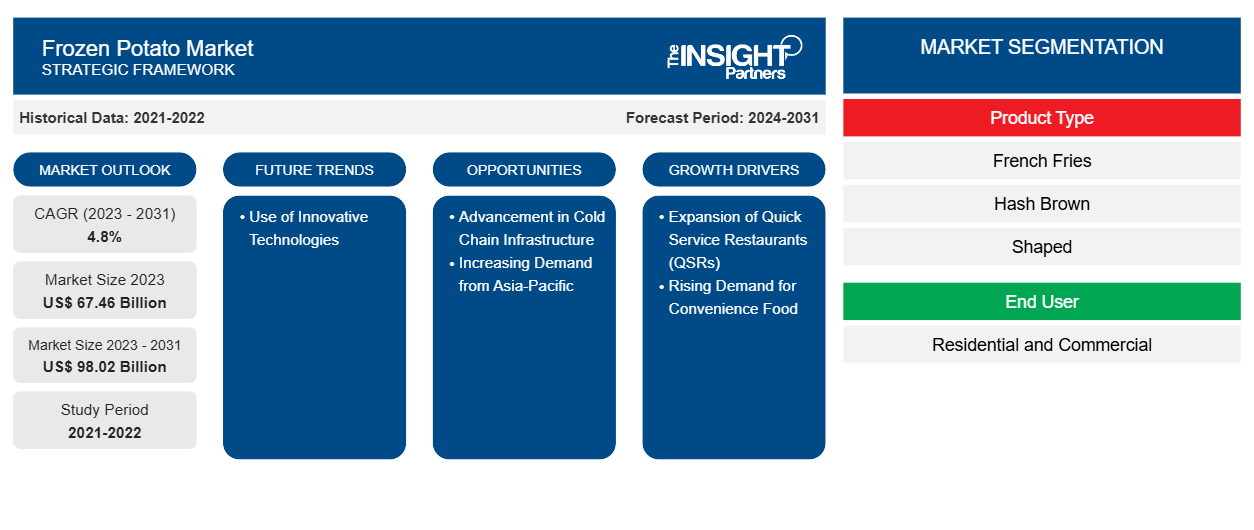

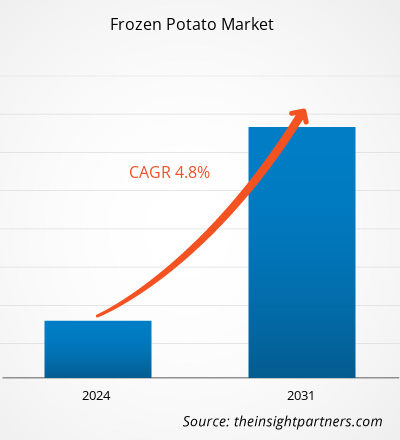

The frozen potato market size is projected to reach US$ 98.02 billion by 2031 from US$ 67.46 billion in 2023. The market is expected to register a CAGR of 4.8% during 2023–2031. The rising adoption of innovative technologies for frozen potato processing is likely to remain a key trend in the market.

Frozen Potato Market Analysis

There is a surge in the demand for frozen food due to growing consumer preference toward ready-to-eat convenience food items, as they are highly suitable for on-the-go consumption and require minimal preparation time. The number of dual-income families in developed countries such as the US, China, Germany, and the UK is rising substantially. People find it hard to manage work as well as household chores due to lack of time. Therefore, they prefer to eat out or consume ready-to-eat products that require minimal preparation and cooking efforts. In addition, the number of single or two-person households is growing in various developed nations such as the US, Canada, and some European countries, e.g., the UK and Germany. According to the 2020 Current Population Survey, there were 36.1 million single-person households in the US, accounting for 28% of all households. As a result of the growing number of one or two-person families, the demand for ready-to-eat, portion-controlled foods has risen. Frozen food products are also growing in demand as they have an extended shelf-life, are suitable for single-person consumption, and can be prepared in less time.

Frozen Potato Market Overview

Potatoes are one of the major staple food products and are consumed either as fresh potatoes or processed potatoes. It is one of the most widely consumed crops. One of the main types of processed vegetables is frozen potato which is highly convenient and flexible about preparation time. Frozen potatoes contain different vitamins and nutrients in naturally preserved form and have a long shelf life. Frozen potatoes contain Vitamin B6, fiber, magnesium, and antioxidants. Frozen potato is made by processing fresh potato with the help of advanced machinery at a very low temperature. French fries, hash brown, shaped, mashed, and battered potato are some of the popular frozen potato products. Products like star-shaped, alphabet-shaped, potato shots, lattice/basket weave cuts, and wedges are some examples of shaped frozen potatoes available in the market. Products having unique shapes become popular among consumers who are ready to pay more for such products. Battered potatoes are very simple and easy to make. These types of potatoes are usually used for a side dish or an appetizer which are dipped into a batter and then deep fried.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Frozen Potato Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Customize This Report To Suit Your Requirement

You will get customization on any report - free of charge - including parts of this report, or country-level analysis, Excel Data pack, as well as avail great offers and discounts for start-ups & universities

Frozen Potato Market: Strategic Insights

- Get Top Key Market Trends of this report.This FREE sample will include data analysis, ranging from market trends to estimates and forecasts.

Frozen Potato Market Drivers and Opportunities

Expansion of Quick Service Restaurants (QSRs)

Due to the rising number of dual-income families and single-person households, people don’t get enough time to focus on their personal lives. Therefore, they are seeking products that offer them convenience and help save their time and effort. Fast food restaurants and quick service restaurants (QSRs) offer mass-produced products in no time offering huge convenience to the consumers. These restaurants are becoming popular because they offer a variety of food in very little time and at affordable prices. Due to the growth and expansion of these quick-service restaurants or QSRs, the demand for frozen potatoes has also increased. Products like frozen French fries, hash browns, and shaped and stuffed/topped potatoes are mostly demanded by the QSRs because frozen potato requires less preparation time and is easy to use. This helps the QSRs to provide the consumers with their food quickly, which is the main strength of the quick-service restaurants.

Advancement in Cold Chain Infrastructure

Cold chain infrastructure has increased significantly in recent years. For instance, according to the International Institute of Refrigeration (IIR) and the Global Cold Chain Alliance (GCCA) report, the total capacity of refrigerated warehouses globally increased to 719 million cubic meters in 2020 which is 16.7% greater than the capacity reported in 2018. In addition, the expansion of cold chain capacity in emerging countries differs for each country. The expansion of cold chain capacity in emerging countries varies for each country. In most developing countries, such as South Africa, Mexico, and Kenya, the cold chain is concentrated in urban areas and transportation terminals such as airports, where exporters may be situated. Further, major market service providers are constantly improving their technologies to stay ahead of the competition and maintain efficiency, integrity, and safety across the globe. For instance, vendors have implemented Hazard Analysis and Critical Control Points (HACCP) and RFID technology to improve efficiency with smaller shipments. In addition, they are expanding their multi-compartment refrigerated vehicle fleets to provide additional services to consumers. Thus, advancements in cold chain infrastructure are emerging as a lucrative opportunity for the frozen potato market players.

Frozen Potato Market Report Segmentation Analysis

Key segments that contributed to the derivation of the frozen potato market analysis are product type and end user.

- Based on product type, the frozen potato market is divided into French fries, hash brown, shaped, mashed, battered/cooked, topped/stuffed, and others. The French fries segment held the largest share of the market in 2023.

- By end user, the market is bifurcated into residential and commercial. The commercial segment is expected to register a higher CAGR during the forecast period.

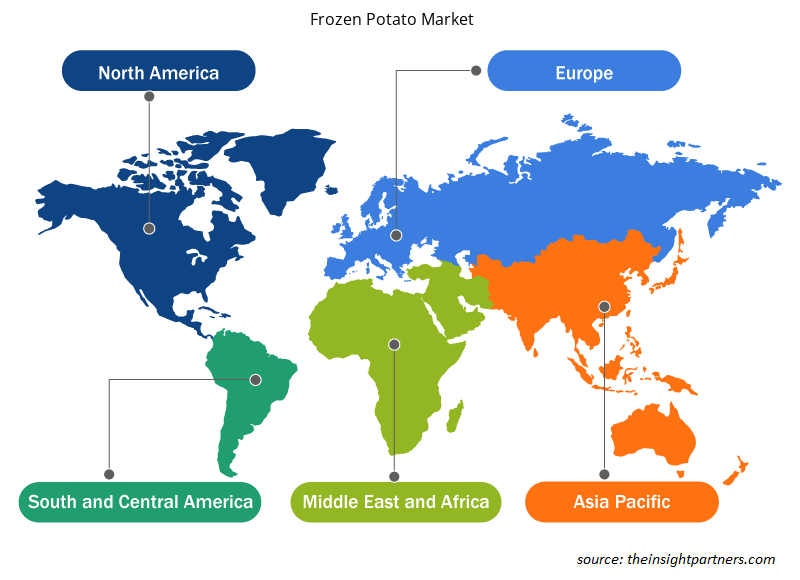

Frozen Potato Market Share Analysis by Geography

The geographic scope of the frozen potato market report is mainly divided into five regions: North America, Asia Pacific, Europe, the Middle East & Africa, and South & Central America.

North America dominates the market. The region is one of the major markets for frozen potatoes due to the presence of a well-established food processing industry, rising trends of takeaway, dine-in, and on-the-go consumption, and string retail as well as the food service sector. Many significant frozen potato manufacturers including H.J. Heinz Company, J.R. Simplot Company, and McCain Foods Limited, among others, are operating actively in the region. These companies have expanded their business across the region and hold a significant market share as well.

Frozen Potato Market Regional Insights

The regional trends and factors influencing the Frozen Potato Market throughout the forecast period have been thoroughly explained by the analysts at Insight Partners. This section also discusses Frozen Potato Market segments and geography across North America, Europe, Asia Pacific, Middle East and Africa, and South and Central America.

- Get the Regional Specific Data for Frozen Potato Market

Frozen Potato Market Report Scope

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 67.46 Billion |

| Market Size by 2031 | US$ 98.02 Billion |

| Global CAGR (2023 - 2031) | 4.8% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

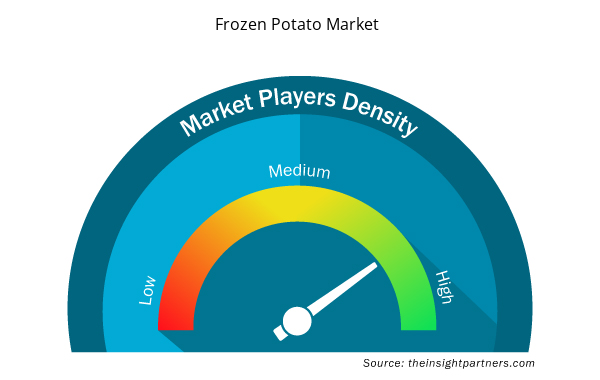

Frozen Potato Market Players Density: Understanding Its Impact on Business Dynamics

The Frozen Potato Market market is growing rapidly, driven by increasing end-user demand due to factors such as evolving consumer preferences, technological advancements, and greater awareness of the product's benefits. As demand rises, businesses are expanding their offerings, innovating to meet consumer needs, and capitalizing on emerging trends, which further fuels market growth.

Market players density refers to the distribution of firms or companies operating within a particular market or industry. It indicates how many competitors (market players) are present in a given market space relative to its size or total market value.

Major Companies operating in the Frozen Potato Market are:

- Bart's Potato Company

- Aviko B.V.

- Agristo NV

- Lamb Weston Holdings Inc

- Mccain

- Farm Frites International B.V.

Disclaimer: The companies listed above are not ranked in any particular order.

- Get the Frozen Potato Market top key players overview

Frozen Potato Market News and Recent Developments

The frozen potato market is evaluated by gathering qualitative and quantitative data post post-primary and secondary research, which includes important corporate publications, association data, and databases. A few of the developments in the frozen potato market are listed below:

- McCain Foods is making a substantial investment in Coaldale, doubling the size of its facility and output in Coaldale, Alberta. (Source: McCain, News, Company Website, March 2023)

- Members of the executive team of Lamb Weston Holdings, Inc. joined with distinguished guests to celebrate the grand opening of the company’s new processing facility in Ulanqab, Inner Mongolia, China. The facility, located in what’s known as China’s Potato Capital, can produce 250 million pounds of frozen potato products annually. (Source: Lamb Weston, News Release, Company Website, November 2023)

- Simplot Global Food introduced Simplot Maple City Waffle Flavored Potatoes, the world’s first waffle fry, and battered potato bites that taste like waffles. Made with real maple syrup, this product will accelerate the explosive growth of chicken & waffles on U.S. menus. (Source: Simplot Foods, New Release, Company Website, March 2024)

Frozen Potato Market Report Coverage and Deliverables

The "Frozen Potato Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

- Frozen potato market size and forecast at global, regional, and country levels for all the key market segments covered under the scope

- Frozen potato market trends, as well as market dynamics such as drivers, restraints, and key opportunities

- Detailed PEST/Porter's Five Forces and SWOT analysis

- Frozen potato market analysis covering key market trends, global and regional framework, major players, regulations, and recent market developments

- Industry landscape and competition analysis covering market concentration, heat map analysis, prominent players, and recent developments in the frozen potato market

- Detailed company profiles

- Historical Analysis (2 Years), Base Year, Forecast (7 Years) with CAGR

- PEST and SWOT Analysis

- Market Size Value / Volume - Global, Regional, Country

- Industry and Competitive Landscape

- Excel Dataset

- Europe Surety Market

- Airline Ancillary Services Market

- Customer Care BPO Market

- Dealer Management System Market

- Digital Language Learning Market

- Terahertz Technology Market

- Real-Time Location Systems Market

- Fertilizer Additives Market

- Grant Management Software Market

- Print Management Software Market

Report Coverage

Revenue forecast, Company Analysis, Industry landscape, Growth factors, and Trends

Segment Covered

Product Type, End User, and Geography

Regional Scope

North America, Europe, Asia Pacific, Middle East & Africa, South & Central America

Country Scope

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Russian Federation, Saudi Arabia, South Africa, South Korea, United Arab Emirates, United Kingdom, United States

Frequently Asked Questions

Adoption of innovative processing techniques is likely to remain a key trend in the market.

Expansion of quick service restaurants and rising demand for convenience food among the consumers are major factors contributing to the market growth.

North America accounted for the largest share of the global frozen potato market in 2023.

Aviko B.V., Agristo NV, Lamb Weston Holdings Inc, Mccain, Farm Frites International B.V., Greenyard, Himalaya Food International Ltd, J.R. Simplot Company, and The Kraft Heinz Co., are a few of the key players operating in the global frozen potato market.

The frozen potato market size is projected to reach US$ 98.02 billion by 2031

Trends and growth analysis reports related to Food and Beverages : READ MORE..

The List of Companies - Frozen Potato Market

- Bart’s Potato Company

- Aviko B.V.

- Agristo NV

- Lamb Weston Holdings Inc

- Mccain

- Farm Frites International B.V.

- Greenyard

- Himalaya Food International Ltd

- J.R. Simplot Company

- The Kraft Heinz Co.

Get Free Sample For

Get Free Sample For