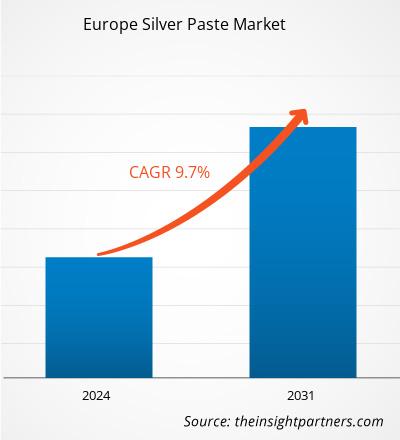

The Europe silver paste market size is projected to reach US$ 1,955.29 million by 2031 from US$ 932.80 million in 2023. The market is expected to register a CAGR of 9.7% during 2023–2031. The increasing focus on the renewable energy sector is likely to bring new Europe silver paste market trends in the coming years.

Europe Silver Paste Market Analysis

The electronics sector in Europe is thriving owing to the region's focus on technological innovation; green energy solutions; and the transition to smart devices such as smartphones, tablets, and wearables. Advancements in consumer electronics, automotive electronics, and industrial applications have made silver paste a crucial material for manufacturing highly efficient and reliable electronic components. Furthermore, technological advancements in silver paste formulations are addressing key challenges faced by manufacturers and expanding the material's applicability across various industries. Innovations in formulation technology are enabling the development of silver pastes that are more cost-effective, efficient, and versatile, meeting the evolving demands of sectors such as electronics, automotive, healthcare, and renewable energy. By reducing the amount of silver used without compromising conductivity and performance, manufacturers are making silver paste more cost-competitive, allowing industries to maintain productivity while mitigating material costs. Such formulations are gaining traction in cost-sensitive applications, such as consumer electronics and solar photovoltaics.

Europe Silver Paste Market Overview

The European silver paste market is a key component of industries such as solar energy, electronics, and automotive manufacturing. Silver paste, known for its superior electrical and thermal conductivity, plays a crucial role in applications such as photovoltaic cells, printed circuit boards, and electronic devices. In the solar industry, silver paste is a critical material for creating conductive pathways in solar cells, enhancing efficiency and performance. Its use in electronics, particularly in conductive adhesives and coatings, supports the growing demand for miniaturized and reliable electronic components. The market in Europe is driven by technological advancements, increasing adoption of renewable energy solutions, and a shift toward eco-friendly materials. Germany, being a hub for automotive and solar industries, represents a significant portion of the demand. Challenges such as the high cost of silver and supply chain disruptions pose constraints. Also, ongoing research and development efforts and sustainability-focused initiatives are expected to fuel the market growth in the coming years.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Silver Paste Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Silver Paste Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Silver Paste Market Drivers and Opportunities

Growing Electronics Industry

Silver paste's exceptional electrical conductivity, thermal stability, and compatibility with advanced manufacturing techniques make it indispensable for key applications such as printed circuit boards (PCBs), sensors, antennas, and flexible electronics. Europe's focus on innovation in electronics manufacturing, supported by research and development activities, has led to the development of flexible and printed electronics. These emerging technologies rely heavily on silver paste for their conductive properties and adaptability to various substrates. Flexible electronics are integrated with displays, sensors, and smart packaging, which fuels the demand for silver paste. With the penetration of the Internet of Things (IoT) and 5G networks and the increasing adoption of smart devices, manufacturers are using silver paste to develop lightweight, compact, and high-performance components. The trend toward miniaturization and enhanced functionality in electronic gadgets has further amplified the use of silver paste in creating precise and reliable conductive pathways. Therefore, the growing electronics industry fuels the Europe silver paste market growth.

Technological Advancements in Silver Paste Formulations

Manufacturers of silver paste are developing advanced formulations to serve emerging applications. For instance, in July 2023, Toyo Ink SC Holdings, the parent company of specialty chemicals firm Toyo Ink Group, developed a lead-free, silver nanoparticle paste for die-attach applications. This material is engineered to meet the needs of next-generation power electronics, capable of sintering at low temperatures under both pressureless and pressure-assisted methods. In addition, in June 2024, Heraeus Electronics introduced its product innovation, the mAgic PE360 Silver Sinter Paste, at PCIM Europe. This latest advancement aims to revolutionize thermal performance in electronic manufacturing and address industry challenges. Therefore, technological advancements in silver paste formulations are transforming the material into a versatile solution for modern manufacturing needs, which is expected to create lucrative opportunities for market growth during the forecast period.

Europe Silver Paste Market Report Segmentation Analysis

Key segments that contributed to the derivation of Europe silver paste market analysis are type, product type, application, and technology.

- Based on type, the market is segmented into silver epoxy, silver polyurethane, and others. The silver epoxy segment held the largest share of the market in 2023.

- In terms of product type, the market is segmented into front-side silver paste, back-side silver paste, die-attach paste, and others. The front-side silver paste segment held the largest share of the market in 2023.

- By application, the market is categorized into photovoltaic (front-side metallization, back-side metallization, and others), electronics (multilayer ceramic capacitors, printed circuit boards, membrane switches, and others), automotive (sensors, heating elements, LED components, and others), healthcare (electrodes, biosensors, and others), and others. The photovoltaic segment accounted for the largest share of the market in 2023.

- By technology, the market is categorized into screen printing, inkjet printing, flexographic printing, and others. The screen printing segment accounted for the largest share of the market in 2023.

Europe Silver Paste Market Share Analysis by Geography

The geographic scope of the Europe silver paste market report is mainly divided into Germany, France, Italy, the UK, Russia, and the Rest of Europe.

In terms of revenue, Germany dominated the Europe silver paste market share in 2023. Germany has a strong electronics industry, which involves the manufacturing, research and development of electronic devices and components. With the increasing use of electronic devices in various sectors, such as automotive, healthcare, and electronics, there is a growing demand for silver paste. Silver paste is frequently used in the production of semiconductors, PCBs, and other electronic devices. According to the Germany Trade & Invest, the electronics industry is the second largest industry in the country; it contributes 10% to domestic industrial output, with a turnover of US$ 191.38 billion in 2021. Further, this industry accounts for 3% of GDP and 23% of total country research and development spending. The government of Germany aims to reinforce semiconductor production. In August 2023, TSMC, a Taiwanese chipmaker, announced a plan worth US$ 3.8 billion (€3.47 billion) to construct a factory in Dresden, a city in eastern Germany. The proposed factory will have a monthly capacity of 40,000 wafers. Construction is expected to begin in the second half of 2024, while the facility will be operational by the end of 2027. Bosch, Infineon, and NXP are participating in the project, with a 10% share each. Germany also possesses the largest concentration of original equipment manufacturer (OEM) plants in Europe. Silver paste is extensively used in applications such as sensors, printed electronics, and EV batteries.

Europe Silver Paste Market Regional Insights

The regional trends and factors influencing the Europe Silver Paste Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Europe Silver Paste Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Europe Silver Paste Market

Europe Silver Paste Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 932.80 Million |

| Market Size by 2031 | US$ 1,955.29 Million |

| Global CAGR (2023 - 2031) | 9.7% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

Europe Silver Paste Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Silver Paste Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Europe Silver Paste Market are:

- Heraeus Group

- Vibrantz Technologies Inc

- DuPont de Nemours Inc

- Dycotec Materials Ltd

- Daejoo Electronic Materials Co., Ltd.

- FENZI SpA

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Europe Silver Paste Market top key players overview

Europe Silver Paste Market News and Recent Developments

The Europe silver paste market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Europe silver paste market are listed below:

- VisIC Technologies Ltd announced a partnership with Heraeus Group and PINK to develop an advanced power module utilizing D3GaN technology. This power module is based on a silicon nitride ceramic substrate, an innovative silver (Ag) sintering process, and an advanced top-side interconnect—promising unprecedented reliability and performance for battery electric vehicles (BEVs). (Source: Heraeus Group, Press Release, July 2024)

- Prince International Corporation, a portfolio company of American Securities LLC, announced the acquisition of Ferro Corporation. In conjunction with the transaction's closing, the company also collaborated with Chromaflo Technologies, a premier global provider of colorant technology solutions and an American Securities portfolio company. The new company was renamed Vibrantz Technologies Inc. (Source: Vibrantz Technologies Inc, Press Release, August 2022)

Europe Silver Paste Market Report Coverage and Deliverables

The "Europe Silver Paste Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Europe silver paste market size and forecast at regional and country levels for all the key market segments covered under the scope

- Europe silver paste market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed Porter's Five Forces and SWOT analysis

- Europe silver paste market analysis covering key market trends, regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments for the Europe silver paste market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

This text is related

to segments covered.

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

This text is related

to country scope.

Frequently Asked Questions

The silver epoxy segment dominated the market in 2023.

The market is estimated to register a CAGR of 9.7% during 2023–2031.

The market is projected to reach US$ 1,955.29 million by 2031.

Strong growth of electronics and automotive industries are among a few factors driving the market.

Heraeus Group; Vibrantz Technologies Inc; DuPont de Nemours Inc; Dycotec Materials Ltd; Daejoo Electronic Materials Co., Ltd.; FENZI SpA; Noritake Co Ltd; Monocrystal; MG Chemicals; and Sun Chemical; are among the key players operating in the Europe silver paste market.

Increasing focus on the renewable energy sector is expected to bring new trends in the market in the coming years.

Trends and growth analysis reports related to Chemicals and Materials : READ MORE..

The List of Companies - Europe Silver Paste Market

- Heraeus Group

- Vibrantz Technologies Inc

- DuPont de Nemours Inc

- Dycotec Materials Ltd

- Daejoo Electronic Materials Co., Ltd.

- FENZI SpA

- Noritake Co Ltd

- Monocrystal

- MG Chemicals

- Sun Chemical

Get Free Sample For

Get Free Sample For