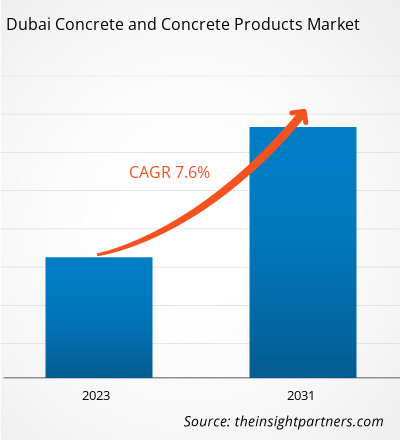

The Dubai concrete and concrete products market size is projected to reach US$ 5.13 billion by 2031 from US$ 2.85 billion in 2023. The market is expected to register a CAGR of approximately 7.6% in 2023–2031. The growing demand for green construction, is likely to remain a key trend in the market.

Dubai Concrete and Concrete Products Market Analysis

Dubai experiences a continuous need for new housing developments to accommodate the expanding urban population, mainly due to the steady influx of expatriates and investors in the city. The construction of residential towers, apartment complexes, and gated communities is common across the city. These projects heavily rely on concrete as the primary building material. Concrete's durability and versatility make it a preferred choice for developers and builders; as a result, it is used in various structures ranging from foundation slabs to structural elements and facades. Moreover, a growing trend of vertical living in Dubai, characterized by the construction of high-rise residential towers, further amplifies the demand for concrete. These towering structures require vast quantities of concrete to support their weight and withstand the city's demanding environmental conditions, including high temperatures and occasional sandstorms. According to the Government of Dubai, in 2022, Dubai recorded real estate transactions of US$ 143.8 billion (AED 528 billion), indicating a 73% increment from 2021. 122,658 real estate units (including residential and commercial) were sold in 2022, reporting an upsurge of 47% compared to 2021.

Dubai Concrete and Concrete Products Market Overview

The concrete and concrete products market within the construction industry is known to promote innovation and grandeur in Dubai—a city known for towering skyscrapers and intricate infrastructure projects. Dubai’s skyline is adorned with architectural marvels, all of which rely heavily on superior-quality concrete and its derivatives. Driven by a robust construction sector and fueled by urbanization, population growth, and ambitious development plans, Dubai’s demand for concrete continues to soar. The city’s strategic location as a global business hub attracts investments and fosters a thriving real estate market, further propelling the need for high-quality concrete products. In response to this demand, Dubai boasts a sophisticated network of concrete suppliers, manufacturers, and contractors, offering a diverse range of products and services. From ready-mix concrete products for large-scale construction projects to precast concrete products for rapid and efficient building solutions, the market caters to a large spectrum of requirements.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Dubai Concrete and Concrete Products Market Drivers and Opportunities

Flourishing Residential Construction Industry

Initiatives by the UAE government to promote affordable housing and sustainable development also contribute to the demand for concrete and concrete products in residential construction in Dubai, as well as other cities. For instance, in January 2024, Sheikh Mohammed bin Rashid Al Maktoum launched Dubai Social Agenda 33 with a plan to allocate ~US$ 3.9 billion (AED 14.5 billion) for the development of residential compounds for Emirati citizens. From affordable housing projects to eco-friendly communities, concrete plays a vital role in delivering environmentally responsible housing solutions to Dubai's diverse population. Thus, the flourishing residential construction industry is a significant catalyst for the Dubai concrete and concrete products market progress.

Surging Tourism and Commercial Sectors

As one of the tourism destinations and a hub for international business and commerce, Dubai continuously invests in the development of world-class infrastructure, iconic landmarks, and commercial properties. The construction of hotels, resorts, shopping malls, office towers, and entertainment complexes to cater to the growing influx of tourists and businesses drives substantial demand for concrete and concrete products. In February 2024, Emaar Properties, the prime real estate development company, completed the detailed design of "Dubai Square," which became the second-largest shopping and entertainment mall in Dubai Creek Harbour. Dubai Square is set to gain high popularity with the expected incorporation of breakthrough technologies, including Artificial Intelligence (AI) as well as innovative retail, dining, and entertainment concepts. It is part of the large Dubai Creek Harbour development project, spanning over ~7.4 million sq. m.

Dubai Concrete and Concrete Products Market Report Segmentation Analysis

Key segments that contributed to the derivation of Dubai concrete and concrete products market analysis are type, process, and end use.

- Based on type, the market is segmented into cement, ready-mix concrete, and concrete products. The ready-mix concrete segment held the largest share of the market in 2023.

- On the basis of end use, the market is segmented into residential, commercial, infrastructure, and others. The residential segment held the largest market share in 2023.

Dubai Concrete and Concrete Products Market Share Analysis

In terms of revenue, the residential sector dominated the Dubai concrete and concrete products market share in 2023. In residential settings, concrete is utilized in a multitude of applications ranging from foundational structures to aesthetic enhancements. For foundations, concrete is indispensable, providing a robust and stable base that ensures the structural integrity of homes. Concrete slabs are commonly employed as the base for flooring in houses, and they serve as the substrate for various floor coverings, including tile, wood, and carpet.

Dubai Concrete and Concrete Products Market Regional Insights

The regional trends and factors influencing the Dubai Concrete and Concrete Products Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Dubai Concrete and Concrete Products Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Dubai Concrete and Concrete Products Market

Dubai Concrete and Concrete Products Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 2.85 Billion |

| Market Size by 2031 | US$ 5.13 Billion |

| Global CAGR (2023 - 2031) | 7.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Dubai

|

| Market leaders and key company profiles |

Dubai Concrete and Concrete Products Market Players Density: Understanding Its Impact on Business Dynamics

The Dubai Concrete and Concrete Products Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Dubai Concrete and Concrete Products Market are:

- Ducon Industries

- Fujairah Cement Industries

- Gulf Cement Company

- Jebel Ali Cement

- Lafarge Emirates Cement LLC

- National Cement Co

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Dubai Concrete and Concrete Products Market top key players overview

Dubai Concrete and Concrete Products Market News and Recent Developments

The Dubai concrete and concrete products market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are mentioned below:

- Cemex UAE has announced signing a cooperation agreement with Star Cement Co LLC, a wholly owned subsidiary of UltraTech Cement Limited, India, an Aditya Birla Group Company. The partnership aims to recycle concrete waste in the construction industry as well as reduce carbon emissions and improve the overall environmental impact of construction projects. (Source: CEMEX S.A.B. de C.V., Press Release, 2023)

Dubai Concrete and Concrete Products Market Report Coverage and Deliverables

The "Dubai Concrete and Concrete Products Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Dubai concrete and concrete products market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Dubai concrete and concrete products market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter’s Five Forces and SWOT analysis

- Dubai concrete and concrete products market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Dubai concrete and concrete products market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The Dubai concrete and concrete products market size is projected to reach US$ 5.13 billion by 2031.

The flourishing residential construction industry is a significant catalyst for the Dubai concrete and concrete products market progress.

Ducon Industries, Fujairah Cement Industries, Gulf Cement Company, Jebel Ali Cement, Lafarge Emirates Cement LLC, National Cement Co, CEMEX Topmix LLC, UltraTech Cement Ltd, Union Cement Company, Ras Al Khaimah Cement Company LLC, FAST Concrete Products Factory LLC, Berisha Brick Factory, Phoenix Concrete Products, TransGulf Cement Products LLC, and BILDCO Aerated Concrete LLC are a few of the key players operating in the Dubai concrete and concrete products market.

The growing demand for green construction is expected to bring new trends in the Dubai concrete and concrete products market during the forecast period.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Dubai Concrete and Concrete Products Market

- Ducon Industries

- Fujairah Cement Industries

- Gulf Cement Company

- Jebel Ali Cement

- Lafarge Emirates Cement LLC

- National Cement Co

- CEMEX Topmix LLC

- UltraTech Cement Ltd

- Union Cement Company

- Ras Al Khaimah Cement Company LLC

Get Free Sample For

Get Free Sample For