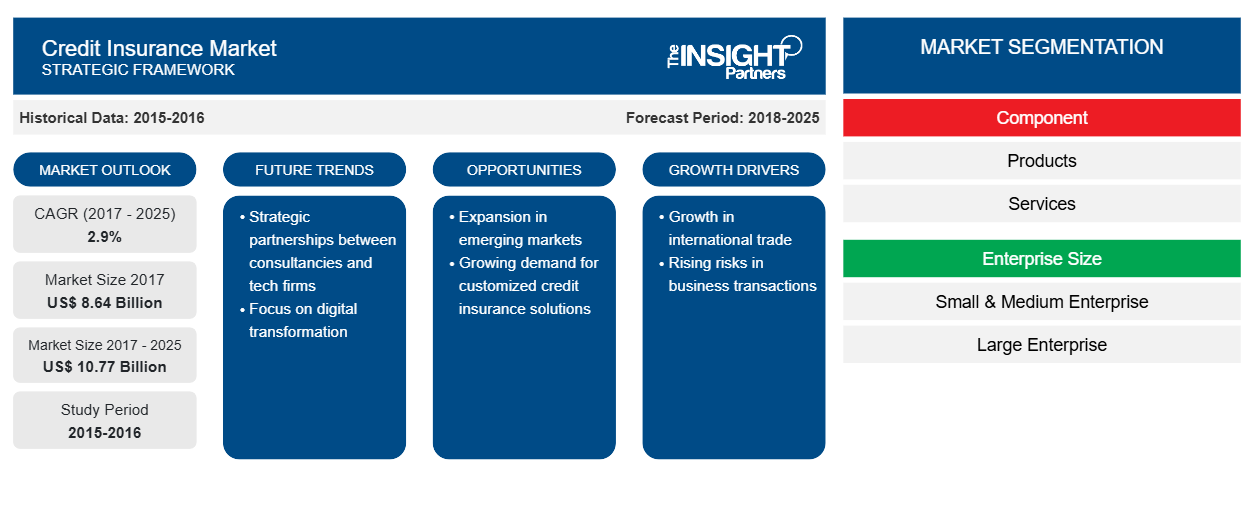

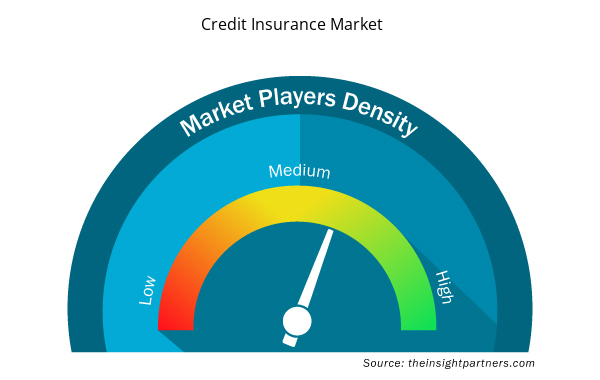

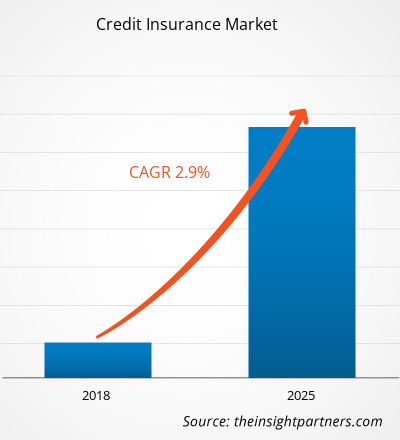

The credit insurance market was valued at US$ 8.64 billion in 2017 and is projected to reach US$ 10.77 billion by 2025. The Credit insurance market is expected to grow at a CAGR of 2.9% during the forecast period of 2017 to 2025.

The credit insurance market refers to the type of insurance which deals with property and casualty insurance. The traders or the merchants or the exporters across the globe faces severe challenges related to slow payment, debtor’s insolvencies and bankruptcies. This factor has bolstered the adoption rate of credit insurance policies in the developed as well as developing regions. The major benefit of credit insurance which attracts the consumers is that the insurance policies protects the companies from non-payment of commercial debts. The global trade sector is experiencing a significant growth in both domestic market as well as international market, with Europe and North America being the leaders in the exporting various goods and products. Countries in Asia Pacific, Middle East and Africa, and Latin America are constantly experiencing substantial demand for trading and exporting products out the country. The global Credit Insurance market for credit insurance is expected to exhibit high growth in near future. Some of the major driving factors contributing to the market growth includes the global macro-economic instability, which is posing a severe commercial threat to the trader, thereby, increasing the adoption of credit insurance. Another factor catalyzing the demand accounted for different services offered by the companies which include sales support and account receivable support. However, the growth of global market for credit insurance accounted for several fraudulent cases related to insurance claims from both the policyholders as well as the insurance underwriters.

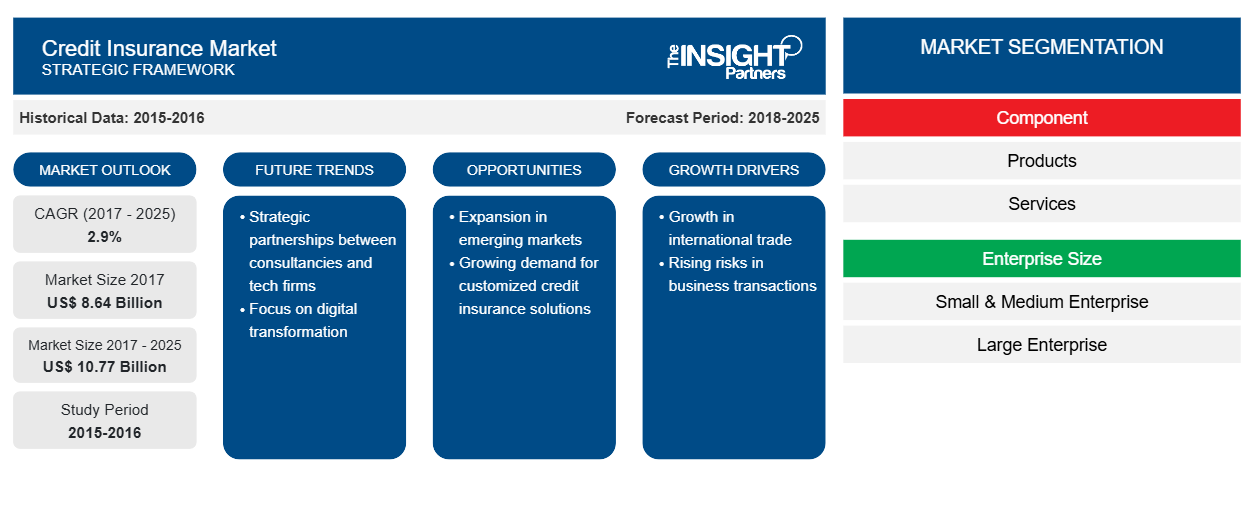

The market for credit insurance globally has been segmented on the basis of components into two major segment including products and services. The companies operating in the global credit insurance market design and innovate robust products and services depending upon the requirements of the customers or clients. The global credit insurance market is further bifurcated on basis of enterprise size as small & medium enterprises (SMEs) and large enterprises. The large enterprises capture a significant market share in the global credit insurance market over the years. The different types of applications of credit insurance includes domestic trading market and export trading market. The export segment in the application is much more prominent and the demand for credit insurance products and services are gaining importance in the domestic market in the current years. The global market for credit insurance is categorized on basis of five strategic regions namely; North America, Europe, Asia Pacific, Middle East and Africa, and South America. Geographically, the two most dominant region in the current market scenario accounted for Europe and North America.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Credit Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Credit Insurance Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Credit insurance Market Insights

Improving Sales and Accounts Receivable Support Benefits to Accentuate the Demand for Credit Insurance

Businesses now a days are constantly focusing on enhancing their technologies, services, and customer base in order to improve the sales year on year. The credit insurance companies help the manufacturer, distributors, suppliers and other business traders with enhanced knowledge to select the appropriate customers, in order to optimize the trader to optimize their company’s bottom line. Selecting the inappropriate or wrong customers lead to credit defaulter or slow pay customers, which again negatively impact on the company’s sales. Credit insurance also offers protection against exceptional export risks by stipulating the market dynamics and knowledge across the globe in which the company operates. This offers the traders to venture into different geographies, thereby resulting in increase in customer base and ultimately improving sales. This factor also mitigates the potential risks of the company with less clientele. These factors place the trader especially an export business company at a competitive advantages position over other traders operating in the same industry.

Component -Based Market Insights

The credit insurance market has been segmented on basis of component as products and services. The products are the insurance policies offered by the underwriters, which benefits the insurance buyers or traders to understand the market scenario and the available risks related to the buyer’s business. This factor is a major driver for the product segment under component segment. On the other, the insurance companies are also dedicating their time and efforts to offer their clients with enhanced services, which is propelling the demand for credit insurance in the merchandise sector across the globe.

Enterprise Size -Based Market Insights

The global credit insurance market is segmented on basis of enterprise size as small & medium enterprises and large enterprises. The credit insurance companies offer their products and services to every level enterprises and also alters the policies and services depending upon the enterprise size, annual revenue, trading history, historical debt loss, trade sectors and customer base. In case of the policyholder opts for political risk coverage, the premium amount is higher for both large and small & medium enterprises.

Players operating in the Credit insurance market focus on strategies, such as market initiatives, acquisitions, and product launches, to maintain their positions in the credit insurance market. A few developments by key players of the credit insurance market are:

In June 2018, Atradius N.V. opened branch office in Sofia, Bulgaria to strengthen its strategic presence in the burgeoning Bulgarian market, through steadily expanding exports and high GDP growth rates, creating a substantial credit insurance market volume.

In September 2018, Coface announced that it has signed a binding agreement to acquire PKZ.

Credit Insurance Market Regional Insights

The regional trends and factors influencing the Credit Insurance Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Credit Insurance Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Credit Insurance Market

Credit Insurance Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2017 | US$ 8.64 Billion |

| Market Size by 2025 | US$ 10.77 Billion |

| Global CAGR (2017 - 2025) | 2.9% |

| Historical Data | 2015-2016 |

| Forecast period | 2018-2025 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

Credit Insurance Market Players Density: Understanding Its Impact on Business Dynamics

The Credit Insurance Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Credit Insurance Market are:

- Euler Hermes

- Atradius N.V.

- Coface SA

- American Internation Group, Inc.

- Credendo

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Credit Insurance Market top key players overview

Credit Insurance Market – by Component

- Products

- Services

Credit Insurance Market – by Application

- Domestic

- Exports

Credit Insurance Market – by Enterprise Size

- Small & Medium Enterprise

- Large Enterprise

Credit Insurance Market – by Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- UK

- Italy

- Rest of Europe

- Asia Pacific (APAC)

- China

- India

- Japan

- South Korea

- Rest of APAC

- MEA

- Saudi Arabia

- UAE

- South Africa

- Rest of MEA

- SAM

- Brazil

- Rest of SAM

Credit Insurance Market – Company Profiles

- American International Group, Inc

- Atradius N.V.

- CESCE

- China Export & Credit Insurance Corporation

- coface sa

- Credendo

- Euler hermes

- Export Development Canada

- Qbe insurance group limited

- zurich insurance group

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Component ; Enterprise Size ; & Application

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

US, Canada, Mexico, UK, Germany, Spain, Italy, France, India, China, Japan, South Korea, Australia, UAE, Saudi Arabia, South Africa, Brazil, Argentina

Trends and growth analysis reports related to Banking, Financial Services, and Insurance : READ MORE..

The List of Companies

1. Euler Hermes

2. Atradius N.V.

3. Coface SA

4. American Internation Group, Inc.

5. Credendo

6. QBE Insurance Group Ltd.

7. Zurich Insurance Group

8. China Export & Credit Insurance Corporation

9. CESCE

10. Export Development Canada

Get Free Sample For

Get Free Sample For