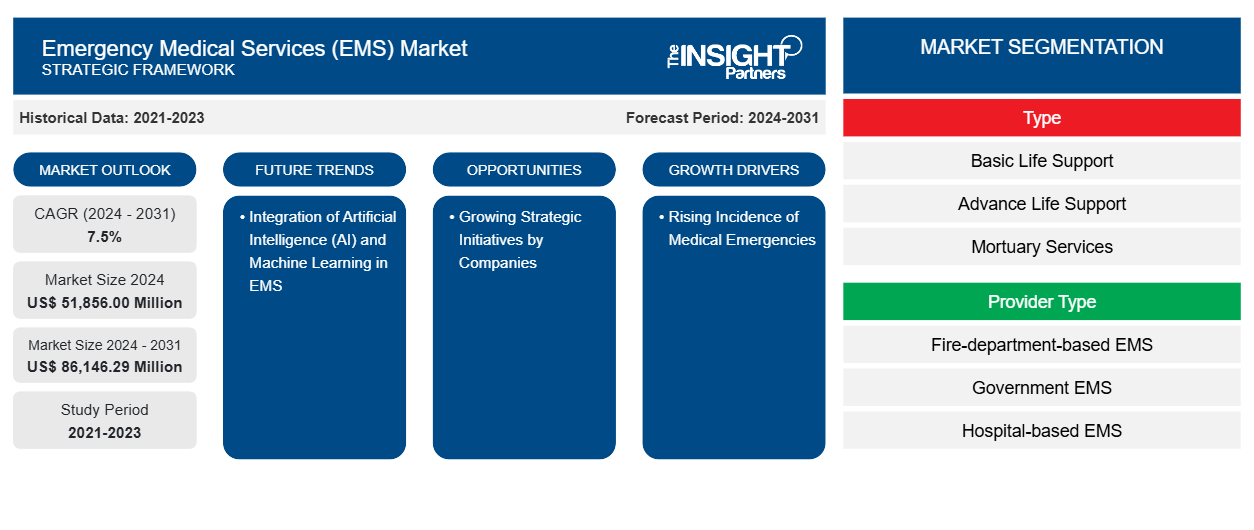

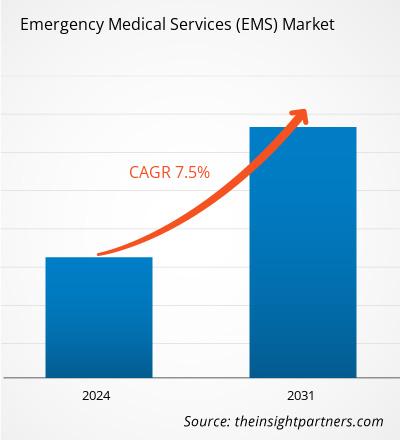

The Emergency Medical Services (EMS) Market size is projected to reach US$ 86,146.29 million by 2031 from US$ 51,856.00 million in 2024. The market is estimated to register a CAGR of 7.5% during 2024–2031. The integration of artificial intelligence (AI) and machine learning in EMS is likely to bring new trends to the market in the coming years.

Emergency Medical Services (EMS) Market Analysis

The market for emergency medical services (EMS) market is expanding significantly owing to the growing need for quick medical attention, improvements in pre-hospital care technology, and an increase in emergency situations such as natural disasters, accidents, and cardiac arrests. The EMS landscape is changing as a result of the integration of telemedicine and AI-powered systems, which allow for quicker response times and better patient outcomes. Moreover, increasing government programs to improve healthcare infrastructure and the rising use of ambulance services in both urban and rural areas are fueling the market expansion. As healthcare systems place a higher priority on emergency preparedness and technological innovation, the EMS market is expected to continue growing during the forecast period.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Emergency Medical Services (EMS) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Emergency Medical Services (EMS) Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Emergency Medical Services (EMS) Market Overview

Emergency medical services (EMS) involve the acute care of patients. EMS, also known as ambulatory services, provides urgent medical care and transportation in emergencies. The primary focus of EMS is on attending to patients with injuries and emergency illnesses, such as chronic diseases, stroke, cardiac arrest, and accidents. The growing geriatric population, increasing lifestyle changes, and rising healthcare demand are surging the urgent need for effective and efficient EMS.

Cardiovascular diseases (CVDs) remain the leading cause of death worldwide. According to the World Health Organization (WHO) factsheet 2021, CVD accounted for ~17.9 million deaths in 2019, which represents 32% of all global deaths. Notably, over 85% of these deaths were due to heart attacks and strokes. Additionally, as per the World Stroke Organization (WSO): Global Stroke Fact Sheet 2022, there were more than 12.2 million new cases of stroke globally every year, resulting in ~6.5 million deaths. Over 110 million individuals worldwide have experienced a stroke. More than 60% of strokes occur in individuals under 70 years, and 16% affect those between 15 and 49 years. Alarmingly, one in four people over the age of 25 is expected to experience a stroke in their lifetime. In addition, the burden of stroke in Europe is expected to grow remarkably in the coming years. As per a report titled "The Burden of Stroke in Europe," the projected data indicates a 34% increase in the total number of stroke cases in the European Union during 2015–2035, as the case count is likely to reach 819,771 by 2035 from 613,148 in 2015. The rising incidence of these conditions has intensified the demand for efficient and timely EMS interventions.

According to the article titled "European Resuscitation Council Guidelines 2021," published in April 2021, the reported annual incidence of out-of-hospital cardiac arrest in Europe is ~67–170 per 100,000 individuals. The American Heart Association has released the Heart and Stroke Statistics - 2022 Update, focusing on out-of-hospital cardiac arrest in the US. The report reveals that cardiac arrest remains a public health crisis, with more than 356,000 out-of-hospital cardiac arrests occurring annually in the country, with ~90% of them resulting in death. This highlights the need for EMS to provide lifesaving interventions, such as defibrillation and advanced cardiovascular care, as quickly as possible to improve survival chances.

According to the WHO Noncommunicable Diseases Factsheet 2023, chronic diseases account for 41 million global deaths annually, equivalent to 74% of worldwide deaths. As per the article "Emergency Department Patients Are More Likely to Have Chronic Diseases," published in September 2022, older adults who went to the emergency department often had chronic conditions. The study examined data from 2017 to 2019 in the US, revealing that there were 107.3 million visits to emergency departments each year. Among these visits, 59.5% involved adults who had at least one chronic disease. The most common chronic conditions among patients in the emergency department were heart disease (11.4%) and substance use disorder (10.5%).

The need for prompt emergency medical intervention is increasing with the prevalence of medical emergencies, particularly chronic diseases, cardiac arrests, strokes, and other medical conditions, and drives the demand for EMS globally.

Emergency Medical Services (EMS) Market Drivers and Opportunities

Growing Government Initiatives and Investments Bolsters Market Growth

EMS plays a critical role in providing rapid medical care during emergencies. With the rising demand for EMS due to aging populations, growing healthcare needs, and urbanization, governments worldwide are increasingly prioritizing investment in EMS to enhance public health outcomes and emergency response capabilities. Governments worldwide have recognized the importance of strengthening EMS infrastructure and have taken certain initiatives and allocated significant resources to support its growth. In countries where EMS infrastructure is often underdeveloped, the government has collaborated with private players to launch dedicated emergency ambulance services. For instance, the government of India has been supporting states in developing an integrated emergency care system through the National Health Mission (NHM), which has become synonymous with the accessible and affordable healthcare system in India. Government initiatives such as the National Ambulance Service (NAS), under the NHM, have become an integral part of the country's healthcare system as they play a significant role in bringing the patient closer to a healthcare facility. Since the introduction of NAS, the Emergency Medical Services (EMS) in India has expanded exponentially and geographically, evolving from a basic transport service concept to a lifesaving emergency medical transportation. Due to this, there has been an increase in the total number of ambulances from 12,000 in 2012 to 28,863 in 2023. Additionally, the 108 Medical Emergency Response Services, a public-private partnership initiative in India, provides free ambulance services and has saved the lives of over 2 million patients across 15 states and 2 union territories since its inception in August 2005. In addition, 108 Medical Emergency Response Services respond to 22,000 emergencies per day.

Several governments across the globe recognize the vital need for robust EMS to respond to medical emergencies efficiently and effectively. They have made significant investments in EMS systems to improve people's health. Government funding is directly aimed at enhancing EMS capabilities, such as expanding the fleet of ambulances and upgrading medical equipment. For instance, in November 2023, the United Nations Development Programme (UNDP) in Ukraine, with financial backing from the government of Canada and in collaboration with the Ministry of Health of Ukraine, delivered five ambulances to emergency medical care and disaster medicine centers in the Chernihiv, Dnipropetrovsk, Kharkiv, Mykolaiv, and Zaporizhzhia. This initiative is part of a larger commitment by the UNDP and the government of Canada to bolster the resilience of healthcare services in Ukrainian communities. Following the earlier donation of 10 B-class vehicles in 2023, this latest provision of five C-class ambulances, valued at ~US$ 420,000, signifies a significant investment in the health and well-being of vulnerable populations during challenging times. These specialized ambulances function as mobile units, providing lifesaving care and advanced medical support while ensuring swift transportation for patients and effectively managing emergencies.

In August 2024, Sumeet Facilities Limited, in partnership with SSG Matrix from Spain and the previous service operator BVG India, unveiled their plans to transform emergency medical services in India through the launch of the Maharashtra Emergency Medical Services (MEMS) 108 Ambulance Project in Maharashtra, with a total investment of ~US$ 190.76 million (Rs 1,600 crore). This ambitious 10-year initiative introduces a cutting-edge operational model designed to enhance service efficiency and effectiveness, thereby implementing significant reforms in the healthcare sector throughout Maharashtra. This project marks the first instance in India of a Public-Private Partnership (PPP) utilizing a Design-Build-Finance-Operate-Transfer (DBFOT) model, with the service provider contributing 51% of the capital expenditure and the government providing the remaining 49%. The MEMS-108 project is poised to redefine emergency medical care by incorporating advanced medical technology, data analytics, and high-tech communication systems, ultimately improving pre-hospital health emergency services for patients in both critical and non-critical conditions.

Government investments and initiatives are vital in shaping a more efficient, responsive, and accessible EMS market globally, promoting better health outcomes and saving lives, thereby contributing to the growth of the emergency medical services market.

Growing Strategic Initiatives by Companies to Create Growth Opportunities

Strategic initiatives have become pivotal in the evolution of the market, offering avenues for growth, innovation, and enhanced service delivery. Such initiatives have been instrumental in expanding EMS capabilities and market reach. A few examples are given below.

- In January 2025, the Foundation for Health and Learning Empowerment (FHLE) entered into a strategic partnership with GoAid, a prominent provider of ambulance and emergency medical services. This partnership is poised to revolutionize the emergency response framework in India, especially in rural and underserved areas where access to timely and quality medical care is often limited. This collaboration aims to establish a seamless and highly responsive emergency healthcare system by integrating GoAid's extensive ambulance network and technological capabilities with FHLE's commitment to community empowerment and enhancing healthcare accessibility.

- In November 2024, RED.Health introduced Salus EMS, a groundbreaking end-to-end emergency medical services platform aimed at enhancing the delivery of emergency care in India. This innovative system guarantees timely interventions in life-threatening scenarios by bridging crucial communication gaps between emergency rooms and ambulances. It also optimizes real-time communication, allowing hospital teams to prepare effectively in advance.

- In September 2024, VMSC Emergency Medical Services (VMSC) and Burholme First Aid Corps announced their merger, effective from January 2025. This strategic collaboration aims to enhance access to advanced life support (ALS) emergency medical and mobile health services in Philadelphia and Montgomery County, ensuring sustainable, innovative, and high-quality care for all communities served. The merger will enable VMSC to expand its ALS and mobile health services throughout Philadelphia, bringing its specialized care expertise and advanced clinical technologies to more neighborhoods and healthcare facilities. This growth will build on Burholme's strong connections within Philadelphia, furthering its mission by leveraging VMSC's operational capabilities, clinical advancements, and comprehensive service infrastructure. The collaboration will prioritize innovation in EMS delivery, integrating new technologies and methods to ensure the highest standards of patient care.

- In April 2024, Response Plus Medical (RPM), a prominent provider of pre-hospital care and emergency medical services, successfully acquired the UK-based Prometheus Medical. This acquisition represents a pivotal step in RPM's strategy for international expansion. It aligns with the company's vision to enhance its service offerings and broaden its geographical presence across its portfolio. Additionally, RPM has also secured distribution rights for Safeguard Medical's innovative range of trauma care and simulation kits in the GCC and India, thereby introducing world-class emergency products to these regions.

- In March 2022, Even (a health tech company and healthcare provider) joined forces with StanPlus (a leading emergency medical response company) to enhance emergency medical transportation services. This collaboration ensures that patients have access to round-the-clock, unlimited emergency ambulance services across India, which encompass both road and air ambulance transportation, as well as on-call medical professionals.

Thus, such strategic initiatives enable companies to expand their service offerings, integrate advanced technologies, and enhance operational efficiencies, thus meeting the evolving demands of emergency medical care and thereby offering lucrative growth opportunities to the emergency medical services market.

Emergency Medical Services (EMS) Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Emergency Medical Services (EMS) Market analysis are type, provider type, application, age group, and geography.

- Based on type, the emergency medical services (EMS) market is segmented into basic life support, advance life support, mortuary services, patient transfer services, and others. The basic life support segment held the largest share of the emergency medical services (EMS) market in 2024, and it is expected to register a significant CAGR during 2024–2031.

- By provider type, the market is categorized into fire-department-based EMS, government EMS, hospital-based EMS, private ambulance service, and other EMS agencies. The government EMS segment held the largest share of the emergency medical services (EMS) market in 2024.

- In terms of application, the emergency medical services (EMS) market is divided into cardiac care, trauma injuries, respiratory care, oncology, and others. The cardiac care segment held a larger share of the emergency medical services (EMS) market in 2024.

- By age group, the market is bifurcated into adults and pediatric. The pediatric segment held a larger share of the emergency medical services (EMS) market in 2024.

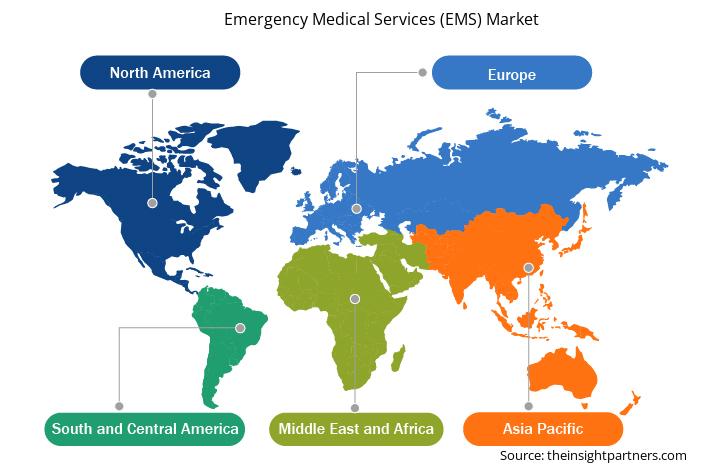

Emergency Medical Services (EMS) Market Share Analysis by Geography

The geographic scope of the emergency medical services (EMS) market report is mainly divided into five major regions: North America, Europe, Asia Pacific, the Middle East and Africa, and South and Central America. The market growth trajectory is determined by the increasing prevalence of heart diseases. According to the Canadian Institute for Health Information, in July 2022, ~2.4 million people were diagnosed with heart disease; it was the second major cause of death after cancer in Canada. According to Statistics Canada, 67,399 fatality cases were due to heart disease or stroke in 2020. EMS plays an essential role in the management and prevention of heart disease and stroke-related deaths. Additionally, EMS systems are equipped with advanced tools to monitor heart rhythms and assess stroke symptoms, ensuring early diagnosis. Furthermore, the swift actions of EMS significantly improve survival rates and outcomes for patients suffering from heart diseases and strokes. By relaying patient data to hospitals en route, EMS teams enable faster treatment upon arrival, significantly improving outcomes where every second counts in saving lives.

The aging population in Canada also contributes to the growing demand for EMS. As the proportion of elderly individuals increases, there is a higher incidence of chronic diseases such as cardiovascular conditions, respiratory disorders, and diabetes, leading to more frequent emergency interventions. Moreover, technological advancements are enhancing EMS capabilities. The integration of telemedicine solutions and advanced medical equipment allows for better patient monitoring and care during transport. As artificial intelligence transforms healthcare (from drug discovery to aiding in diagnoses and uncovering unusual patterns), it is also establishing a presence in Canada's medical emergency departments. Emergency Medical Services (EMS) or paramedic operations generate vast amounts of data, handling ~3,000 cases daily and covering over 40 million kilometers annually. Utilizing smart algorithms is a logical approach to analyzing this data for predictive insights. In 2020, the software company Hexagon launched its AI solution for medical emergency services. The Hexagon's HxGN OnCall Dispatch | Smart Advisor system analyzes operational data in real-time, detecting patterns and identifying significant events as they occur, as well as enabling improved resource distribution and faster dispatch during emergencies.

With increasing incidences of heart disease, strokes, and other emergencies, coupled with technological advancements, EMS is better equipped than ever to save lives and improve outcomes. Continued investment in training, infrastructure, and innovation is expected to be essential to meet the rising demand for emergency care across Canada.

Emergency Medical Services (EMS) Market Regional Insights

Emergency Medical Services (EMS) Market Regional Insights

The regional trends and factors influencing the Emergency Medical Services (EMS) Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Emergency Medical Services (EMS) Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Emergency Medical Services (EMS) Market

Emergency Medical Services (EMS) Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 51,856.00 Million |

| Market Size by 2031 | US$ 86,146.29 Million |

| Global CAGR (2024 - 2031) | 7.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

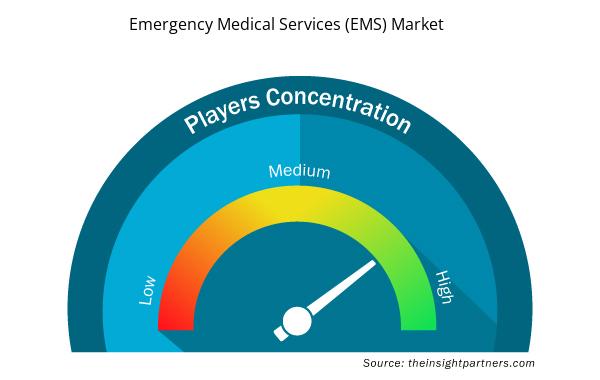

Emergency Medical Services (EMS) Market Players Density: Understanding Its Impact on Business Dynamics

The Emergency Medical Services (EMS) Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Emergency Medical Services (EMS) Market are:

- RPM Holding

- Lifestar Emergency Medical Services

- ProTransport-1

- Apollo Hospitals Enterprise Ltd

- AMR, Hamilton Medical AG

- Aero Medical Ambulance Service

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Emergency Medical Services (EMS) Market top key players overview

Emergency Medical Services (EMS) Market News and Recent Developments

The Emergency Medical Services (EMS) Market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the market are listed below:

- Nova Scotia has a new fleet of ambulances and response and transport vehicles, ensuring the right mix of resources to improve emergency care and relieve pressure on paramedics and the emergency health system. The Province has signed a contract with Tri-Star Industries in Yarmouth to lease 146 new ambulances. (Source: Emergency Medical Care Inc, Company Website, July 2022)

- The company donates 30 ambulances to Ukraine and its neighboring countries, where the ambulances will be part of the local emergency services and the handling of injured Ukrainian citizens and refugees. (Source: Falck AS, Company Website, March 2022).

Emergency Medical Services (EMS) Market Report Coverage and Deliverables

The "Emergency Medical Services (EMS) Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Emergency Medical Services (EMS) Market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Emergency Medical Services (EMS) Market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST and SWOT analysis

- Emergency Medical Services (EMS) Market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Emergency Medical Services (EMS) Market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The market is expected to register a CAGR of 7.5% during 2024–2031.

The market value is expected to reach US$ 86,146.29 million by 2031.

Integration of artificial intelligence (AI) and machine learning in EMS is expected to emerge as a prime trend in the market in the coming years.

RPM Holding, Lifestar Emergency Medical Services, ProTransport-1, Apollo Hospitals Enterprise Ltd, AMR, Hamilton Medical AG, Aero Medical Ambulance Service, Immediate Care Medical, Falck AS, Acadian Ambulance Service, Blueheights Aviation Pvt Ltd, American Ambulance Service Inc, Spark Medical Limited, Emergency Medical Care Inc., Ambulance Victoria are among the key players in the market.

Rising incidence of medical emergencies and growing government initiatives and investments are among the significant factors fueling the market growth.

North America dominated the market in 2024.

Trends and growth analysis reports related to Life Sciences : READ MORE..

The List of Companies - Emergency Medical Services (EMS) Market

- RPM Holding

- Lifestar Emergency Medical Services

- ProTransport-1

- Apollo Hospitals Enterprise Ltd

- AMR

- Hamilton Medical AG

- Aero Medical Ambulance Service

- Immediate Care Medical

- Falck AS

- Acadian Ambulance Service

- Blueheights Aviation Pvt Ltd

- American Ambulance Service Inc

- Spark Medical Limited

- Emergency Medical Care Inc.

- Ambulance Victoria

Get Free Sample For

Get Free Sample For