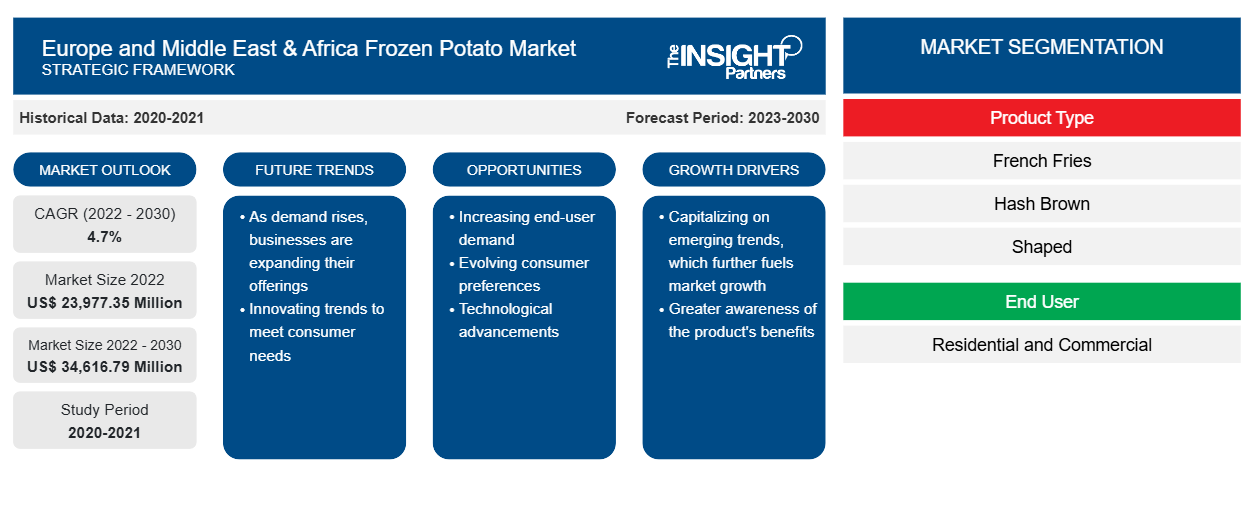

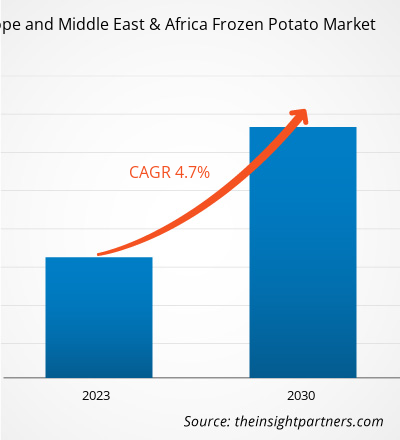

The Europe and Middle East & Africa frozen potato market size was valued at US$ 23,977.35 million in 2022 and projected to reach US$ 34,616.79 million by 2030; it is expected to register a CAGR of 4.7% from 2022 to 2030.

Market Insights and Analyst View:

Potatoes are among the major staple food products and are consumed either as fresh or in processed form. Over the past few years, people’s lifestyle has changed dramatically. They are spending most of their time in their offices and workplaces. Therefore, due to lack of time, they prefer convenience, ready-to-eat, and instant products that require minimum cooking time and effort. This factor is expected to significantly drive the frozen potato market across Europe and the Middle East & Africa. Also, the younger population and children love snacking during their free time. Frozen potatoes are widely consumed by children and younger people due to their crispy texture and the availability of different products with a variety of flavors and shapes. These factors are also driving the growth of the frozen potato market.

Growth Drivers and Challenges:

There is a surge in demand for frozen food due to the rising purchasing power and growing consumer preference toward ready-to-eat convenience food items. The preference for ready-to-eat, microwavable, and ready-to-prepare food products is significantly rising as they are highly suitable for on-the-go consumption and require minimal preparation time. The number of dual-income families in developed countries such as Germany and the UK is rising substantially. People find it hard to manage work as well as household chores due to lack of time. Therefore, they prefer to eat out or consume ready-to-eat products that require minimal preparation and cooking efforts. Moreover, due to hectic work schedules, millennials prefer quick, easy meals without compromising taste and nutrition. The number of single or two-person households is also growing in European countries such as the UK, France, Spain, and Germany. According to the European Commission, the number of single-person households in the European Union (EU) increased by 30.7% from 2009 to 2022. The growing number of one or two-person families has fueled the demand for ready-to-eat, portion-controlled foods. Fast-food franchises such as McDonald's, Wendy's, KFC, and Burger King offer frozen potatoes that give the same benefits and taste as fresh potatoes but have a longer shelf life. Thus, the growing consumption of frozen potatoes, owing to convenience, drives the market growth.

Manufacturers of frozen potatoes are making significant investments in product innovation to expand their customer base across Europe and Middle East & Africa and meet emerging consumer trends. They are launching gluten-free, organic, and clean-labeled products which meet the varied requirements of consumers. For instance, in January 2021, Aviko B.V., a Netherlands-based manufacturer in the frozen potato industry, launched three new potato products. i.e., New Super Crunch Julienne Fries, Bistro Garlic and Herb Wedges, and natural rustic mash. The newly launched fries and wedges are gluten-free and vegetarian-friendly. Such product innovations help them extend their reach and gain a competitive edge in international markets.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe and Middle East & Africa Frozen Potato Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe and Middle East & Africa Frozen Potato Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Report Segmentation and Scope:

The Europe and Middle East & Africa frozen potato market is segmented on the basis of product type, end user, and region. Based on product type, the market is segmented into French fries, hash brown, shaped, mashed, battered/cooked, topped/stuffed, and others. By end user, the market is bifurcated into residential and commercial. By region, the market is segmented into Europe and Middle East & Africa. Based on country, the Europe frozen potato market is further segmented into Germany, the UK, Italy, France, Spain, and the Rest of Europe. By country, the market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Segmental Analysis:

Based on product type, the Europe and Middle East & Africa frozen potato market is categorized into French fries, hash brown, shaped, mashed, battered/cooked, topped/stuffed, and others. The French fries segment holds a significant share of the Europe and Middle East & Africa frozen potato market. However, the market for the shaped products segment is expected to grow significantly during the forecast period. French fries are a popular side dish in burger joints, fast-food restaurants, and at home. Frozen French fries are available in various sizes and shapes, including thin shoestring fries, curly fries, waffle fries, wedge-cut fries, crinkle-cut fries, and thick steak-cut fries. They can be added to numerous cuisines, including burgers or hamburgers, poutine, waffle potato appetizers, tater tots, sandwiches, etc.

- This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Regional Analysis:

By region, the market is bifurcated into Europe and Middle East & Africa. Based on country, the Europe frozen potato market is further segmented into Germany, the UK, Italy, France, Spain, and the Rest of Europe. By country, the market in the Middle East & Africa is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Europe and Middle East & Africa frozen potato market was dominated by Europe, which accounted for US$ 19,887 million in 2022. The frozen potato market in Europe is significantly growing owing to the rising demand for convenience food, extensive retail infrastructure, and the availability of a wide range of products of different brands across various distribution channels.

Moreover, the presence of consumers with high per-capita income is driving the demand for frozen food products such as French fries, hash browns, mashed potatoes, and potato gems. Consumers are seeking nutritional benefits from the products they consume. Therefore, the demand for clean, organic, minimally processed frozen potato products has increased significantly, further boosting the market growth in Europe.

Industry Developments and Future Opportunities:

Initiatives taken by the key players operating in the Europe and Middle East & Africa frozen potato market are listed below:

- In August 2022, Seara, a Brazilian food brand, launched 120 new frozen food products in Saudi Arabia.

- In June 2022, McCain Foods, the world’s largest producer of frozen potato products, unveiled a plan to launch a regenerative agriculture project in South Africa. The project is part of the company’s drive to reduce carbon emissions and overcome the effects of climate change. This project has launched intending to grow 125 hectares of potatoes each year for use across the country using regenerative agriculture practices.

COVID-19 Pandemic Impact:

Increasing inclination toward ready-to-eat food products coupled with surging preference for convenience food products owing to the rising working population propelled the demand for frozen potato products before the COVID-19 pandemic. In addition, product developments by key market players and surging demand for healthier products contributed to the growth of the Europe and Middle East & Africa frozen potato market. However, the food & beverages industry experienced adverse impacts of the pandemic during the first quarter of 2020. Many industries had to slow down their operations due to value chain disruptions caused by the restrictions on national and international boundaries. Further, social distancing norms and negative economic impact hindered the manufacturing and distribution operations in the Europe and Middle East & Africa frozen potato market. The COVID-19 pandemic also led to an economic recession in the initial month of 2020, giving rise to financial uncertainties among low-income and mid-income consumers.

Many businesses recovered as the governments of various countries eased social restrictions after the initial months of lockdowns in 2020. The COVID-19 vaccine offered relief from the distressing pandemic, benefiting economies by encouraging businesses to regain their activities. The resumption of operation in manufacturing units positively impacted the frozen potato market and led to its recovery in 2021. Manufacturers overcame the demand–supply gap as they were permitted to operate at their total capacities.

Competitive Landscape and Key Companies:

Aviko B.V., Agristo NV, Lamb Weston Holdings Inc, Mccain, Farm Frites International B.V., Strong Roots, Mondial Foods, General Mills, Bird’s Eye Limited, and Sunbulah Group are among the prominent players operating in the Europe and Middle East & Africa frozen potato market. These market players are adopting strategic development initiatives to expand, further driving the Europe and Middle East & Africa frozen potato market growth.

Europe and Middle East & Africa Frozen Potato Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 23,977.35 Million |

| Market Size by 2030 | US$ 34,616.79 Million |

| Global CAGR (2022 - 2030) | 4.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, and End User

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Europe and Middle East & Africa Frozen Potato Market

- Agristo NV

- Aviko BV

- Birds Eye Ltd

- Farm Frites International BV

- General Mills Inc

- Lamb Weston Holdings Inc

- McCain Foods Ltd

- Mondial Foods BV

- Handy Food Innovation Ltd

- Sunbulah Food & Fine Pastries Manufacturing Co Ltd

Get Free Sample For

Get Free Sample For