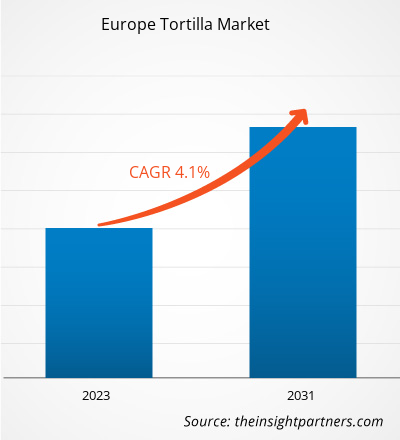

The Europe tortilla market size is projected to reach US$ 14.78 billion by 2031 from US$ 10.70 billion in 2023. The market is expected to register a CAGR of 4.1% during 2023–2031. The rising demand for natural, organic, and clean-label products is likely to remain a key trend in the market.

Europe Tortilla Market Analysis

In recent years, European cuisine has been markedly influenced by Mexican culinary art. Flavors, spices, and dishes that were largely unfamiliar among the masses in Europe have gained popularity owing to the emergence of Mexican cuisine across various European countries, such as France, Denmark, Sweden, and Italy. Moreover, several Mexican restaurants have been established across European countries to meet the increasing demand. Tortilla products such as nachos, burritos, tacos, and fajitas are among the most popular Mexican food items. Thus, the growing prominence of Mexican cuisines in European countries drives the tortilla market growth across the region.

Europe Tortilla Market Overview

Tortillas are round, thin flatbreads originating from Mexico, mainly made from corn, wheat, and other flour such as chickpea flour, fava bean flour, and multigrain flour. The demand for tortillas is increasing across Europe with a rising inclination toward Mexican cuisine, growing number of Mexican restaurants, and surging number of people exploring various global cuisines. Also, the rising trend of eating out is propelling the demand for tortilla dishes such as tacos, burritos, and quesadillas, thereby driving the sales of tortillas across the foodservice sector in Europe. The demand for organic tortillas is also increasing in the region as consumers prefer certified organic ingredients that are free from genetically modified organisms (GMOs), pesticides, and harmful chemicals.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Tortilla Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Europe Tortilla Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Europe Tortilla Market Drivers and Opportunities

Strategic Initiatives by Key Market Players

Fast-food chains and quick-service restaurants are expanding their presence in Europe to cater to the increasing demand of consumers. In January 2024, the Mexican restaurant group ‘Tortilla’ extended its partnership with SSP and announced opening four new restaurants through the franchise in 2024 at transport hubs, universities, and other locations. Tortilla manufacturers are also expanding their business presence across various European countries. Paulig—a parent company of Poco Loco and Santa Maria—opened a new tortilla factory in Belgium in September 2022 to meet the growing demand for Tex Mex products in Europe. Thus, strategic development initiatives such as product launches and expansion strategies further drive the tortilla market growth in Europe.

Increasing Preference for Gluten-Free Products

The prevalence of celiac disease is increasing in Europe. As per the data published by Epidemiology, Presentation, and Diagnosis of Celiac Disease in 2021, celiac disease is found to exist across the world, contrary to earlier beliefs that it primarily affects people in Northern and Western Europe. Celiac disease can often damage the intestine lining and cause thyroid and Type 1 diabetes in some patients. The gluten-free diet can help reduce the effect of celiac disease by promoting intestinal healing. Therefore, European consumers are tremendously preferring gluten-free diets. Thus, the increasing preference for gluten-free products is expected to create a huge growth opportunity for the Europe tortilla market during the forecast period.

Europe Tortilla Market Report Segmentation Analysis

Key segments that contributed to the derivation of the Europe tortilla market analysis are source, product types, category, and end user.

- Based on source, the Europe tortilla market is segmented into wheat, corn, and others. The corn segment held the largest market share in 2023.

- By product type, the market is segmented into tortilla chips, taco shells, tortilla wraps, and others. The tortilla chips segment held the largest share of the market in 2023.

- In terms of category, the market is bifurcated into organic and conventional. The conventional segment held a larger share in 2023.

- Based on end user, the market is categorized into foodservice and food retail. The food retail segment is further divided into supermarkets & hypermarkets, convenience stores, online retail, and others.

Europe Tortilla Market Share Analysis by Country

The regional scope of the Europe tortilla market report is mainly divided into Germany, France, Italy, UK, Spain, Netherlands, Finland, Poland, Norway, Denmark, Sweden, Belgium, Austria, Switzerland, Czech Republic, and the Rest of Europe.

Spain dominated the market in 2023. The tortilla market is significantly growing in Spain owing to the rise in health consciousness among the population. Tortillas are available in cafes, restaurants, and other fast-food chains in the form of wraps, as well as grocery stores. Old El Paso and private label are the most common tortilla brands in Spain. The population traditionally consumes Spanish tortillas, which augment the sale of tortillas. Moreover, snacks made from tortillas, such as tacos and tortilla chips, are increasing in popularity in Spain. These factors are expected to impact the tortilla market growth in the country positively. Furthermore, the market in Sweden is anticipated to register the highest CAGR in the coming years.

Europe Tortilla Market Regional Insights

The regional trends and factors influencing the Europe Tortilla Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Europe Tortilla Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Europe Tortilla Market

Europe Tortilla Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 10.70 Billion |

| Market Size by 2031 | US$ 14.78 Billion |

| Global CAGR (2023 - 2031) | 4.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2023-2031 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

Europe Tortilla Market Players Density: Understanding Its Impact on Business Dynamics

The Europe Tortilla Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Europe Tortilla Market are:

- Paulig Ltd

- Sinnack Snacks GmbH & Co KG

- Durum Company NL BV

- General Mills Inc

- Mexma Food BV

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Europe Tortilla Market top key players overview

Europe Tortilla Market News and Recent Developments

The Europe tortilla market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the Europe tortilla market are listed below:

- Tortilla, a UK-based Mexican restaurant, partnered with SSP Group to expand its travel presence. The group aims to launch four new restaurants in 2024. (Source: Tortilla, Newsletter, February 2024)

- Paulig acquired Spanish-based company Liven to boost its Tex Mex and snacking business in Europe. (Source: Paulig, Press Release, September 2022)

Europe Tortilla Market Report Coverage and Deliverables

The "Europe Tortilla Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Europe tortilla market size and forecast at regional and country levels for all the key market segments covered under the scope

- Europe tortilla market trends as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Europe tortilla market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the Europe tortilla market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Nature, Source, Product type, Distribution Channel

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

UK, Germany, France, Italy, Russia

Frequently Asked Questions

Spain dominated the Europe tortilla market in 2023.

Rising popularity of Mexican cuisines in European countries and strategic development initiatives by key market players are the key drivers of the Europe tortilla market.

The rising demand for natural, organic, and clean-label products is expected to introduce new trends in the market during the forecast period.

Paulig Ltd, Sinnack Snacks GmbH & Co KG, Durum Company NL BV, General Mills Inc, Mexma Food BV, Mestemacher GmbH, Signature Flatbreads Ltd, Turka Invest Sp Zoo, DF World of Spices GmbH, DOO PIP Novi Sad, GRUMA SAB de CV, Leighton Foods AS, Intersnack Group GmbH & Co KG, Dijo Baking Sp Zoo, and Roger&Roger NV are the key players operating in the market.

The Europe tortilla market is anticipated to reach US$ 14.78 billion by 2031.

The market is likely to record a CAGR of 4.1% from 2023 to 2031.

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Europe Tortilla Market

- Paulig Ltd

- Sinnack Snacks GmbH & Co KG

- Durum Company NL BV

- General Mills Inc

- Mexma Food BV

- Mestemacher GmbH

- Signature Flatbreads Ltd

- Turka Invest Sp Zoo

- GRUMA SAB de CV

- Leighton Foods AS

Get Free Sample For

Get Free Sample For